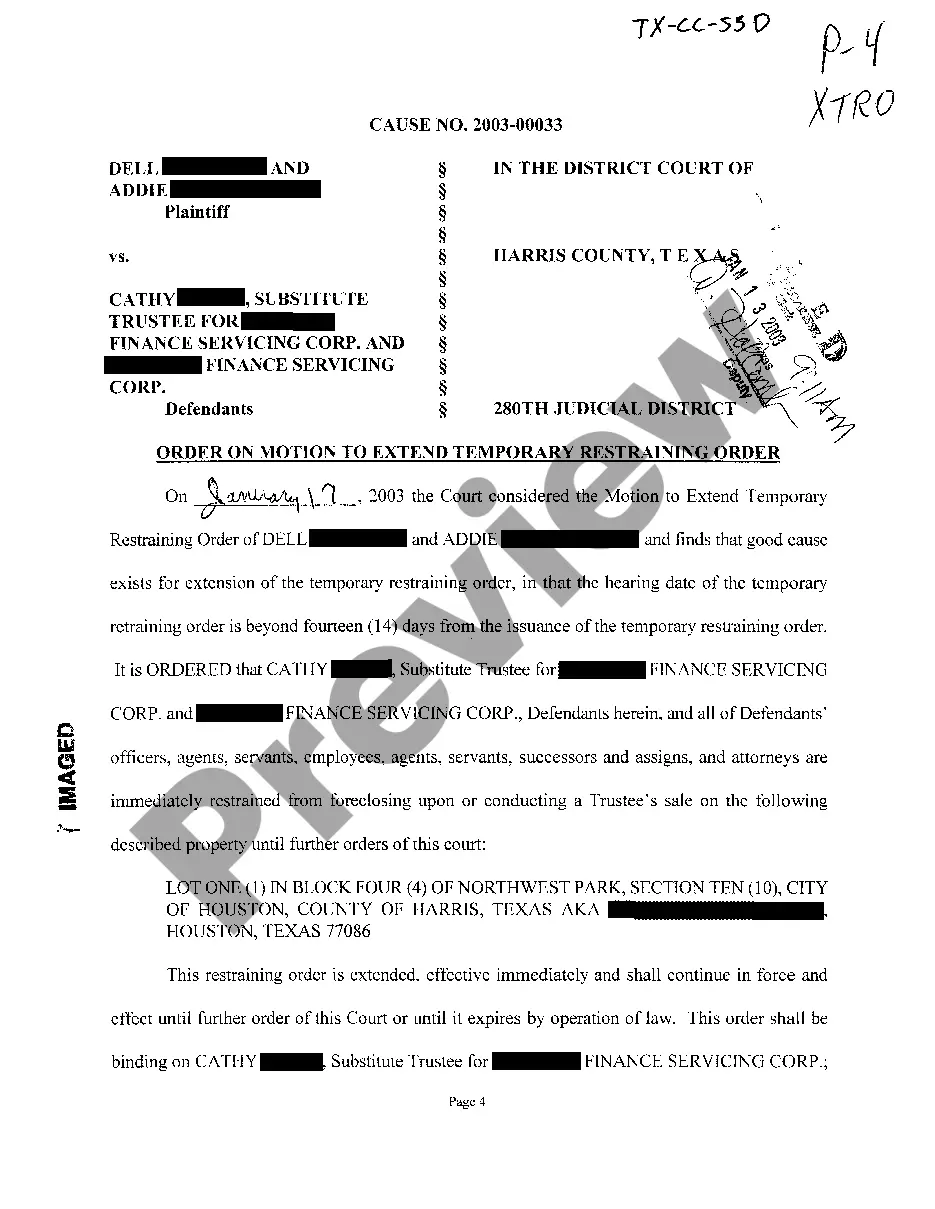

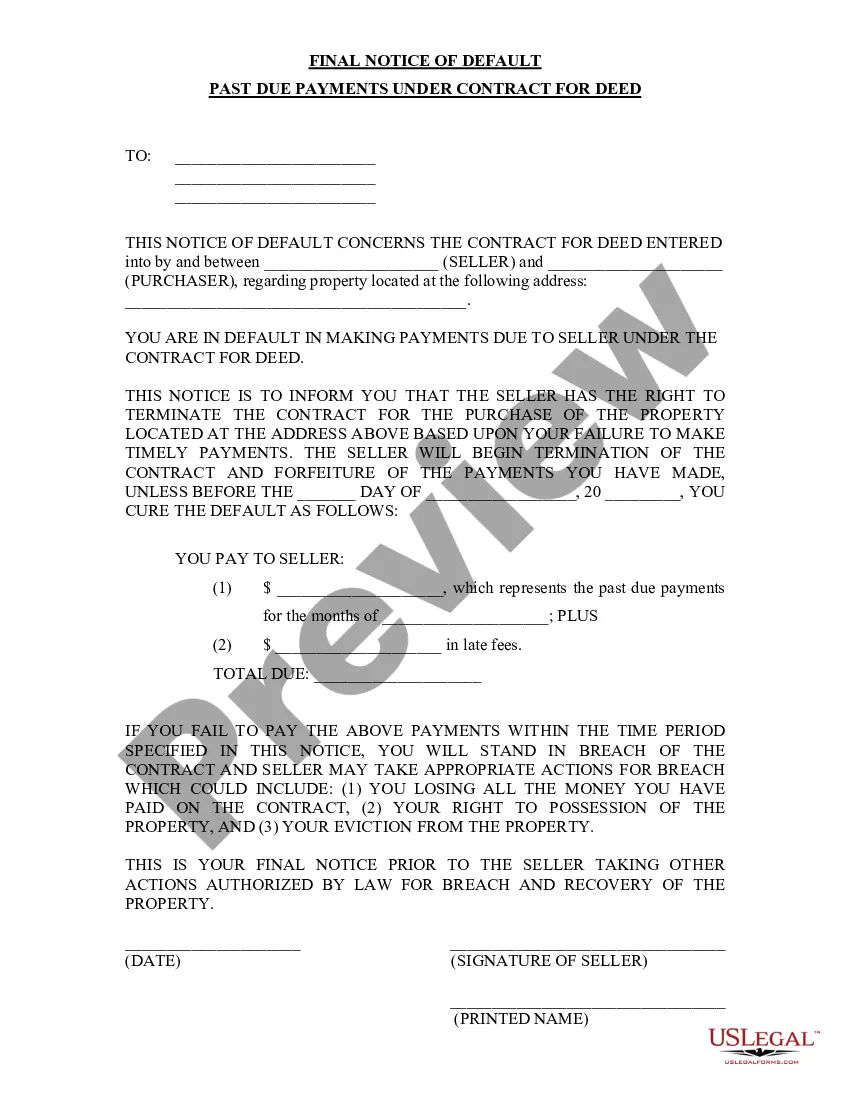

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description Notice Default Contract

How to fill out Notice Past Contract?

Use US Legal Forms to get a printable Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most complete Forms catalogue on the internet and provides affordable and accurate samples for customers and lawyers, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download samples, users must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to easily find and download Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Check to ensure that you have the proper template with regards to the state it’s needed in.

- Review the document by looking through the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed. Over three million users have utilized our service successfully. Select your subscription plan and have high-quality documents in a few clicks.

Notice Payments With Form popularity

Notice Past Payments Other Form Names

Payments With Contract FAQ

Default notices are recorded on credit files and usually remain there for six years. This could affect your ability to obtain credit in the future. If the default was issued by mistake or you made the full payment within the time period, you can ask for it to be removed from your file.

What happens when you get a default notice? Your creditor will ask you to pay the full amount of the debt instead of paying the instalments you first agreed. You can offer to pay in instalments at a rate you can afford, but your creditor may not agree to this.

Ignoring a default notice can lead to the creditor taking further action and could result in a County Court Judgment being sought against you. The default letter should state what further action the creditor will seek if the balance is not settled, often in the form of court action and a CCJ being issued.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

A defaulted account will drop off your credit record six years after the default date. It doesn't matter what happens after the default whether you pay the account in full, start paying it, agree a partial settlement or don't pay anything at all, the account will still be deleted after six years.

A default negatively impacts your ability to borrow money. When you apply for credit, lenders check your credit information to decide if you're likely to pay them back. A default looks like bad news to lenders, as it shows you've struggled to repay credit in the past.

Default notices are recorded on credit files and usually remain there for six years. This could affect your ability to obtain credit in the future. If the default was issued by mistake or you made the full payment within the time period, you can ask for it to be removed from your file.