Affidavit of No Florida Estate Tax Due

Description

Key Concepts & Definitions

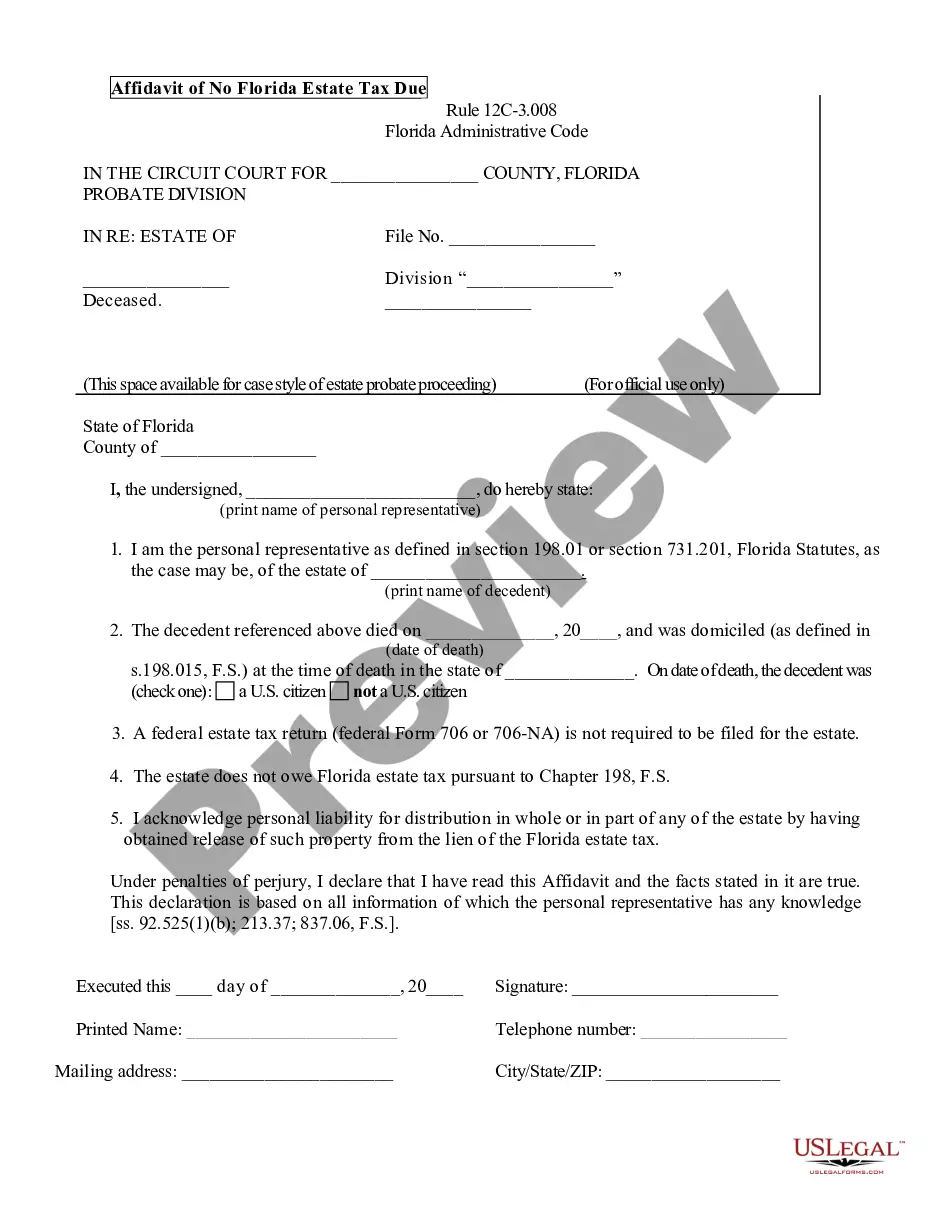

Affidavit of No Florida Estate Tax Due: This is a legal document used in the state of Florida to declare that an estate is not liable for any Florida estate taxes. This affidavit is typically required to formally close an estate in probate and to distribute the assets to heirs without any tax implications.

Step-by-Step Guide

- Verify Eligibility: Confirm that the estate is exempt from Florida estate taxes based on the current tax laws and exemptions.

- Obtain the Form: Acquire the correct affidavit form from the Florida Department of Revenue or a legal professional.

