This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Florida Quitclaim Deed - Individual to a Trust

Description

How to fill out Florida Quitclaim Deed - Individual To A Trust?

Access the most comprehensive library of authorized forms. US Legal Forms is a platform to find any state-specific document in couple of clicks, such as Florida Quitclaim Deed - Individual to a Trust templates. No need to spend hrs of your time seeking a court-admissible form. Our qualified pros make sure that you receive up-to-date documents every time.

To take advantage of the forms library, select a subscription, and create an account. If you already created it, just log in and click Download. The Florida Quitclaim Deed - Individual to a Trust template will immediately get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new account, look at brief instructions below:

- If you're having to use a state-specific documents, ensure you indicate the proper state.

- If it’s possible, review the description to know all the nuances of the document.

- Take advantage of the Preview option if it’s available to check the document's content.

- If everything’s correct, click on Buy Now button.

- Right after picking a pricing plan, register an account.

- Pay by credit card or PayPal.

- Downoad the example to your computer by clicking Download.

That's all! You ought to fill out the Florida Quitclaim Deed - Individual to a Trust template and check out it. To be sure that things are exact, contact your local legal counsel for support. Join and simply look through over 85,000 helpful forms.

Form popularity

FAQ

A quitclaim deed in Florida works by transferring whatever interest the grantor has in a property to the grantee. Importantly, it does not provide warranties or guarantees about the property’s title. Once signed and recorded, the deed officially changes ownership. For anyone initiating a Florida Quitclaim Deed - Individual to a Trust, consider consulting UsLegalForms for a straightforward and reliable process.

Yes, a quitclaim deed can effectively transfer property from a trust to another party. This transfer is executed once the trust's trustee completes the quitclaim deed. It's crucial to ensure that the trust document allows such a transfer without violating any specific terms laid out in the trust. Opting for a Florida Quitclaim Deed - Individual to a Trust simplifies this process.

