Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description Assumption Agreement Mortgage

How to fill out Agreement Mortgage Form?

Get access to the most comprehensive catalogue of legal forms. US Legal Forms is actually a system where you can find any state-specific form in a few clicks, such as Florida Assumption Agreement of Mortgage and Release of Original Mortgagors templates. No need to spend hrs of your time seeking a court-admissible sample. Our accredited experts make sure that you get up to date examples every time.

To leverage the forms library, select a subscription, and create an account. If you already created it, just log in and click on Download button. The Florida Assumption Agreement of Mortgage and Release of Original Mortgagors template will automatically get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new account, follow the short recommendations listed below:

- If you're proceeding to utilize a state-specific example, be sure to indicate the correct state.

- If it’s possible, look at the description to understand all of the ins and outs of the form.

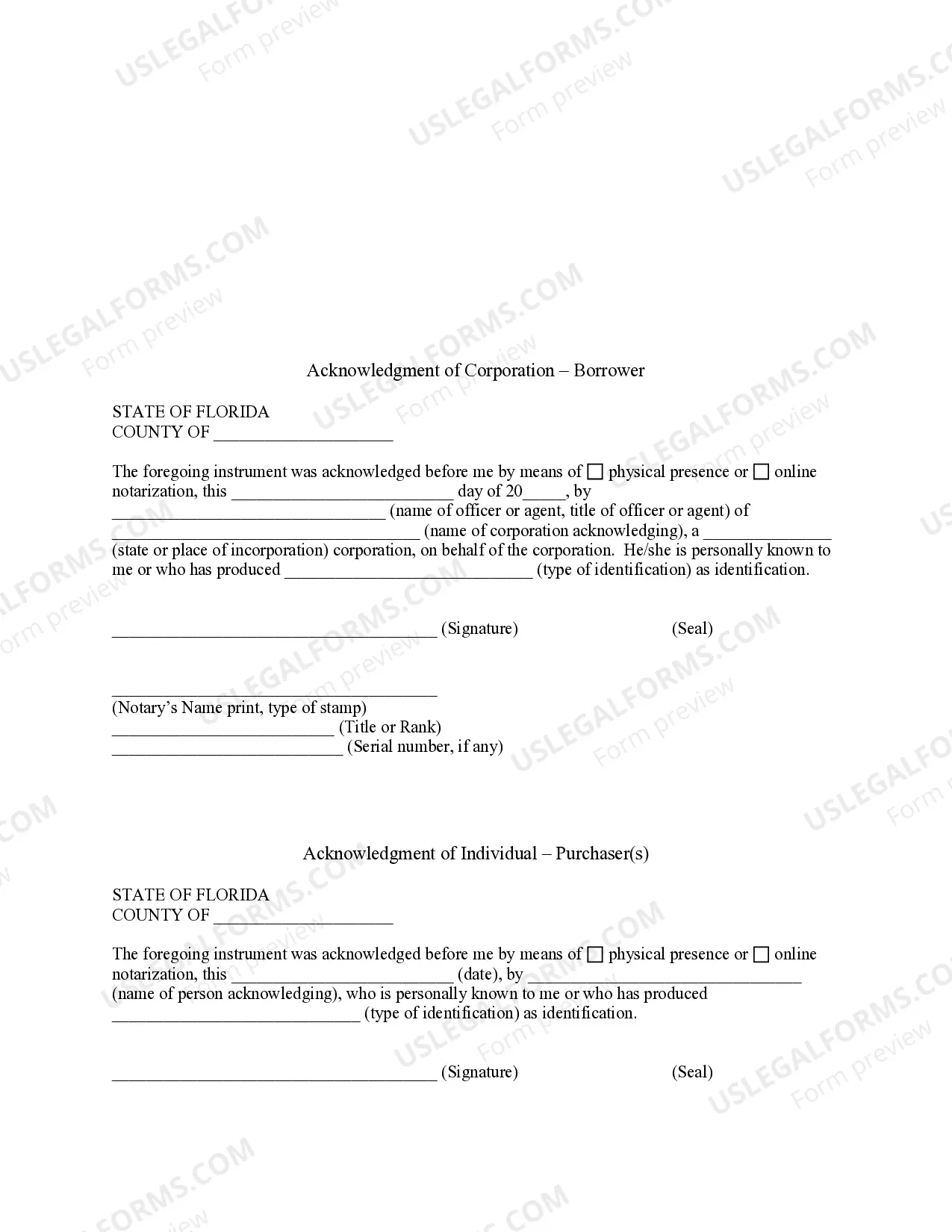

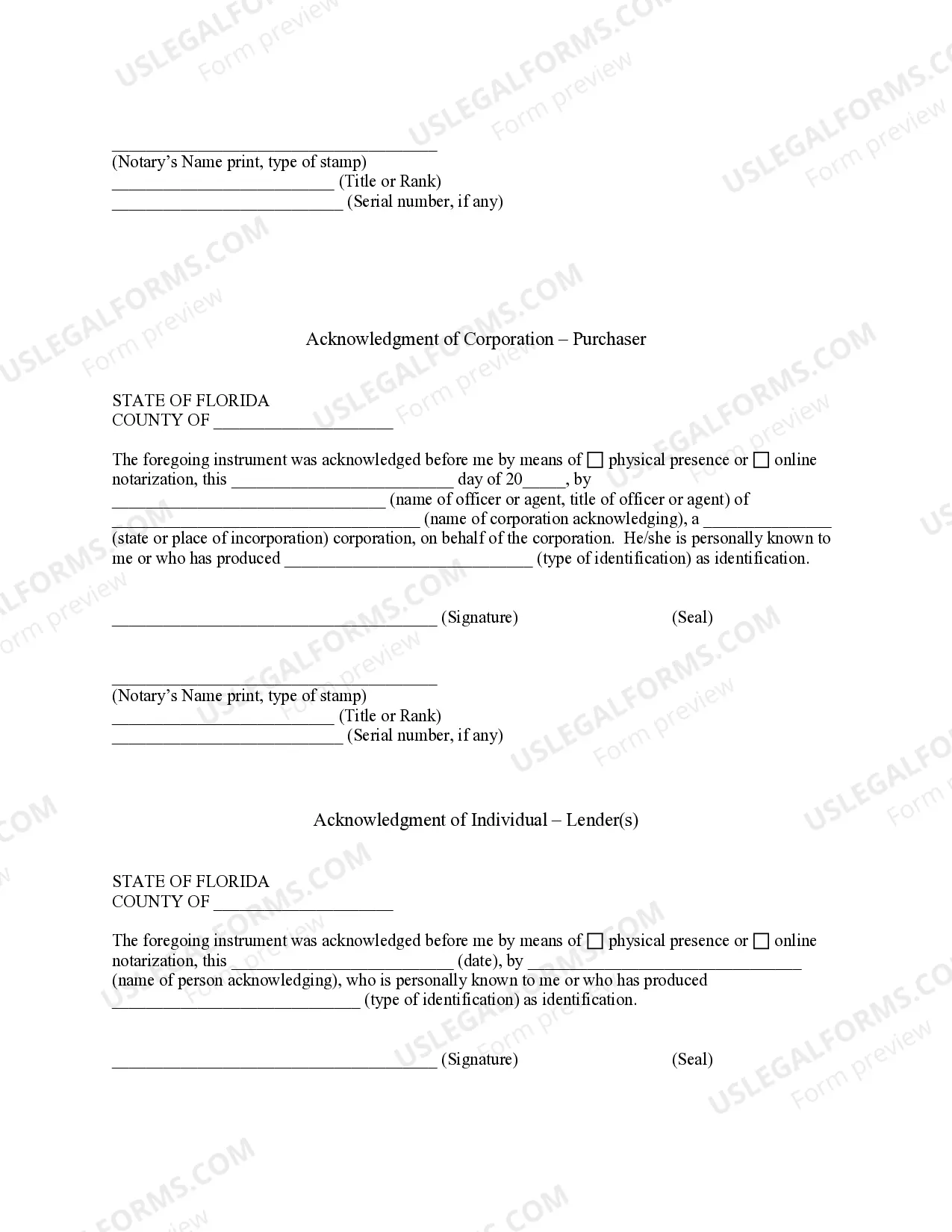

- Make use of the Preview option if it’s offered to check the document's information.

- If everything’s appropriate, click on Buy Now button.

- After selecting a pricing plan, make your account.

- Pay out by card or PayPal.

- Save the document to your computer by clicking Download.

That's all! You need to complete the Florida Assumption Agreement of Mortgage and Release of Original Mortgagors form and check out it. To make sure that things are precise, call your local legal counsel for assist. Join and simply find more than 85,000 helpful samples.

Mortgage Form Form popularity

Assumption Mortgage Mortgagors Form Order Other Form Names

Florida Mortgage Release Form FAQ

Cost. This is determined by the loan program and (in some cases) where the property's located. The average assumption fees range from $562 to $1,062. Additional 3rd party fees may apply.

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

How to qualify for mortgage assumption. Unless you're assuming a loan from a relative, you generally must qualify for mortgage assumption once the home seller confirms they have an assumable loan. Generally speaking, the buyer must meet the same credit and income requirements applicable to a brand-new loan.

No, all mortgages are not assumable. Conventional mortgages (those originated by lenders and then sold in the secondary mortgage investment marketplace) may be more difficult to assume, whereas FHA, VA and USDA mortgages are assumable.In the case of FHA, USDA and VA loans, the loan can either be fixed or adjustable.

It is a legal contract that effectuates an agreement between two parties, whereby one party agrees to assume the responsibilities, interests, rights, and obligations of another party in respect to a separate agreement made between the latter and a third party.

How to qualify for mortgage assumption. Unless you're assuming a loan from a relative, you generally must qualify for mortgage assumption once the home seller confirms they have an assumable loan. Generally speaking, the buyer must meet the same credit and income requirements applicable to a brand-new loan.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.