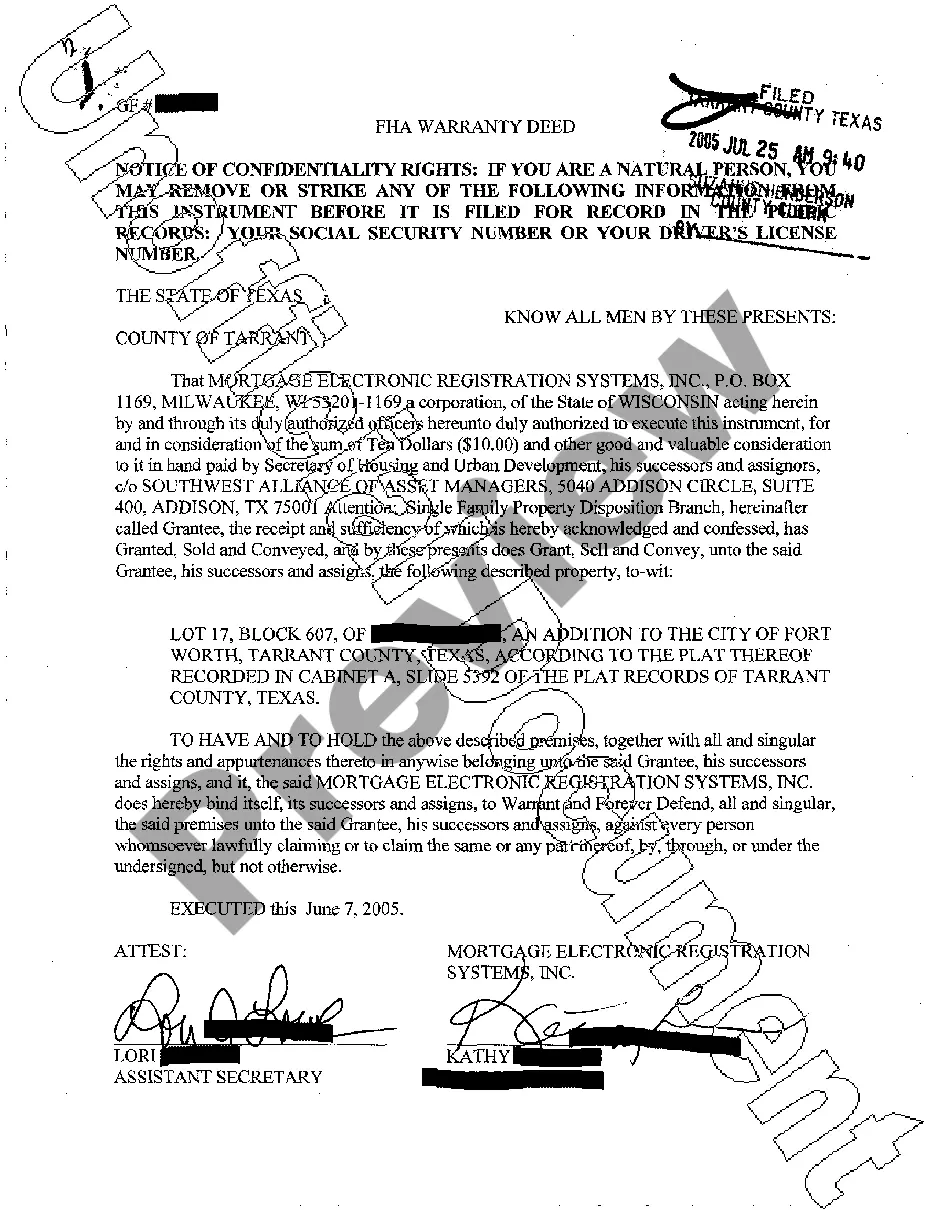

This form is a Warranty Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Florida Warranty Deed for a Time Share from an Individual to a Trust

Description Deed Trust Form

How to fill out Florida Warranty Deed For A Time Share From An Individual To A Trust?

