Florida Commercial Sublease

Description Commercial Sublease Agreement Florida

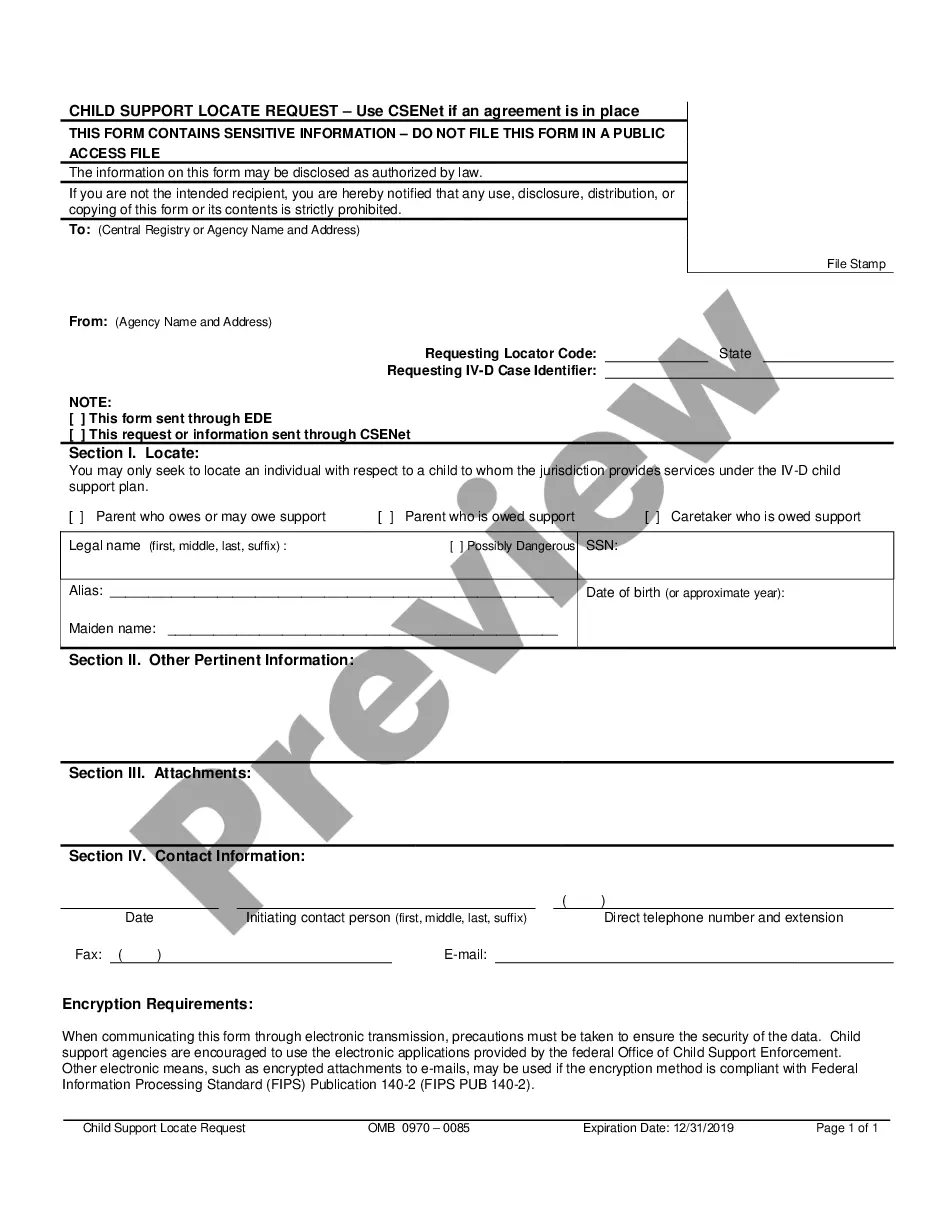

How to fill out Florida Commercial Sublease?

Get the most comprehensive library of legal forms. US Legal Forms is a system to find any state-specific form in a few clicks, even Florida Commercial Sublease examples. No reason to waste hrs of the time searching for a court-admissible sample. Our certified specialists ensure that you get up to date examples all the time.

To leverage the documents library, choose a subscription, and create your account. If you already did it, just log in and click Download. The Florida Commercial Sublease sample will automatically get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, look at simple recommendations listed below:

- If you're going to utilize a state-specific documents, ensure you indicate the right state.

- If it’s possible, review the description to know all of the ins and outs of the document.

- Utilize the Preview function if it’s available to take a look at the document's content.

- If everything’s proper, click on Buy Now button.

- Right after choosing a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Save the example to your device by clicking Download.

That's all! You should fill out the Florida Commercial Sublease form and double-check it. To make certain that things are correct, speak to your local legal counsel for help. Sign up and easily browse more than 85,000 useful forms.

Commercial Sublease Agreement Form popularity

Commercial Sublet Other Form Names

FAQ

Tenants cannot unreasonably deny their landlord access to the rental unit. However, landlords must provide the tenant with a reasonable amount of notice before entry. For a repair, the landlord must give the tenant 12-hour notice in writing.

