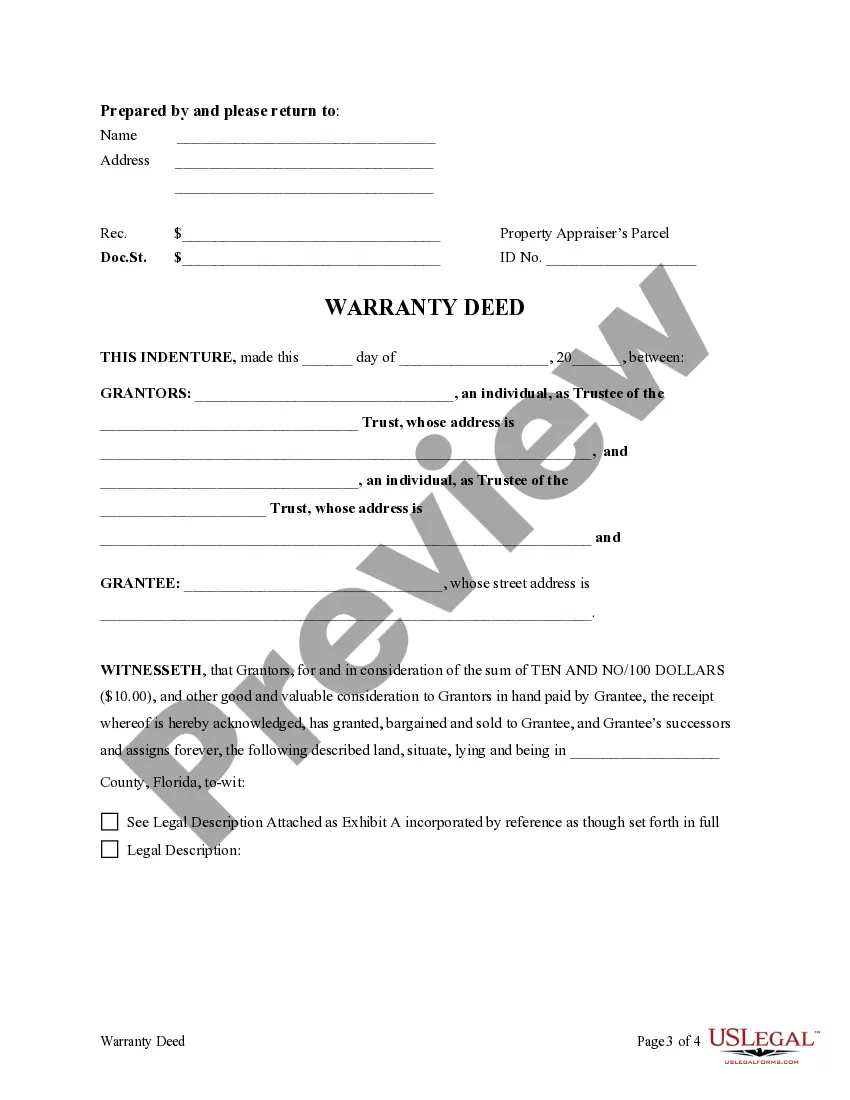

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Florida Trust - Two Individual Trustees - to an Individual

Description

How to fill out Florida Trust - Two Individual Trustees - To An Individual?

Get the most comprehensive library of authorized forms. US Legal Forms is really a solution to find any state-specific form in a few clicks, even Florida Trust - Two Individual Trustees - to an Individual examples. No reason to waste hours of your time trying to find a court-admissible example. Our certified specialists ensure you get updated documents every time.

To take advantage of the forms library, select a subscription, and create your account. If you registered it, just log in and then click Download. The Florida Trust - Two Individual Trustees - to an Individual sample will immediately get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new account, look at quick instructions listed below:

- If you're going to utilize a state-specific documents, make sure you indicate the right state.

- If it’s possible, review the description to understand all of the ins and outs of the form.

