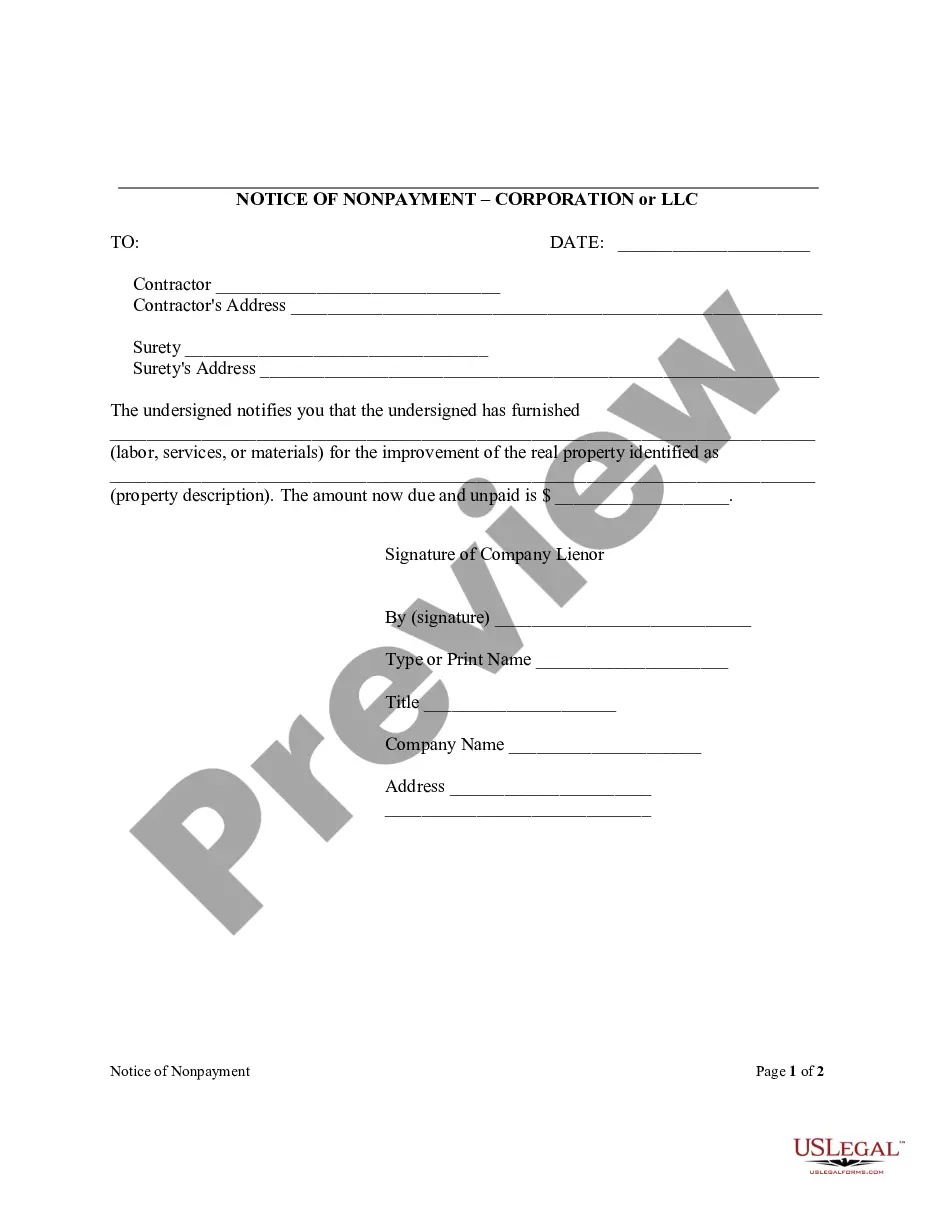

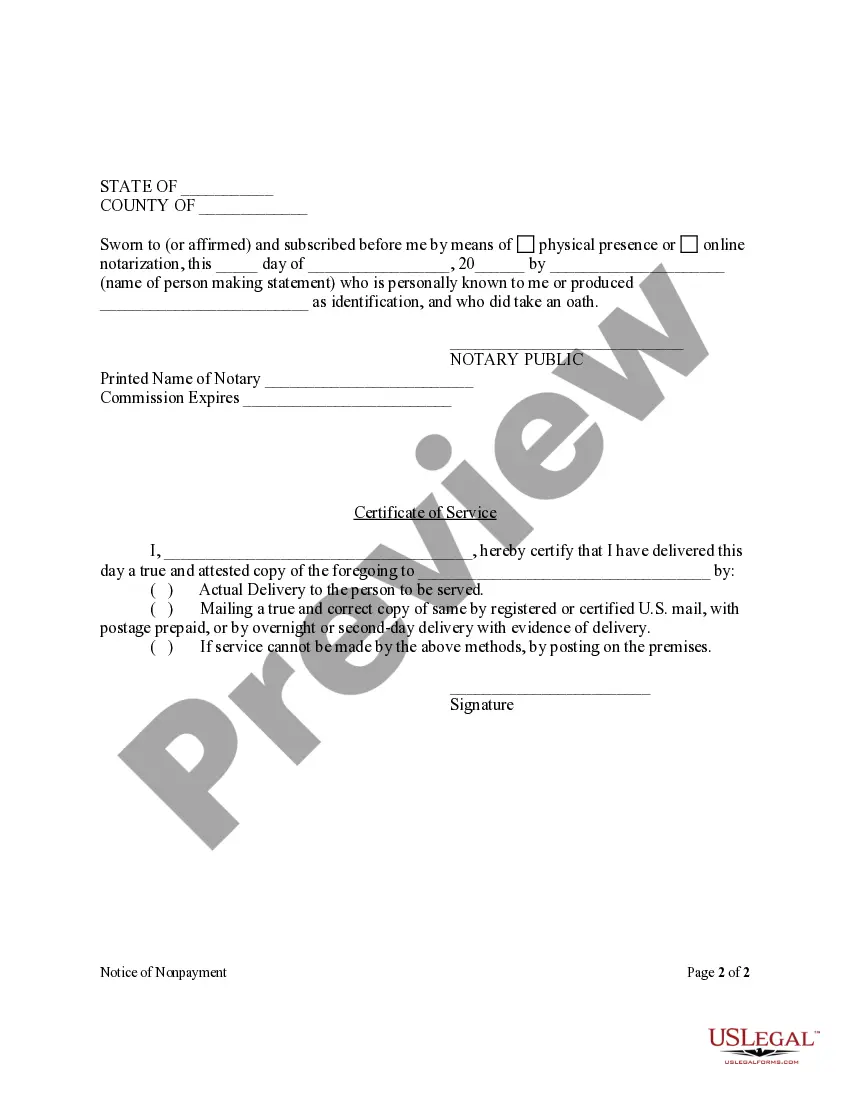

Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Florida Notice Of Nonpayment - Corporation Or LLC?

The greater the number of documents you need to produce, the more anxious you become.

You can discover countless Florida Notice of Nonpayment - Corporation or LLC samples online, but you may be uncertain which ones are reliable.

Eliminate the frustration and simplify sample detection with US Legal Forms.

Make the payment via PayPal or credit card, select a convenient document format, and obtain your template. All samples can be accessed in the My documents section. Simply navigate there to create a fresh version of the Florida Notice of Nonpayment - Corporation or LLC. Even with well-prepared templates, it’s crucial to consider consulting a local lawyer to verify that your document is correctly filled out. Achieve more for less with US Legal Forms!

- Obtain expertly crafted forms designed to meet state regulations.

- If you currently possess a US Legal Forms subscription, Log In to your profile, and you'll find the Download button on the web page for the Florida Notice of Nonpayment - Corporation or LLC.

- If you haven’t utilized our website before, complete the registration process following these guidelines.

- Ensure the Florida Notice of Nonpayment - Corporation or LLC is legitimate in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

Form popularity

FAQ

A lien in Florida can be deemed invalid for several reasons, such as failure to meet filing deadlines, not adhering to legal requirements, or lack of proper notice. Additionally, if the work performed does not meet agreed specifications, it may also affect the validity of a lien. Being informed about these factors is essential, especially when dealing with the Florida Notice of Nonpayment - Corporation or LLC, as they dictate your rights and responsibilities.

In Florida, immediate family generally includes parents, children, siblings, and, in some cases, spouses. This definition may impact legal matters, such as property disputes or estate planning. Knowing who qualifies as immediate family can be significant in various legal contexts, including those involving the Florida Notice of Nonpayment - Corporation or LLC. Always consult legal guidance when uncertain.

A no information notice in Florida is a declaration that indicates a contractor has not provided sufficient information regarding their lien claim. This notice is typically sent to property owners to highlight the lack of details. Understanding this notice helps you navigate lien-related issues more effectively. If you receive such a notice, consider the implications it may have on your position concerning the Florida Notice of Nonpayment - Corporation or LLC.