- Complete the Form: Fill in the form accurately, providing all necessary details about the decedent and the estate.

- Legal Review: Have the document reviewed by a legal expert to ensure compliance with state laws.

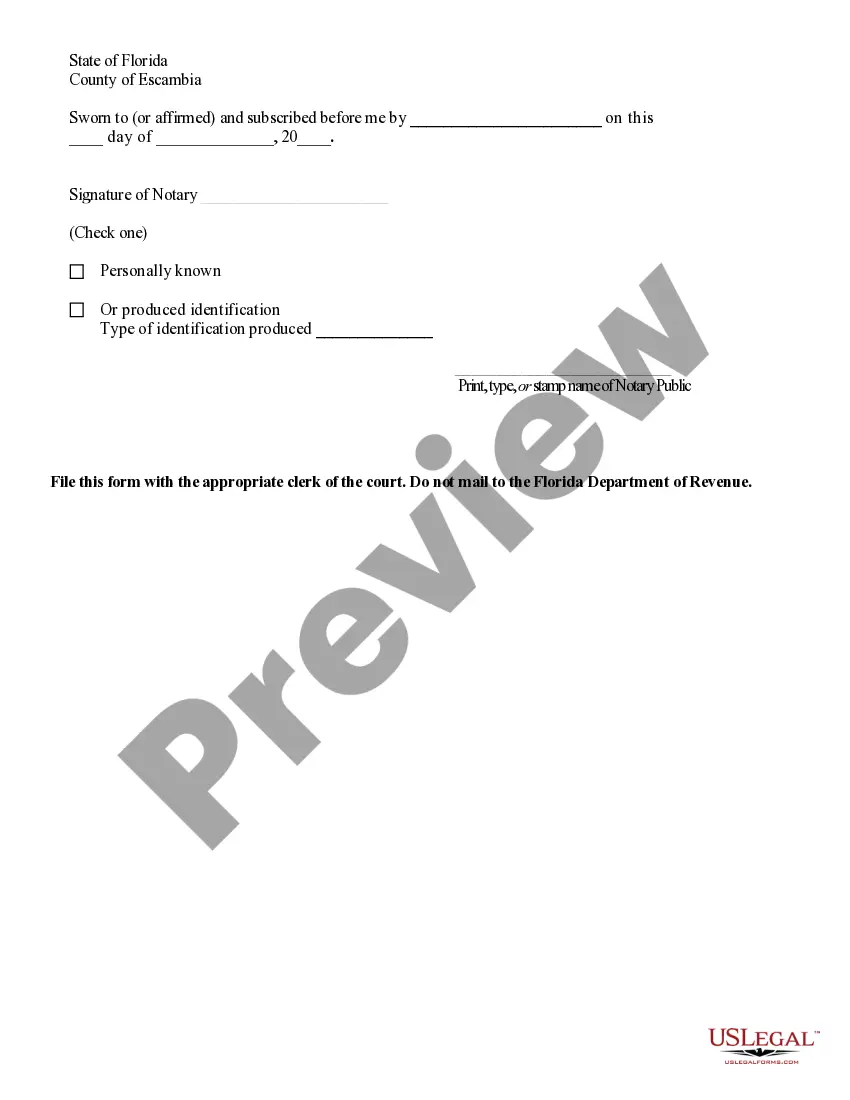

- Submit the Affidavit: File the affidavit with the appropriate probate court and notify any relevant financial institutions.

- Keep Records: Retain copies of the affidavit and any correspondence for your records.

Risk Analysis

- Penalty for Incorrect Information: Providing false information on an Affidavit of No Florida Estate Tax Due can result in legal penalties, including fines or other sanctions.

- Legal Delays: Incorrect or incomplete forms may cause delays in the probate process, affecting the timely distribution of estate assets.

- Financial Implications: Errors in the affidavit could potentially expose the estate to unanticipated tax liabilities.

Best Practices

- Consult a Professional: Always consult with a probate attorney or tax advisor familiar with Florida estate laws before submitting the affidavit.

- Accurate Record-Keeping: Maintain accurate financial records and documentation related to the estate's assets and liabilities.

- Timely Filing: File the affidavit and other probate documents as early as possible to prevent any delays.

Common Mistakes & How to Avoid Them

- Inaccurate Information: Double-check all entries on the affidavit form for accuracy to avoid legal complications.

- Lack of Legal Guidance: Engage a legal professional to avoid common legal pitfalls during the probate process.

