This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Delaware Employee Stock Option Agreement

Description

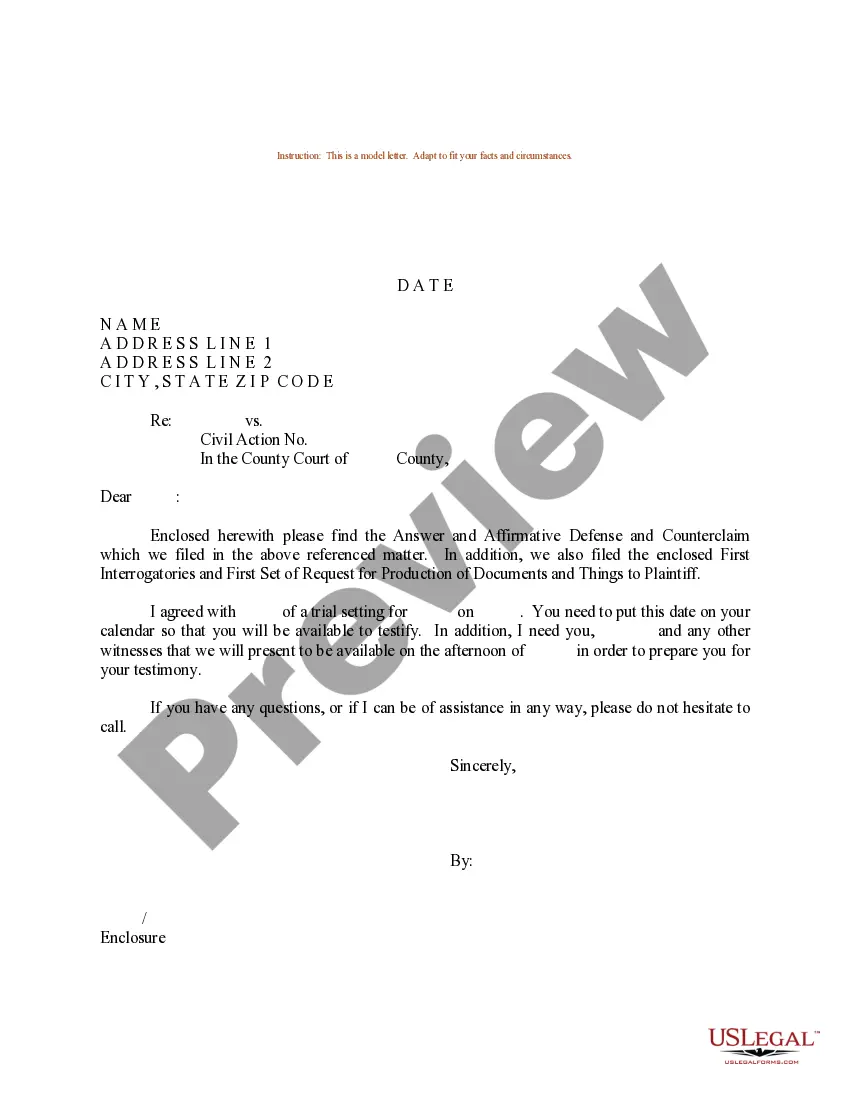

How to fill out Employee Stock Option Agreement?

If you have to complete, obtain, or print legitimate papers themes, use US Legal Forms, the greatest assortment of legitimate kinds, which can be found on the web. Make use of the site`s simple and easy convenient lookup to find the papers you need. Numerous themes for business and personal reasons are categorized by classes and suggests, or search phrases. Use US Legal Forms to find the Delaware Employee Stock Option Agreement in a couple of clicks.

Should you be already a US Legal Forms consumer, log in to the bank account and then click the Acquire option to get the Delaware Employee Stock Option Agreement. You can also entry kinds you in the past downloaded in the My Forms tab of the bank account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate metropolis/land.

- Step 2. Utilize the Review method to examine the form`s content material. Never neglect to see the information.

- Step 3. Should you be unhappy with the form, make use of the Research field at the top of the display screen to find other types of your legitimate form format.

- Step 4. Upon having identified the form you need, click on the Acquire now option. Choose the costs strategy you favor and include your accreditations to sign up on an bank account.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Choose the structure of your legitimate form and obtain it on your own product.

- Step 7. Comprehensive, change and print or sign the Delaware Employee Stock Option Agreement.

Every legitimate papers format you get is your own property forever. You might have acces to every single form you downloaded with your acccount. Click on the My Forms segment and select a form to print or obtain yet again.

