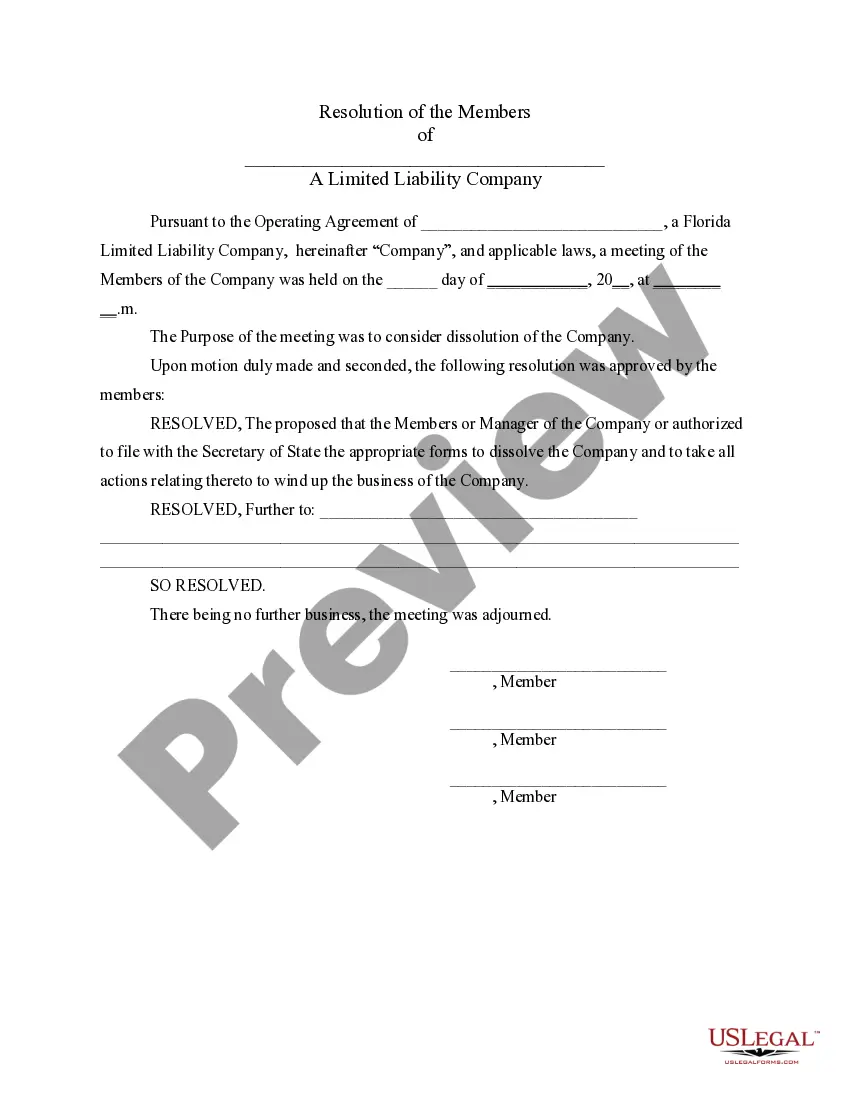

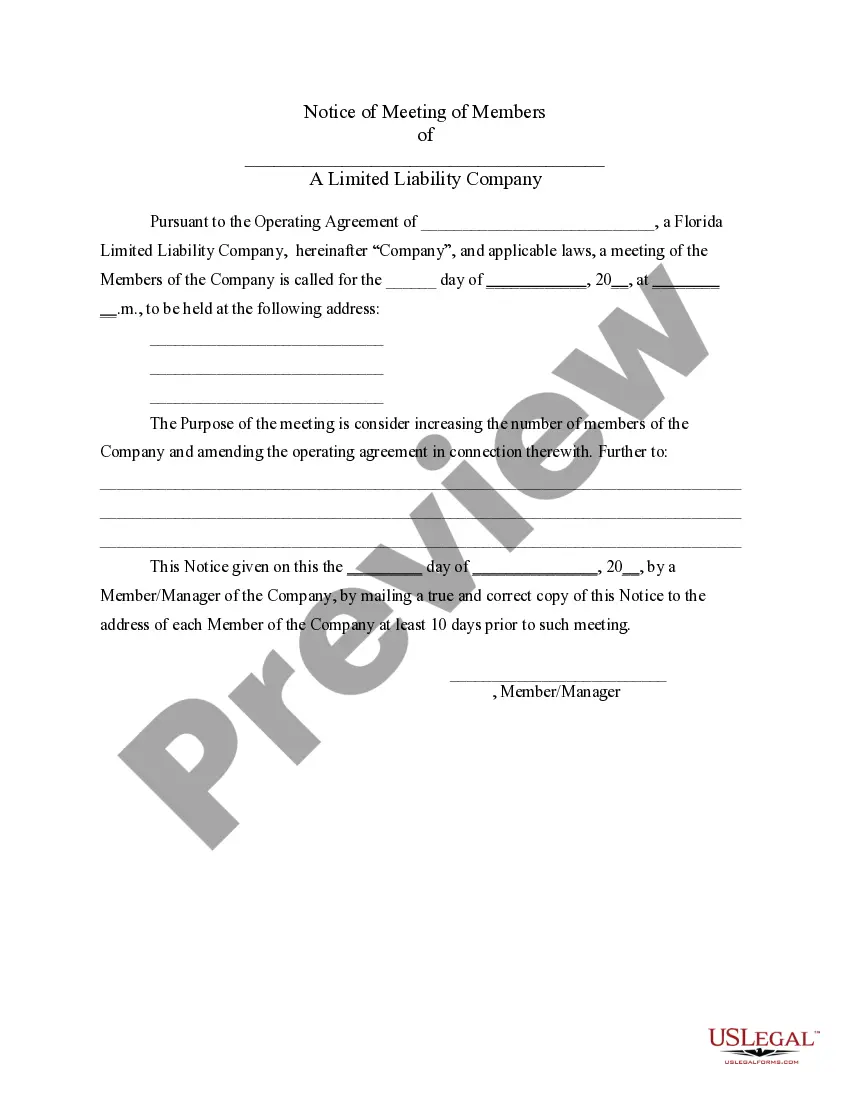

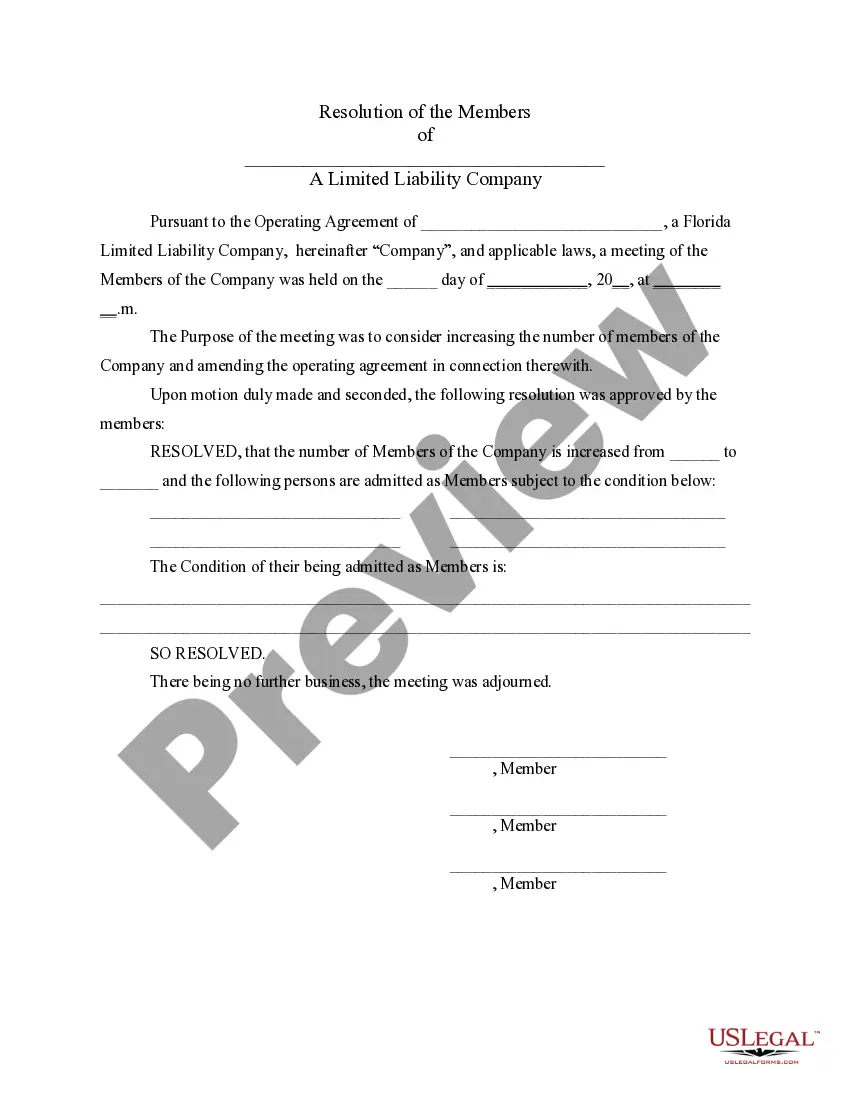