Access the most extensive catalogue of legal forms. US Legal Forms is actually a system where you can find any state-specific file in a few clicks, such as Florida Warranty Deed for a Time Share from an Individual to a Trust templates. No reason to spend hrs of your time trying to find a court-admissible example. Our certified pros make sure that you receive up-to-date documents every time.

To leverage the documents library, select a subscription, and sign-up an account. If you created it, just log in and click on Download button. The Florida Warranty Deed for a Time Share from an Individual to a Trust sample will instantly get saved in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, follow the simple recommendations below:

- If you're having to utilize a state-specific documents, ensure you indicate the correct state.

- If it’s possible, review the description to understand all the nuances of the document.

- Utilize the Preview option if it’s available to take a look at the document's information.

- If everything’s right, click on Buy Now button.

- After choosing a pricing plan, make an account.

- Pay out by card or PayPal.

- Downoad the document to your computer by clicking Download.

That's all! You ought to fill out the Florida Warranty Deed for a Time Share from an Individual to a Trust template and check out it. To ensure that everything is accurate, call your local legal counsel for help. Join and easily look through more than 85,000 valuable samples.

Florida Warranty Deed Template Form popularity

Legal Florida Property Other Form Names

FAQ

Step 1Be careful. Step 2Create a buy sell agreement, known as an earnest money contract. Step 3Create a deed. Step 4Record your deed with the county. Step 5Notify the resort. Call us anytime at 1-877-748-7488.

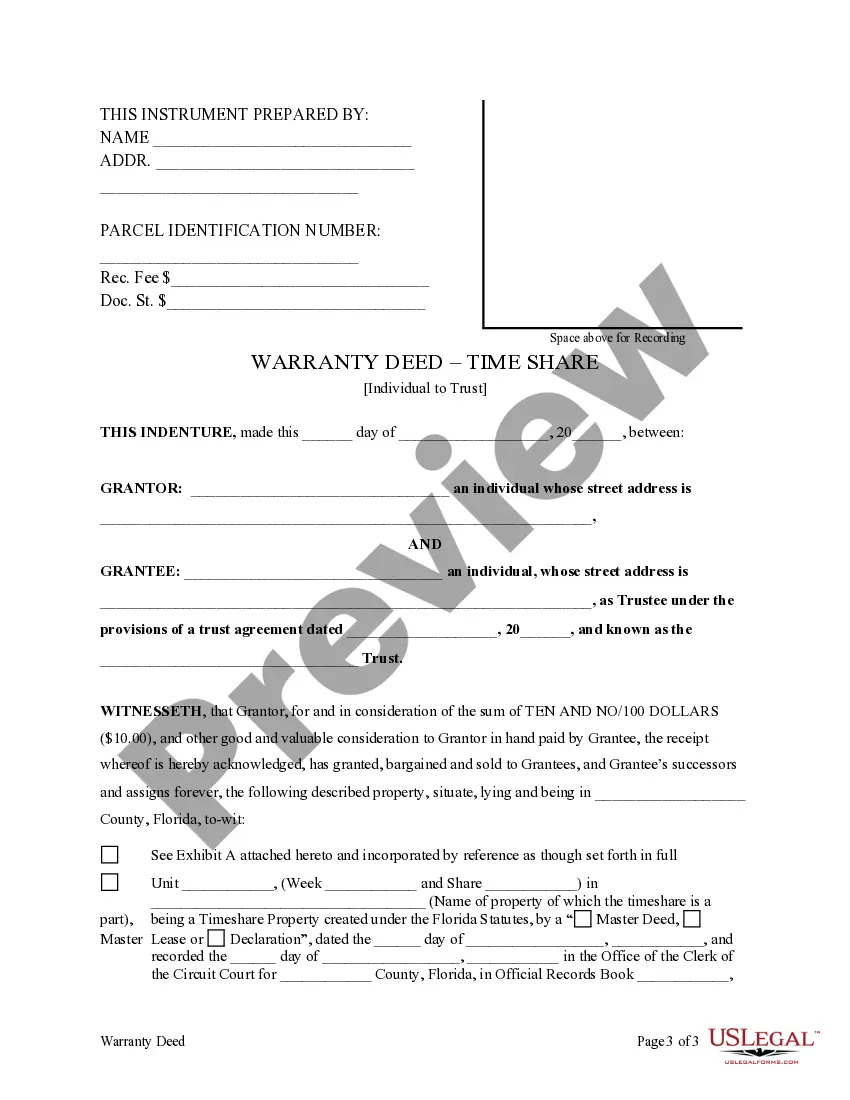

It is no different than receiving a deed for your home, or any other real estate you own. When it comes time to fund a deeded timeshare to a trust, you must obtain a new deed. This new deed will transfer the property ownership rights from you to the living trust you have established.

