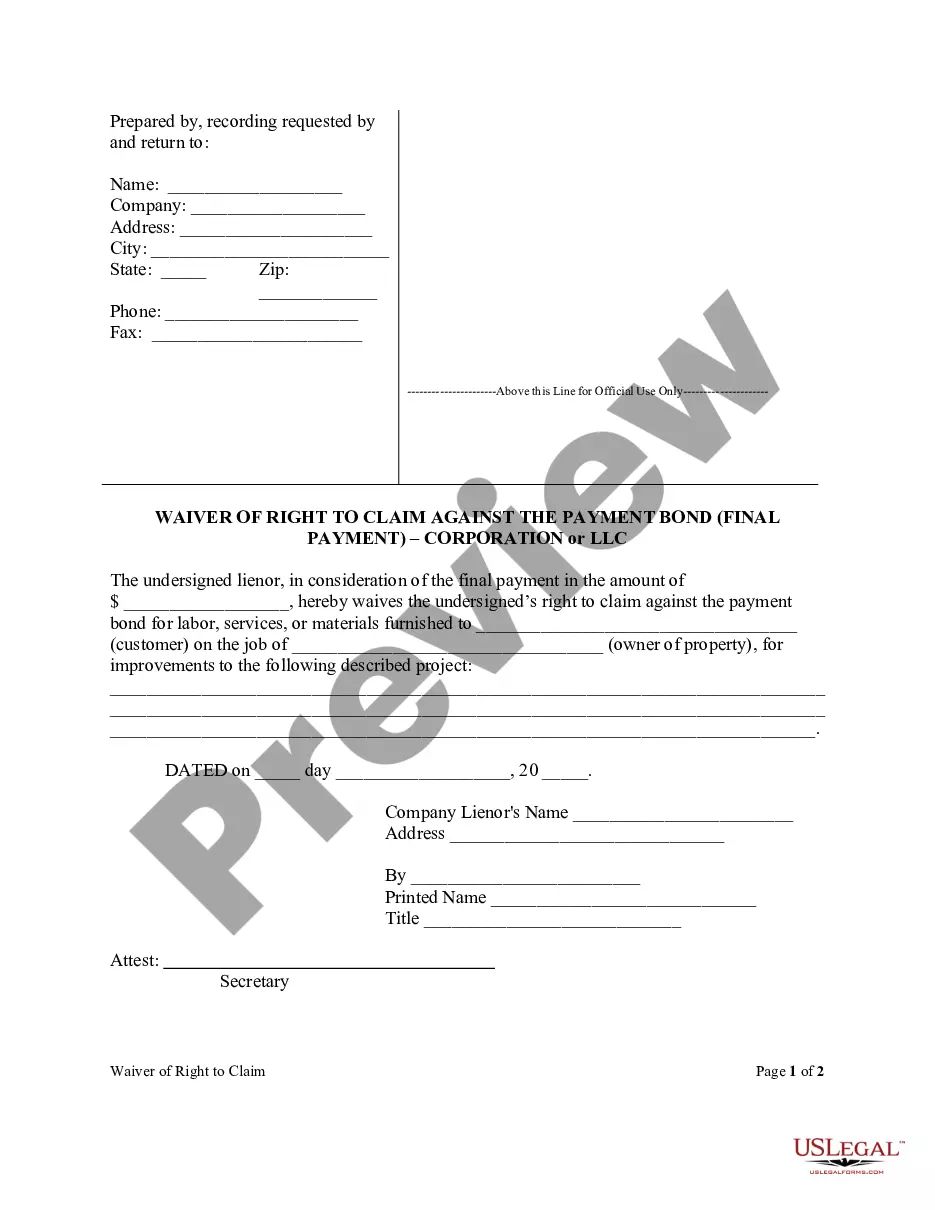

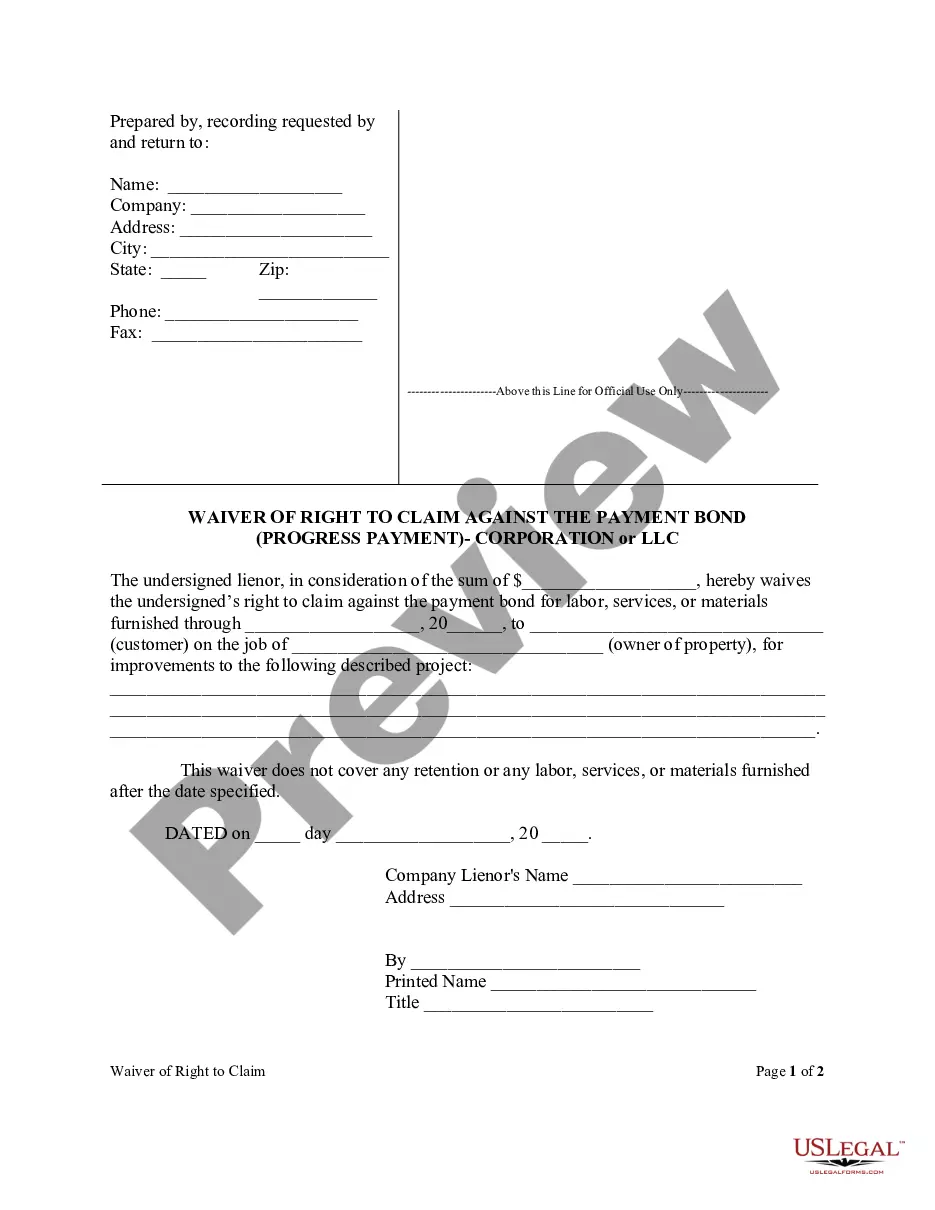

Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Corporation or LLC

Description Florida Corporation Llc

How to fill out Payment Claim Against?

The more papers you need to create - the more anxious you feel. You can get a huge number of Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Corporation or LLC blanks online, but you don't know which ones to rely on. Eliminate the headache to make finding exemplars more straightforward using US Legal Forms. Get accurately drafted forms that are composed to go with the state demands.

If you have a US Legal Forms subscription, log in to the account, and you'll see the Download button on the Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Corporation or LLC’s web page.

If you have never used our service before, finish the signing up procedure using these guidelines:

- Make sure the Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Corporation or LLC applies in your state.

- Double-check your option by reading the description or by using the Preview mode if they are available for the selected record.

- Simply click Buy Now to start the sign up procedure and select a rates plan that meets your preferences.

- Provide the requested info to make your account and pay for the order with your PayPal or bank card.

- Select a convenient document type and obtain your copy.

Access every document you get in the My Forms menu. Simply go there to produce a new copy of your Florida Waiver of Right to Claim Against the Payment Bond (Final Payment) - Corporation or LLC. Even when preparing properly drafted templates, it is still vital that you consider asking your local lawyer to re-check filled out sample to make sure that your record is correctly completed. Do much more for less with US Legal Forms!

Claim Bond Form popularity

Florida Claim Payment Bond Other Form Names

Claim Payment Final FAQ

Payment Bond guarantees that suppliers and subcontractors will be paid for materials and labor furnished to the contractor. The owner's purpose in requiring a payment bond is to guarantee that the project will be delivered free of liens.

