Section 520.73 of the Florida Statutes

Home improvement contract; form and content; separate disclosures.

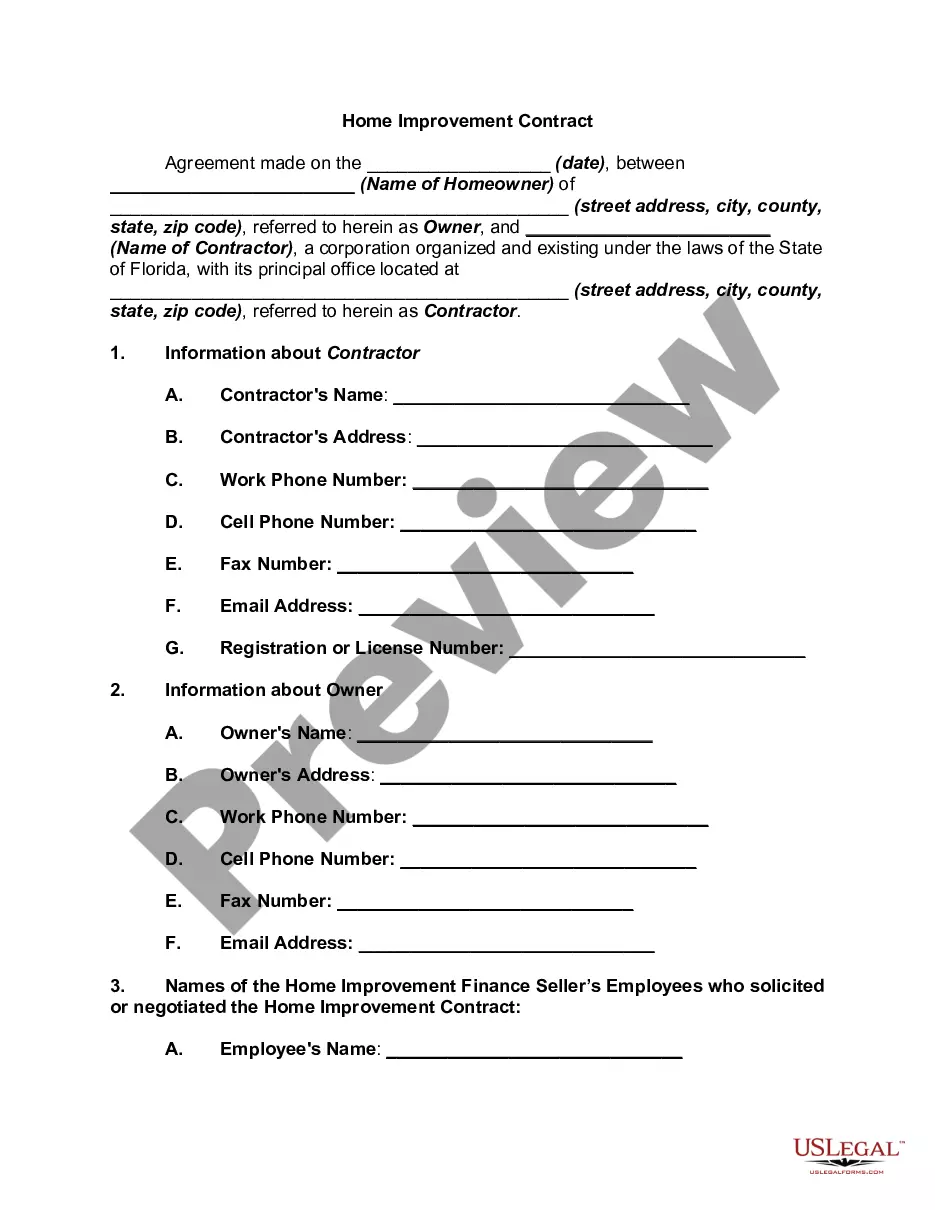

(1) Every home improvement contract shall be evidenced by a written agreement and shall be signed by the parties. The home improvement contract shall be in the form approved by the office and shall contain:

(a) The name, address, and license number of the home improvement finance seller;

(b) The names of the home improvement finance seller's employees who solicited or negotiated the home improvement contract;