For the majority of timeshare owners, the property is located in a state other than their state of residency. In order to avoid probate involving the out-of-state timeshare property, you need to include the timeshare in your living trust. This will avoid complications down the road.

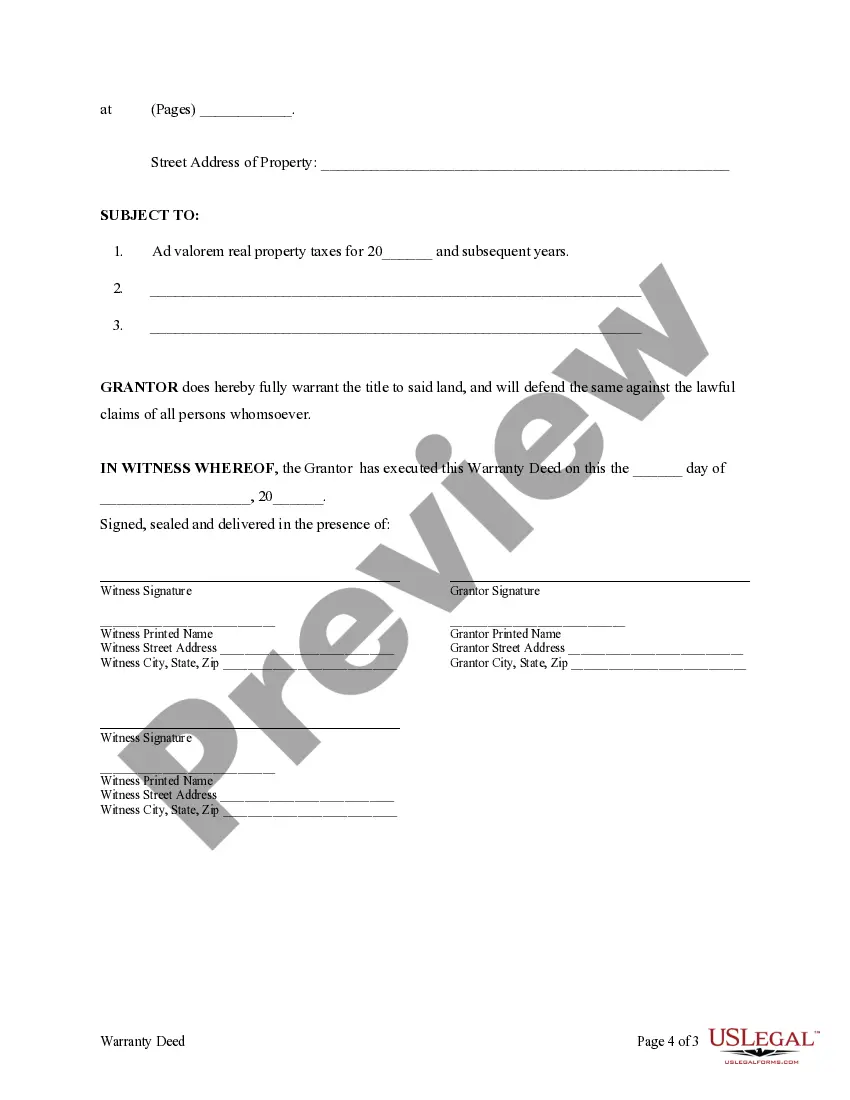

Date the document in dd/m/yyyy. Provide the name of the Grantor (seller) AND. The name of the Grantee (buyer) Mailing address. Enter the amount paid to the Grantor and is in receipt. Name of the County in which the property is situated.

