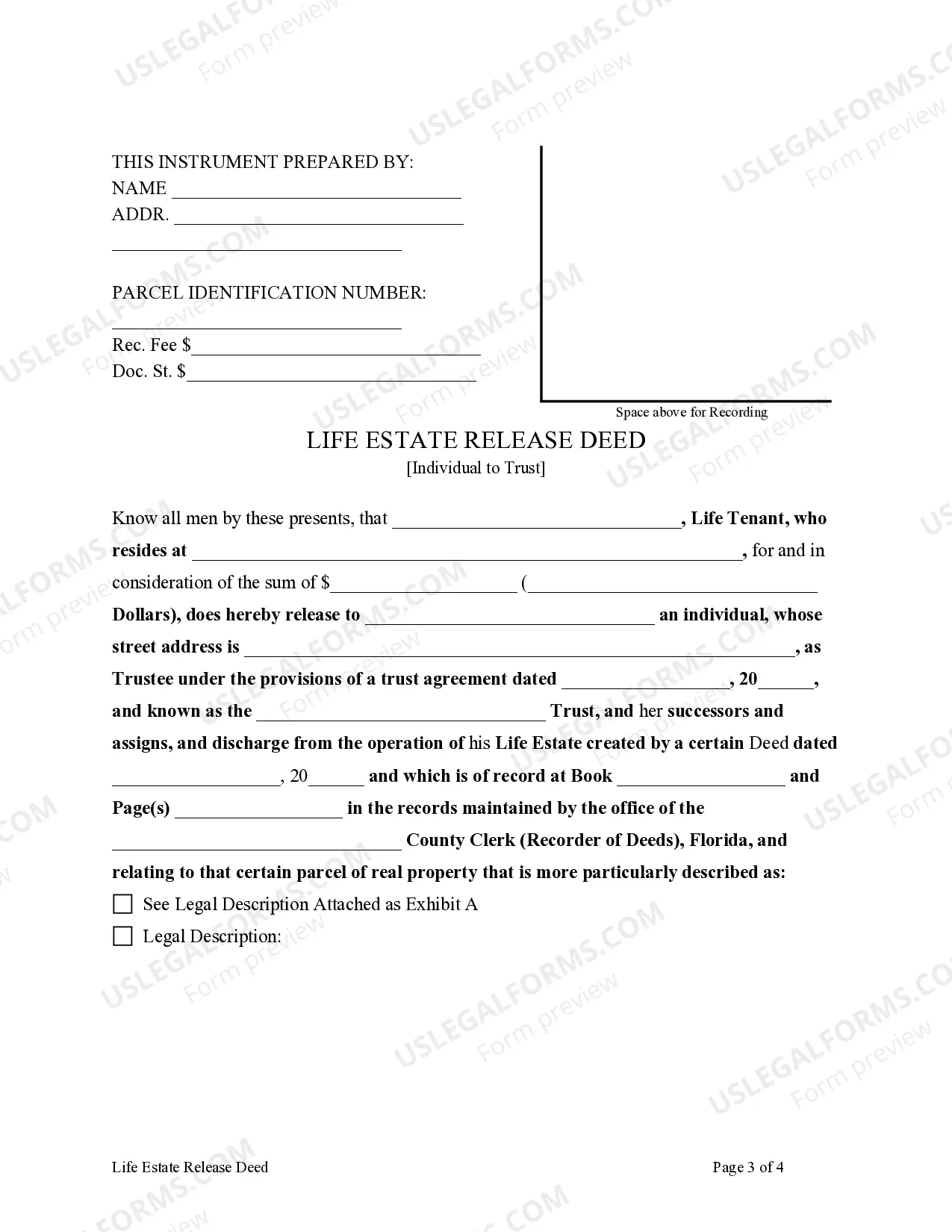

This form is a Life Estate Release Deed where the Grantor is an individual life tenant and the Grantee is a Trust. Grantor conveys and releases the life estate interest to the Grantee. This deed complies with all state statutory laws.

Florida Life Estate Release Deed

Description

Key Concepts & Definitions

A life estate release deed is a legal document used in the United States to release a life estate holders rights in a property. This type of deed is often used when a life estate holder wishes to relinquish their surviving interests in a property, thereby allowing other parties (like remaindermen) to gain full control.

Step-by-Step Guide

- Determine the Need: Decide if a release is necessary based on personal or financial reasons.

- Consult a Lawyer: Engage a legal expert to understand the implications and process.

- Prepare the Deed: The lawyer drafts the life estate release deed.

