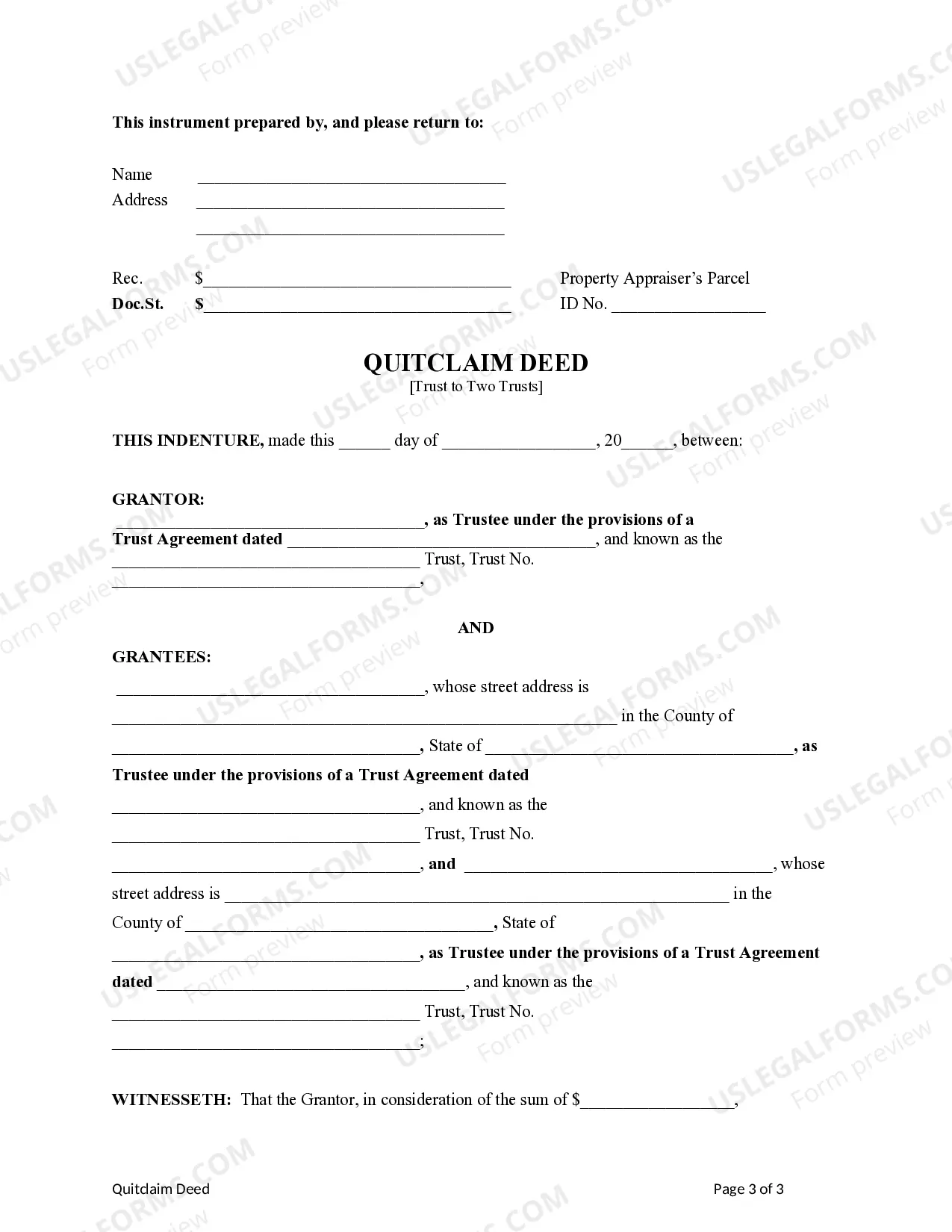

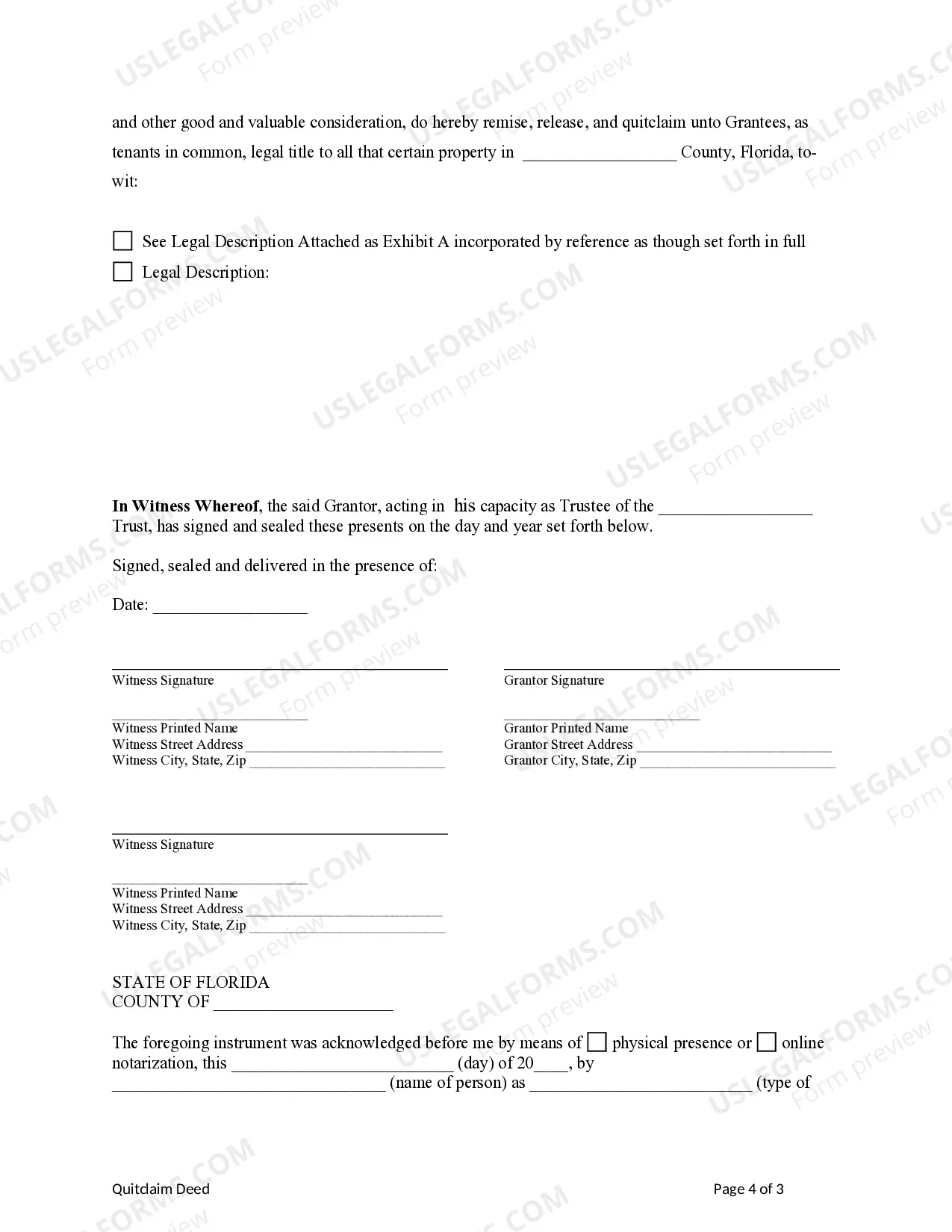

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are two Trusts. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Florida Quitclaim Deed

Description

How to fill out Florida Quitclaim Deed?

Get access to the most holistic catalogue of legal forms. US Legal Forms is a solution to find any state-specific form in couple of clicks, including Florida Quitclaim Deed examples. No need to waste time of your time searching for a court-admissible form. Our qualified pros make sure that you receive up-to-date documents every time.

To make use of the documents library, choose a subscription, and register an account. If you did it, just log in and click on Download button. The Florida Quitclaim Deed file will immediately get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, follow the simple guidelines below:

- If you're having to utilize a state-specific example, be sure you indicate the appropriate state.

- If it’s possible, go over the description to know all of the nuances of the form.

- Take advantage of the Preview option if it’s accessible to check the document's content.

- If everything’s right, click on Buy Now button.

- After selecting a pricing plan, make your account.

- Pay by credit card or PayPal.

- Save the document to your device by clicking Download.

That's all! You need to submit the Florida Quitclaim Deed form and check out it. To make sure that all things are precise, speak to your local legal counsel for help. Register and simply find over 85,000 useful templates.

Form popularity

FAQ

Certainly, you can create your own quitclaim deed. This document allows you to transfer property ownership without any warranties regarding the title. Be mindful that the Florida quitclaim deed must comply with specific legal standards, so using a reliable source like US Legal Forms can help you simplify this process and ensure all necessary elements are included.

Yes, you can complete a Florida quitclaim deed yourself. The process involves drafting the deed and signing it in front of a notary public. However, it's crucial to ensure that the document meets Florida's legal requirements for it to be valid. If you feel uncertain, consider using resources like US Legal Forms to obtain a correctly formatted template.

A Florida Quitclaim Deed works by enabling one party, the grantor, to transfer their interest in a property to another party, the grantee. This process is simple and involves drafting a deed that outlines the transfer of ownership and having it notarized. Once recorded, the grantee takes ownership, but be mindful of the lack of guarantee about the property's title.