Florida Sublease Agreement Form In Florida, a sublease agreement is a legal agreement between two tenants; one who will be moving out of a rented unit and one that will be moving in. A sublease agreement grants the sublessee (the incoming tenant) the right to move into the unit and pay rent while the sublessor is gone.

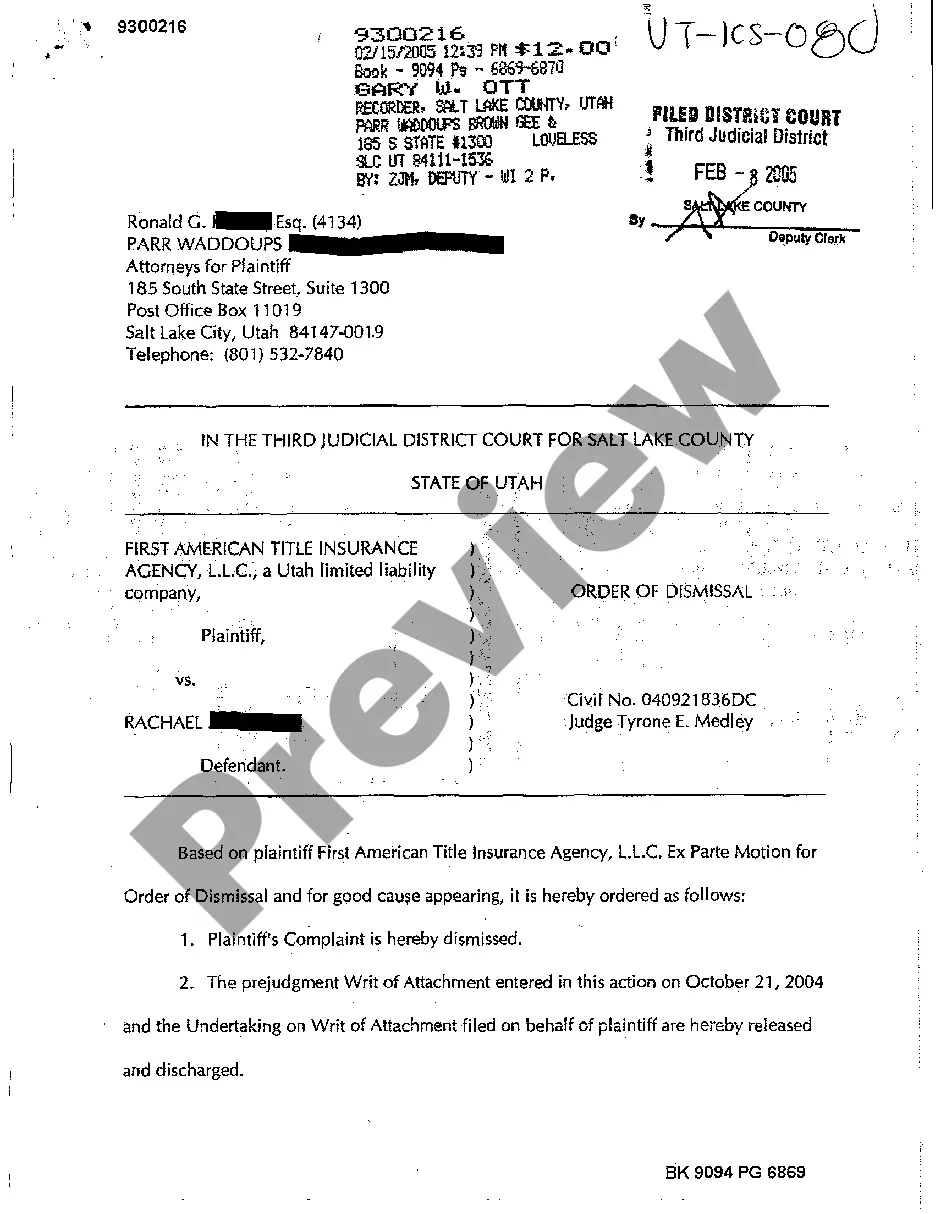

Oftentimes, sub-tenants have the right to be presented with an eviction notice in advance of having to move out and, in some jurisdictions, may be able to bring a lawsuit against the landlord.

Florida is the only state in the United States to impose a sales tax on commercial rent.

Florida law does not specifically prohibit or permit sublets, so what your lease says matters. If your lease says no sublets, then that means no sublets.

If the Subtenant does not pay rent or violates the lease, the Tenant can bring an Eviction against the Subtenant. Florida Statute 83 will still apply to a Subtenant being evicted by a Tenant. A Tenant can also file an Unlawful Detainer.The Landlord will likely give the Tenant a 7 Day Notice to Cure.

The short answer is that rental income is taxed as ordinary income. If you're in the 22% marginal tax bracket and have $5,000 in rental income to report, you'll pay $1,100. However, there's more to the story. Rental property owners can lower their income tax burdens in several ways.

A commercial sublease is an agreement between a tenant currently leasing a property, a new tenant looking for space, and the property owner. When you sublease your space you are the sublessor (or sublandlord) and your new tenant is the sublessee (or subtenant).