Florida Trust Affidavit

Description

Key Concepts & Definitions

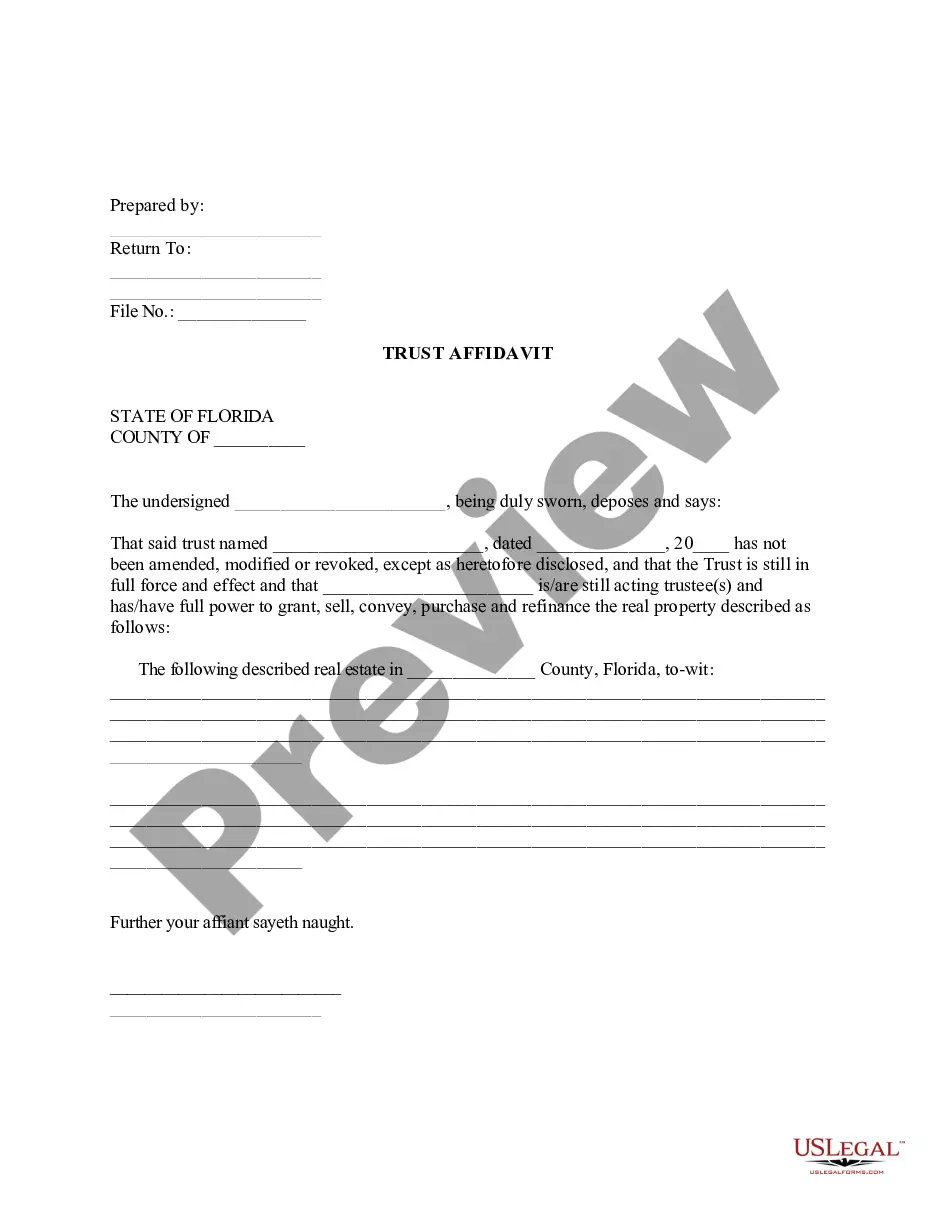

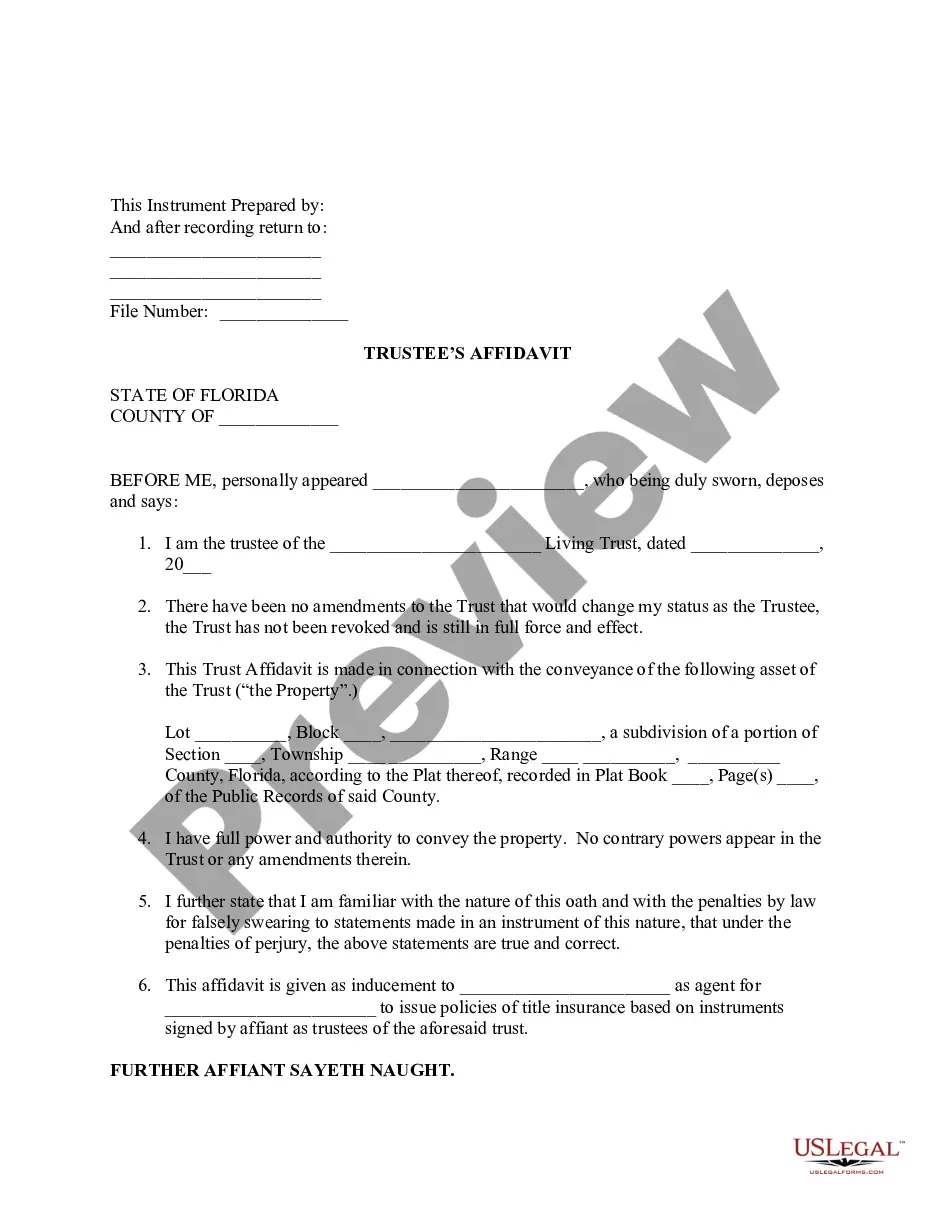

Trust Affidavit is a legal document used in the United States whereby the trustee of a trust asserts certain facts pertaining to the trust. This may include asserting the validity of the trust, confirming that the trust has not been revoked or amended, and verifying the trustee's authority to act on behalf of the trust.

Step-by-Step Guide

- Identify the Need for a Trust Affidavit: Determine if your transaction or situation requires a trust affidavit, commonly necessary in real estate transactions.

- Obtain the Trust Document: Review the actual trust document to understand its terms and identify the designated trustee.