Contend and obtain, and print the Delaware Employee Stock Option Agreement with US Legal Forms. There are many skilled and status-certain kinds you can use for your business or personal requirements.

Form popularity

FAQ

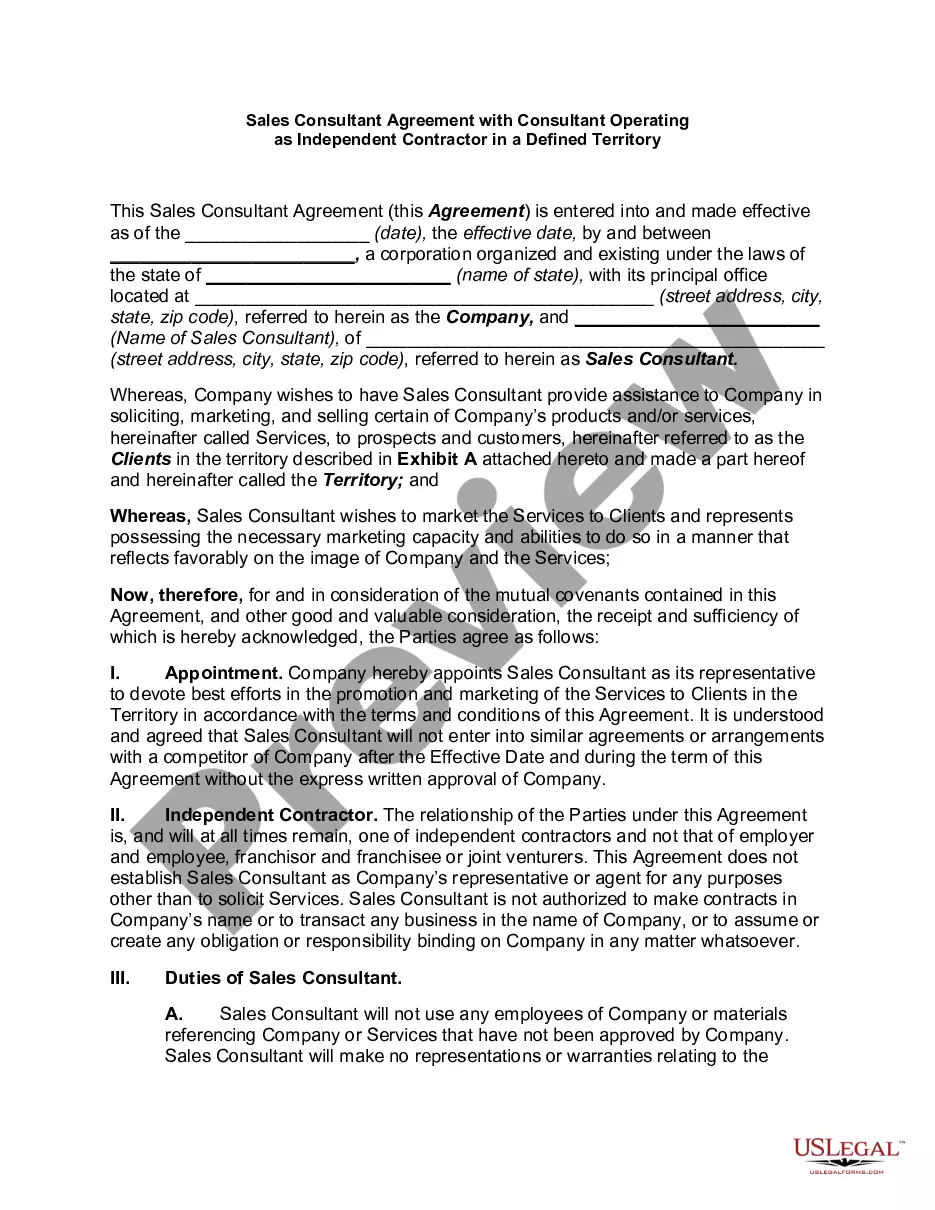

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

As far back as 1955, California courts considered with how to deal with incentive compensation, such as employee stock awards. Since then, courts consistently hold that agreements to provide stock options, restricted stock units (RSUs), or other ownership rights count as wages under the California Labor Code.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.

Stock Option Plan (the ?Plan?) is to assist Delaware Management Holdings, Inc., a Delaware corporation (the ?Corporation?), and its subsidiaries in attracting, retaining, and rewarding high-quality executives, investment professionals, employees, and other persons who provide services to the Corporation and/or its ...

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value. Stock options can result in high levels of compensation of executives for mediocre business results.