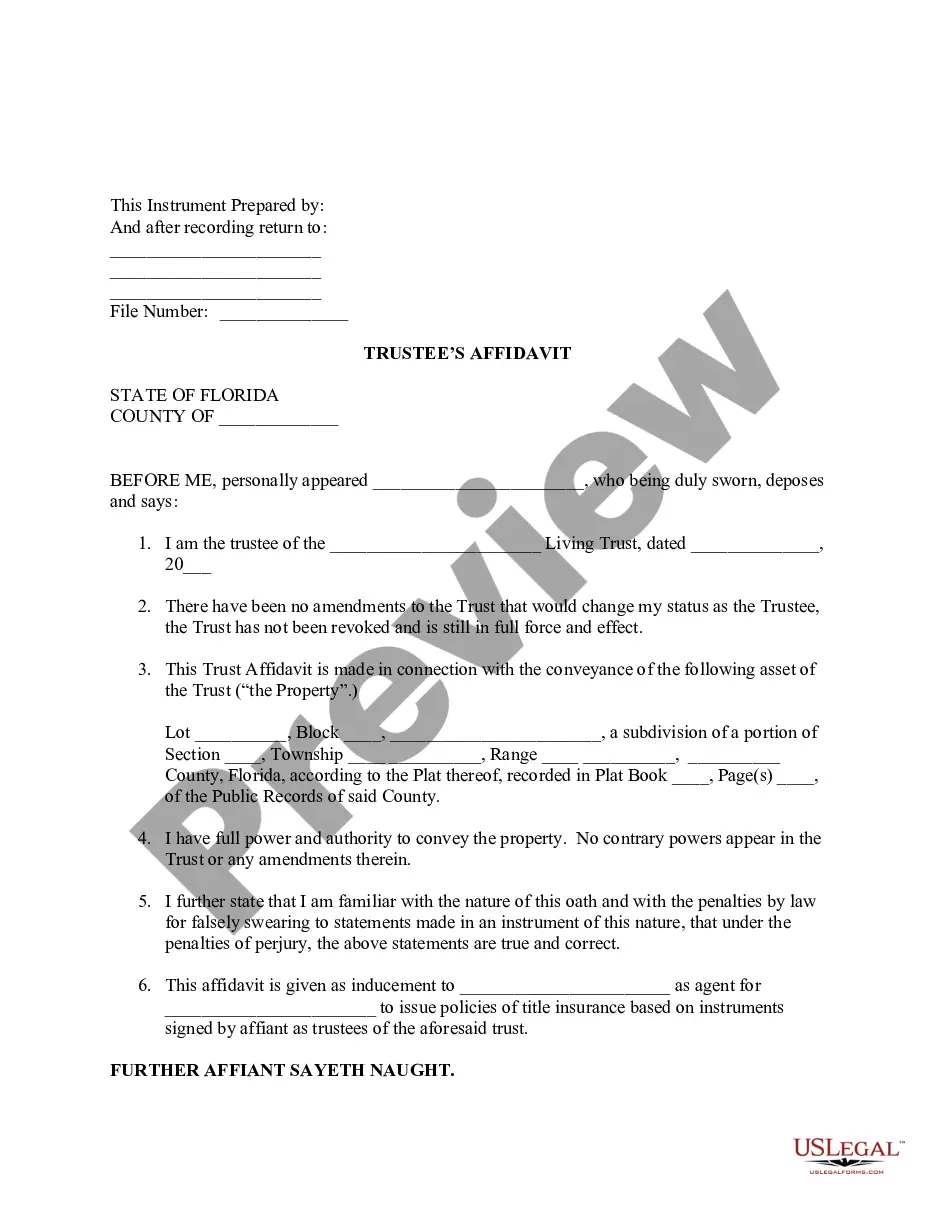

Florida Trustee Affidavit

Description Affidavit Of Successor Trustee

How to fill out Florida Trustee Affidavit?