Step 1: Send a copy of the claim to every party with an interest. The claim process and the parties required to receive your payment bond claim vary from state to state. Step 2: Wait for surety's response and reply promptly when you receive it. Step 3: Follow up with the surety all the time. Step 4: File a lawsuit.

How Much Does a Payment Bond Cost? Payment bond rates typically fall around 3%, which would translate to a $3,000 premium for $100,000 of coverage. The best way to determine exactly what your premium will be is to get a free surety bond price quote with no obligation.

A payment bond is a surety bond posted by a contractor to guarantee that its subcontractors and material suppliers on the project will be paid. They are required in contracts over $35,000 with the Federal Government and must be 100% of the contract value. They are often required in conjunction with performance bonds.

Step 1: Send required notices to protect your bond claim rights. Step 2: Send a Notice of Intent. Step 3: Submit your bond claim. Step 4: Send a Notice of Intent to Proceed Against Bond. Step 5: Enforce your bond claim in court.

Payment bonds are surety bonds that ensure subcontractors and material suppliers are paid according to contract. These bonds are critical for jobs on public property where mechanic's liens (security interests) cannot be used.

A bond is like an added level of insurance on your coverage plan. It guarantees a payment amount if certain conditions are (or aren't) met in a contract you've signed. For example, let's say you're a contractor with general liability insurance.

The Performance Bond secures the contractor's promise to perform the contract in accordance with its terms and conditions, at the agreed upon price, and within the time allowed. The Payment Bond protects certain laborers, material suppliers and subcontractors against nonpayment.

The Payment Bond protects certain laborers, material suppliers and subcontractors against nonpayment. Since mechanic's liens cannot be placed against public property, the payment bond may be the only protection these claimants have if they are not paid for the goods and services they provide to the project.