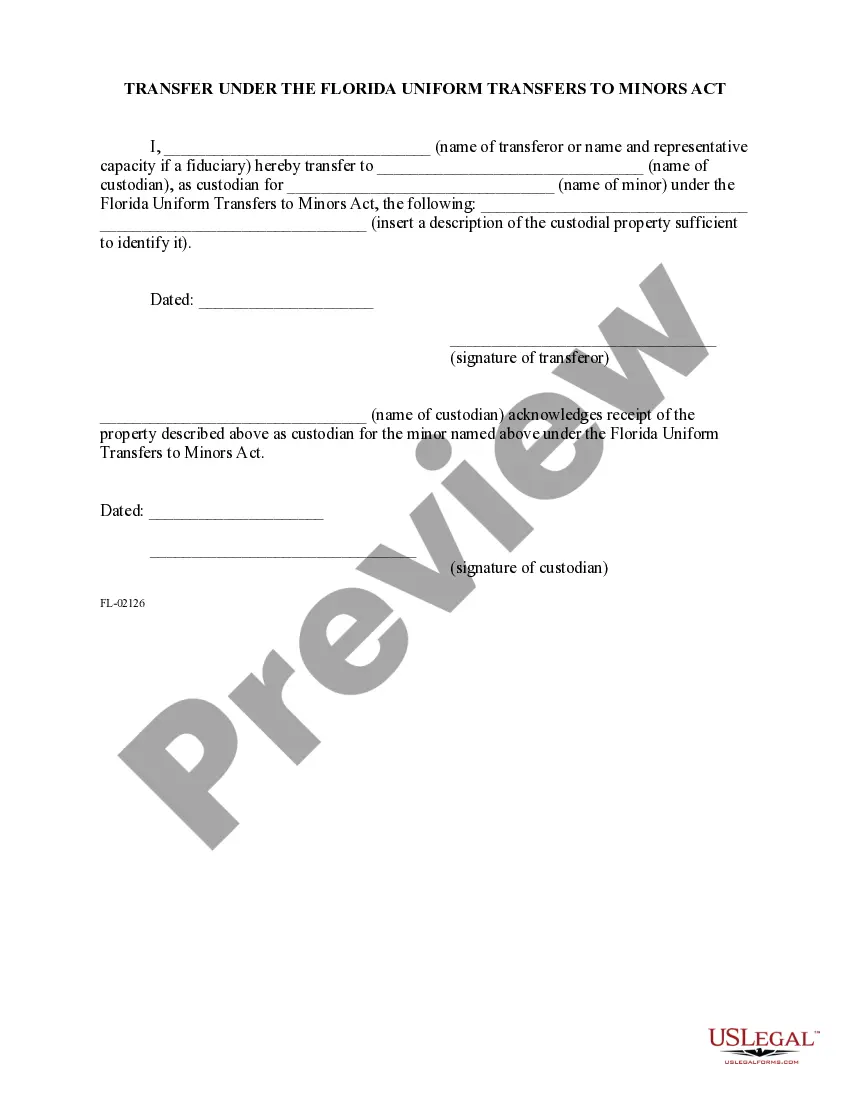

Transfer Under The Florida Uniform Transfers to Minors Act: This is an official Florida Court form that complies with all applicable Florida codes and statutes. USLF amends and updates all Florida forms as is required by Florida statutes and law.

Transfer Under The Florida Uniform Transfers to Minors Act

Description Uniform Gift To Minors Act Florida

How to fill out Florida Uniform Conveyance Docuenmts?

The greater number of documents you have to make - the more stressed you get. You can find a huge number of Transfer Under The Florida Uniform Transfers to Minors Act blanks on the internet, but you don't know which ones to rely on. Remove the hassle and make finding samples easier using US Legal Forms. Get professionally drafted documents that are written to go with the state requirements.

If you currently have a US Legal Forms subscribing, log in to the account, and you'll see the Download button on the Transfer Under The Florida Uniform Transfers to Minors Act’s webpage.

If you’ve never applied our platform earlier, finish the sign up procedure using these guidelines:

- Make sure the Transfer Under The Florida Uniform Transfers to Minors Act applies in your state.

- Double-check your choice by studying the description or by using the Preview function if they are available for the chosen record.

- Click on Buy Now to start the signing up process and choose a costs program that suits your expectations.

- Provide the requested data to make your profile and pay for the order with the PayPal or bank card.

- Select a prefered document formatting and obtain your copy.

Access each file you get in the My Forms menu. Simply go there to produce a fresh duplicate of the Transfer Under The Florida Uniform Transfers to Minors Act. Even when using professionally drafted forms, it’s still essential that you consider requesting the local legal professional to re-check filled in sample to be sure that your document is correctly filled out. Do much more for less with US Legal Forms!

Florida Uniform Transfers To Minors Act Form popularity

Florida Utma Account Other Form Names

Florida Utma Statute FAQ

As the custodian of a UTMA/UGMA account, a parent can withdraw money whenever needed to benefit the child.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee.The donor can name a custodian who has the fiduciary duty to manage and invest the property on behalf of the minor until the minor becomes of legal age.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

Generally, the UTMA account transfers to the beneficiary when he or she becomes a legal adult, which is usually 18 or 21. However, the age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

The Uniform Gifts to Minors Act (UGMA) provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point he assumes control of the account.

Florida Statute 710.123 (effective July 1, 2015) now permits UTMA accounts created by an individual, or authorized under a will or trust, to continue until the minor attains age 25.

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.