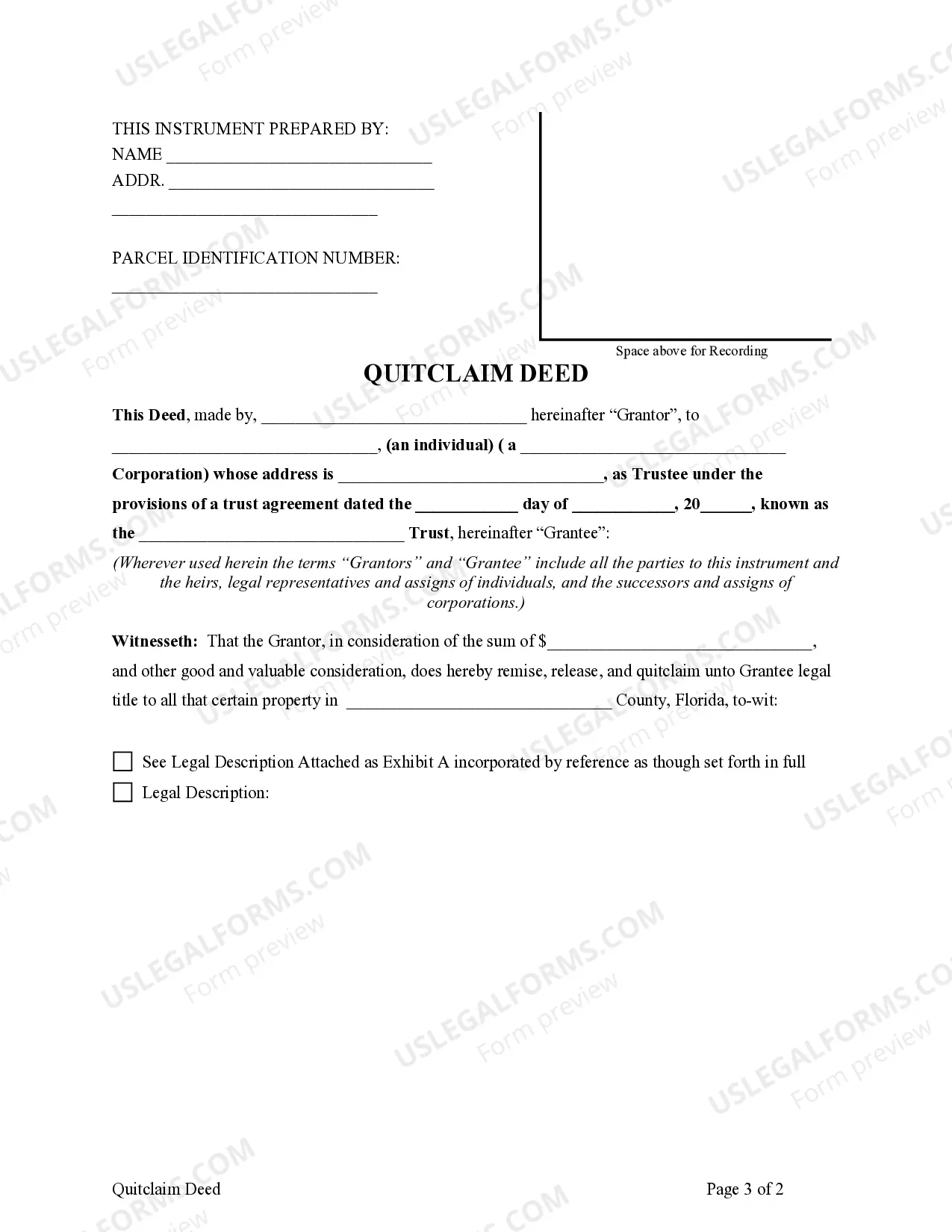

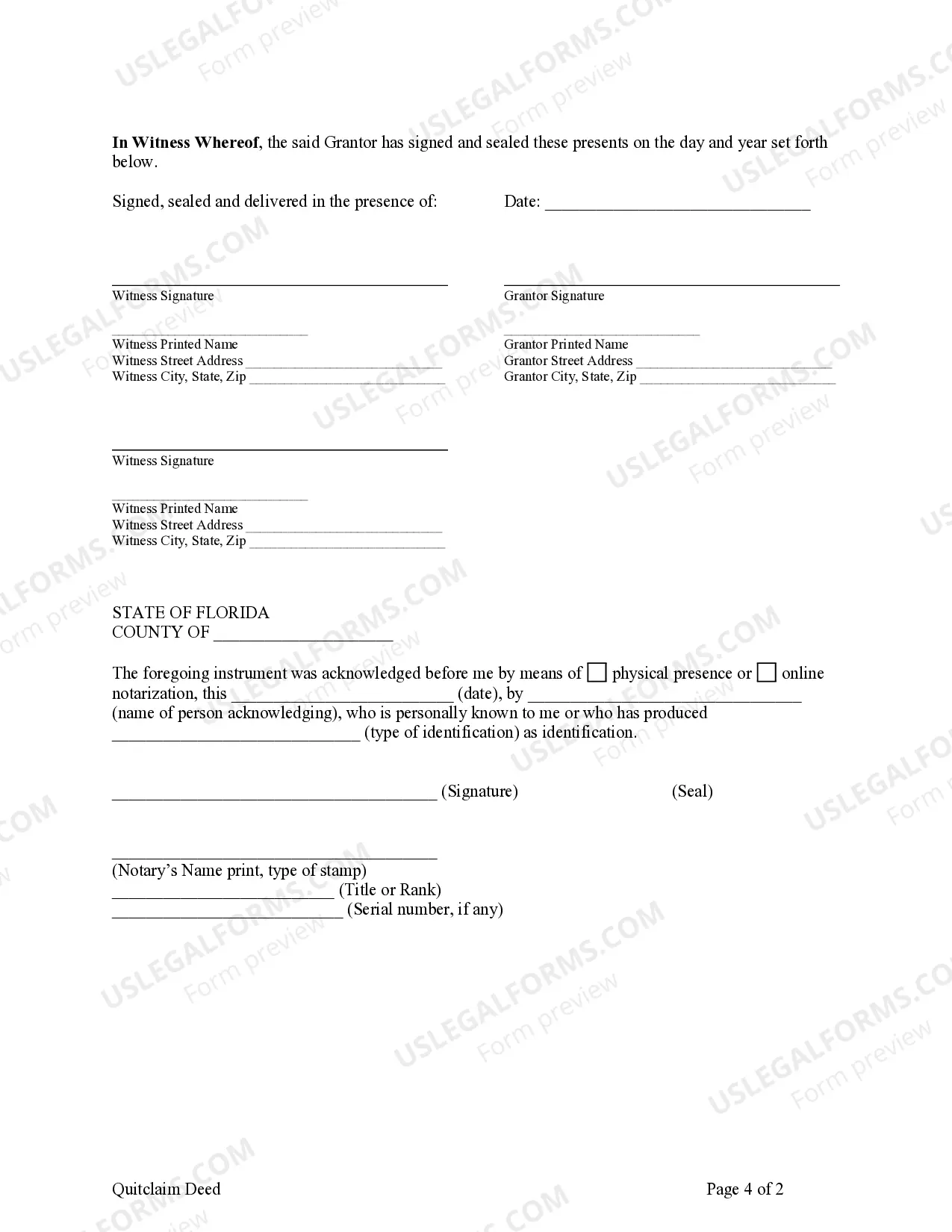

In Florida, a quitclaim deed must include specific elements, such as the names of the grantor and grantee, a legal description of the property, and a statement of consideration. Additionally, the deed must be signed by the grantor and should be notarized to be valid. To understand these regulations in detail, exploring resources like UsLegalForms can provide helpful templates and guidance on the Florida Quitclaim Deed - Individual to a Trust.

One major disadvantage of a quitclaim deed is that it does not guarantee a clear title. If there are liens or claims against the property, the new owner may inherit these issues. Additionally, you cannot undo a quitclaim deed once it is executed. To mitigate risks associated with the Florida Quitclaim Deed - Individual to a Trust, consider conducting thorough property title research prior to transfer.

A quitclaim deed provides ownership of property immediately upon signing and recording it. The deed transfers whatever interest the grantor has in the property. However, it does not guarantee that the grantor has a clear title. For clarity on ownership issues, considering a Florida Quitclaim Deed - Individual to a Trust is beneficial.

Yes, you can transfer property from a trust to an individual. This process typically involves drafting a document, often a quitclaim deed, to facilitate the transfer. This deed can effectively direct the title from the trust to a specified individual. When considering a Florida Quitclaim Deed - Individual to a Trust, ensure you understand the requirements to avoid complications.

