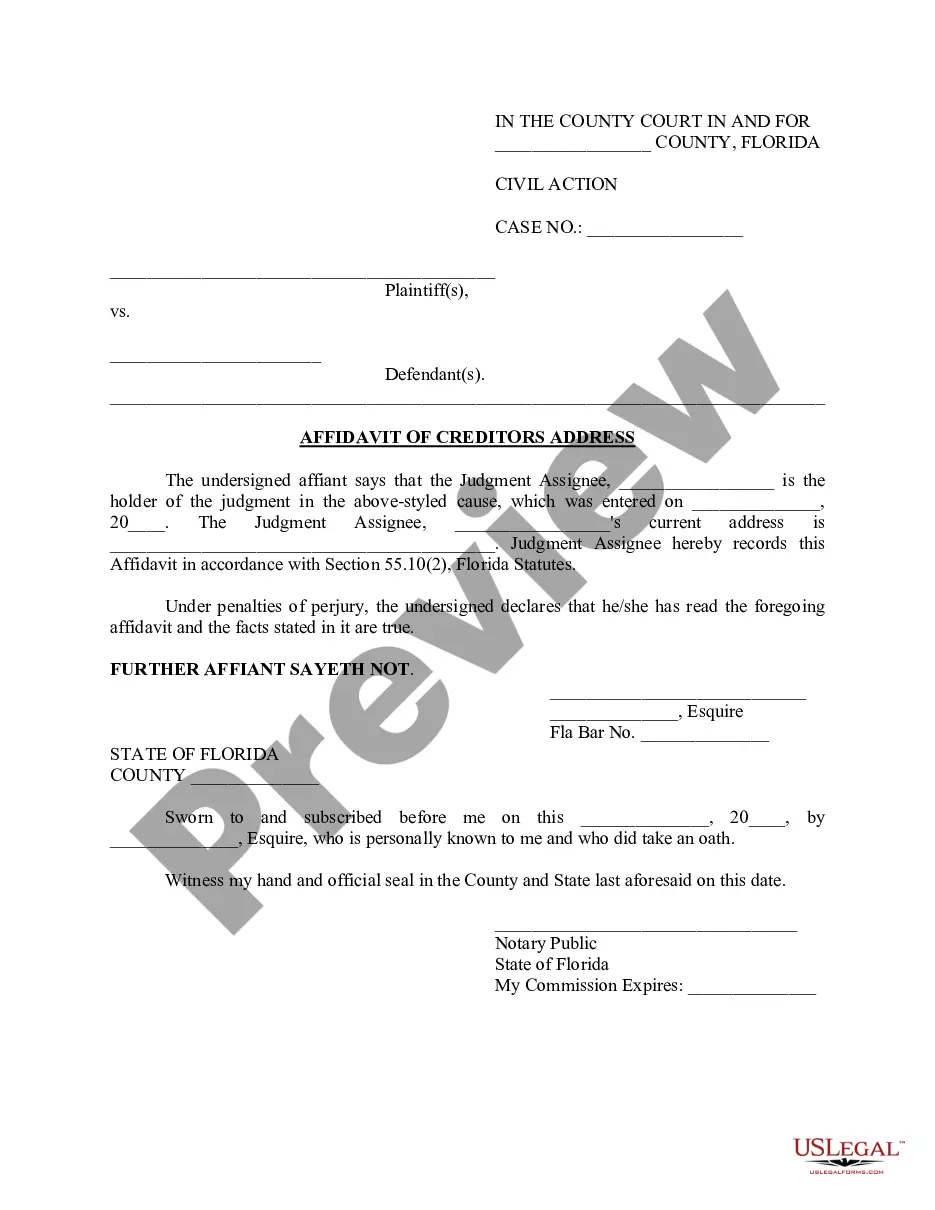

Florida Affidavit of Creditors Address

Description Affidavit For Address

How to fill out Florida Affidavit Of Creditors Address?

Get one of the most comprehensive library of legal forms. US Legal Forms is actually a solution where you can find any state-specific document in couple of clicks, even Florida Affidavit of Creditors Address examples. No need to spend hrs of the time searching for a court-admissible sample. Our licensed specialists ensure you get up to date documents all the time.

To benefit from the documents library, pick a subscription, and sign up an account. If you already registered it, just log in and click Download. The Florida Affidavit of Creditors Address template will immediately get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, look at simple instructions below:

- If you're proceeding to utilize a state-specific example, make sure you indicate the appropriate state.

- If it’s possible, look at the description to understand all the nuances of the document.

- Make use of the Preview function if it’s accessible to look for the document's content.

- If everything’s right, click on Buy Now button.

- Right after selecting a pricing plan, create your account.

- Pay by card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You ought to complete the Florida Affidavit of Creditors Address template and double-check it. To make sure that everything is correct, contact your local legal counsel for help. Register and easily look through around 85,000 valuable forms.

Form popularity

FAQ

In Florida no judgment, order, or decree of any court shall be a lien upon real or personal property within the state after the expiration of 20 years from the date of the entry of such judgment.18 In order to retain a lien for the maximum period of 20 years, the certified copy of the judgment must be recorded

Can creditors take your house in Florida? No. In Florida, up to 160 acres of contiguous property in a county, and up to a 1/2 acre in a city, is completely protected from civil judgment creditors.

Your home and Florida's homestead exemption If you own the home you live in, your home is protected from all creditors except those holding a mortgage or lien on your residence.However, creditors who lend you money to buy, improve or repair your home may put a lien on your home.

Homestead, with some acreage limitations. The wages of someone who qualifies as head of household. Annuities. Life Insurance. Retirement Accounts. Tenants by entireties property when the judgment is separate.

Take the certified copy of your Final Judgment to the Recording Division of the Clerk's office at 501 E. Kennedy Blvd. in Tampa. Ask the clerk to record the judgment.

In Florida, a judgment lasts for 20 yearsit can be renewed after the 20 year period, although this is rarely done. Judgments which are not recorded as liens, or are recorded as junior liens, are still valid judgments which can be executed against the debtor's property.

Step 1: Investigate Assets. The first step in enforcing a judgment is to investigate the collectible assets of the opposing party against whom you obtained a judgment (the debtor). Step 2: Execute the Judgment. The next step is to execute the judgment upon the debtor's collectible assets.

A homestead is defined as your primary residence; investment property does not fall within the definition.In order for a creditor to force the sale of your primary residence, they must have a judgment against you and your home must have equity. Just how much equity leaves a home vulnerable is a function of state law.

Some of the key assets that are exempt from creditors in Florida include: Head of household wages. Annuities and life insurance proceeds and cash surrender value. Homestead (up to 1/2 acre in a city and 160 acres in the county)