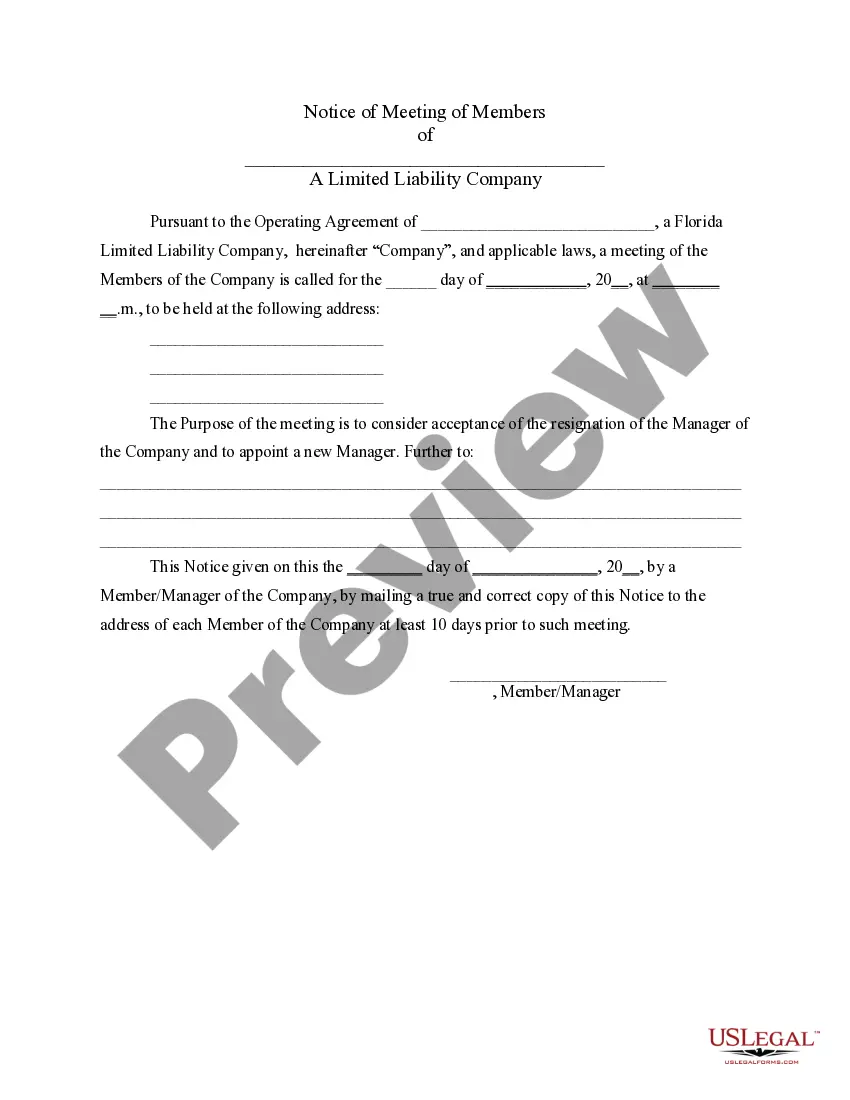

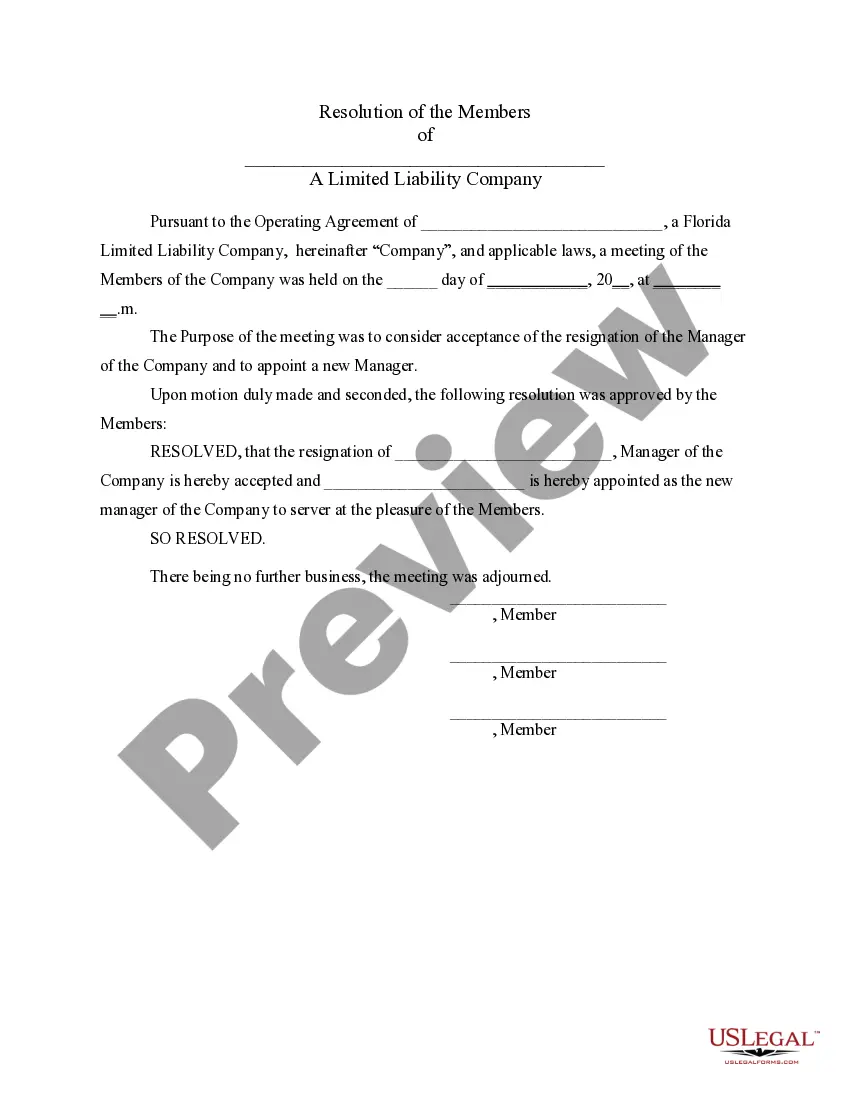

Florida LLC Notices, Resolutions and other Operations Forms Package

Description 3 Day Notice Florida

How to fill out Limited Liability Company?