While a Florida Quitclaim Deed provides a quick transfer of ownership, it does have some disadvantages. Most notably, it offers no guarantee regarding the title's validity, meaning the grantee has no recourse if problems arise with the title. Additionally, since it does not require a title search, hidden liens or claims may not be addressed, which can lead to complications down the line.

Yes, you can sell a house that was transferred through a Florida Quitclaim Deed. However, it is essential to ensure that the deed is properly recorded and that all parties understand their rights. If you plan to sell the property, you may want to consult a legal expert to clarify any ownership issues that could arise.

In Florida, a quitclaim deed must include the names of the grantor and grantee, a description of the property, and be signed in front of a notary public. It is important to record the deed with the local county clerk to ensure public notice of the ownership transfer. Without following these rules, the validity of the Florida Quitclaim Deed may be challenged.

A Florida Quitclaim Deed transfers ownership of property immediately upon signing and recording the deed. Once recorded, the new owner has the right to the property indefinitely, unless another agreement or legal action states otherwise. This means that your ownership is secure as long as you follow state laws regarding property ownership.

The process of executing a quitclaim deed in Florida can be completed within a few days if you have all necessary documents ready. Once filed, it typically takes the county office a few weeks to officially record the Florida Quitclaim Deed. However, you can expedite this process by using electronic filing options in some counties. It is advisable to check local regulations for any specific requirements.

Yes, you can create a quitclaim deed on your own, but it requires careful attention to detail. A Florida Quitclaim Deed must be properly drafted, signed, and notarized to be valid. While DIY options exist, utilizing a service like USLegalForms can provide templates and expert guidance to ensure a smooth process. This can help you avoid mistakes that may complicate ownership issues later.

One major disadvantage of a quit claim deed is that it offers no warranties regarding the property’s title. This means, with a Florida Quitclaim Deed, you might inherit problems like unpaid liens or disputed ownership. Additionally, it does not provide protection against legal claims from other parties. Therefore, it is crucial to understand the implications before proceeding.