Florida Assignment to Living Trust

Description Florida Trust Form

How to fill out Annual Leave Extension Request Letter?

Get one of the most expansive library of legal forms. US Legal Forms is a solution to find any state-specific form in clicks, such as Florida Assignment to Living Trust templates. No reason to spend hours of your time looking for a court-admissible example. Our qualified professionals make sure that you receive up-to-date samples all the time.

To take advantage of the documents library, pick a subscription, and sign-up an account. If you already did it, just log in and click Download. The Florida Assignment to Living Trust sample will automatically get saved in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new account, follow the short instructions below:

- If you're proceeding to use a state-specific documents, be sure to indicate the proper state.

- If it’s possible, look at the description to learn all of the ins and outs of the form.

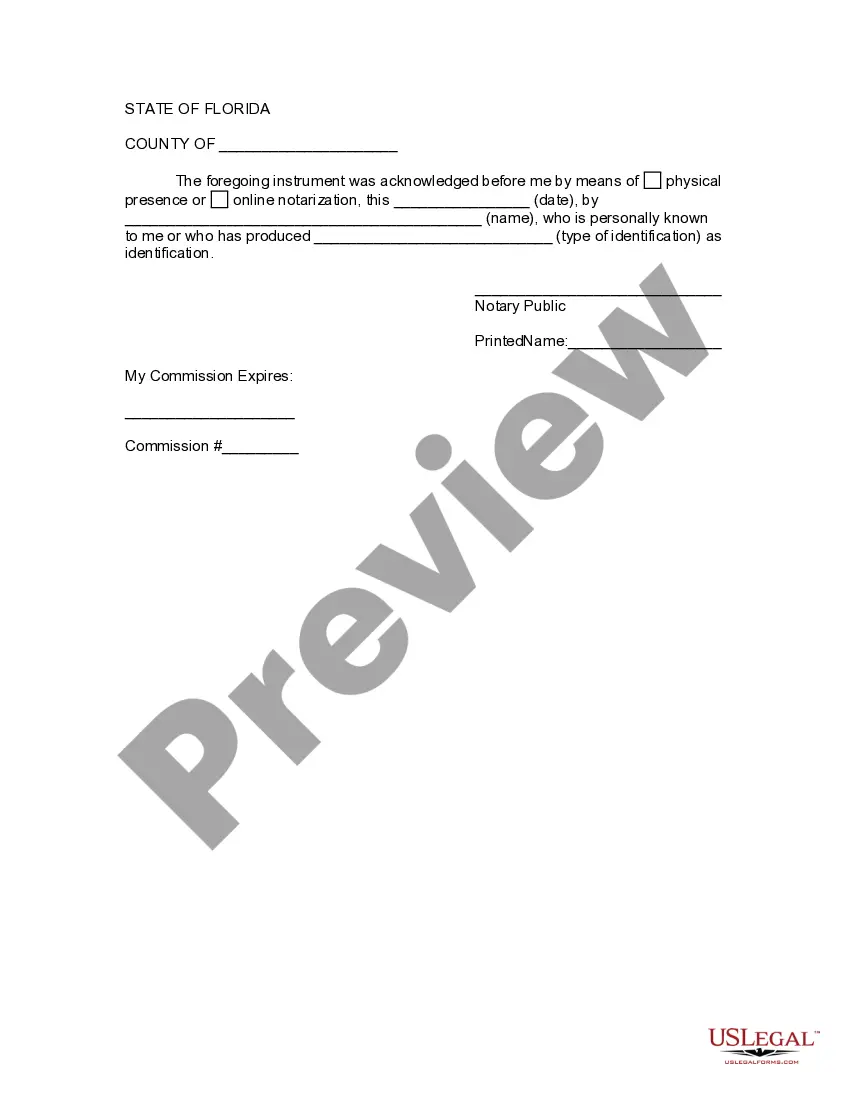

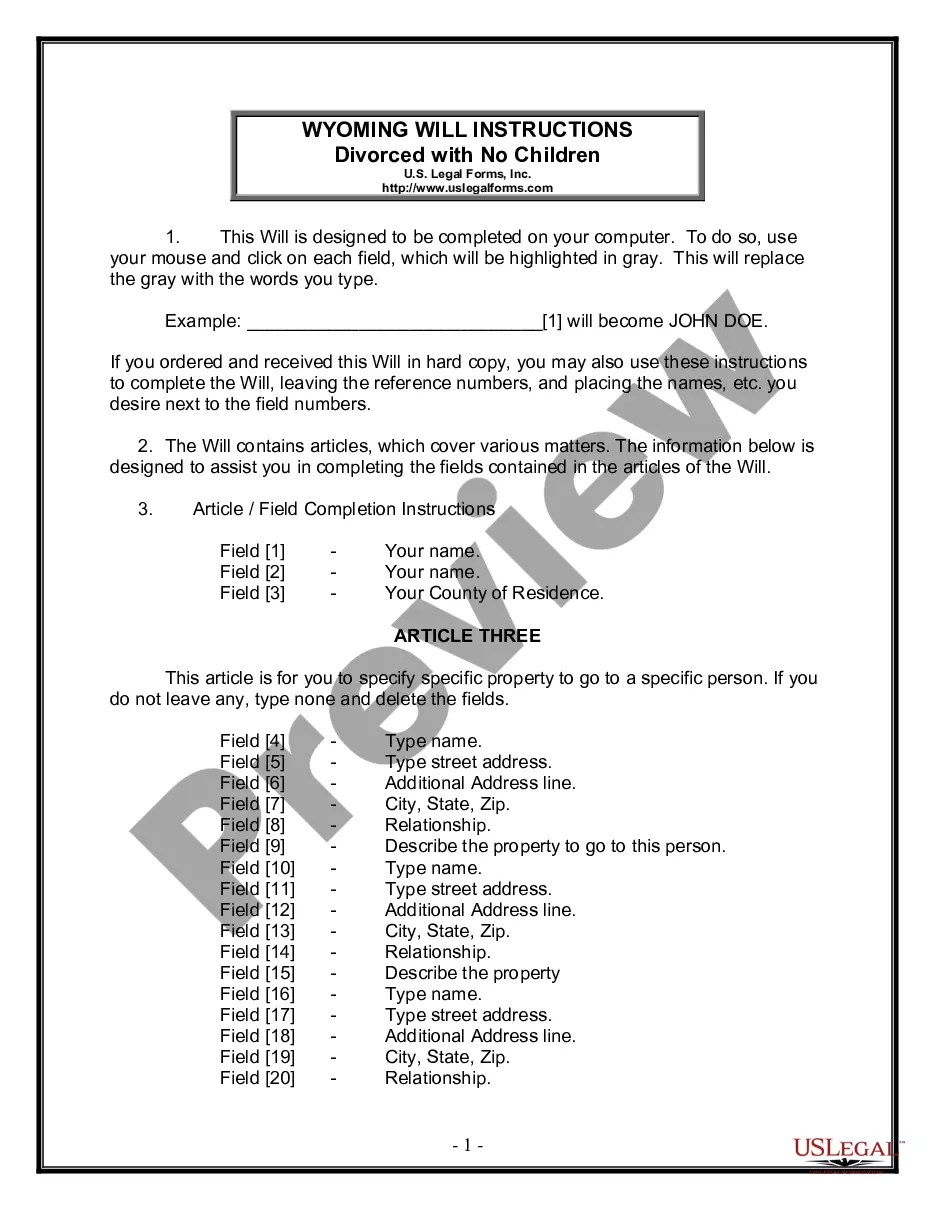

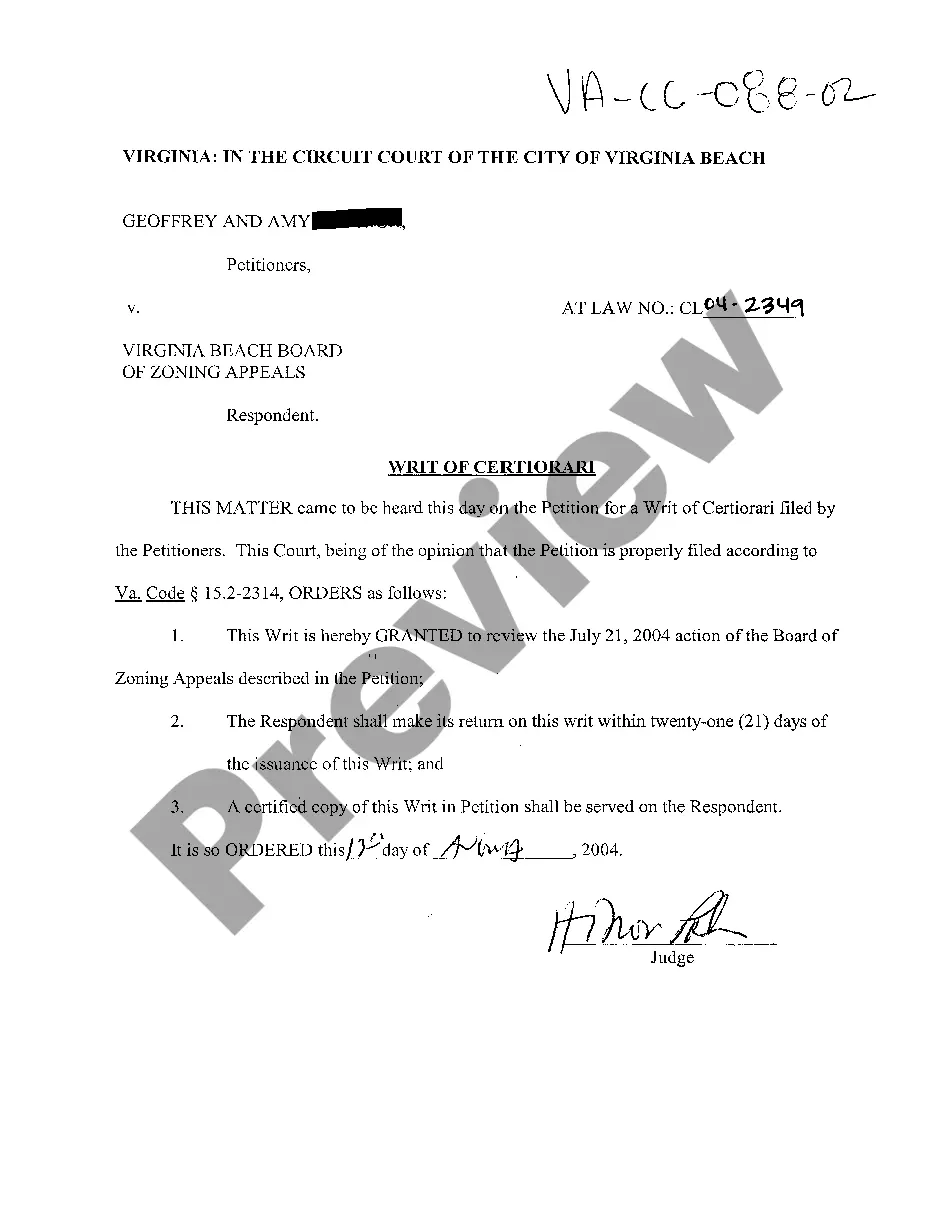

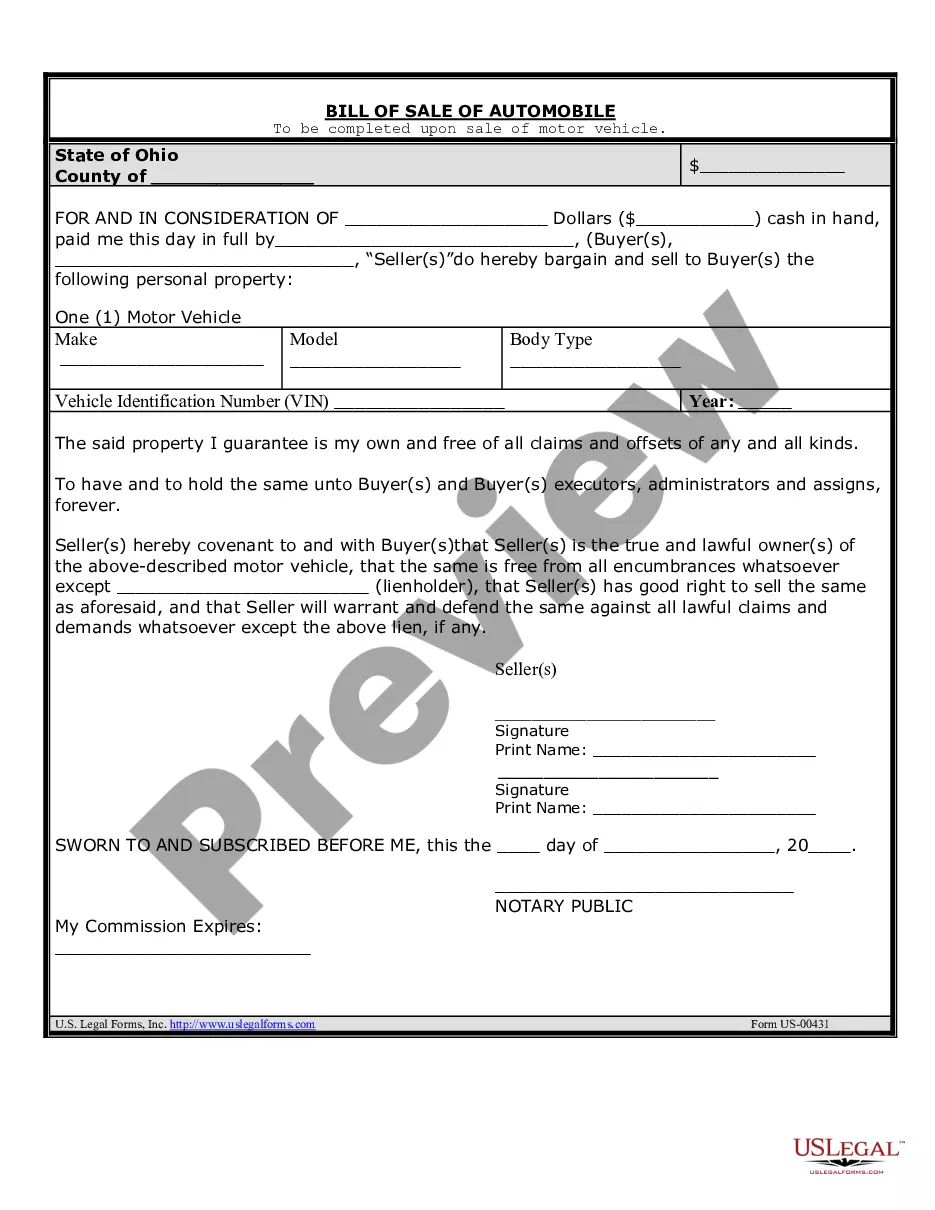

- Make use of the Preview option if it’s offered to look for the document's content.

- If everything’s proper, click on Buy Now button.

- After choosing a pricing plan, register an account.

- Pay by card or PayPal.

- Save the sample to your computer by clicking on Download button.

That's all! You should fill out the Florida Assignment to Living Trust form and check out it. To ensure that everything is accurate, contact your local legal counsel for assist. Register and simply browse over 85,000 valuable forms.

Fl Trust Form Form popularity

Living Trust Form Online Other Form Names

Fl Living Trust Document FAQ

The exact cost will depend on the attorney's fees, but you could end up paying more than $1,000. Before choosing an attorney to work with, make sure you understand the fees they'll charge and also note whether the attorney specializes in trusts.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

If your main goal is to avoid probate court, so long as you have assets that will not pass through probate then you will not need a trust. However, if you have assets that will pass through probate, the a Florida revocable living trust will be a good idea.

A Florida living trustallows you to transfer assets into a trust during your lifetime while you continue to use them, and then have them distributed to your choice of beneficiaries after your death. Living trusts have many benefits and are an appealing estate planning option.

If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

One of the advantages of a revocable living trust as opposed to a will, is that upon your death, all the details of what you leave to who are private.A revocable living trust allows you to buy additional real estate at any time during your lifetime, in the name of the trust, whether in Florida or outside the state.

Most everyone needs a will, however not everyone needs a revocable living trust. You and your Florida estate planning attorney will determine whether you require a revocable living trust based on your level of assets, your age, and your marital status.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

The above scope of legal services for a married couple (first marriage) with two minor children, requiring no tax planning, will cost $1,500 $2,250.