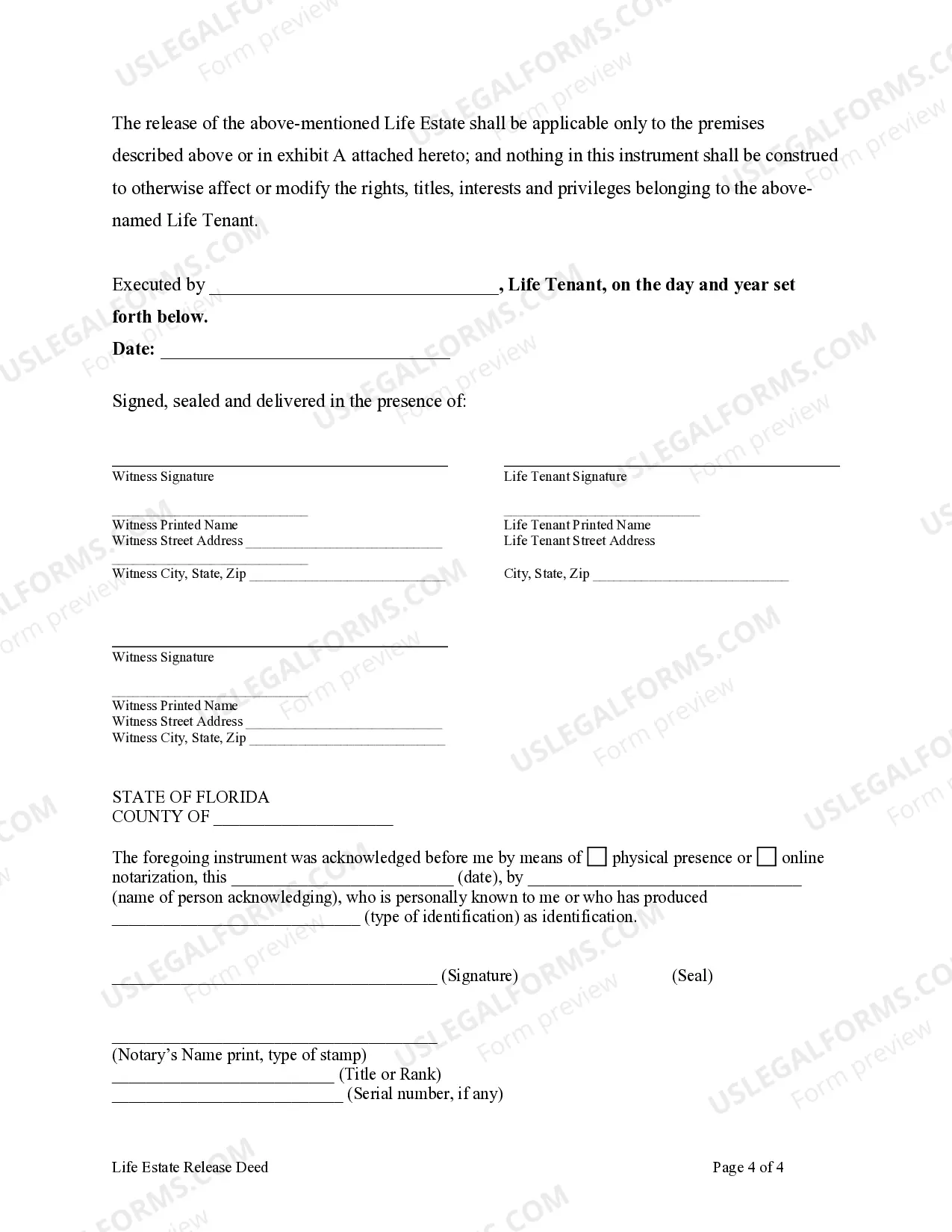

- Signatures: All parties, including the life tenant and remaindermen, must sign the deed.

- Notarization: The deed should be notarized to validate the signatures.

- Recording: File the deed with the relevant countys recorder office to make it official.

Risk Analysis

- Legal Risks: Improper drafting can lead to disputes or unclear property rights.

- Financial Risks: The life tenant may lose rights to live in the property or might not understand the financial implications completely.

- Emotional Risks: Releasing a life estate can also have emotional impacts due to a sense of loss of the property.

Best Practices

- Always consult with a real estate attorney to ensure all legal aspects are properly handled.

- Understand all implications, both financial and personal before releasing a life estate.

- Ensure clear communication among all parties involved to prevent future conflicts.

- Double-check that all legal documents are complete and correctly executed.

Common Mistakes & How to Avoid Them

- Lack of Clarity: Ensure the deed explicitly states what is being released and any conditions tied to the release.

- Not Using Professional Help: Engage a lawyer experienced in real estate matters to avoid potential legal pitfalls.

