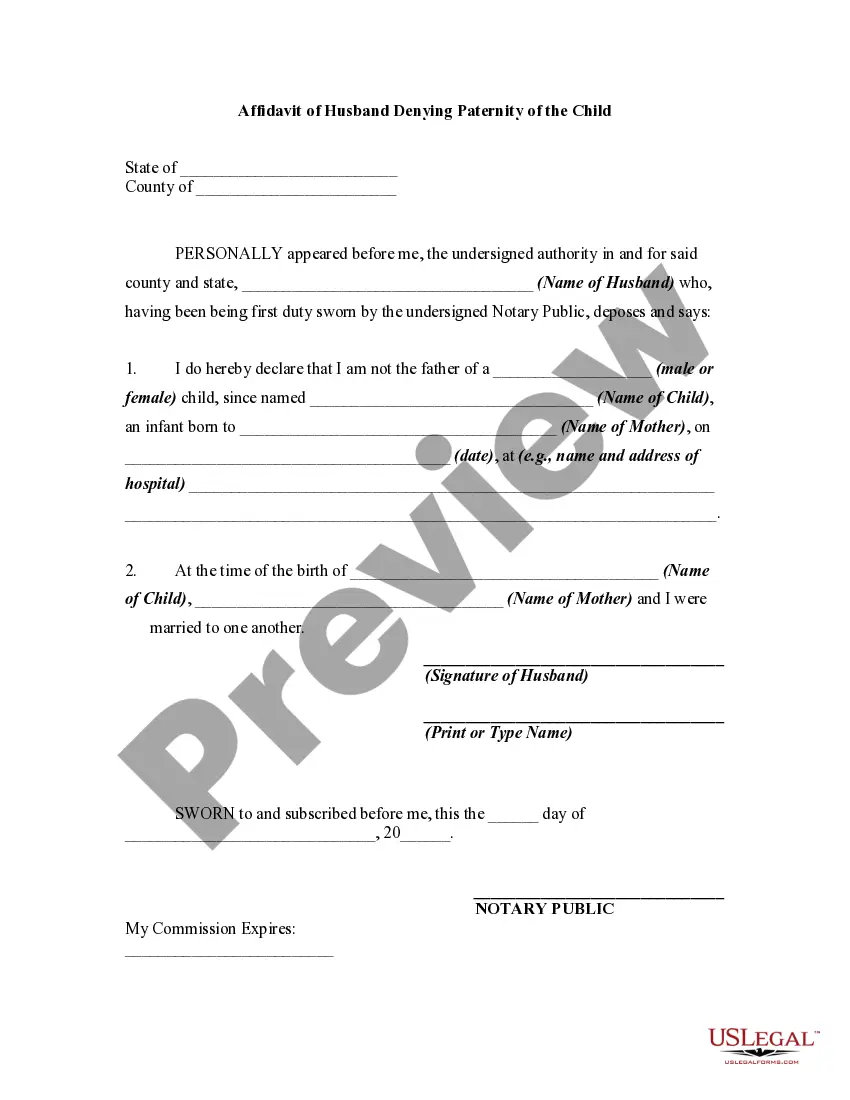

This non-employee director option agreement grants the optionee (the non-employee director) a non-qualified stock option under the company's non-employee director stock option plan. The option allows optionee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Delaware Non Employee Director Stock Option Agreement

Description

How to fill out Non Employee Director Stock Option Agreement?

