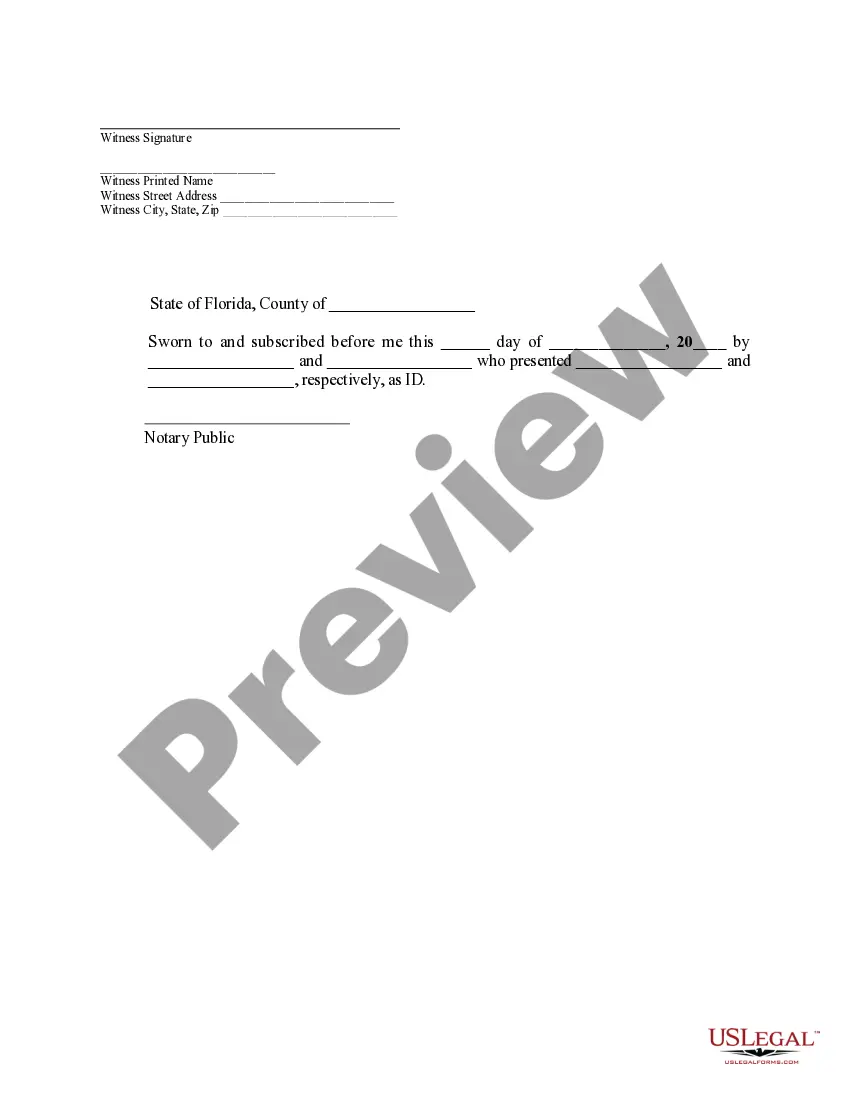

Florida Affidavit (Real Property)

Description Affidavit Form

How to fill out Affidavit Template Florida?

Get access to the most extensive library of legal forms. US Legal Forms is really a solution to find any state-specific form in couple of clicks, such as Florida Affidavit (Real Property) templates. No requirement to waste time of your time searching for a court-admissible example. Our accredited specialists ensure you get updated documents all the time.

To make use of the forms library, pick a subscription, and sign up your account. If you registered it, just log in and click Download. The Florida Affidavit (Real Property) sample will instantly get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new profile, look at quick guidelines below:

- If you're proceeding to use a state-specific documents, make sure you indicate the right state.

- If it’s possible, look at the description to understand all of the nuances of the document.

- Utilize the Preview option if it’s available to look for the document's content.

- If everything’s proper, click on Buy Now button.

- Right after choosing a pricing plan, make your account.

- Pay by card or PayPal.

- Downoad the sample to your computer by clicking on Download button.

That's all! You should fill out the Florida Affidavit (Real Property) template and double-check it. To make sure that things are accurate, call your local legal counsel for assist. Sign up and simply look through more than 85,000 helpful forms.

Gift Affidavit Florida Form popularity

Affadavits Other Form Names

Affidavit Statement FAQ

Summary Administration is generally available only if the value of the estate subject to probate in Florida (less property, which is exempt from the claims of creditors; for example, homestead real property in many circumstances) is not more than $75,000, and if the decedent's debts are paid, or the creditors do not

All estates do not go through probate in Florida.However, without a will or trust all assets must pass through probate court if no beneficiary or joint owner is named.

The simple answer is that you do not have to probate a will in Florida. There is no requirement under Florida law that anyone is required to probate a will.

Unfortunately, Florida does not have a small estate affidavit process, with one exception, which means the family will more than likely need to consult a probate attorney to help gain control of the assets.

If you're a Florida resident and the total value of your estate is less than $11.4 million, you will pay neither state nor federal estate taxes. However, if the current federal tax laws remain in place, the exemption amount will be decreased by 50% in 2026.

What is the DR-312 form for? This form is called the Affidavit of No Florida Estate Tax Due. It serves as an evidence of non-liability for Florida estate tax and will remove the Department's estate tax lien.

Household furnishings at the usual place of abode, valued at no more than $20,000. Two motor vehicles held in the decedent's name and regularly used by the decedent and or members of the immediate family.

In Florida, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).