Use US Legal Forms to get a printable Florida Trustee Affidavit. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most complete Forms catalogue online and provides cost-effective and accurate samples for customers and lawyers, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

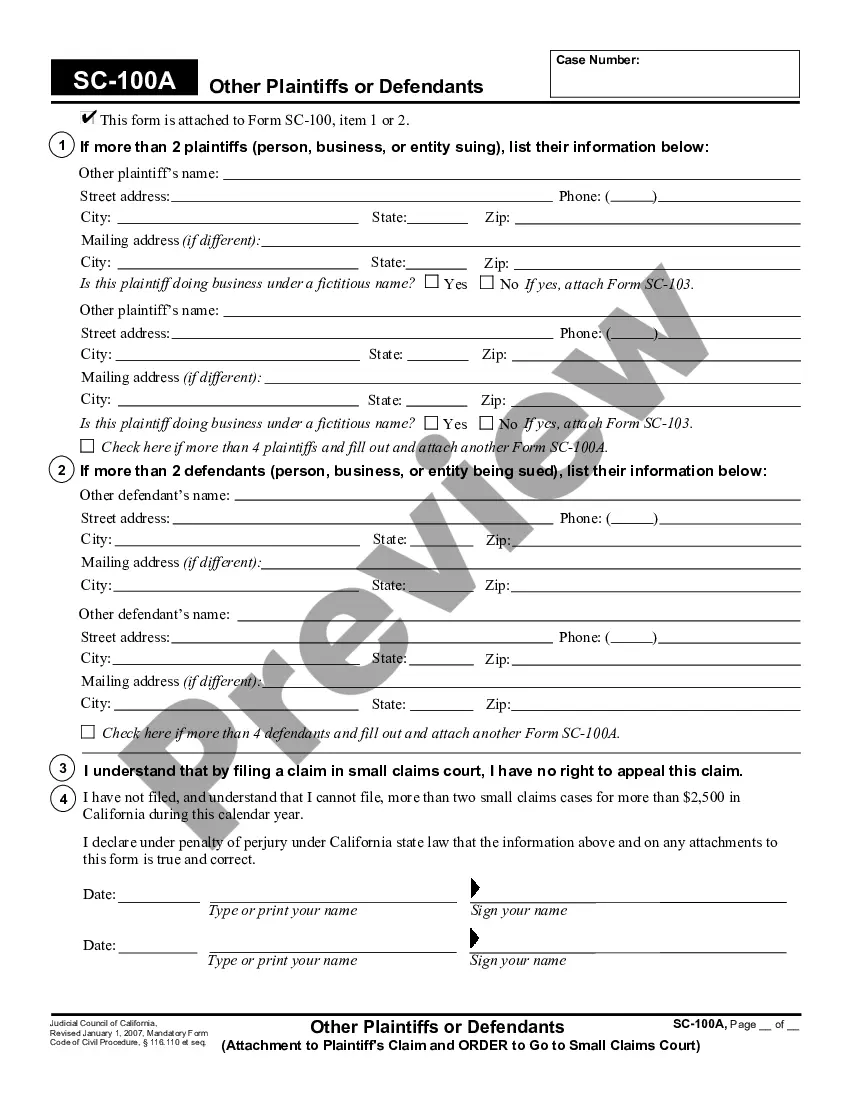

For people who do not have a subscription, follow the following guidelines to quickly find and download Florida Trustee Affidavit:

- Check out to make sure you get the right form with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Florida Trustee Affidavit. Above three million users have used our service successfully. Choose your subscription plan and obtain high-quality forms in just a few clicks.

Successor Trustee Affidavit Form popularity

FAQ

The Role of Trustee. A trust is a written legal document reflecting an agreement by a trustee to hold and manage property (the trust estate) for the benefit of another (the beneficiary) according to terms established by the creator (or grantor) of the trust.

The trustee must keep the qualified beneficiaries of the trust reasonably informed of the status of the trust and the trust administration. The first rule the statutes state is that within 60 days after acceptance of the trust, the trustee shall give notice to the qualified beneficiaries of the acceptance of the trust.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

2 attorney answers Just the grantors. They are usually also the trustees. If they are not the trustees still no need to sign. However, that is why you want successor trustees listed in case trustee does not or cannot serve.

On average, trustee fees can range from 1% to 3% of the trust assets. For example, a 3% fee can be considered a reasonable fee for large and complex assets that can take years to administer.

The trustee is responsible for managing the trust's assets according to the best interest of the beneficiaries and distributing assets to the beneficiaries according to the trust agreement.A trustee has the legal authority to modify the trust account to add another beneficiary or a successor trustee.

Affidavit-death forms are used to change the title on rea200bl property after the death of a joint tenant, trustee or trustor. Information and forms are available from the Sacramento County Public Law Library. Blank forms may also be available at office supply stores.

It depends on the terms of the trust. If the trust designates that the trustees are to act together, and not independently, then yes, a signature by both trustees are required in order to transfer property out of the trust.