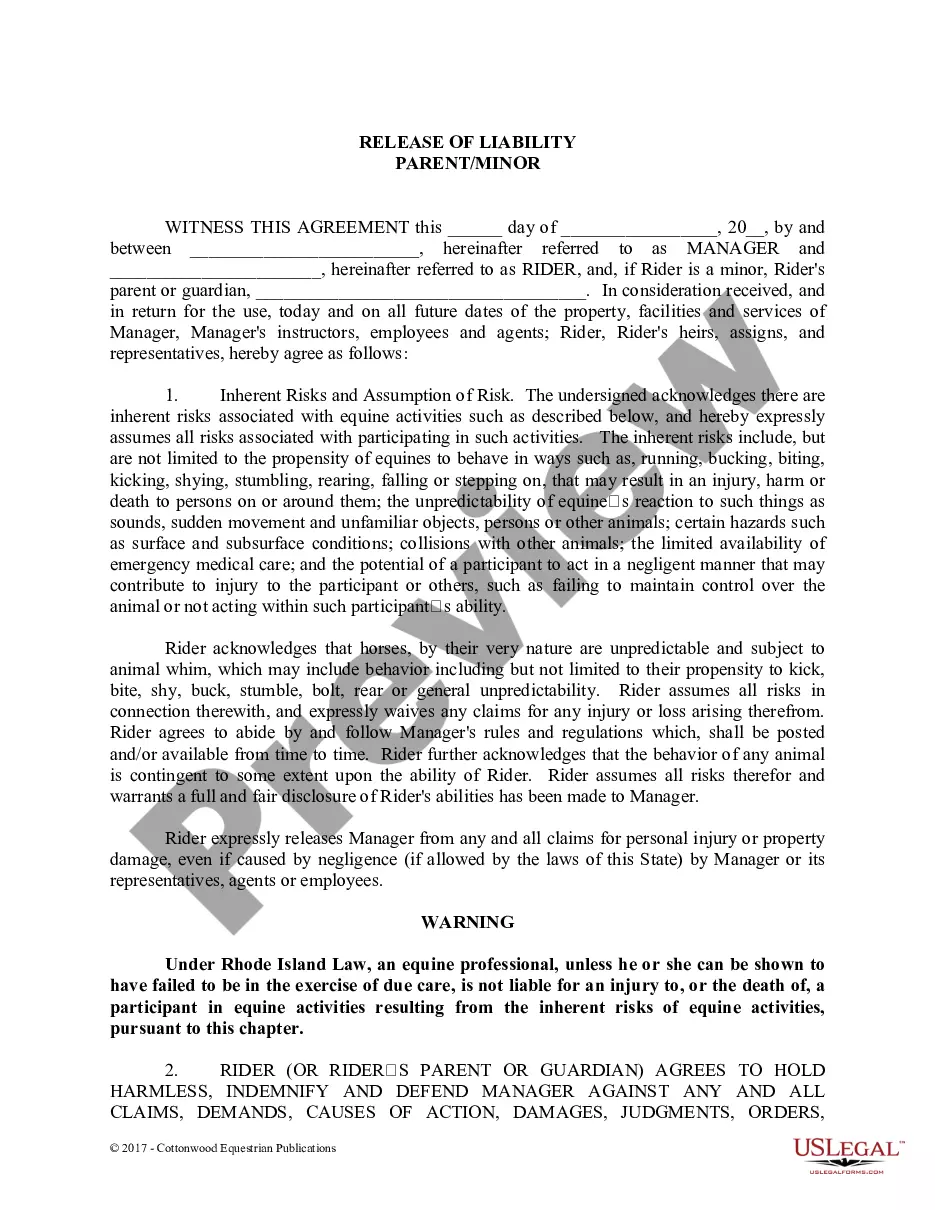

Get one of the most expansive library of legal forms. US Legal Forms is actually a platform where you can find any state-specific file in a few clicks, including Florida LLC Notices, Resolutions and other Operations Forms Package samples. No requirement to spend several hours of your time seeking a court-admissible example. Our accredited professionals make sure that you receive up to date documents all the time.

To leverage the forms library, select a subscription, and register an account. If you registered it, just log in and then click Download. The Florida LLC Notices, Resolutions and other Operations Forms Package template will quickly get stored in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new account, follow the quick recommendations listed below:

- If you're going to utilize a state-specific documents, be sure you indicate the appropriate state.

- If it’s possible, go over the description to know all the nuances of the form.

