Florida Business Credit Application

Description

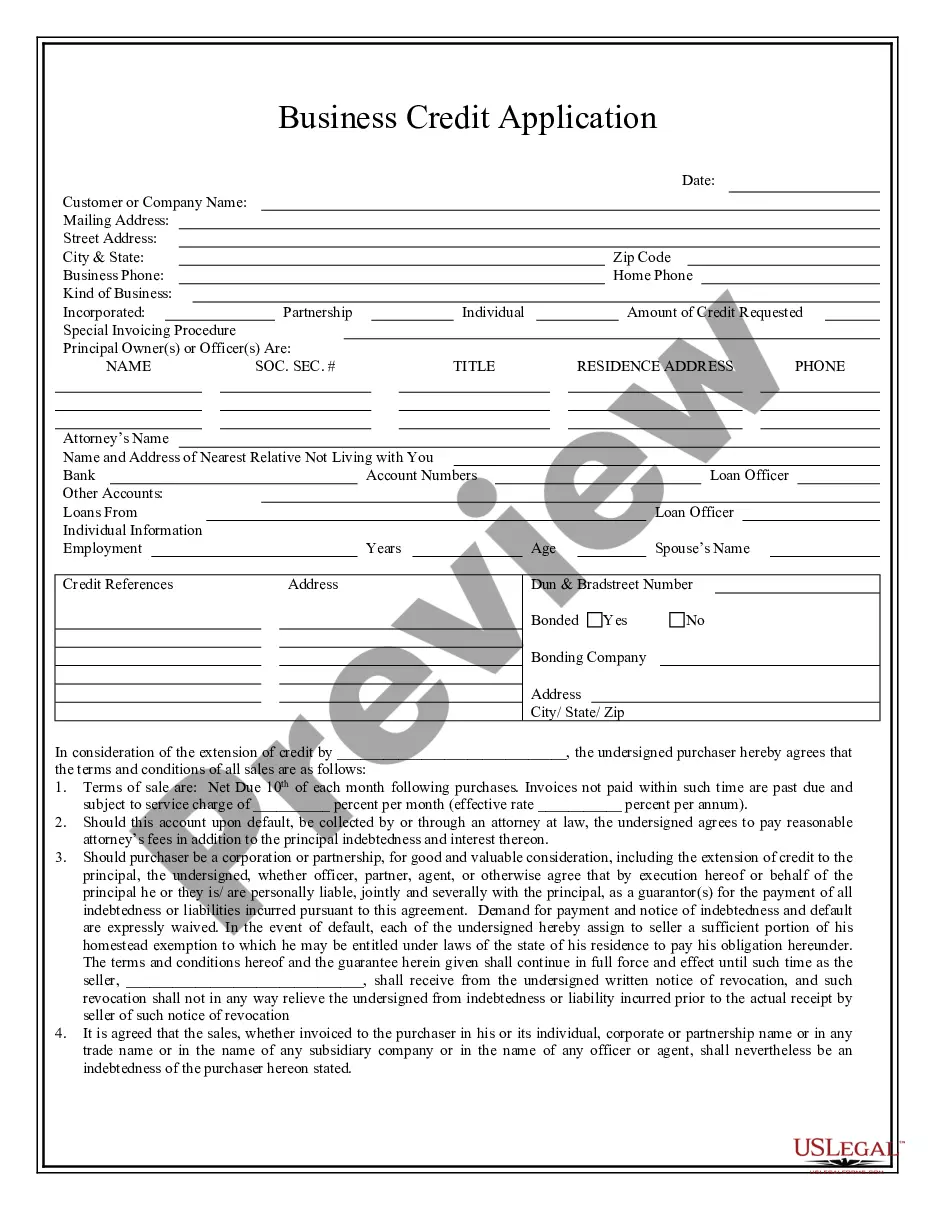

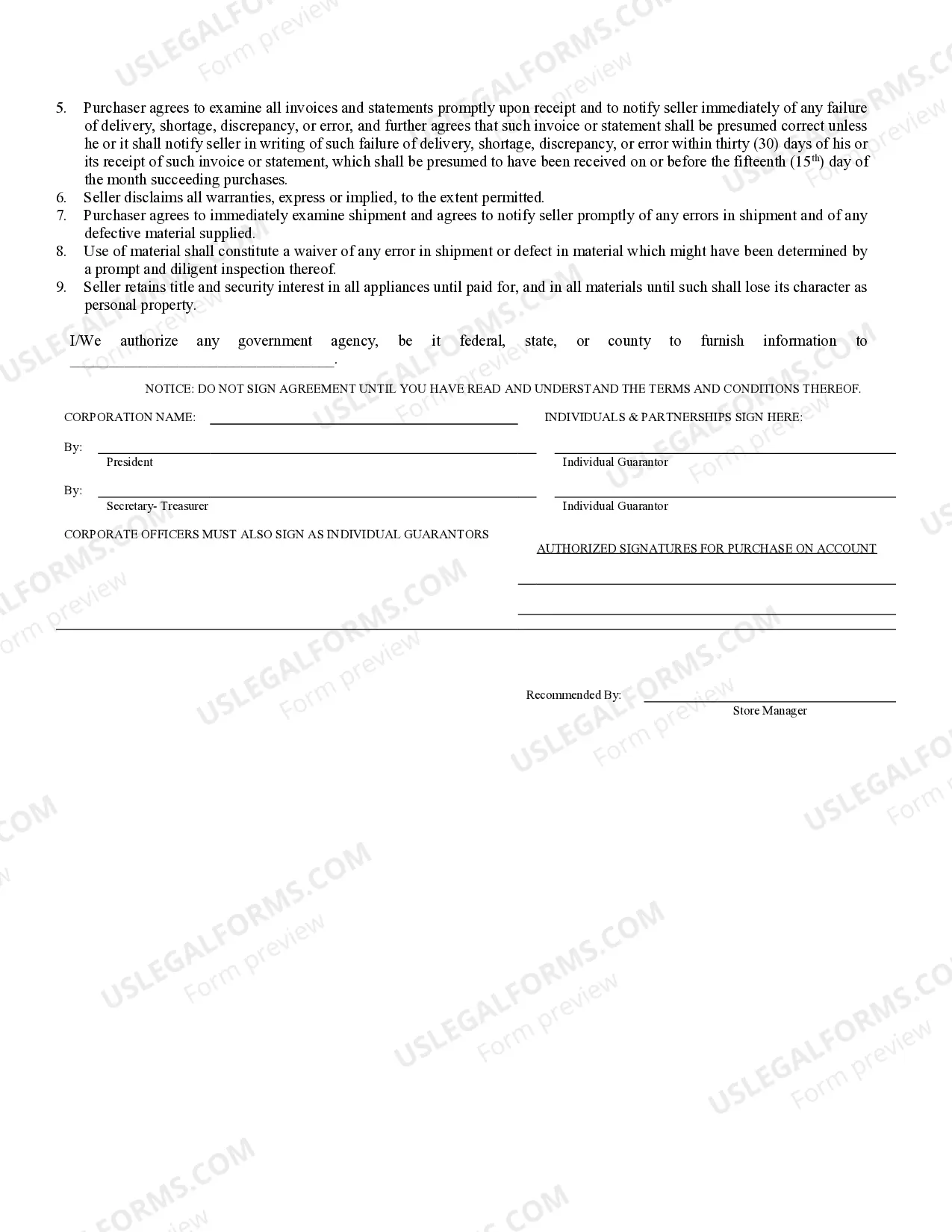

How to fill out Florida Business Credit Application?

Get access to the most expansive library of authorized forms. US Legal Forms is a platform where you can find any state-specific document in clicks, even Florida Business Credit Application samples. No reason to waste several hours of your time seeking a court-admissible form. Our qualified professionals ensure you receive updated examples all the time.

To take advantage of the forms library, choose a subscription, and create your account. If you already registered it, just log in and then click Download. The Florida Business Credit Application file will immediately get kept in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new profile, look at short guidelines listed below:

- If you're going to use a state-specific documents, be sure to indicate the proper state.

- If it’s possible, go over the description to learn all of the nuances of the form.

- Take advantage of the Preview option if it’s available to check the document's content.

- If everything’s right, click Buy Now.

- After selecting a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You should submit the Florida Business Credit Application template and check out it. To be sure that all things are exact, call your local legal counsel for help. Register and simply find around 85,000 beneficial samples.

Form popularity

FAQ

To secure business credit for your LLC, start by forming a solid business plan and applying for an EIN. You can then open a business bank account and apply for various lines of credit, such as credit cards or loans. Using a thorough Florida Business Credit Application increases your chances of obtaining credit, as it ensures that you provide necessary information clearly and concisely. Platforms like USLegalForms can simplify this process by providing customizable templates tailored for your LLC’s needs.

To quickly obtain business credit for your LLC, begin by establishing a separate business identity, including an Employer Identification Number (EIN) and a business bank account. Additionally, consider applying for vendor credit and promptly paying your bills to build positive credit history. A well-prepared Florida Business Credit Application can streamline this process significantly. Utilizing resources like USLegalForms can guide you in crafting an efficient application that meets lender requirements.

An LLC does not automatically have a credit score upon formation; it must establish its credit history first. Initially, your LLC's creditworthiness depends on your personal credit score. However, as your LLC engages in financial activities, pays bills on time, and builds relationships with creditors, it can develop its credit score. Completing a Florida Business Credit Application is an excellent step toward building that essential credit history.