Yes, you can complete a quitclaim deed by yourself in Florida, provided you understand the steps involved. You will need to fill out the Florida Quitclaim Deed - Individual to a Trust form correctly and ensure all required information is included. After signing the deed before a notary, file it with the county clerk. Using tools like US Legal Forms can simplify this process, offering templates and guidelines that help you navigate the required tasks confidently.

While it is not legally required to hire a lawyer to file a quitclaim deed in Florida, consulting one can be beneficial, especially for complex situations. A qualified attorney can help you understand the implications of a Florida Quitclaim Deed - Individual to a Trust and ensure that the document adheres to state laws. However, if your case is straightforward, you can file the quitclaim deed yourself, using resources like US Legal Forms to guide you through the process.

To put your house in a trust in Florida, you must create the trust document and specify the property transfer. Then, you need to execute a Florida Quitclaim Deed - Individual to a Trust, which officially transfers the title of your home to the trust. After filling out the quitclaim deed form, you must sign it before a notary and file it with the county's clerk of court. This process ensures that your property is protected and managed according to the terms of the trust.

To transfer a deed to a trust in Florida, use a Florida Quitclaim Deed - Individual to a Trust to formalize the process. Complete the deed with the necessary details about the property and trust. Once you have signed it in front of a notary, file it with your county’s clerk of court. This step will finalize the transfer and ensure that the property is properly held in the trust.