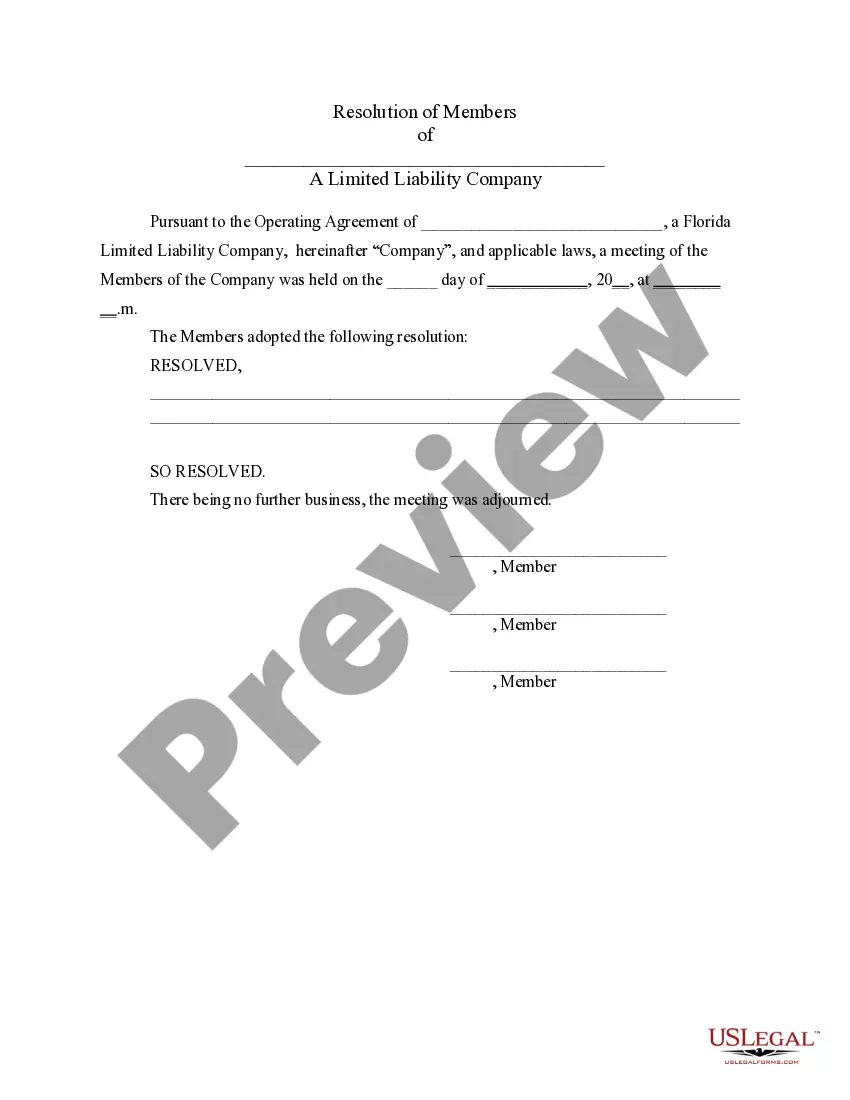

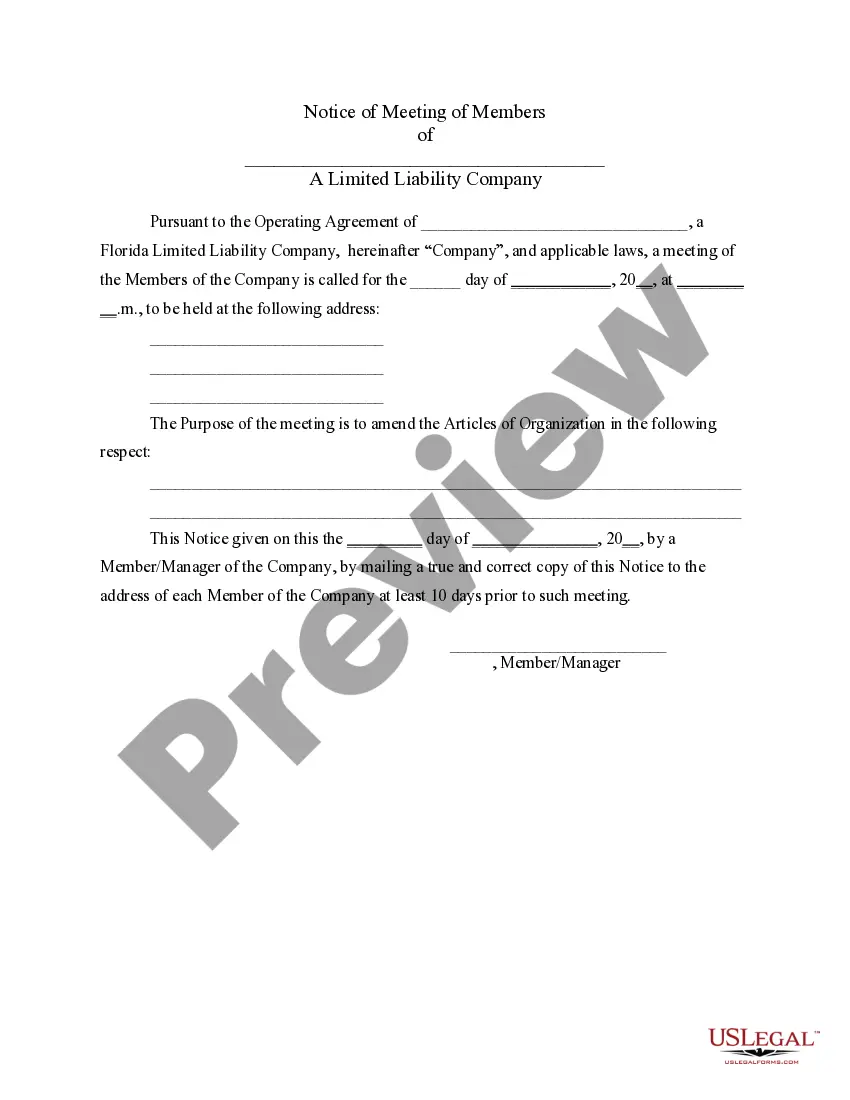

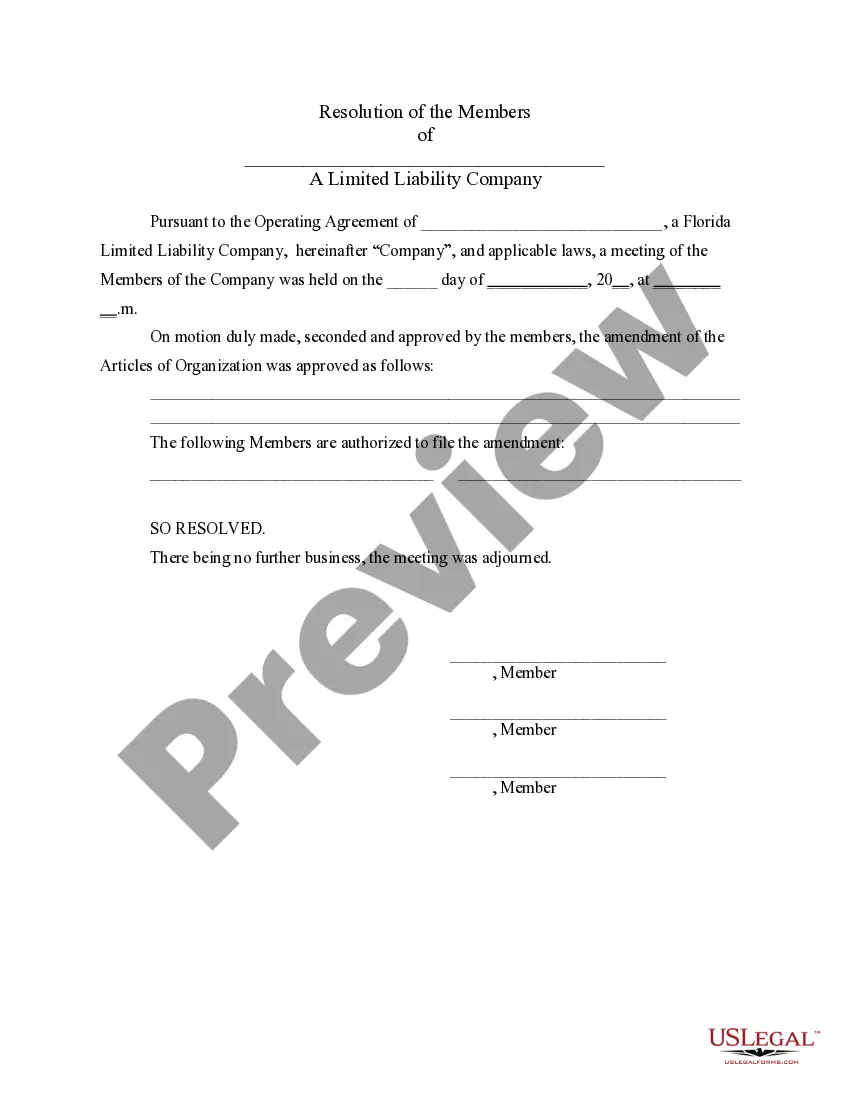

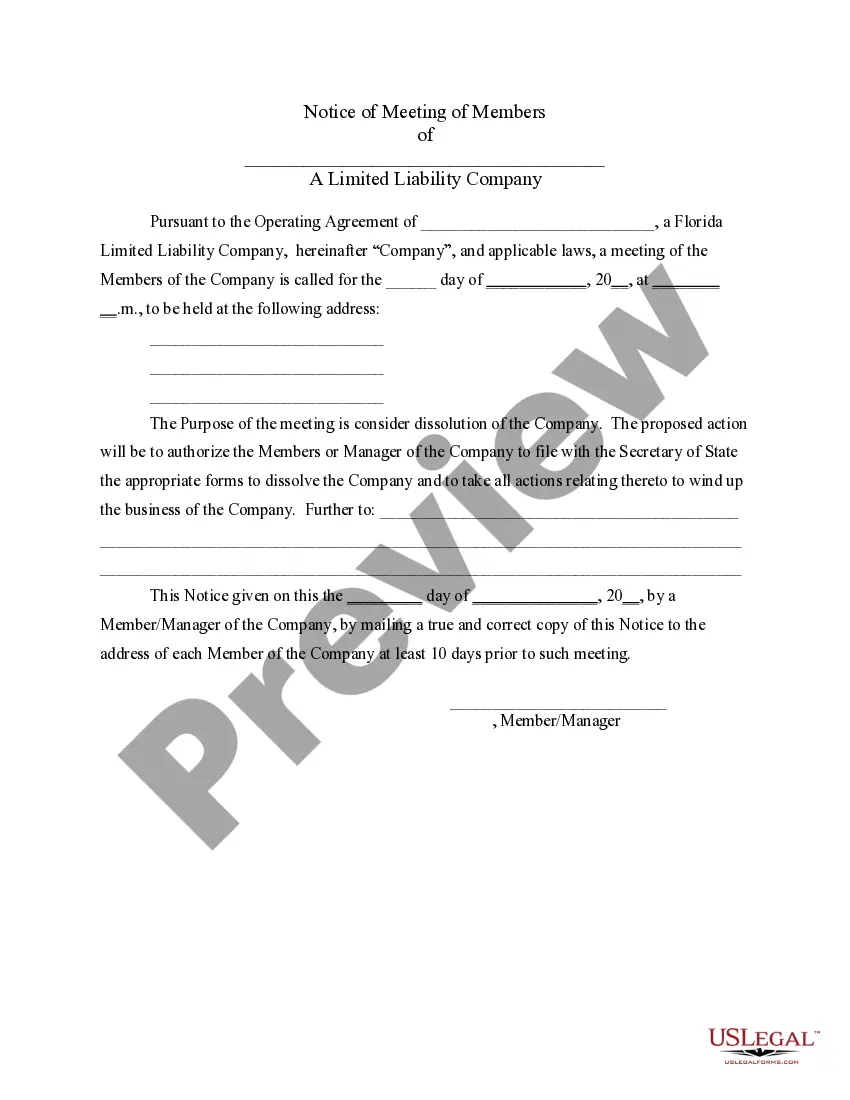

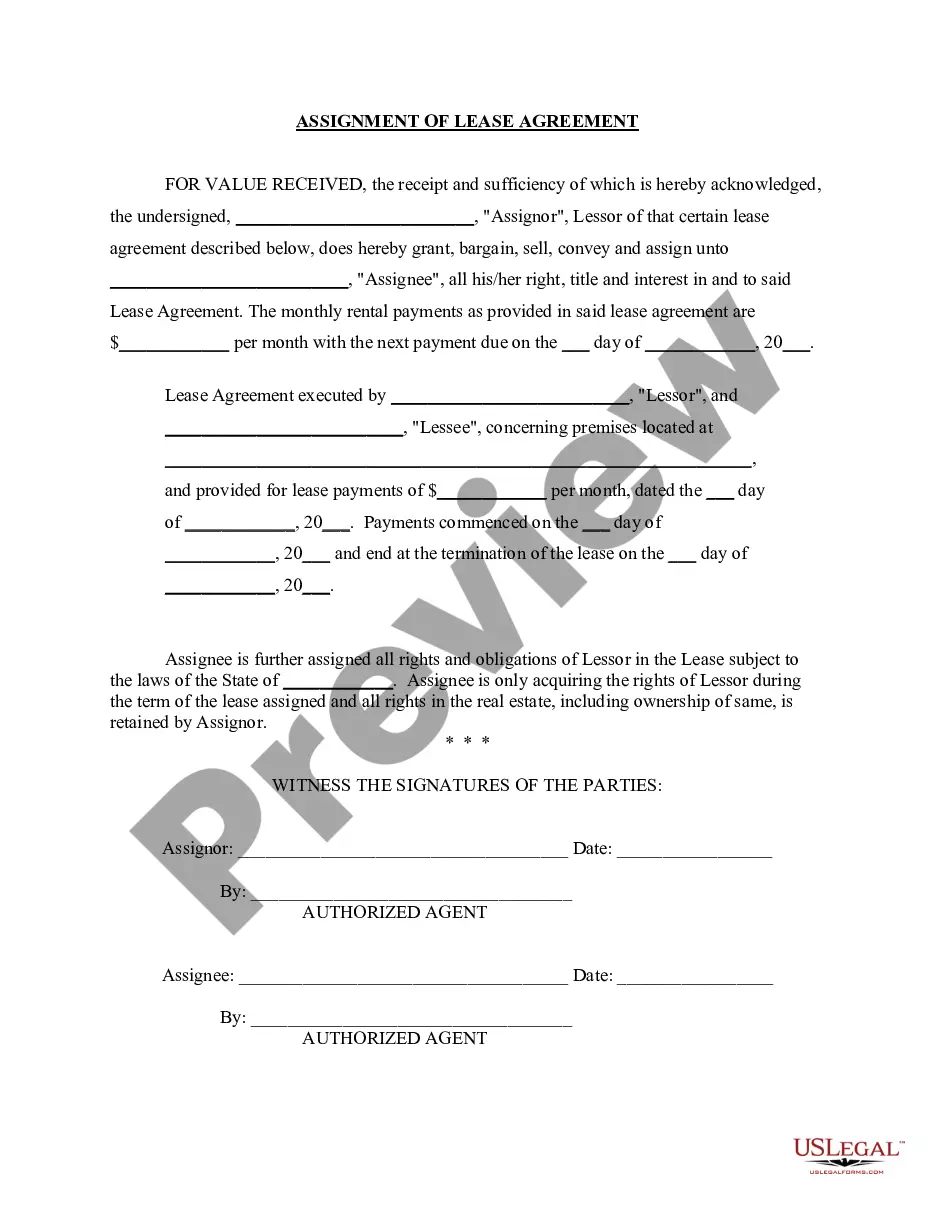

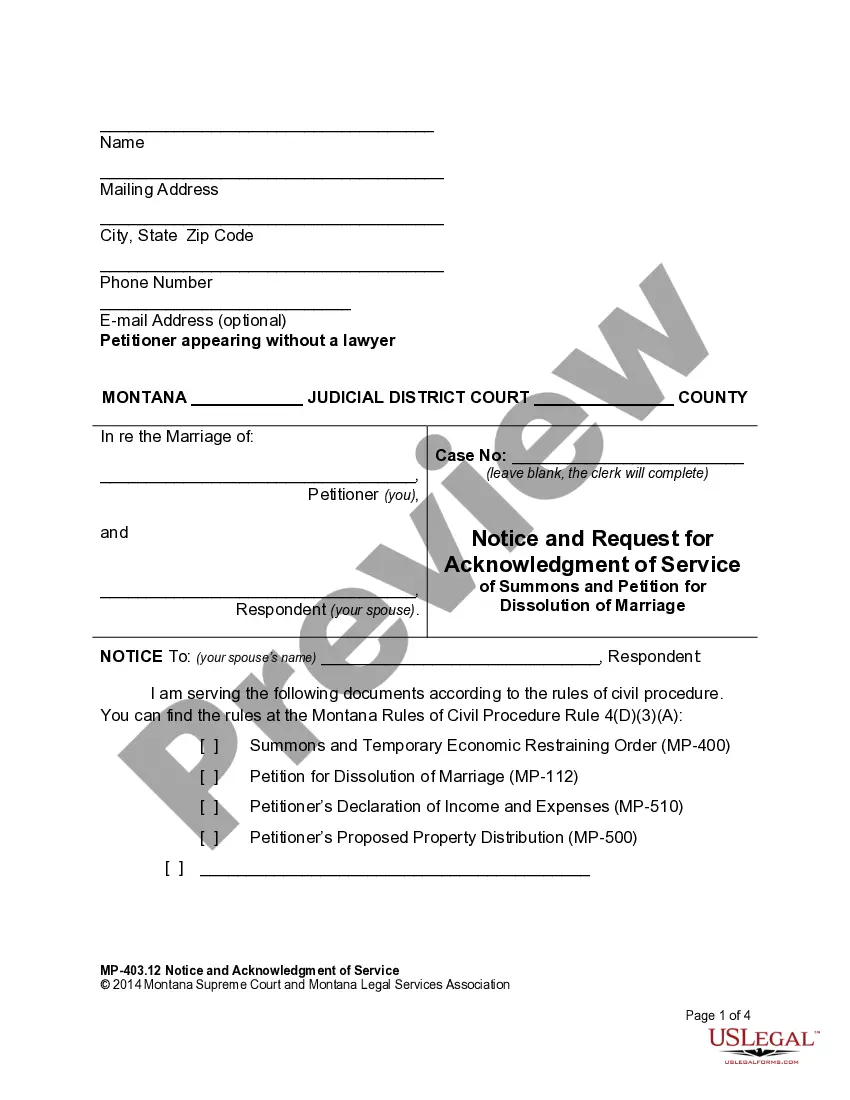

- Utilize the Preview option if it’s offered to look for the document's content.

- If everything’s appropriate, click on Buy Now button.

- Right after picking a pricing plan, register your account.

- Pay by card or PayPal.

- Save the example to your device by clicking Download.

That's all! You ought to submit the Florida LLC Notices, Resolutions and other Operations Forms Package template and double-check