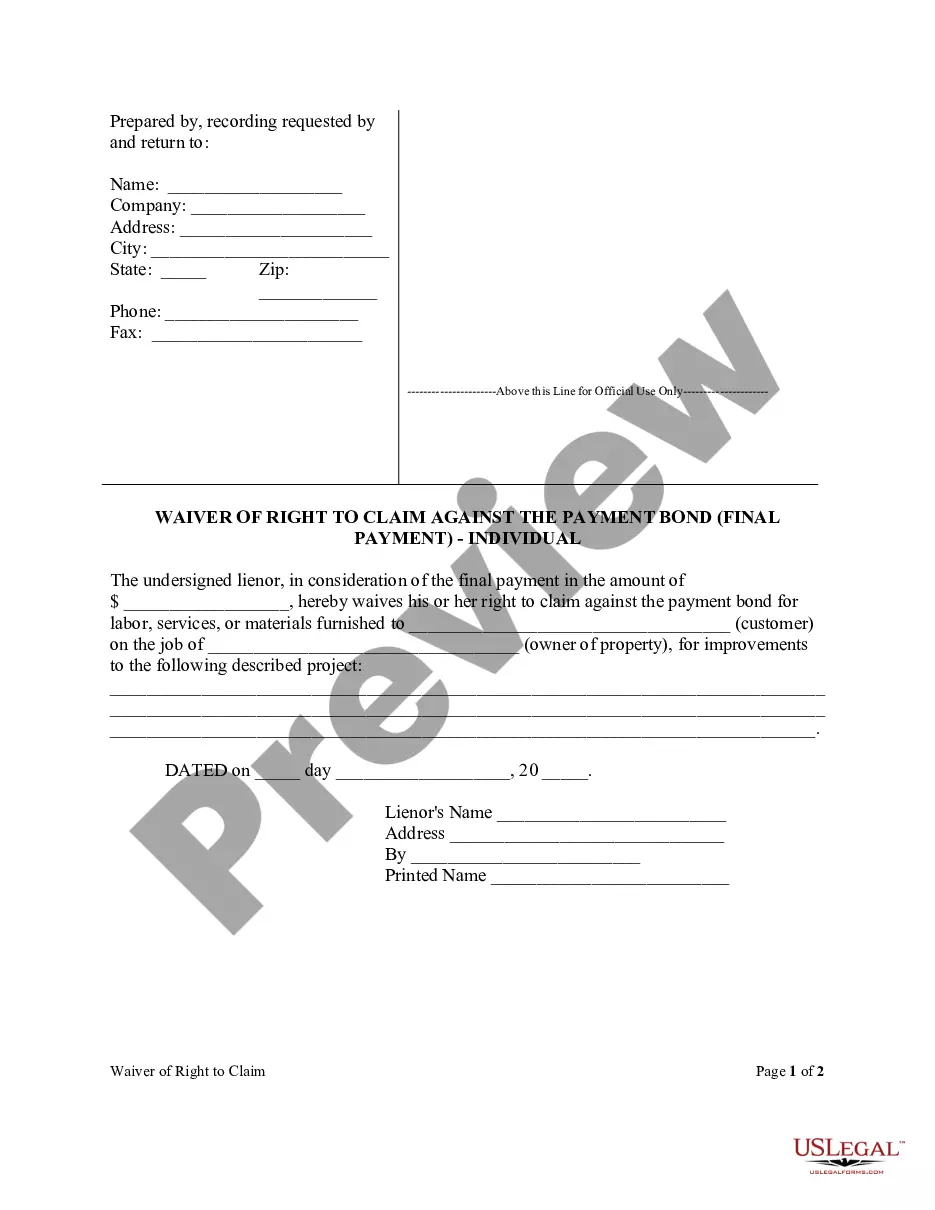

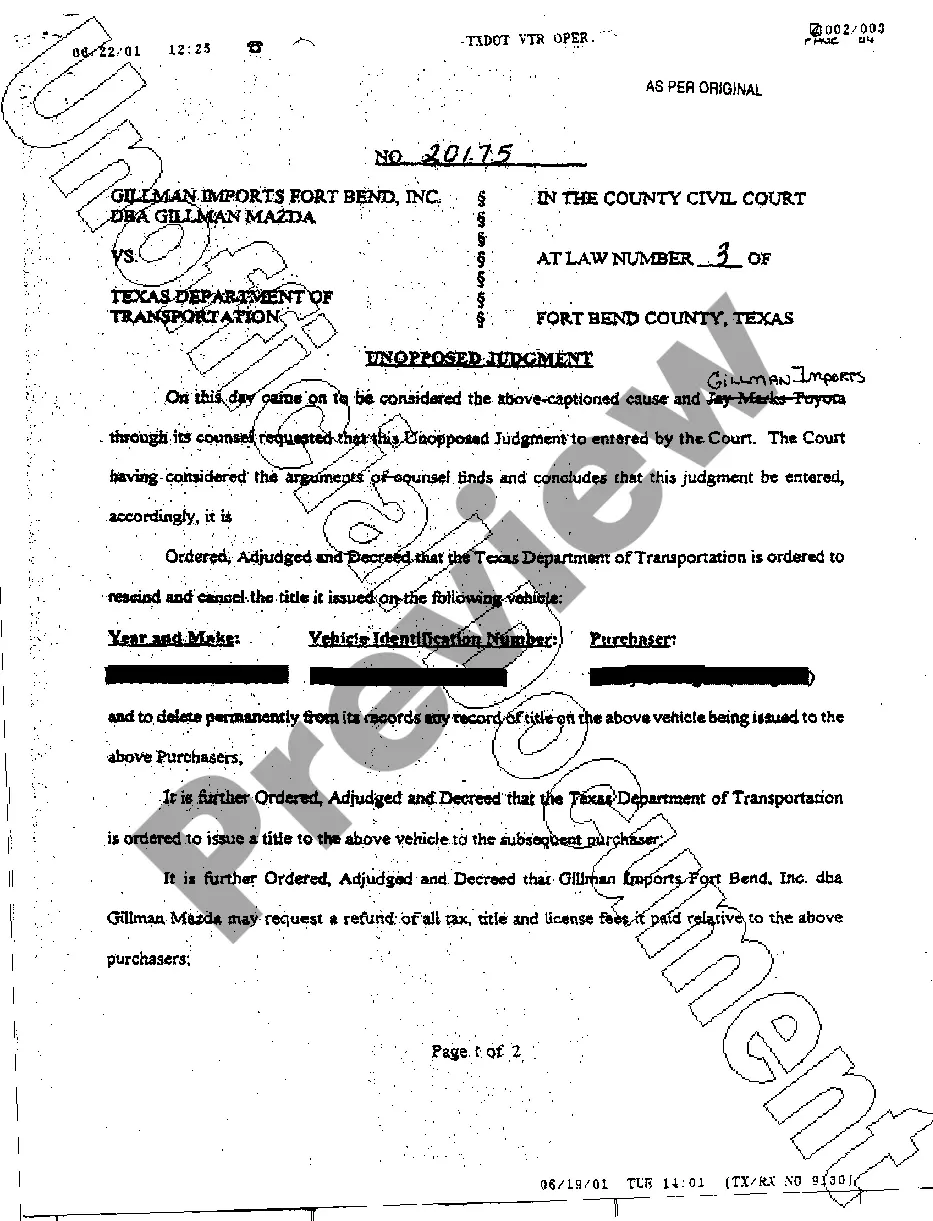

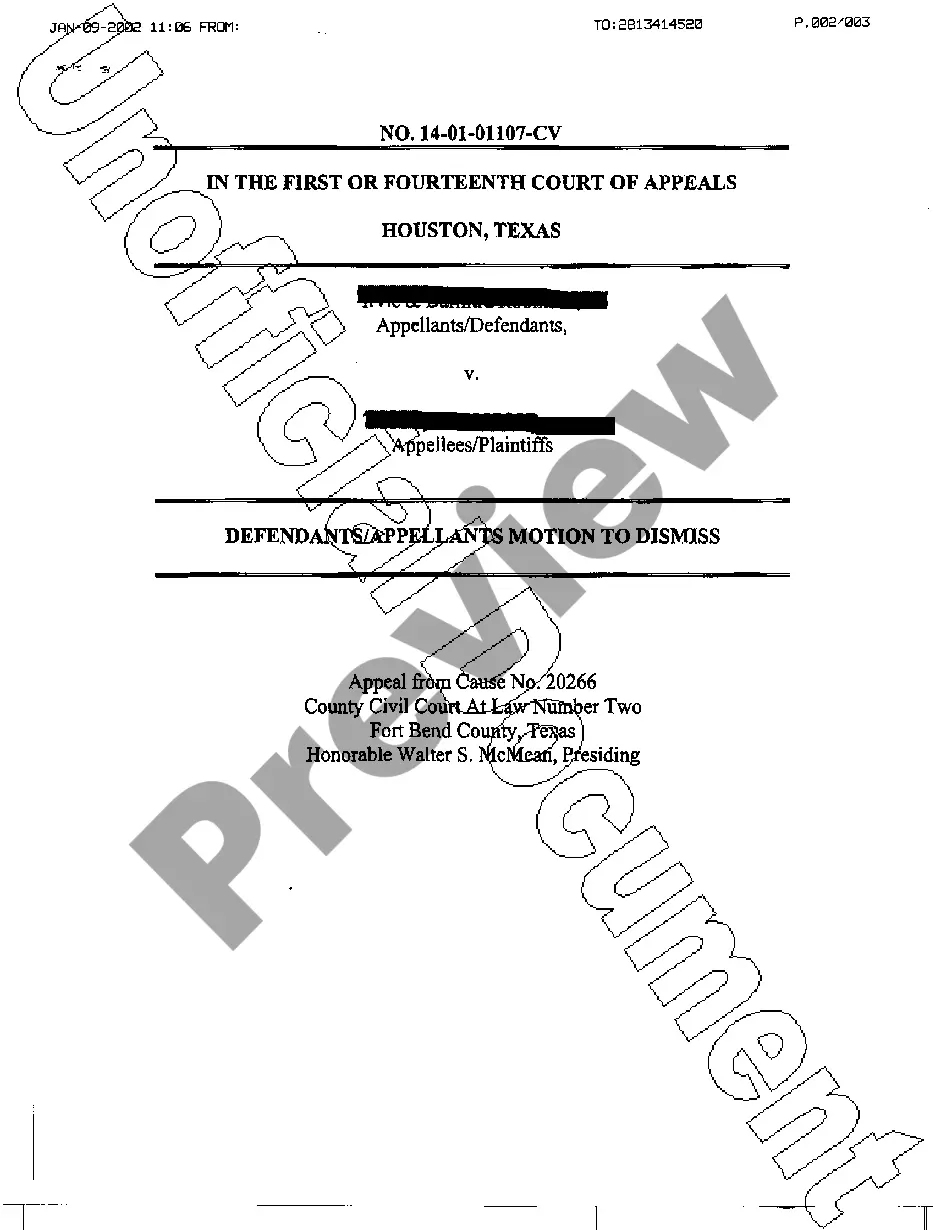

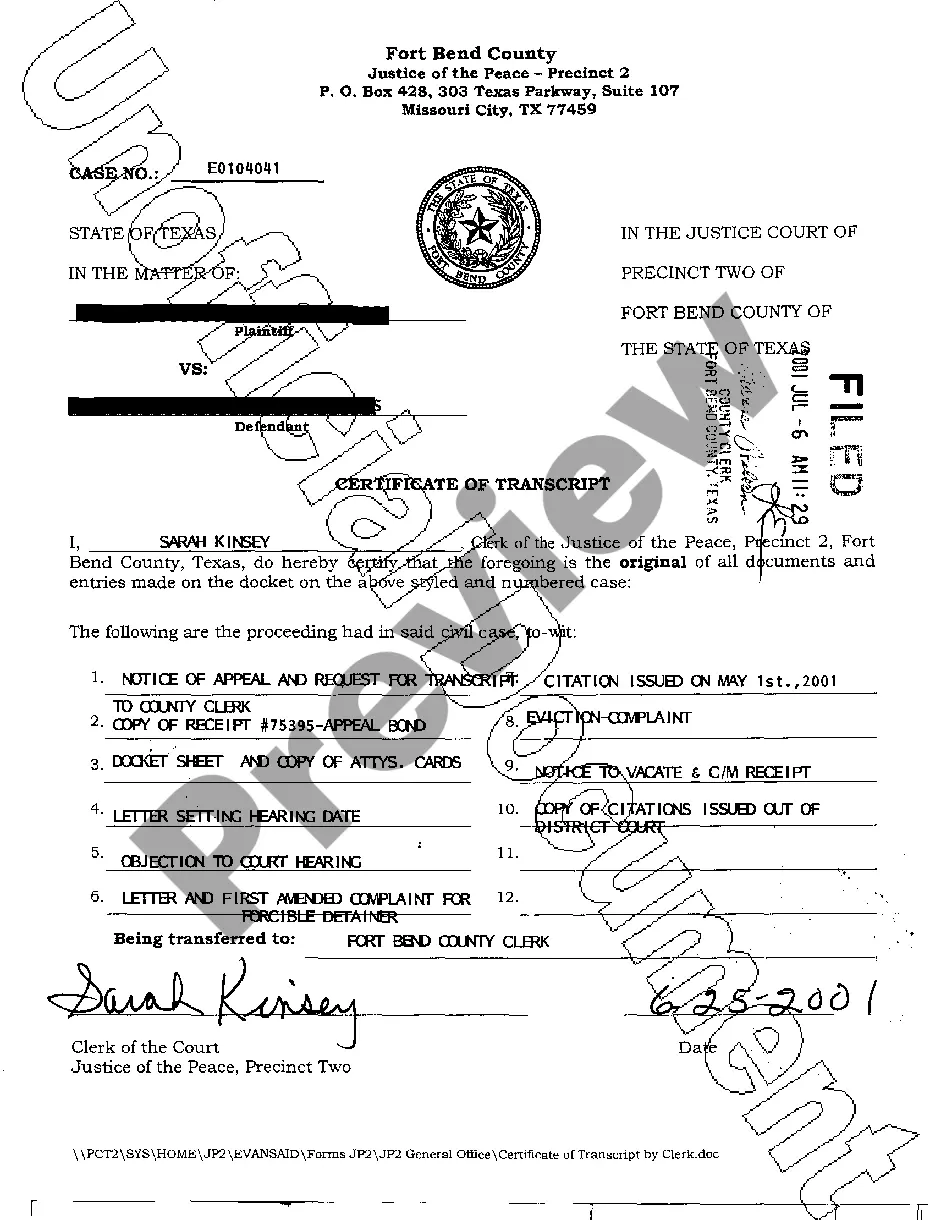

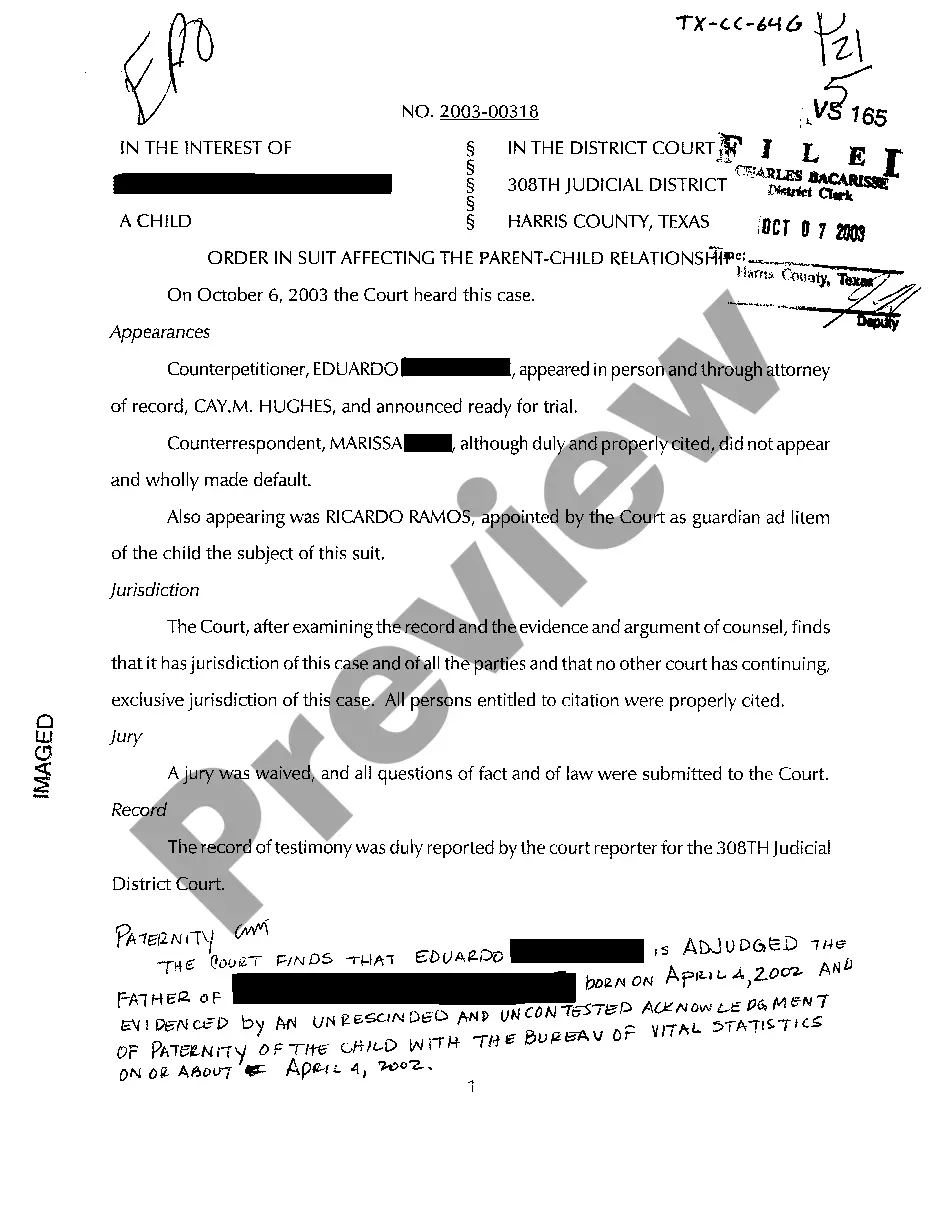

Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Individual

Description Payment Claim Final

How to fill out Claim Against Final?

The greater number of documents you need to make - the more stressed you are. You can find a huge number of Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Individual templates on the internet, but you don't know which of them to rely on. Eliminate the hassle to make getting samples more convenient employing US Legal Forms. Get expertly drafted documents that are created to go with the state specifications.

If you have a US Legal Forms subscribing, log in to the account, and you'll see the Download option on the Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Individual’s page.