- Prepare the Affidavit: Draft the affidavit, ensuring it includes all necessary assertions about the trust, such as its continuing validity and the trustee's authority.

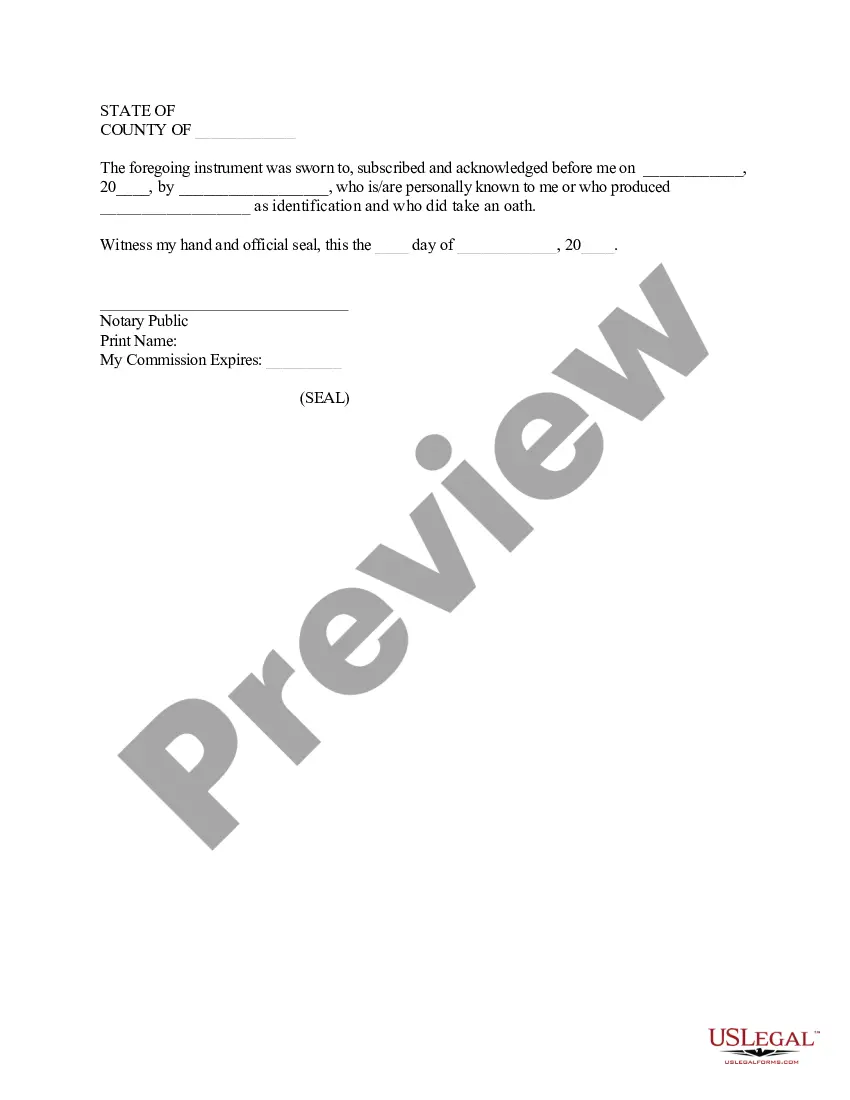

- Sign Before a Notary: The trustee needs to sign the affidavit in the presence of a notary public to authenticate the document.

- Use as Required: Submit or present the trust affidavit as required by legal, financial, or property transfer processes.

Risk Analysis

- Legal Risks: Inaccurate or false information within a trust affidavit can lead to legal disputes or challenges against the trustee.

- Financial Risks: A defect in the trust affidavit may impede transactions such as property transfers, possibly resulting in financial loss.

- Reputational Risks: Errors or omissions in the trust affidavit may damage the reputation of the trustee or the trust itself among beneficiaries and in broader business or legal contexts.

How to fill out Florida Trust Affidavit?

Utilize US Legal Forms to obtain a printable Florida Trust Affidavit.

Our court-recognized templates are crafted and consistently revised by qualified lawyers.

Ours is the most comprehensive collection of forms online and offers affordable and precise templates for individuals, attorneys, and small to medium-sized businesses.

