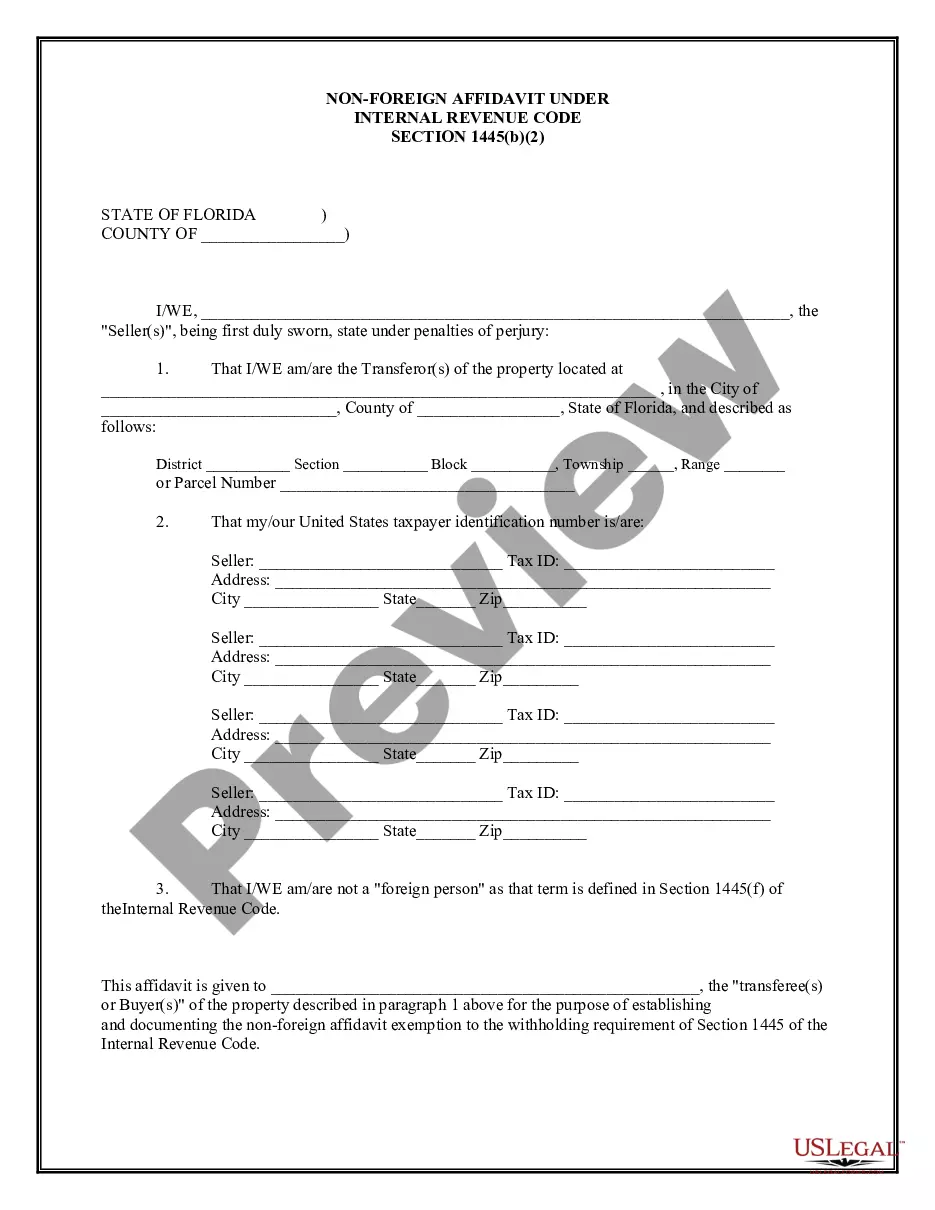

Florida Non-Foreign Affidavit Under IRC 1445

Description Affidavit Of Non Cohabitation Sample

How to fill out Firpta Affidavit?

Get access to the most comprehensive catalogue of legal forms. US Legal Forms is a platform where you can find any state-specific form in a few clicks, even Florida Non-Foreign Affidavit Under IRC 1445 samples. No need to waste time of your time trying to find a court-admissible form. Our qualified specialists ensure you receive up to date examples every time.

To leverage the forms library, select a subscription, and sign-up your account. If you created it, just log in and then click Download. The Florida Non-Foreign Affidavit Under IRC 1445 file will quickly get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new profile, look at simple guidelines listed below:

- If you're having to utilize a state-specific sample, be sure you indicate the appropriate state.

- If it’s possible, look at the description to understand all the nuances of the form.

- Make use of the Preview function if it’s accessible to check the document's content.

- If everything’s proper, click on Buy Now button.

- Right after selecting a pricing plan, create an account.

- Pay by credit card or PayPal.

- Save the example to your computer by clicking Download.

That's all! You need to submit the Florida Non-Foreign Affidavit Under IRC 1445 template and check out it. To be sure that everything is correct, contact your local legal counsel for support. Join and easily find more than 85,000 useful templates.

What Is A Firpta Affidavit Form popularity

What Is Firpta Affidavit Other Form Names

Florida Affidavit Form Template FAQ

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers' agents, and settlement officers are required to withhold 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition (special rules for foreign corporations).

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

In most cases, the purchaser of a U.S. real property interest must deduct and withhold ten percent of the amount realized by the foreign seller. However, the amount withheld should not exceed the seller's maximum tax liability.