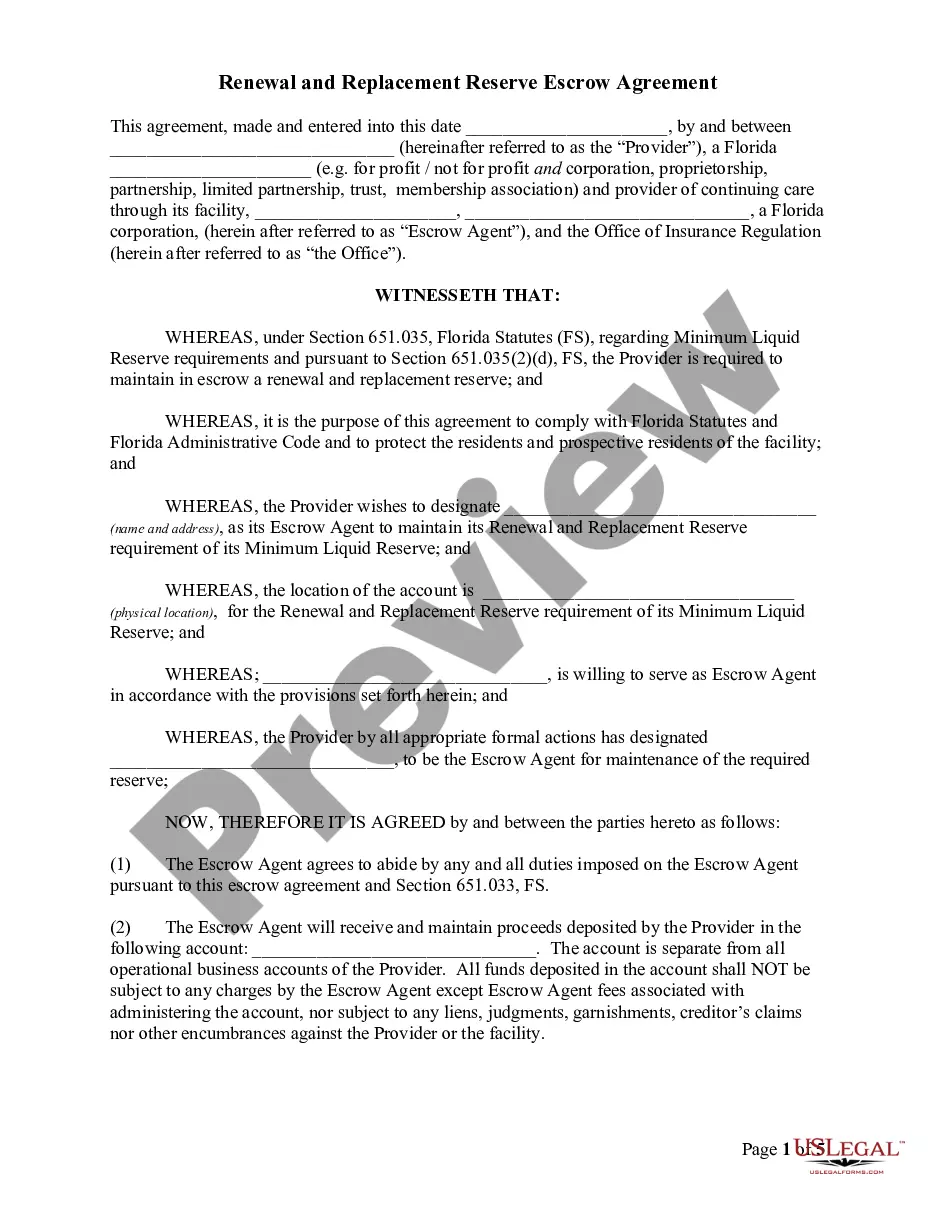

Florida Renewal and Replacement Reserve Escrow Agreement is a financial contract between a lender and a borrower that provides funds for the replacement and/or renewal of property components. The escrow agreement ensures that money is available to cover expenses related to the repair or replacement of property components, such as equipment, furniture, and other furnishings. Funds are typically held in the form of a reserve deposit or escrow account. The lender typically holds the escrow funds until the borrower has met the requirements for the escrow agreement, such as paying off the loan or making the necessary repairs. The two main types of Florida Renewal and Replacement Reserve Escrow Agreements are the Non-Recourse Escrow Agreement and the Recourse Escrow Agreement. The Non-Recourse Escrow Agreement does not permit the lender to seek repayment from the borrower if the reserve funds are not used for their intended purpose. The Recourse Escrow Agreement, on the other hand, allows the lender to pursue the borrower if the reserve funds are not used for repairs or replacement of property components.

Florida Renewal and Replacement Reserve Escrow Agreement

Description

How to fill out Florida Renewal And Replacement Reserve Escrow Agreement?

US Legal Forms is the most straightforward and profitable way to locate suitable legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your Florida Renewal and Replacement Reserve Escrow Agreement.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Florida Renewal and Replacement Reserve Escrow Agreement if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one corresponding to your demands, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Florida Renewal and Replacement Reserve Escrow Agreement and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your reliable assistant in obtaining the corresponding official documentation. Try it out!