Examine the form by reviewing the description and utilizing the Preview option. Click Buy Now if it’s the form you require. Create your account and make payment via PayPal or credit card. Download the form to your device and feel free to use it multiple times. Use the Search function if you need to locate another document template. US Legal Forms provides numerous legal and tax documents and packages for both business and personal necessities, including the Florida Trust Affidavit. Over three million users have successfully utilized our platform. Choose your subscription plan and acquire high-quality forms with just a few clicks.

- The templates are organized into state-specific categories.

- Several can be previewed before downloading.

- To download templates, users need a subscription and must Log In to their account.

- Select Download next to any form you desire and locate it in My documents.

- For users without a subscription, follow these steps to quickly find and download the Florida Trust Affidavit.

- Verify that you have the correct form related to the required state.

Form popularity

FAQ

To fill out a certification of trust, you need to present key details about the trust, such as the date of creation, the names of the trustor and trustee, and the powers granted to the trustee. This document must accurately reflect the terms stated in your Florida Trust Affidavit. By using a reliable template from US Legal Forms, you can ensure you include all necessary elements, making the process straightforward and compliant with Florida regulations.

The biggest mistake parents often make when setting up a trust fund is failing to clearly communicate their intentions and the terms of the trust to their children. Without clarity, beneficiaries may have incorrect expectations or misunderstandings regarding their inheritance. It is vital to establish transparent guidelines in your Florida Trust Affidavit to prevent disputes or confusion down the line.

Filling out a trust form is a methodical process that requires attention to detail. Begin by collecting information regarding your assets, including real estate, bank accounts, and personal property. Then, you’ll enter the necessary details regarding the trustor, trustee, and beneficiaries. Using the Florida Trust Affidavit format from US Legal Forms can make this task easier and more organized.

To write a trust in Florida, begin by clearly defining your objectives and selecting a trustee. Use straightforward language to outline the terms of the trust, including the management of assets and distribution to beneficiaries. A Florida Trust Affidavit should be signed by you and the trustee, ideally in the presence of witnesses. For helpful templates and guidance, consider US Legal Forms, which provides tailored documents for Florida trusts.

Filling out a trust form involves gathering essential information about your assets and beneficiaries. You should start by identifying the type of trust you want to create. After choosing your trust type, you’ll need to input details about the trustor, trustee, and beneficiaries. Utilizing the Florida Trust Affidavit template from US Legal Forms can simplify this process, guiding you through each section.

Filing a notice of trust in Florida requires you to draft a document that includes necessary trust details. After that, you need to file it with the clerk of the circuit court in the appropriate county. This process, facilitated by a Florida Trust Affidavit, helps confirm the existence of the trust legally. To make matters easier, explore the resources available on uslegalforms, which offer templates and guidance.

The Florida statute regarding notice of trust helps establish legal standing and transparency for interested parties. This statute mandates that trustees provide notice when necessary, such as to beneficiaries or creditors. By filing a Florida Trust Affidavit, you can notify relevant parties while maintaining compliance with state regulations. Seeking assistance from uslegalforms can ensure that your notice meets all legal requirements.

In Florida, you do not need to file a certificate of trust with the court unless specified by law or required for transactions. A certificate of trust acts mainly as a supportive document, showing the trust's validity to banks or other institutions. If you find yourself needing this document, a Florida Trust Affidavit can help clarify your intentions. uslegalforms can assist in creating this document efficiently.

A trust does not have to be filed with the court in Florida, as it is usually a private document. Instead, only specific situations might require court involvement, such as trust disputes or when there are claims against the trust. Utilizing a Florida Trust Affidavit can help establish trust legitimacy without unnecessary court procedures. uslegalforms can provide guidance through these legal nuances.

In Florida, you are generally not required to file a trust with the court unless it is a part of an ongoing legal proceeding. Trusts typically remain private documents, allowing for more privacy compared to wills. However, a Florida Trust Affidavit may be necessary if you want to provide proof of trust existence to third parties. Consulting with uslegalforms can clarify your obligations and simplify the filing process.