Account Transfer Trust

Description Transfer Living Trust

How to fill out Florida Living Trust?

- If you have an existing account with US Legal Forms, log in to download your desired form template. Ensure your subscription is active; if not, renew it.

- In your first visit, browse the extensive legal forms library. Use the Preview mode to review form descriptions and confirm you've selected the appropriate document based on your needs.

- If necessary, utilize the Search tab to find alternate templates that may better suit your requirements.

- Click the Buy Now button once you've chosen your document, and select a subscription plan that fits your needs. You'll need to create an account to access the library.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download your document and save it for later use. You can access it anytime in the My Forms section of your profile.

With the support of US Legal Forms, individuals can efficiently manage their legal documentation. The platform provides access to over 85,000 easily editable legal forms, ensuring your documents meet all required standards.

Simplify your legal processes today by exploring the robust library at US Legal Forms and ensure your financial accounts are properly transferred into your living trust.

Financial Account Trust Form popularity

How Does It Cost To Get A Living Trust Other Form Names

Florida Living Trust Printable FAQ

Lifetime Gift Tax Exemption The IRS allows you, as of 2014, to give up to $5.34 million in gifts or, after you die, bequests free of estate tax. This means you can put additional money into your irrevocable trust and, as long as you stay below your lifetime limit, it'll be a tax-free transfer.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Dmitriy Fomichenko, President, Sense Financial Almost all the major banks offer trust accounts. What you need to do is to call their customer representatives and inquire about the features you require. Some of the options include Bank of America, Wells Fargo, US Bank, and TD Bank.

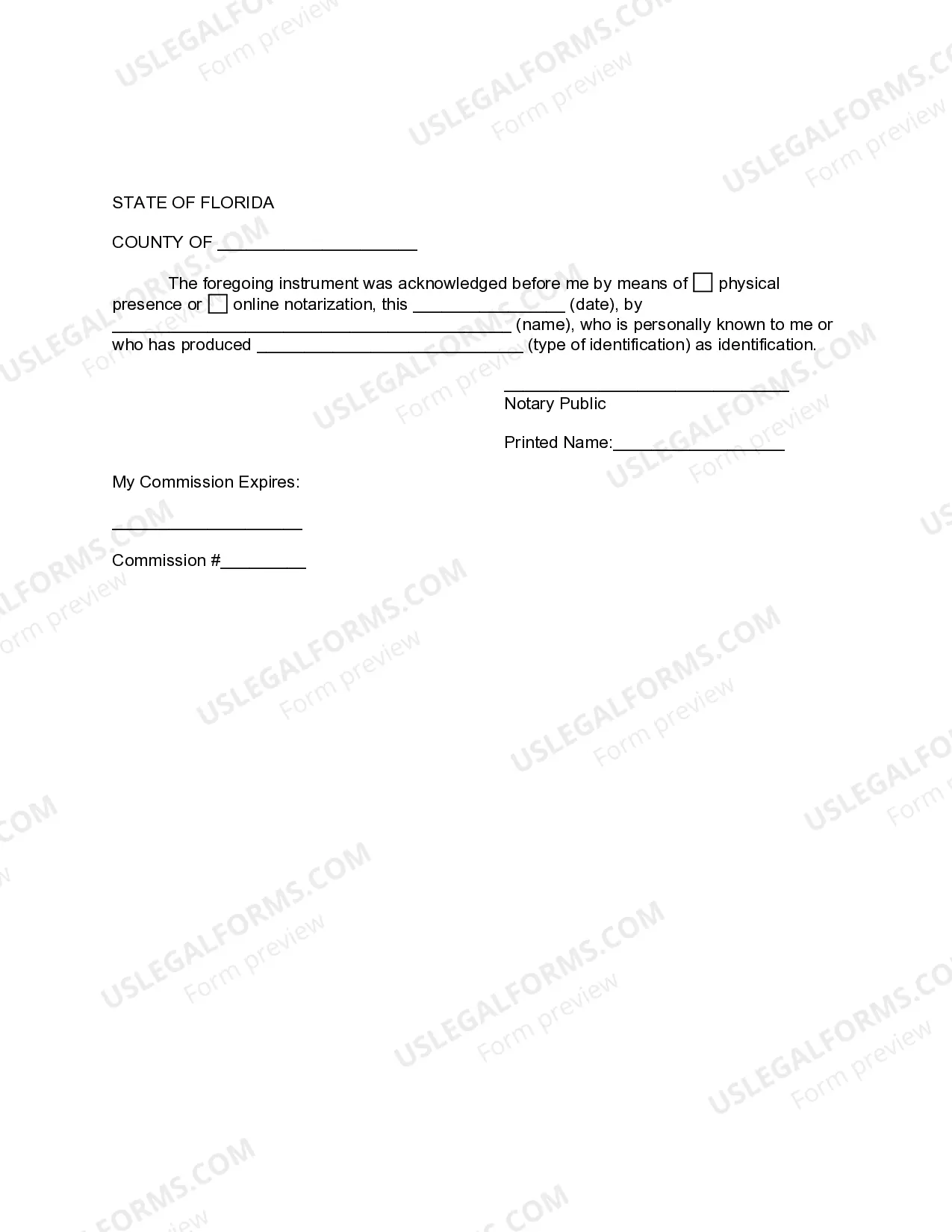

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.