This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description Installments Promissory Secured

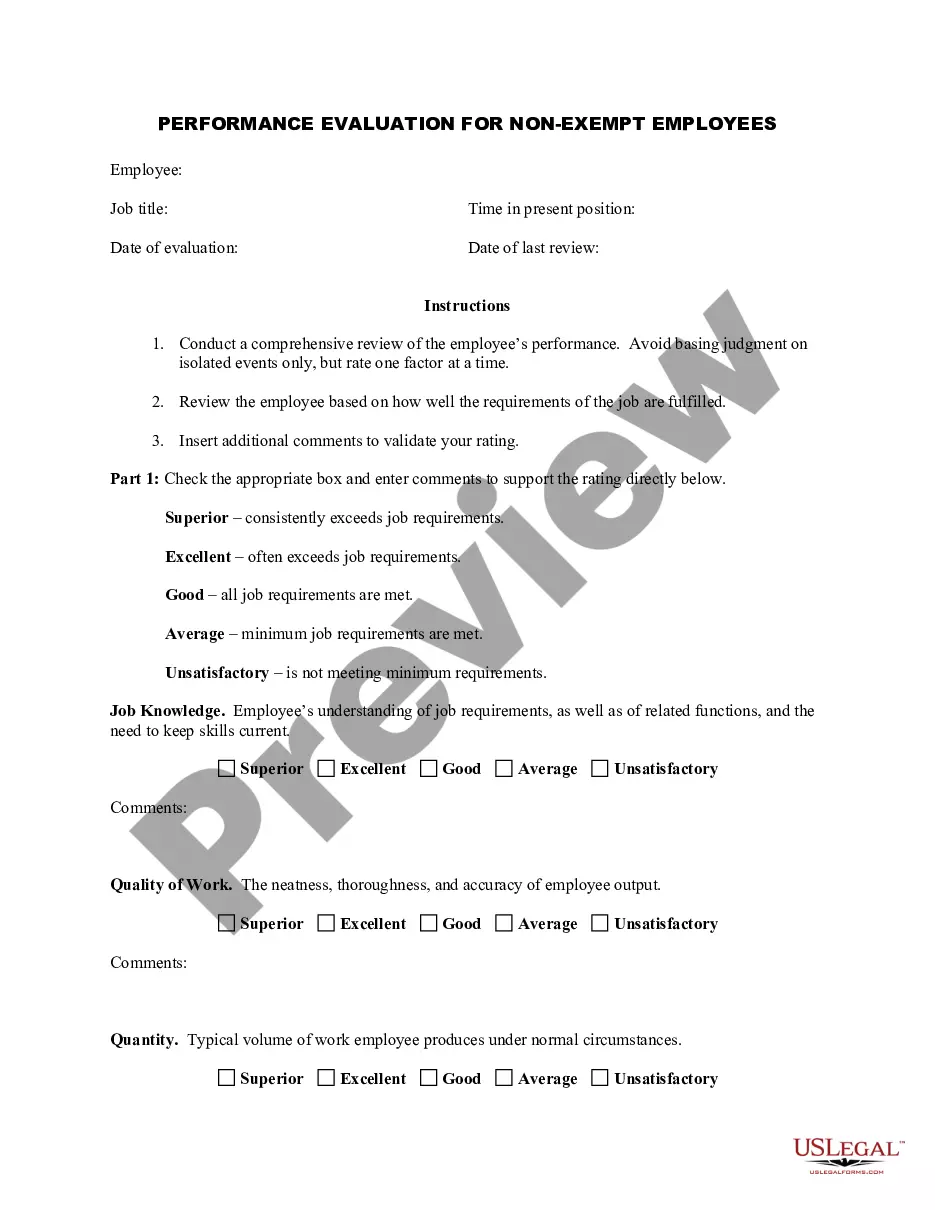

How to fill out Florida Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Get access to one of the most comprehensive library of legal forms. US Legal Forms is actually a platform where you can find any state-specific document in couple of clicks, even Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate samples. No requirement to spend time of your time looking for a court-admissible sample. Our licensed pros ensure you receive up-to-date samples every time.

To take advantage of the documents library, select a subscription, and sign-up your account. If you registered it, just log in and click on Download button. The Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate sample will quickly get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new account, look at simple instructions below:

- If you're going to utilize a state-specific sample, be sure you indicate the correct state.

- If it’s possible, look at the description to know all the nuances of the document.

- Use the Preview function if it’s offered to look for the document's information.

- If everything’s correct, click Buy Now.

- After picking a pricing plan, register your account.

- Pay out by card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You should submit the Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template and double-check it. To make certain that all things are exact, contact your local legal counsel for assist. Register and easily find over 85,000 beneficial samples.

Florida Promissory Note Form popularity

FAQ

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Commercial Promissory note A commercial promissory note is used when borrowing money from a commercial lender such as a bank or loan agency. In the event the borrower is unable to make required payments, the lender may demand full payment of the loan including interest.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A commercial note is the type of promissory note that is signed between a borrower and a financial institution. A real estate note is when a borrower uses an immovable asset as collateral for the credit. Investment note is used by firms and businesses when procuring funds for the enterprise.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.