it. To make sure that all things are accurate, speak to your local legal counsel for help. Register and simply find over 85,000 valuable forms.

Fl Llc Operations Contract Form popularity

Limited Liability Company Purchase Other Form Names

Fl Llc File FAQ

When you're organizing a new business in Florida, there are several entities to choose from, from sole proprietorships and partnerships to corporations and more. One increasingly popular structure is the Limited Liability Company, or LLC. In fact, Florida is the fifth most favorable state for one.

Florida typically processes online filings in around 8 business days, and paper filings can take a week or so longer. When you hire Sunshine Corporate Filings® to form your Florida LLC, we'll file your Articles of Organization online and get your Florida LLC formed within 8 business days.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

If your Articles of Organization were submitted and paid for online, they will usually be processed within two to three business days. Submissions and payments made by mail will take three to five business days to be processed.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

Florida is a tax-friendly state that does not impose an income tax on individuals, and has a 6% sales tax. Corporations that do business in Florida are subject to a 5.5% income tax. However, LLCs, sole proprietorships and S corporations are, however, exempt from paying state income tax.

Pass-through taxation. LLCs typically enjoy pass-through taxation where the members (owners) report their share of the LLC's profit or loss on their individual tax returns. Flexibility. Fewer formalities. Subsidiaries.

Florida typically processes online filings in around 8 business days, and paper filings can take a week or so longer. When you hire Sunshine Corporate Filings® to form your Florida LLC, we'll file your Articles of Organization online and get your Florida LLC formed within 8 business days.