FAQ

- What is a life estate release deed? It is a legal document where a life tenant relinquishes their property rights, usually to the remaindermen.

- Who needs to sign a life estate release deed? Typically, the life tenant and the remaindermen must sign.

- Where do you file a life estate release deed? It must be filed with the relevant county recorders office where the property is located.

Summary

A life estate release deed is an essential document for anyone wishing to relinquish their life estate in a property, typically for personal or financial reasons. Proper execution requires legal expertise and a clear understanding of the implications involved.

How to fill out Florida Life Estate Release Deed?

Get one of the most extensive catalogue of authorized forms. US Legal Forms is a solution to find any state-specific document in a few clicks, such as Florida Life Estate Release Deed examples. No need to spend hrs of your time searching for a court-admissible example. Our licensed specialists ensure you receive up-to-date samples all the time.

To benefit from the forms library, pick a subscription, and create an account. If you registered it, just log in and then click Download. The Florida Life Estate Release Deed sample will automatically get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new account, follow the simple guidelines below:

- If you're proceeding to use a state-specific sample, be sure you indicate the proper state.

- If it’s possible, go over the description to learn all of the ins and outs of the document.

- Use the Preview option if it’s available to check the document's content.

- If everything’s correct, click on Buy Now button.

- Right after selecting a pricing plan, register your account.

- Pay by credit card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You should submit the Florida Life Estate Release Deed template and check out it. To make sure that everything is exact, call your local legal counsel for help. Join and easily look through above 85,000 beneficial samples.

Form popularity

FAQ

Yes, Florida has a legal mechanism known as a life estate deed. This type of deed allows a person to retain rights to a property during their lifetime while designating a beneficiary to inherit the property upon their death. The Florida Life Estate Release Deed provides clarity on ownership and ensures that your wishes for property transfer are honored. Many people find this approach beneficial for estate planning.

A will generally cannot override a life estate deed. When you establish a life estate, the property automatically transfers to the designated beneficiaries after your death, regardless of what is mentioned in your will. This can lead to unintended outcomes if your will indicates different intentions for your property. To navigate these complexities, consider leveraging a Florida Life Estate Release Deed to clarify your property intentions ahead of time.

Removing someone from a life estate deed is possible, but it usually requires the consent of all parties involved. The process can involve creating a Florida Life Estate Release Deed, which serves to formalize the removal and clarify ownership. It's essential to consult with a legal expert to ensure you're following the required procedures while protecting everyone's interests. This way, you can simplify the transfer and management of the property.

A life estate can limit your flexibility in managing the property, as you cannot sell or mortgage it without the consent of the remainder beneficiaries. Additionally, after your passing, the property automatically transfers to the beneficiaries, which may not align with your original wishes. Moreover, unforeseen circumstances like creditor claims can complicate the situation. Understandably, using a Florida Life Estate Release Deed might be a preferable option to address these concerns.

There are several reasons for terminating a life estate, including the death of the life tenant, mutual agreement between the parties, or a Florida Life Estate Release Deed. Other circumstances may involve the life tenant's incapacity or a seller wanting to sell the property. Understanding these reasons can help you make informed decisions about your property management. For those looking for guidance, the US Legal Forms platform offers valuable resources for navigating these legal processes.

Yes, you can get out of a life estate deed using a Florida Life Estate Release Deed. This legal document allows the life tenant to relinquish their interest in the property, thereby transferring their rights to the remainderman. By completing this process, you can regain control over your property and eliminate the constraints that a life estate imposes. If you need assistance, consider using the US Legal Forms platform to create a Florida Life Estate Release Deed efficiently.

Filing a life estate deed involves preparing the appropriate documentation and recording it with your local county clerk. You'll need to include key information about the property and the parties involved in the deed. For a smoother process, consider using US Legal Forms, where you can find resources and templates to assist you in filing the Florida Life Estate Release Deed.

In Florida, a life estate deed allows a property owner to transfer ownership while retaining the right to use the property during their lifetime. Once the life tenant passes away, the property automatically transfers to the remainderman. This mechanism can help avoid probate, making it an efficient estate planning tool.

To file a life estate deed in Florida, you will need to prepare the deed, which includes specific language and information regarding the property and the parties involved. Once completed, you must submit the deed to the appropriate county clerk’s office for recording. Utilizing a platform like US Legal Forms can simplify this process by providing templates and guidance for filing.

Releasing a life estate typically involves executing a Florida Life Estate Release Deed, which allows the life tenant to relinquish their interest in the property. This process requires both the life tenant and the remainderman to agree to the release. It's essential to draft this document accurately to ensure that all parties understand their rights and obligations.