If you have never tried our website before, complete the registration procedure using these instructions:

- Make sure the Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Individual applies in your state.

- Re-check your decision by reading through the description or by using the Preview function if they’re available for the chosen document.

- Simply click Buy Now to get started on the sign up procedure and choose a costs program that fits your expectations.

- Insert the requested info to create your account and pay for the order with the PayPal or bank card.

- Pick a convenient file type and have your example.

Find each template you download in the My Forms menu. Simply go there to produce a new version of your Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Individual. Even when preparing professionally drafted templates, it’s still essential that you think about asking the local attorney to re-check filled in form to make certain that your record is accurately filled out. Do much more for less with US Legal Forms!

Florida Payment Final Form popularity

Waiver Bond Individual Other Form Names

Waiver Right Against FAQ

The surety company will give the Principal (the person who is bonded) a chance to satisfy the claim. If the Principal fails to satisfy the claim, the surety company will step in and satisfy the claim. The surety company will then go to the Principal for repayment of satisfying that claim.

Your complaint form must include your name and contact information, as well as the name and contact information of the construction contractor. If you've already filed a claim against the contractor's bond, you should state this somewhere on your complaint to the licensing board.

Surety bond claims come with a price. If the claim is determined to be valid, the surety bond company will pay the claimant up to the full amount of the bond. The surety company will then come to you for repayment. You are responsible for repaying the surety company every penny they paid out on your bond claim.

Contesting A Lien An owner has a right to file a Notice of Contest of Lien during the one-year period. Upon the filing of a Notice of Contest of Lien, a lienor must file a lawsuit to enforce the lien within 60 days. Failure of the lienor to timely file a lawsuit renders the lien invalid.

Call to have a Complaint Form mailed to you 1-800-321-CSLB (2752), OR. Use the On-line Complaint Form, OR. Download and Print a Complaint Form.

If you opt to purchase a surety bond, you would pay a surety company to write that bond for you.If you buy a surety bond, you cannot cash it out once the bond is exonerated or "released from the court". You also do not receive back the money you paid for it.

Step 1: Send required notices to protect your bond claim rights. Step 2: Send a Notice of Intent. Step 3: Submit your bond claim. Step 4: Send a Notice of Intent to Proceed Against Bond. Step 5: Enforce your bond claim in court.

A bond claim means the claimant is alleging you haven't fulfilled an obligation of yours that may be covered under the bond. However, genuine disputes occur in business transactions regarding the responsibilities between parties which is why surety companies investigate every claim.

Bonding Company. The first step in filing your surety bond claim is to find out who bonded the offender. Make Contact. Maintain Contact.