(c) The approximate dates when the work will begin and will be completed; and

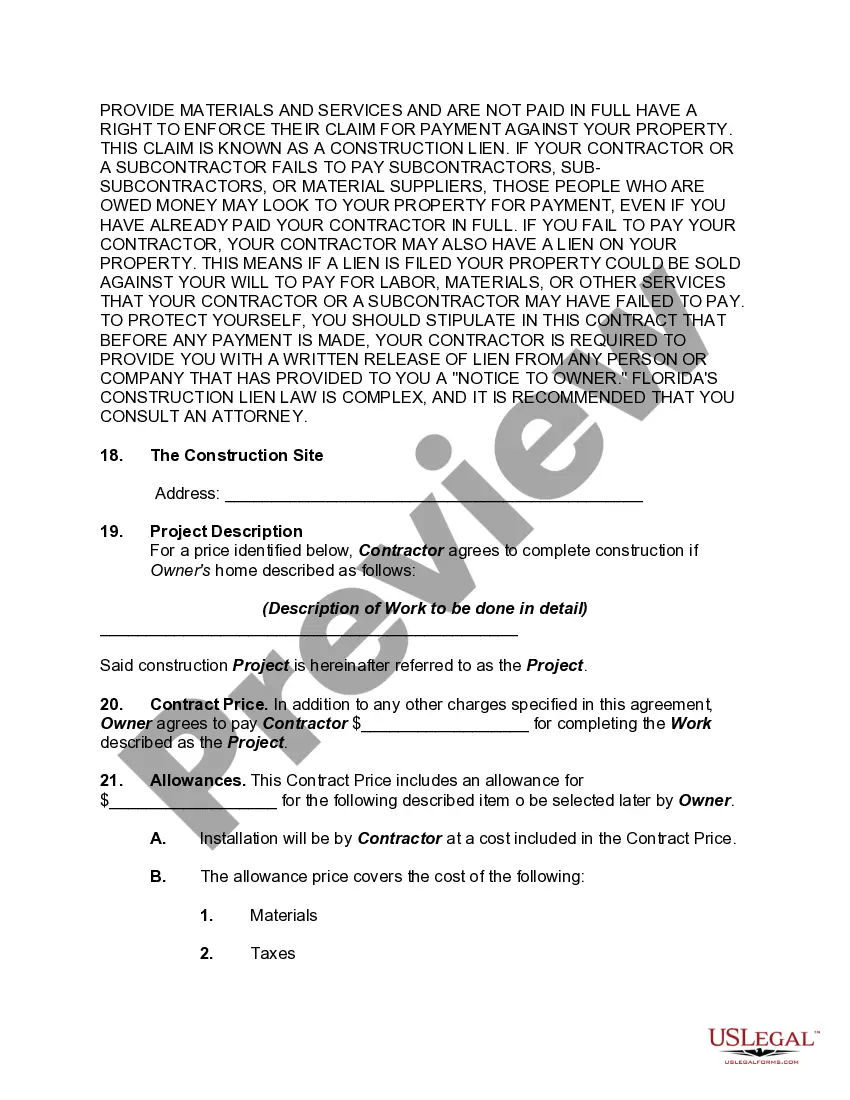

(d) A description of the work to be done and the materials to be used.

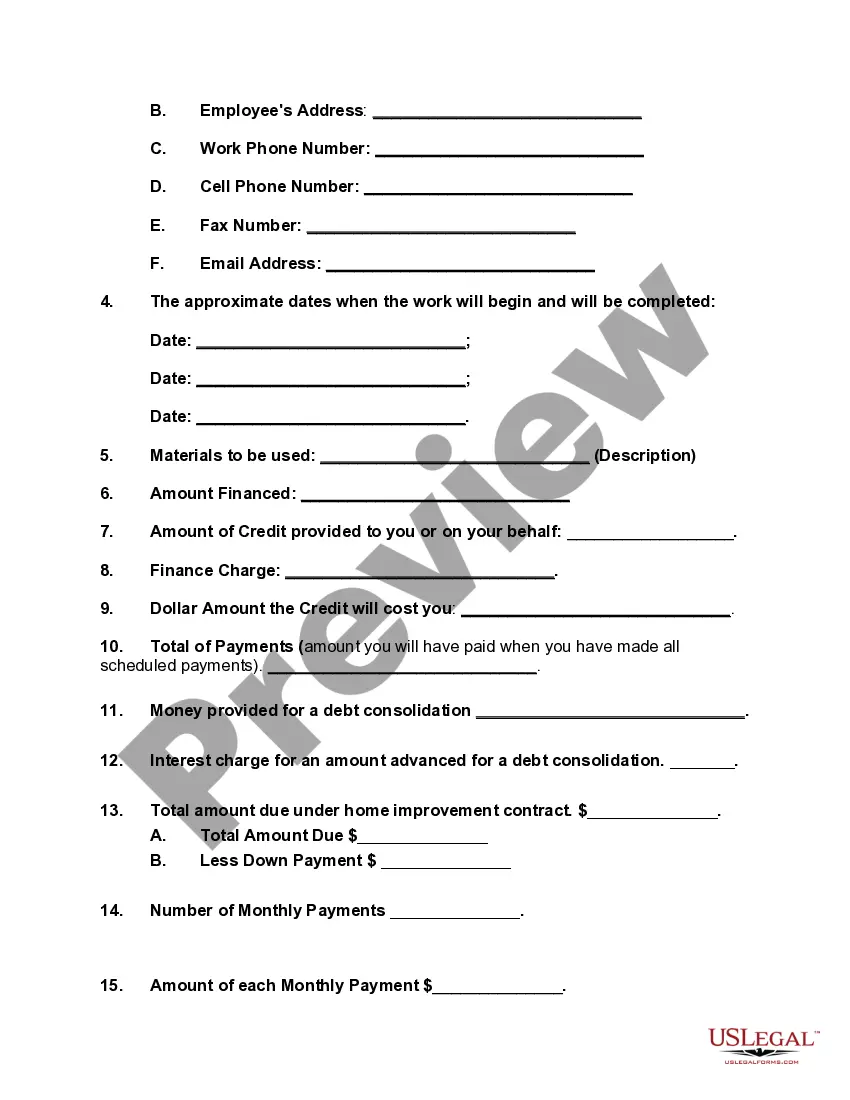

(2) The home improvement contract shall also contain:

