This form is a Quitclaim Deed where the Grantor is a limited partnership and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Florida Quitclaim Deed from Limited Partnership to Limited Liability Company

Description

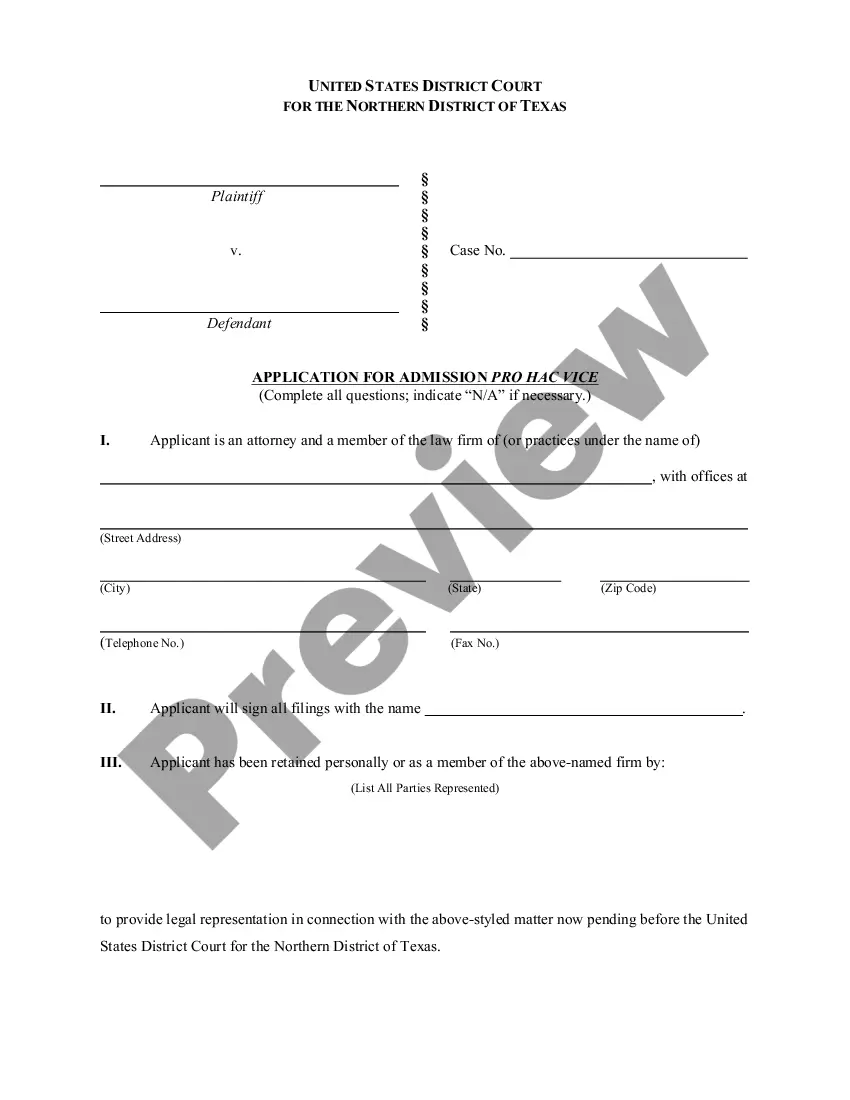

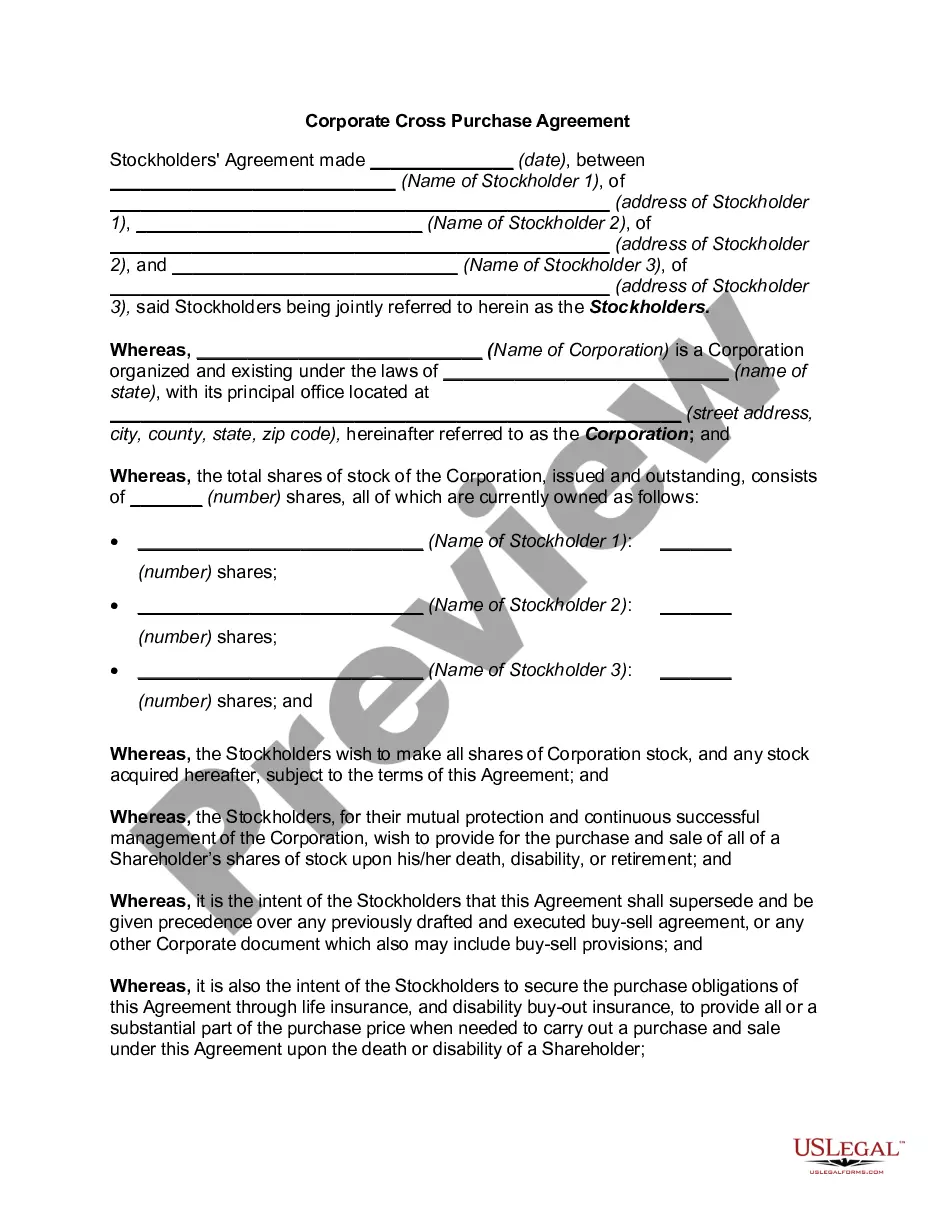

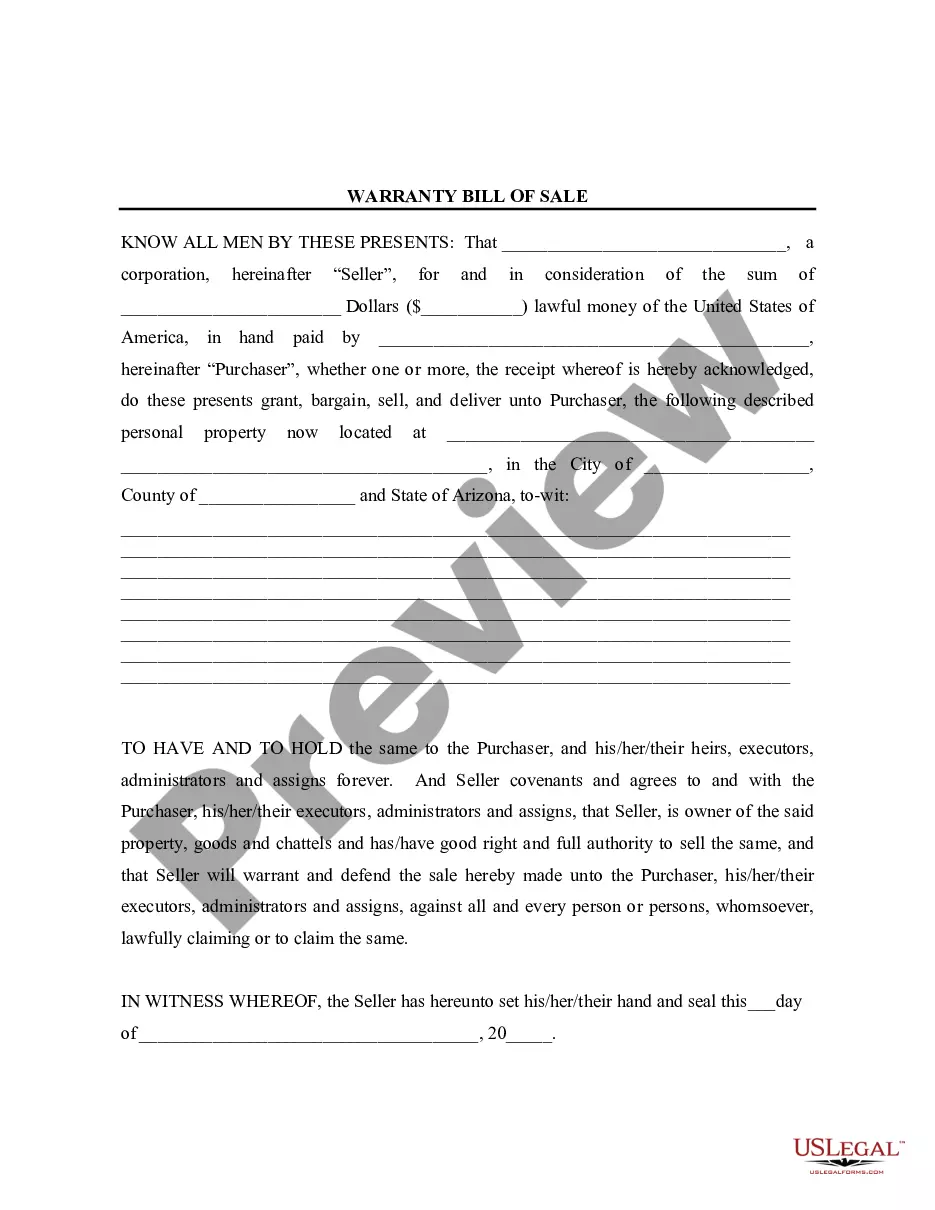

How to fill out Florida Quitclaim Deed From Limited Partnership To Limited Liability Company?

Get access to one of the most comprehensive catalogue of legal forms. US Legal Forms is a platform where you can find any state-specific file in a few clicks, even Florida Quitclaim Deed from Limited Partnership to Limited Liability Company examples. No requirement to waste hrs of your time seeking a court-admissible sample. Our certified specialists make sure that you receive updated samples every time.

To make use of the documents library, pick a subscription, and sign-up your account. If you already created it, just log in and click on Download button. The Florida Quitclaim Deed from Limited Partnership to Limited Liability Company sample will automatically get stored in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new profile, follow the quick instructions listed below:

- If you're proceeding to use a state-specific documents, make sure you indicate the appropriate state.

- If it’s possible, go over the description to learn all of the ins and outs of the form.

- Make use of the Preview option if it’s accessible to take a look at the document's information.

- If everything’s correct, click Buy Now.

- Right after choosing a pricing plan, make an account.

- Pay by credit card or PayPal.

- Downoad the document to your device by clicking on Download button.

That's all! You should fill out the Florida Quitclaim Deed from Limited Partnership to Limited Liability Company template and double-check it. To make sure that things are correct, contact your local legal counsel for assist. Join and easily find over 85,000 helpful forms.