Generally, a personal credit score of 680 or higher is preferred when applying for business credit. Lenders often consider personal credit scores to judge your creditworthiness, especially for new businesses without established credit histories. When completing your Florida Business Credit Application, maintaining a good personal credit score can enhance your likelihood of approval. It reflects your responsibility and reliability as a borrower.

The SSBICI program in Florida helps small businesses access capital by providing guarantees on loans. This program enables lenders to offer better terms, thereby improving your chances of getting funding. If you are considering a Florida Business Credit Application, participating in the SSBICI program can be a valuable resource. It aims to support your business growth by fostering a healthy financial environment.

When applying for new business credit, estimate your annual revenue based on projected sales if your business is newly established. If your business is already active, use your actual revenue from the previous year. Being accurate about your revenue helps lenders assess your ability to repay the credit. Transparency in your Florida Business Credit Application can enhance your credibility.

designed business card should include your name, business name, contact information, and your company’s logo. For best results, make sure to include your website URL and a brief description of your services or products. Since networking is critical in business, having a concise and informative card can make a lasting impression. This is especially useful when you are looking to fill out a Florida Business Credit Application.

On a business credit card application, you should provide accurate and comprehensive information about your LLC. This includes your business name, address, number of employees, and business revenue. Make sure to clearly indicate the purpose of the card and how you plan to use it to ensure that the card issuer understands your needs, particularly when completing your Florida Business Credit Application.

To establish business credit for your LLC, begin with registering with major credit bureaus that track business credit histories. Open a business bank account and use it for all transactions related to your LLC. Additionally, consider acquiring a business credit card or vendor credit to build a positive credit history. Using the Florida Business Credit Application also helps in this process.

When filling out your Florida Business Credit Application, include the official name of your business as registered with the state. This ensures that your application aligns with legal records. If you have a DBA (Doing Business As) name, mention it along with your registered business name. Always double-check for accuracy to avoid delays.