(a) The "amount financed," using that term, and a brief description such as "the amount of credit provided to you or on your behalf." The amount financed is calculated by:

1. Determining the cash price, and subtracting any down payment;

2. Adding any other amounts that are financed by the creditor and that are not part of the finance charge; and

3. Subtracting any prepaid finance charge;

(b) The "finance charge," using that term, and a brief description such as "the dollar amount the credit will cost you";

(c) The "total of payments," using that term, and a descriptive explanation such as "the amount you will have paid when you have made all scheduled payments";

(d) In a credit sale, the "total sale price," using that term, and a descriptive explanation, including the amount of any down payment, such as "the total price of your purchase on credit, including your down payment of $_____." The total sale price is the sum of the cash price, the items described in subparagraph (a)2., and the finance charge disclosed under paragraph (b);

(e) The amount of any money provided for debt consolidation;

(f) The interest charge for the amount advanced for debt consolidation;

(g) The total amount due under the home improvement contract, which shall be stated as a sum in dollars, less any down payment;

(h) The number of monthly payments and the amount of each payment; and

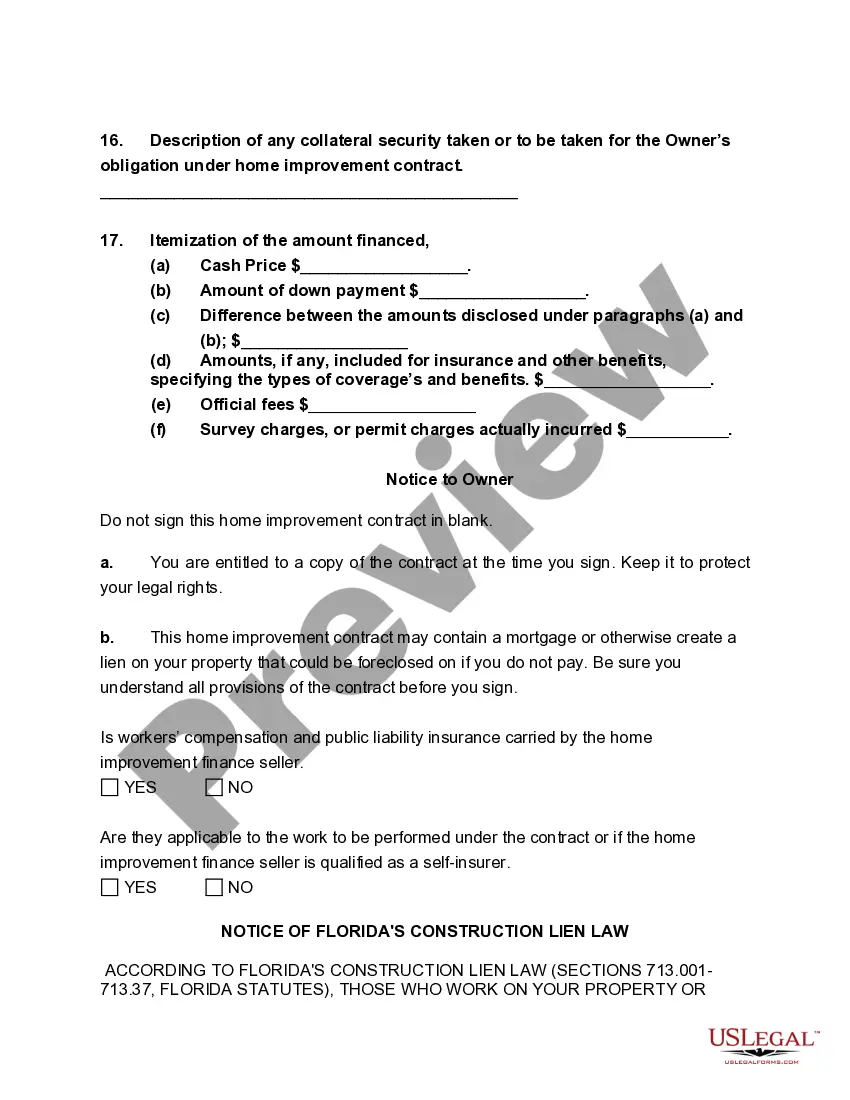

(i) The description of any collateral security taken or to be taken for the owner's obligation under the home improvement contract.

Except for the requirements of subsection (1) and the provisions of subsection (3) which provide for a separate written itemization of the amount financed, a contract which complies with the federal Truth in Lending Act, 15 U.S.C. ss. 1601 et seq., or any accompanying regulations shall be deemed to comply with the provisions of this subsection and subsection (3). However, in any proceeding to enforce the provisions of this section, the burden of alleging and proving compliance with the federal Truth in Lending Act shall be on the party claiming compliance.