Yes, timeshare is deeded real estate and can be transferred to family members. Through the Westgate Legacy Program, you can transfer a timeshare deed to a family member by means of a simple, painless process that we can guide you through.

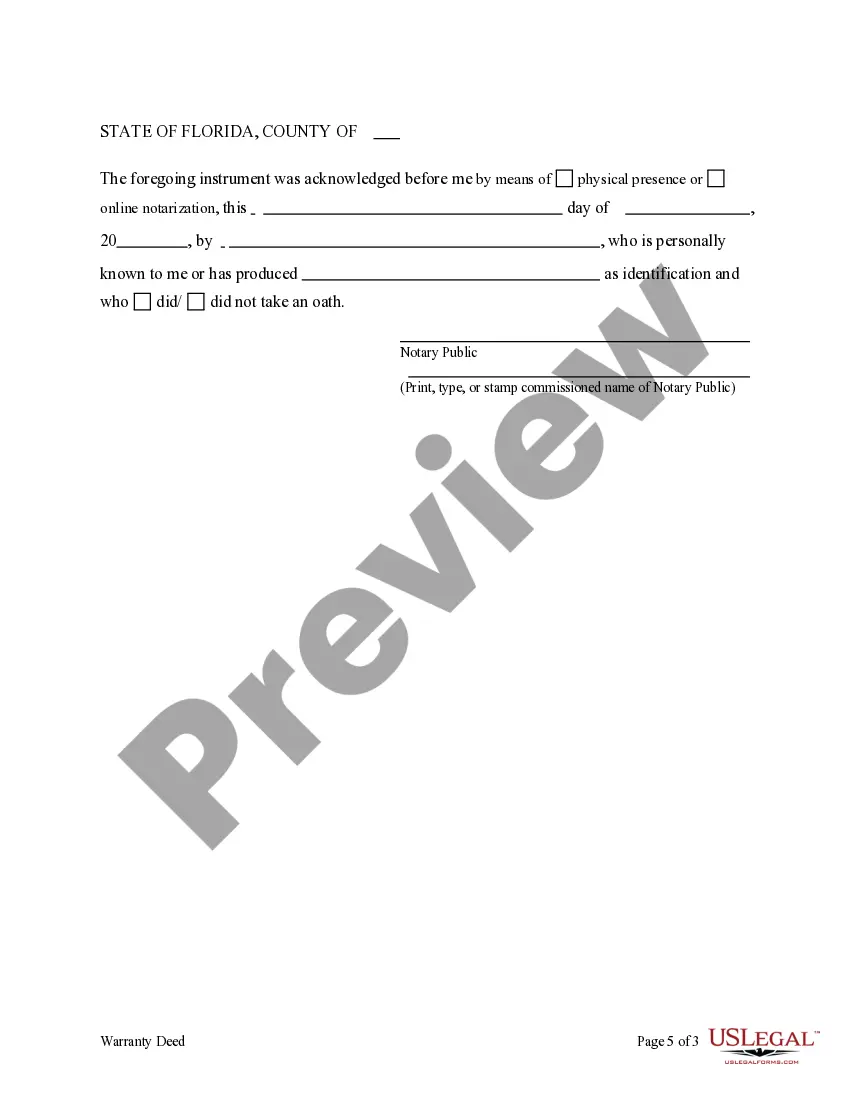

Laws § 689.02. Property Appraiser's Parcel Identification Number Must be included in the Legal Description. Recording Must be filed with the Clerk of the Circuit Court. Signing (A§ 695.26) Must be signed with a Notary Public and Two (2) Witnesses. Step 1 On the first line, write in who is preparing the deed.

Timeshare closing costs typically range from $300 to $500 for a comprehensive transfer of timeshare ownership and associated closing activity. These fees cover the services of the closing company but do not include additional recording fees or taxes.

When you purchase property, the previous owner will transfer the warranty deed to you. However, if you're paying for your home with a mortgage, as most people do, the warranty deed is not free and clear.You must deal with your mortgage appropriately if you move to sell your home.

If you are either left a timeshare in a will or are the legal heir of someone who owned a timeshare and died without a will, you may choose to refuse to accept your inheritance. In legal terms, this is generally called renunciation of property.