Form popularity

FAQ

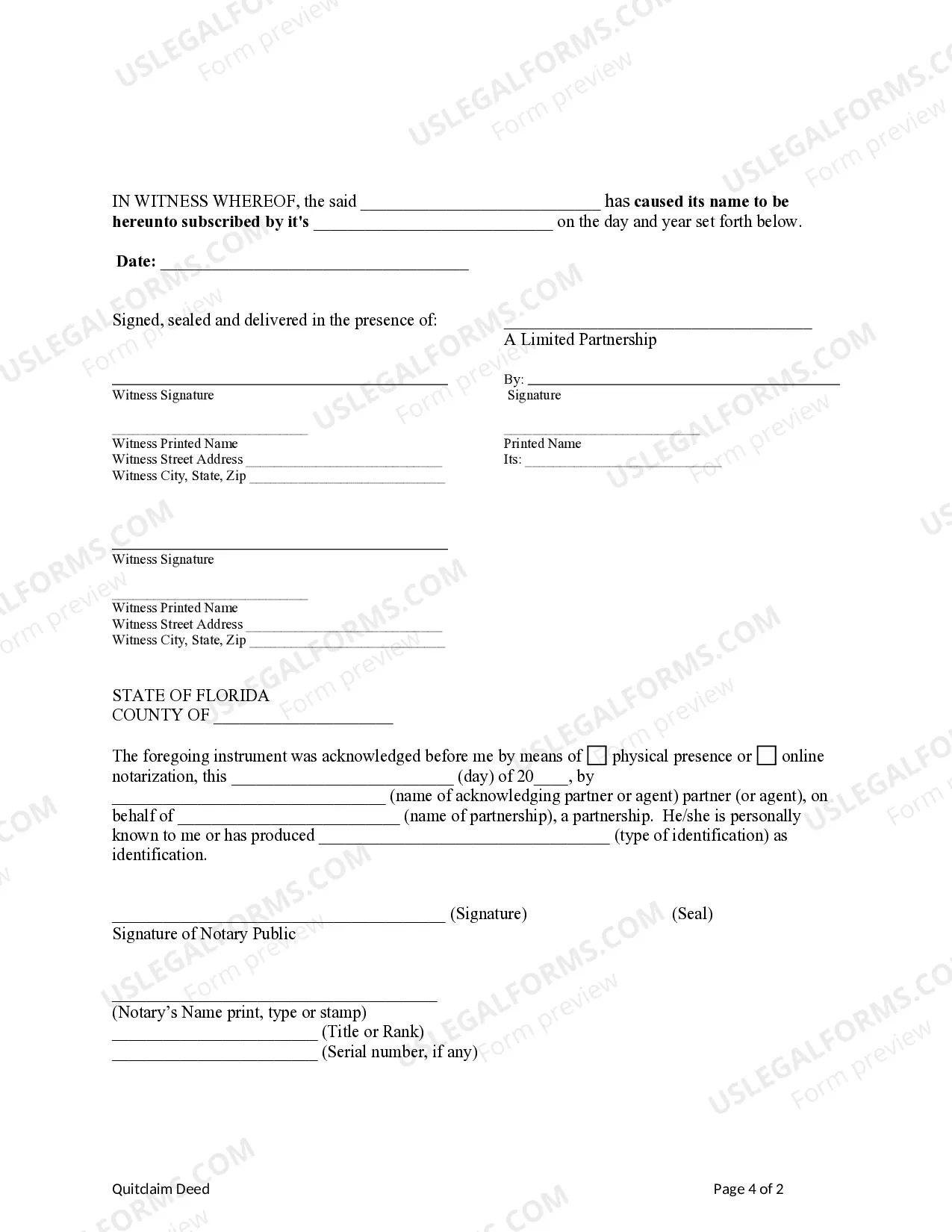

Transferring property to an LLC in Florida involves preparing a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company. After you complete the deed, you must have it notarized and submitted to your local county recording office. This process formalizes the transfer and ensures that the LLC owns the property.

While it is not legally required to hire a lawyer to complete a quitclaim deed in Florida, it is often beneficial. A legal professional can help ensure that the Florida Quitclaim Deed from Limited Partnership to Limited Liability Company is executed properly. This can prevent potential issues or disputes regarding property ownership in the future.

To remove property from your LLC, you will need to execute a new deed. Typically, this involves creating a Florida Quitclaim Deed from Limited Liability Company to yourself or another entity. Ensure that you accurately record this deed to maintain an updated property title.

To change a property deed to an LLC, you need to file a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company. Start by obtaining the appropriate deed form, fill it out with accurate details, and then have it signed before a notary. Finally, submit the deed to the county recorder's office to finalize the transfer.

Yes, you can quit claim your property to your LLC using a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company. This process allows for the transfer of ownership without a formal sale. However, it's important to ensure that the deed is correctly filled out and recorded to maintain legal clarity.

Yes, you can put your house in an LLC in Florida. This process is often done to protect personal assets and streamline property management. It is beneficial to work with legal experts or use platforms like US Legal Forms to ensure a smooth transfer when executing a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company.

Many individuals choose to place their property in an LLC primarily for legal protection. By doing so, they can safeguard personal assets against claims related to the property. Another reason is to streamline property management and estate planning, which can be facilitated through a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company.

One major disadvantage of putting property in an LLC is that it may trigger reassessment for property taxes. Additionally, managing an LLC involves administrative requirements, which can lead to unexpected costs. It's essential to weigh these factors against the benefits of liability protection when considering a transfer through a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company.

Transferring property to a Limited Liability Company (LLC) offers several advantages. It can provide personal liability protection and simplify the management of property. However, there are also cons, such as potential tax implications and loss of certain benefits associated with personal property ownership. Understanding these factors helps in making informed decisions about a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company.

In Florida, there is generally no transfer tax on a quitclaim deed. However, it is important to confirm this as exceptions may apply depending on the specific circumstances of the transfer. For transfers involving a Florida Quitclaim Deed from Limited Partnership to Limited Liability Company, it’s advisable to consult a tax professional to understand any potential liabilities.