Florida Owner's Information Sheet - Horse Equine Forms

Overview of this form

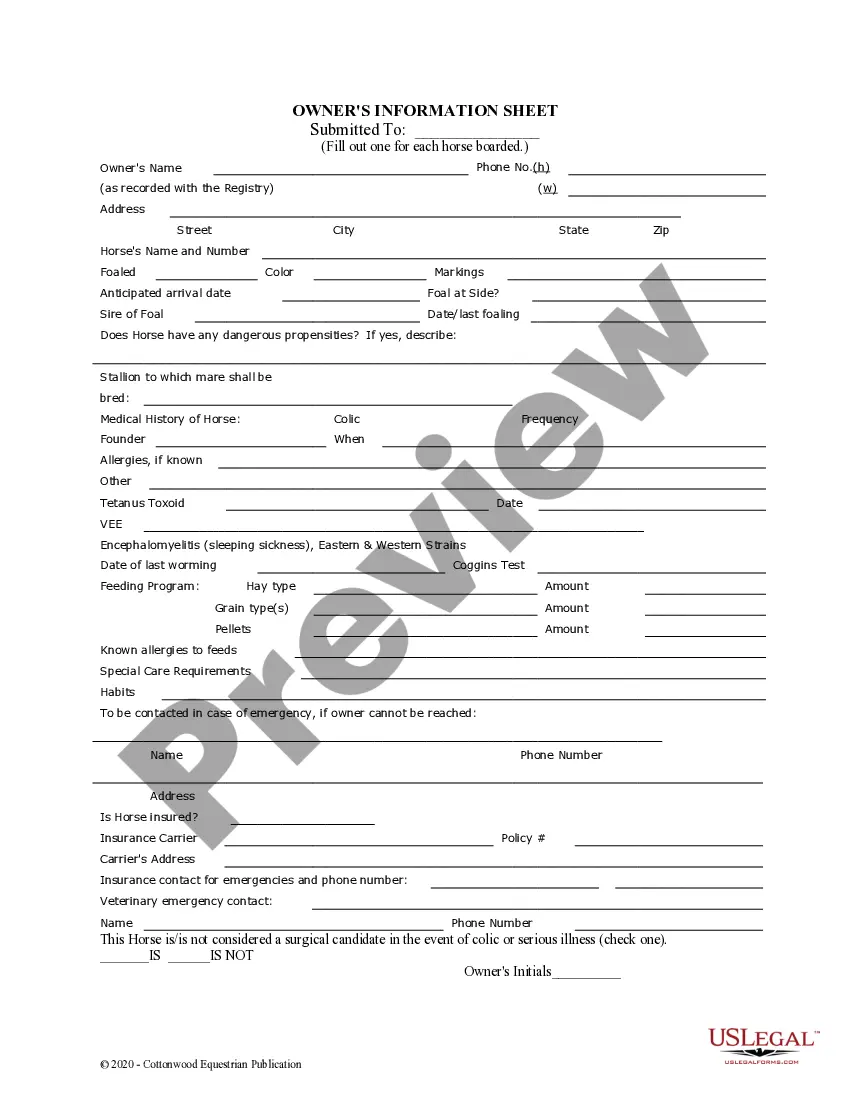

The Owner's Information Sheet is designed for horse owners to document essential details about each horse they board. This form ensures that boarding facilities have vital information regarding the horse's health, behavioral tendencies, and emergency contacts. It differs from other forms by focusing specifically on the unique needs related to horse care and management, serving as a comprehensive guide for both the owner and the boarding facility.

Main sections of this form

- Owner's contact details including phone number and address

- Horse's identification including name, color, markings, and registration number

- Health history emphasizing any allergies or medical conditions

- Feeding program detailing types of hay, grain, and any special dietary needs

- Emergency contact information for situations when the owner cannot be reached

- Insurance details for the horse and emergencies

Common use cases

This form should be used when boarding horses at a facility or when seeking veterinary services. Completing the Owner's Information Sheet is crucial to ensure that the boarding staff or veterinarians have all relevant information readily available. It helps to prevent miscommunication and ensures proper care for the horse while the owner is unavailable.

Intended users of this form

- Horse owners looking to board their horses at a facility

- Stable managers or owners requiring detailed horse information from clients

- Veterinarians needing a thorough health history for treatment

How to prepare this document

- Identify the owner by filling out their name, phone number, and address.

- Provide specific details for each horse, including their name, registration number, and physical description.

- Document the horseâs medical history, listing any known allergies and previous health issues.

- Outline the feeding program, specifying types and amounts of feed.

- Enter emergency contact information and details about horse insurance.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Leaving sections incomplete, particularly medical histories.

- Failing to provide accurate emergency contact details.

- Neglecting to mention any known allergies or behavioral issues.

Why use this form online

- Convenient access to the form from any device, allowing for easy updates.

- Editable fields to customize information specific to each horse.

- Reliable format ensuring all necessary information is collected systematically.

Looking for another form?

Form popularity

FAQ

Who Needs to File Form 1065? All business partnerships must file Form 1065. A partnership is a legal entity type formed by two or more individuals who sign a partnership agreement to run a business as co-owners.

Introduction. In addition to federal income taxes, U.S. citizens are liable for various state taxes as well. While some states do not levy a state income tax, all states assess some form of tax, such as sales or use taxes. And some of these taxes will require you to submit a separate state tax form each year.

The corporation must file a Florida corporate income/franchise tax return, reporting its own income and the income of the single member LLC, even if the only activity of the corporation is ownership of the single member LLC.S corporations that pay federal income tax on Line 22c of Federal Form 1120S.

No. Florida does not levy a state individual income tax. You do not need to mail an income tax return to the state. The Florida return in TurboTax is to report tangible personal property that is used in a Florida-located business or rental property and is filed with the county property appraiser.

Who Must File Florida Form F-1065? Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code must file Florida Form F-1065. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes, must also file Florida Form F-1065.

Each partner must file a Schedule K-1 separately, and items reported on it are assigned to each individual partner's personal tax return. Most of the information you'll need to complete your Schedule K-1 will come from the Income and Expenses section of Form 1065.

Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code is required to file Form F-1065. Limited liability companies, if classified as a partnership for federal tax purposes are also required to file Form F-1065.

Since Florida does not collect an income tax on individuals, you are not required to file a FL State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

Who Must File Florida Form F-1065? Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code must file Florida Form F-1065. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes, must also file Florida Form F-1065.