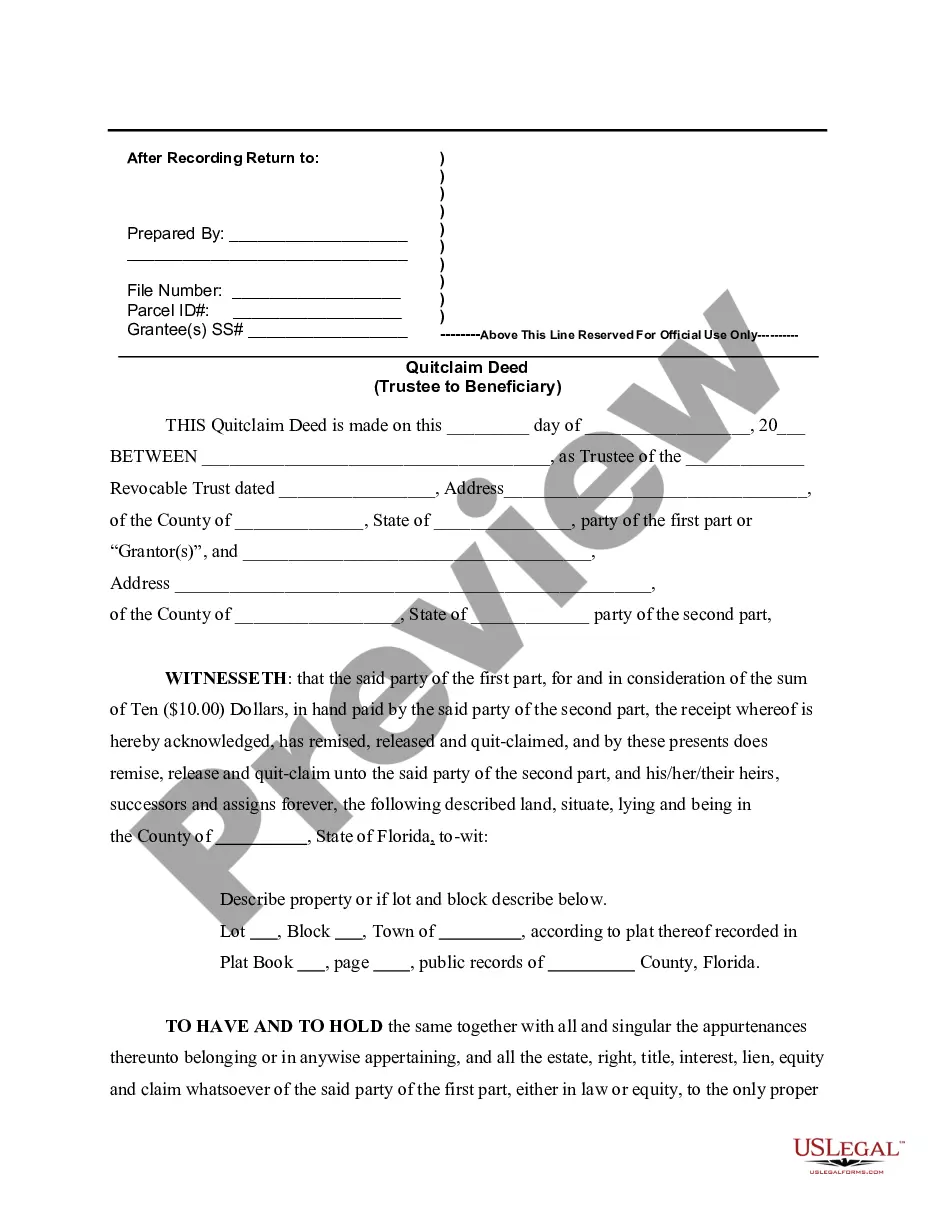

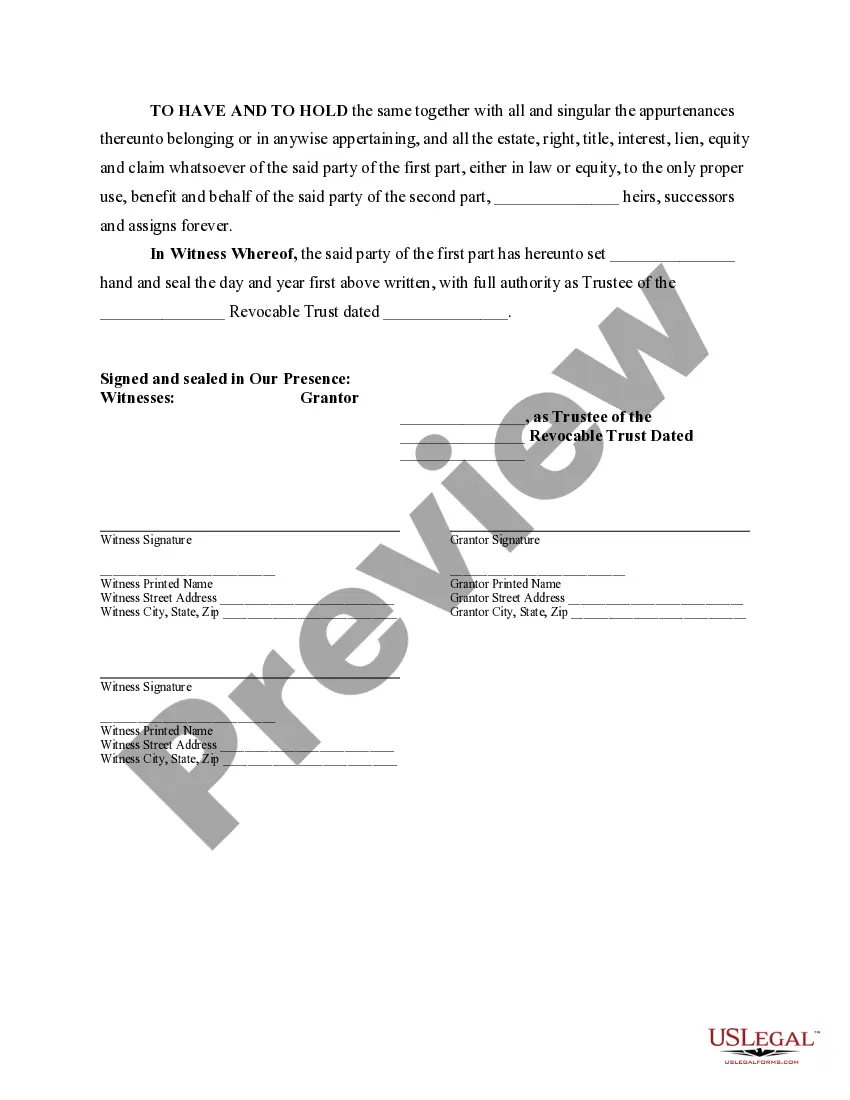

Florida Quitclaim Deed for Trustee to Beneficiary

Description Can The Beneficiary Also Be The Trustee

How to fill out Trustee's Deed Florida?

Get access to the most extensive library of legal forms. US Legal Forms is actually a platform to find any state-specific form in a few clicks, including Florida Quitclaim Deed for Trustee to Beneficiary examples. No need to spend hrs of your time searching for a court-admissible sample. Our accredited pros make sure that you get up to date documents all the time.

To leverage the documents library, pick a subscription, and create your account. If you did it, just log in and click Download. The Florida Quitclaim Deed for Trustee to Beneficiary file will instantly get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at quick recommendations below:

- If you're going to use a state-specific example, ensure you indicate the appropriate state.

- If it’s possible, look at the description to know all the nuances of the form.

- Utilize the Preview option if it’s available to look for the document's information.

- If everything’s proper, click Buy Now.

- Right after choosing a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Save the sample to your device by clicking on Download button.

That's all! You ought to submit the Florida Quitclaim Deed for Trustee to Beneficiary template and double-check it. To make sure that everything is precise, speak to your local legal counsel for assist. Register and easily browse over 85,000 useful samples.

Fl Quitclaim Form Printable Form popularity

Deed Beneficiary Other Form Names

Trustee Deed Florida FAQ

Two documents are needed to transfer California real property from a trust to beneficiaries of the trust; a deed and an 'affidavit of death of trustee. ' An 'affidavit death of trustee' is a declaration, under oath, by the successor trustee.

A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Two documents are needed to transfer California real property from a trust to beneficiaries of the trust; a deed and an 'affidavit of death of trustee. ' An 'affidavit death of trustee' is a declaration, under oath, by the successor trustee.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...