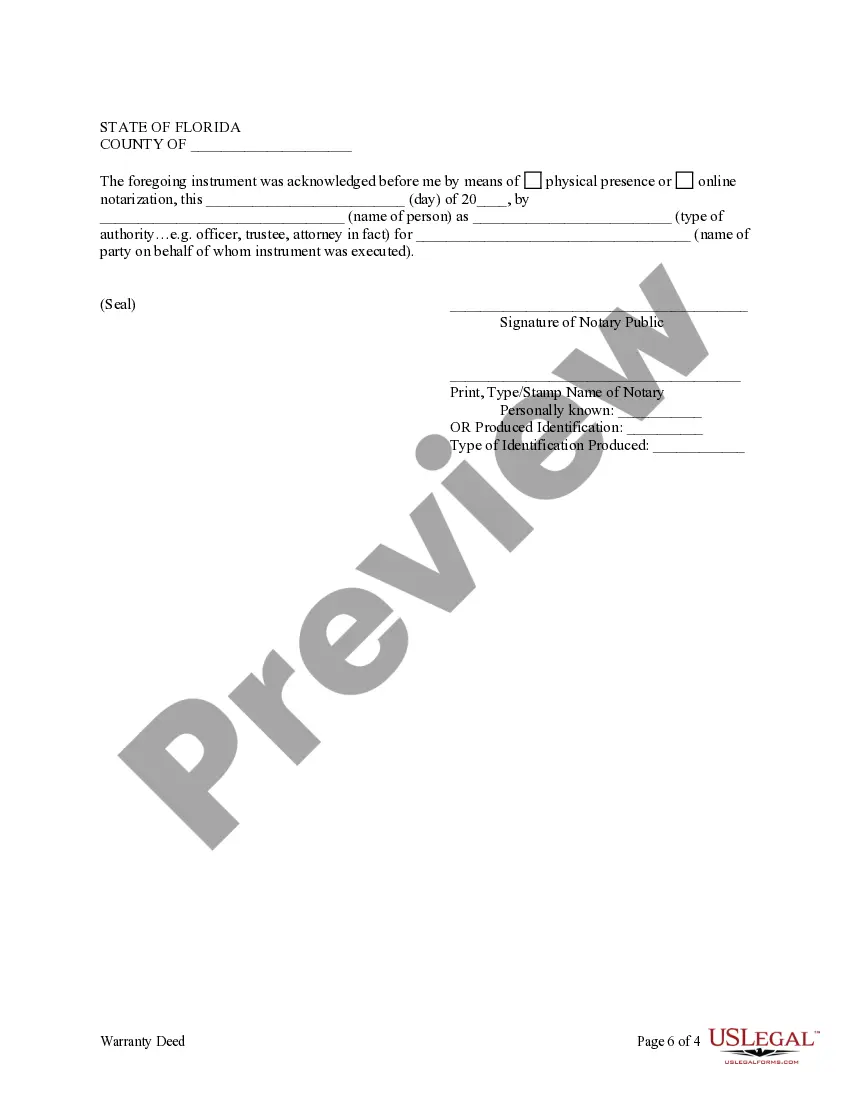

- Make use of the Preview option if it’s available to look for the document's information.

- If everything’s correct, click on Buy Now button.

- After selecting a pricing plan, register an account.

- Pay out by credit card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You need to submit the Florida Trust - Two Individual Trustees - to an Individual template and double-check it. To make sure that things are accurate, call your local legal counsel for support. Join and easily look through more than 85,000 valuable samples.

Form popularity

FAQ

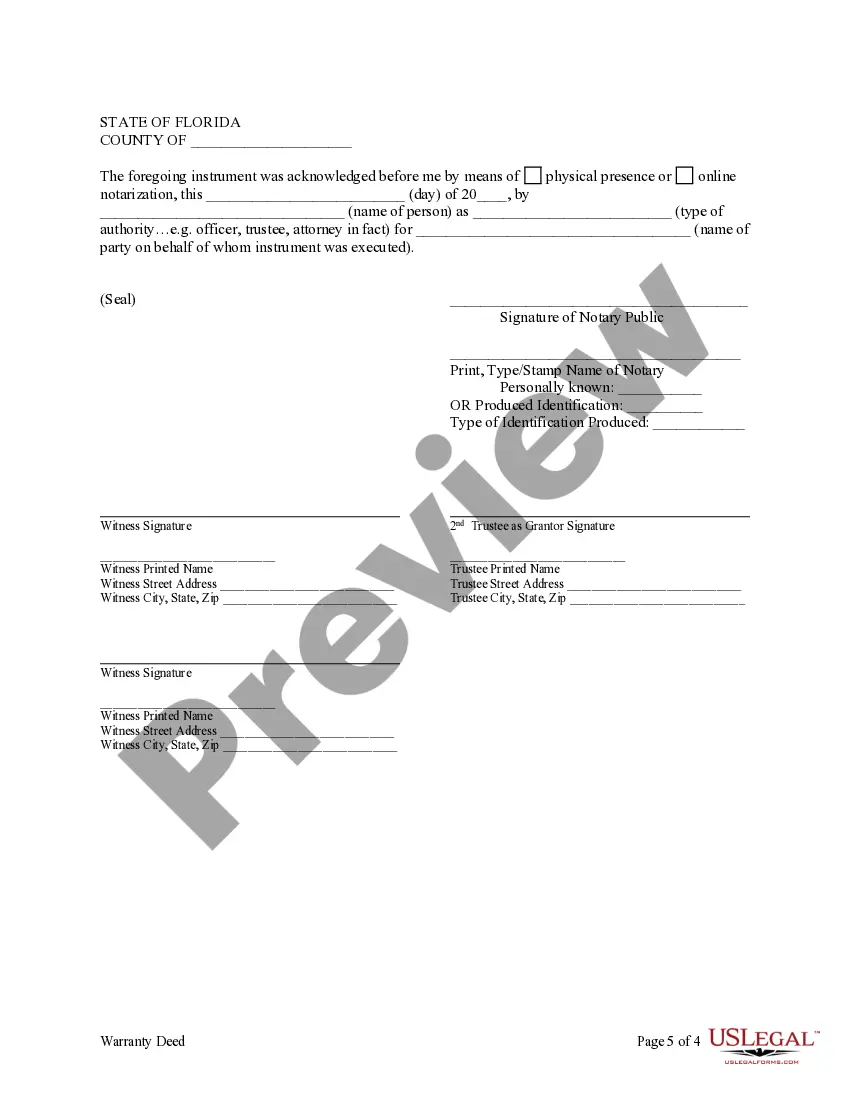

Generally, if you are a trustee you should identify yourself as the trustee on all trust-related paperwork by signing your name followed by the words as trustee." As an alternative, you can also state your name followed by as trustee and not individually." Doing so will help ensure separation between you in your

