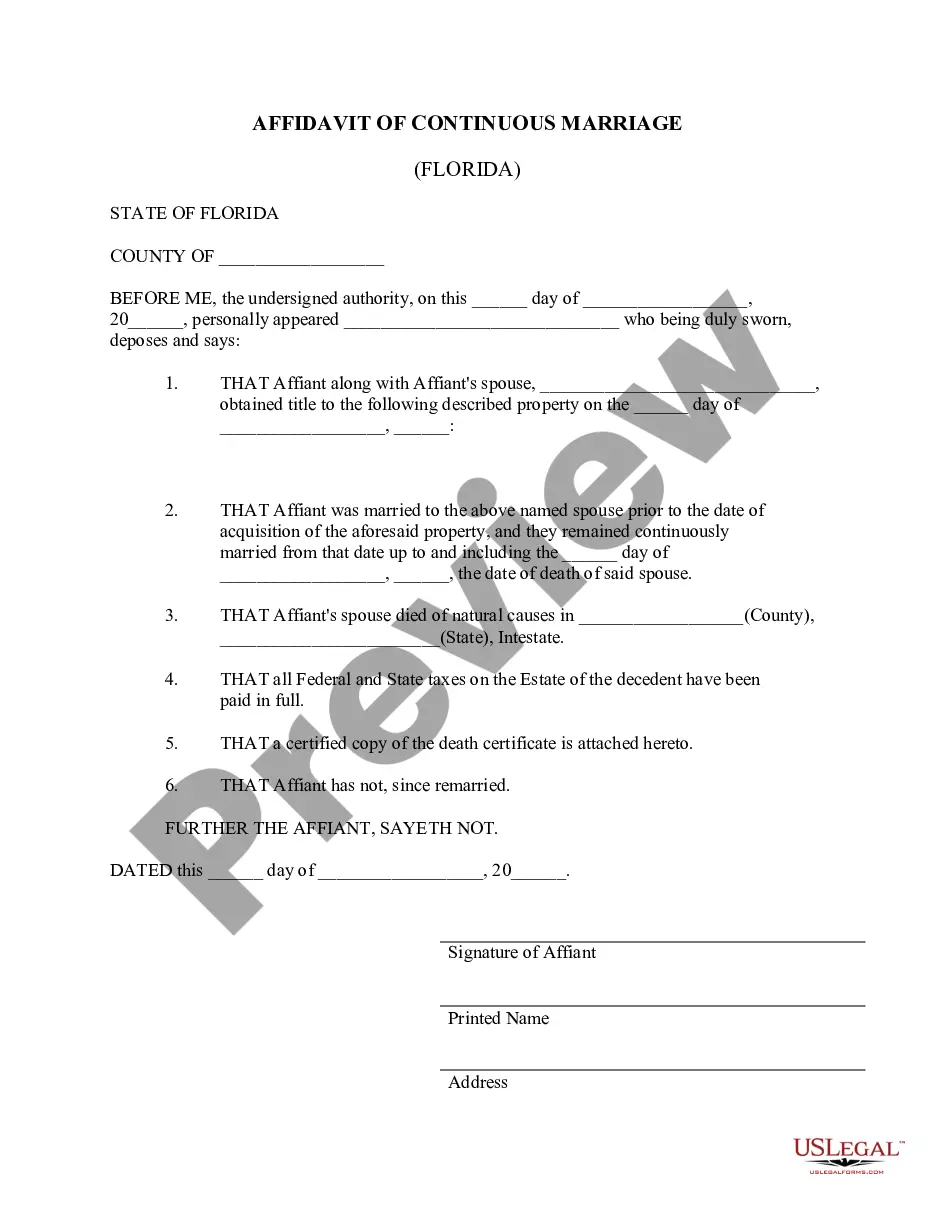

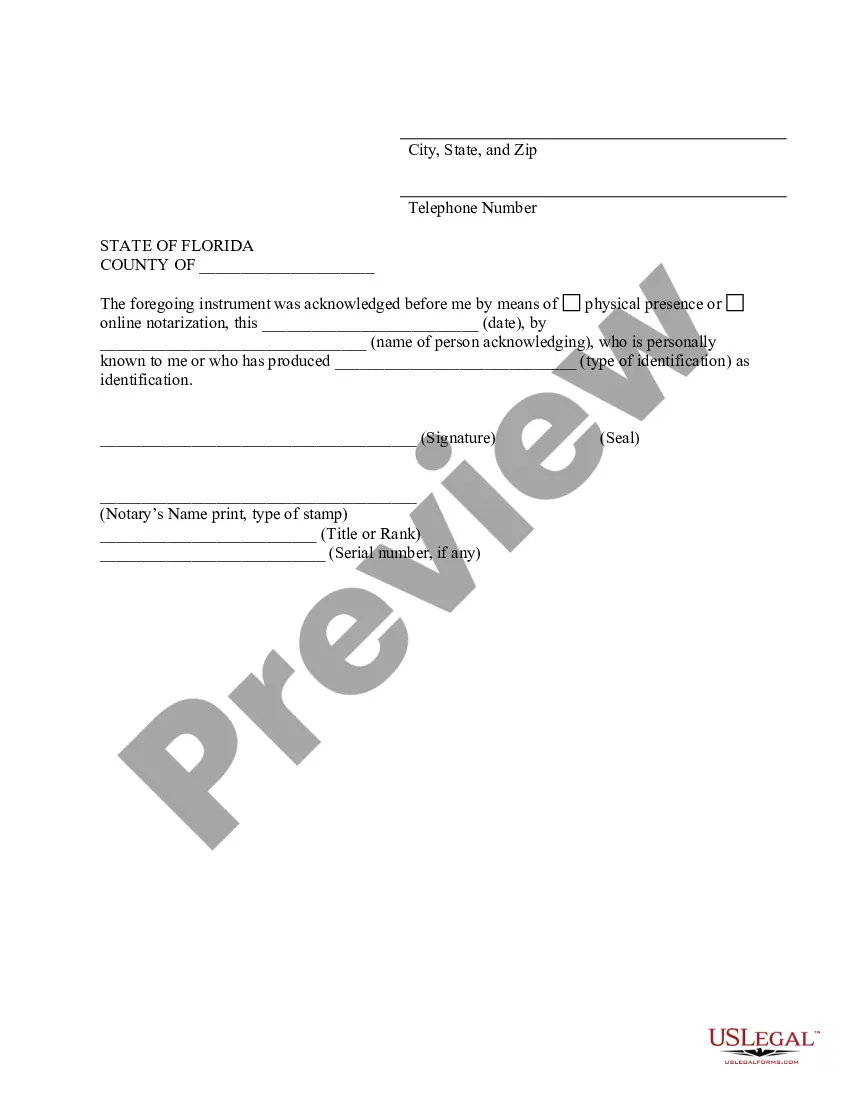

Affidavit Of Continuous Marriage Florida

Description What Is A Continuous Marriage Affidavit

How to fill out Sample Letter Of Affidavit Of Support For Marriage?

- Log in to your US Legal Forms account or create one if you're a new user.

- Verify that your subscription is active; if it’s expired, choose a suitable renewal plan.

- Search for the 'Florida Affidavit of Continuous Marriage - Deceased Spouse' template. Use the Preview mode to ensure it meets your jurisdiction's requirements.

- If the document fits your needs, click the 'Buy Now' button and select your preferred subscription plan.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download the form to your device, and you can access it anytime from the 'My Forms' section of your profile.

US Legal Forms provides an extensive library featuring over 85,000 fillable and editable legal forms, ensuring you always find the exact document you need. Unlike competitors, it offers a robust collection and access to premium experts for assistance, making it easier to create precise legal documents.

Ready to simplify your document preparation? Log in to US Legal Forms today and get started on your Florida Affidavit of Continuous Marriage - Deceased Spouse.

Florida Marriage Certificate Sample Form popularity

Marriage Affidavit Sample Other Form Names

Sample Of Affidavit Of Marriage FAQ

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

A: A Continuous Marriage Affidavit (a/k/a CMA) is an affidavit that states that the property was acquired by the owners during their marriage (as tenants by the entirety) and the owners remained married (continuously) through the date of sale or the passing (date of death) of one of the spouses.

A continuous marriage affidavit that is used in Florida to clear title following the death of a spouse where real property located in Florida was owned by the spouses as tenants by the entirety. This Standard Document has integrated notes with important explanations and drafting tips.

The surviving spouse has the right to Family Exempt Property.The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate.

A certified copy of the deceased property owner's Death Certificate. Tax forms from the State of Florida Department of Revenue (DOR).

While nothing needs to be done, the best practice is for a surviving owner to formally record the transfer of the interest. File an affidavit of survivorship with the recorder's office to remove the deceased person's name from the title.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

It will depend what state the property is in. For example, the minimum fee payable when changing the title to have someone removed from a property title in NSW is $133.48. This fee must be paid to the NSW Government Land & Property Information Department.