Section 713.245 of the Florida statute pertains to notices related to the nonpayment of construction services. This law establishes the process through which those who have not received payment can assert their rights. It’s an essential tool when navigating through financial disputes in construction and contracting. Utilizing resources like the Florida Notice of Nonpayment - Corporation or LLC can be beneficial in this context.

To avoid a construction lien in Florida, make timely and accurate payments to contractors and subcontractors. Additionally, obtaining waivers after payments can prevent potential claims. It’s essential to create a clear and documented payment history, especially if the Florida Notice of Nonpayment - Corporation or LLC comes into play. Be proactive in your financial dealings to maintain peace of mind.

In Florida, property owners have a legal duty to warn known trespassers of hazardous conditions. However, for undiscovered trespassers, this duty is generally limited. This means that if you’re facing issues related to trespassing, understanding these legal obligations can guide you in protecting your interests. Consider how the Florida Notice of Nonpayment - Corporation or LLC might impact liabilities in such cases.

The eviction process in Florida typically starts with the landlord providing a notice to the tenant, outlining the reasons for eviction. If the tenant does not comply, the landlord can file a complaint in court for formal eviction. Following a court order, the tenant may be removed by law enforcement. Understanding these steps ensures proper handling of eviction under circumstances where the Florida Notice of Nonpayment - Corporation or LLC may be relevant.

A Notice to Owner (NTO) in Florida must include specific information such as the project address, the name and address of the property owner, and the contractor's details. This document serves to inform the property owner of a party's involvement in the project, ensuring their right to a lien if they face nonpayment. A well-prepared NTO strengthens claims under the Florida Notice of Nonpayment - Corporation or LLC, helping to secure your interests.

In Florida, the property owner or authorized agent is responsible for filing the notice of commencement. This step is vital in protecting your rights related to any Florida Notice of Nonpayment - Corporation or LLC. It’s advisable for the property owner to choose an experienced contractor or legal advisor to ensure proper filing. Platforms like U.S. Legal Forms provide resources to help streamline this process, making it easier for you to understand your obligations and rights.

Filling out a Notice of Commencement in Florida involves including specific details like identification of the contractor and the project location. Additionally, you need to mention the start date of construction and any recorded changes to the terms. It is essential to present your project clearly, especially when addressing elements related to Florida Notice of Nonpayment - Corporation or LLC. Consider using U.S. Legal Forms for precise templates that guide you through each step without confusion.