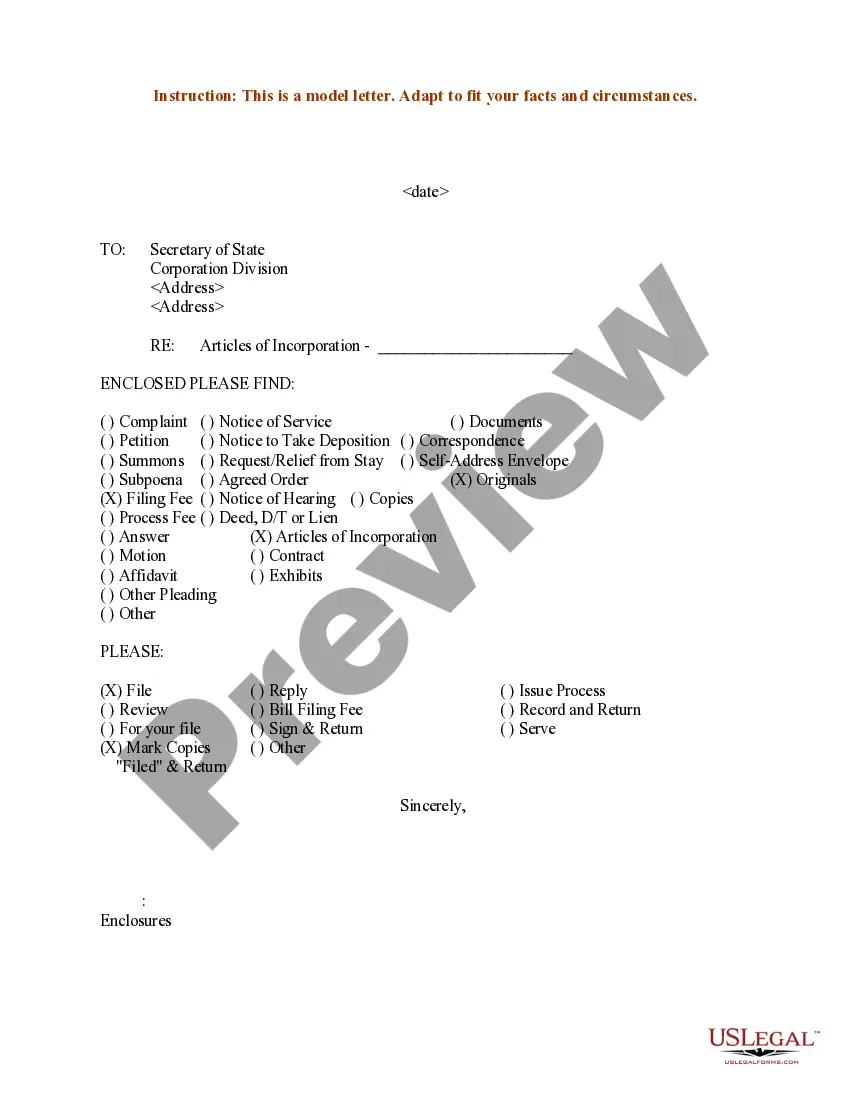

Are you in a placement that you need to have documents for both enterprise or specific functions almost every time? There are tons of legitimate file themes accessible on the Internet, but finding versions you can depend on is not easy. US Legal Forms gives a huge number of kind themes, much like the Delaware Non Employee Director Stock Option Agreement, that are created to meet state and federal requirements.

In case you are currently informed about US Legal Forms website and possess a free account, basically log in. Next, you are able to download the Delaware Non Employee Director Stock Option Agreement web template.

If you do not offer an account and wish to begin to use US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is for that right town/state.

- Take advantage of the Review button to check the form.

- Look at the information to actually have chosen the right kind.

- When the kind is not what you`re seeking, use the Look for area to find the kind that meets your needs and requirements.

- Whenever you get the right kind, click Acquire now.

- Pick the pricing plan you desire, complete the desired information to generate your money, and pay money for an order utilizing your PayPal or bank card.

- Decide on a hassle-free document format and download your version.

Locate each of the file themes you possess bought in the My Forms menus. You can aquire a extra version of Delaware Non Employee Director Stock Option Agreement any time, if needed. Just click the required kind to download or produce the file web template.

Use US Legal Forms, by far the most considerable assortment of legitimate types, to save some time and steer clear of blunders. The support gives skillfully made legitimate file themes that can be used for a range of functions. Create a free account on US Legal Forms and start making your life easier.

Form popularity

FAQ

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

The stock options plan is drafted by the company's board of directors and contains details of the grantee's rights. The options agreement will provide the key details of your option grant such as the vesting schedule, how the ESOs will vest, shares represented by the grant, and the strike price.

A stock purchase plan involves the actual purchase of the stock, and differs from an option, which is only the right to purchase stock.

An employee stock option agreement (sometimes known as a share option agreement) is a contract between an employer and employee that guarantees the employee's right to purchase stock in the employer's company at a specified price after a certain period of continuous employment.