- Procrastination: Addressing estate matters promptly prevents last-minute issues and ensures compliance with Florida legal deadlines.

How to fill out Affidavit Of No Florida Estate Tax Due?

Access one of the most expansive library of authorized forms. US Legal Forms is actually a platform to find any state-specific form in couple of clicks, even Affidavit of No Florida Estate Tax Due samples. No need to waste several hours of the time seeking a court-admissible sample. Our certified professionals make sure that you receive up-to-date examples every time.

To take advantage of the forms library, pick a subscription, and create your account. If you created it, just log in and click on Download button. The Affidavit of No Florida Estate Tax Due template will immediately get stored in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new profile, look at simple instructions listed below:

- If you're going to utilize a state-specific documents, be sure to indicate the appropriate state.

- If it’s possible, look at the description to learn all of the ins and outs of the form.

- Utilize the Preview function if it’s offered to take a look at the document's content.

- If everything’s right, click Buy Now.

- After selecting a pricing plan, create an account.

- Pay out by credit card or PayPal.

- Save the document to your computer by clicking Download.

That's all! You ought to fill out the Affidavit of No Florida Estate Tax Due form and check out it. To ensure that all things are exact, contact your local legal counsel for assist. Register and easily find around 85,000 useful samples.

Form popularity

FAQ

The estate tax closing letter serves as an official confirmation that an estate has fulfilled all tax obligations. This document reassures heirs and beneficiaries that the estate is clear of tax liabilities, making the transition of assets smoother. By securing both the estate tax closing letter and an Affidavit of No Florida Estate Tax Due, you provide necessary protections for the estate's distribution.

The Affidavit of No Florida Estate Tax Due is a legal document affirming that an estate does not owe any taxes to the state. This affidavit is essential for properly administering the estate, providing a clear record for heirs and beneficiaries. Documenting this can help expedite distributions and finalize the estate efficiently.

Correct, Florida currently does not impose a state estate tax. However, it is important to confirm that you meet all legal requirements for an Affidavit of No Florida Estate Tax Due, especially if estate value exceeds federal limits. Always consult professionals to ensure that you follow the right processes.

An Affidavit of No Florida Estate Tax Due demonstrates that no estate tax liability exists for the estate in question. This document is crucial in establishing that the estate does not owe any taxes to Florida, simplifying the process for executors and heirs. Understanding this affidavit can help you navigate the estate settlement process smoothly.

Yes, obtaining an estate tax closing letter may be necessary for certain estate transactions. This letter confirms that no estate tax is due to the state of Florida, which can be particularly relevant for beneficiaries and heirs. Without it, you might face delays in settling the estate, as the Affidavit of No Florida Estate Tax Due serves as proof when required.

The threshold for a small estate affidavit in Florida is $75,000, excluding homestead property. If the estate falls below this value, heirs can simplify asset transfer by using a small estate affidavit instead of probate. This efficient approach saves time and resources while ensuring that you can manage the estate smoothly. It’s advisable to confirm that an Affidavit of No Florida Estate Tax Due applies to your situation before proceeding.

In Florida, small estates generally do not require probate, provided they meet certain criteria. If the total value of the estate is below the threshold set by law, you can use a small estate affidavit instead of going through the probate process. This simplifies estate management, allowing heirs to access assets more quickly and without the complications of formal probate. Utilizing an Affidavit of No Florida Estate Tax Due can further streamline this process for affordable financial resolution.

To file a small estate affidavit in Florida, you need to complete a specific form that verifies the decedent's property. This affidavit helps you prove that an Affidavit of No Florida Estate Tax Due is applicable, which simplifies the transfer of assets. After filling it out, you submit the affidavit to the county court in the county where the decedent resided. Ensure you have the necessary documentation, such as proof of death and details of the estate.

A small estate affidavit in Florida requires that the estate's total value does not exceed a specified limit set by the state. Typically, the affidavit must declare the assets and liabilities while confirming that there are no taxes owed, such as shown in an Affidavit of No Florida Estate Tax Due. Using resources like US Legal Forms can help you ensure your affidavit meets all necessary requirements.

In Florida, requirements for an affidavit generally include identifying the deceased, detailing assets, and declaring debts. You may need to submit an Affidavit of No Florida Estate Tax Due to provide clarity regarding the estate's tax status. US Legal Forms can simplify this process by supplying well-structured templates to follow.