It is possible to include either one corporate trustee or up to three individual trustees. A trustee can also be a beneficiary provided that it is not the sole trustee and beneficiary. If there is another trustee, or another beneficiary as well, then it is acceptable.

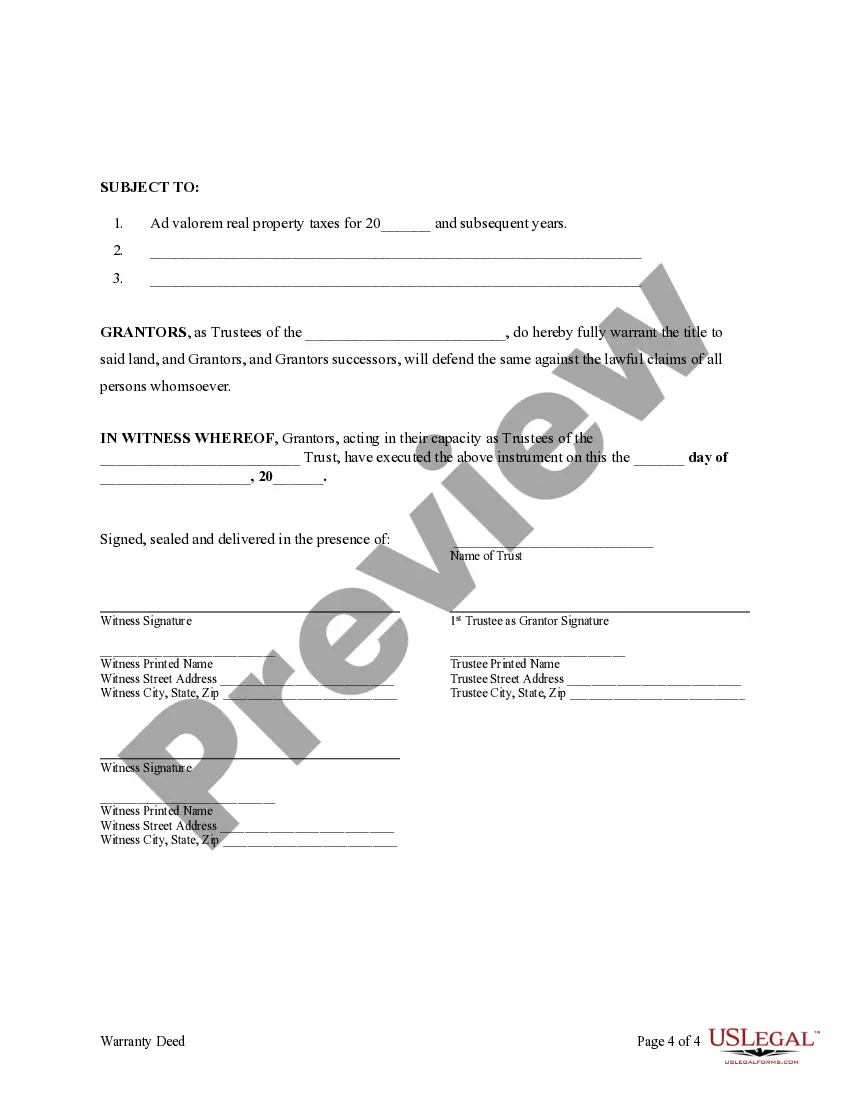

If the Trust list you both as Co-Trustees, both signature are required. Make sure you have the right, as specified in the Trust Agreement, to sell the real property. Equally important, is the party entitled to the proceeds.

When a grantor establishes a trust, a single trustee manages the trust's assets on behalf of the named beneficiaries. However, there is no requirement for a trust to have only one trustee. When a grantor names multiple trustees, or co-trustees, they are responsible for co-managing the trust's assets.

It depends on the terms of the trust. If the trust designates that the trustees are to act together, and not independently, then yes, a signature by both trustees are required in order to transfer property out of the trust.

Usually a family member will incorporate a company to act as a Trustee, and nominates various family members as beneficiaries.Hence many advisors prefer a company to act as trustee. When there is only one individual trustee and the same person is the sole beneficiary of the trust, this will be an invalid trust.

The default rule in California is that co-trustees must act unanimously. In California, unlike most states, co-trustees must make administration decisions by unanimous consent.

2 attorney answers Just the grantors. They are usually also the trustees. If they are not the trustees still no need to sign. However, that is why you want successor trustees listed in case trustee does not or cannot serve.