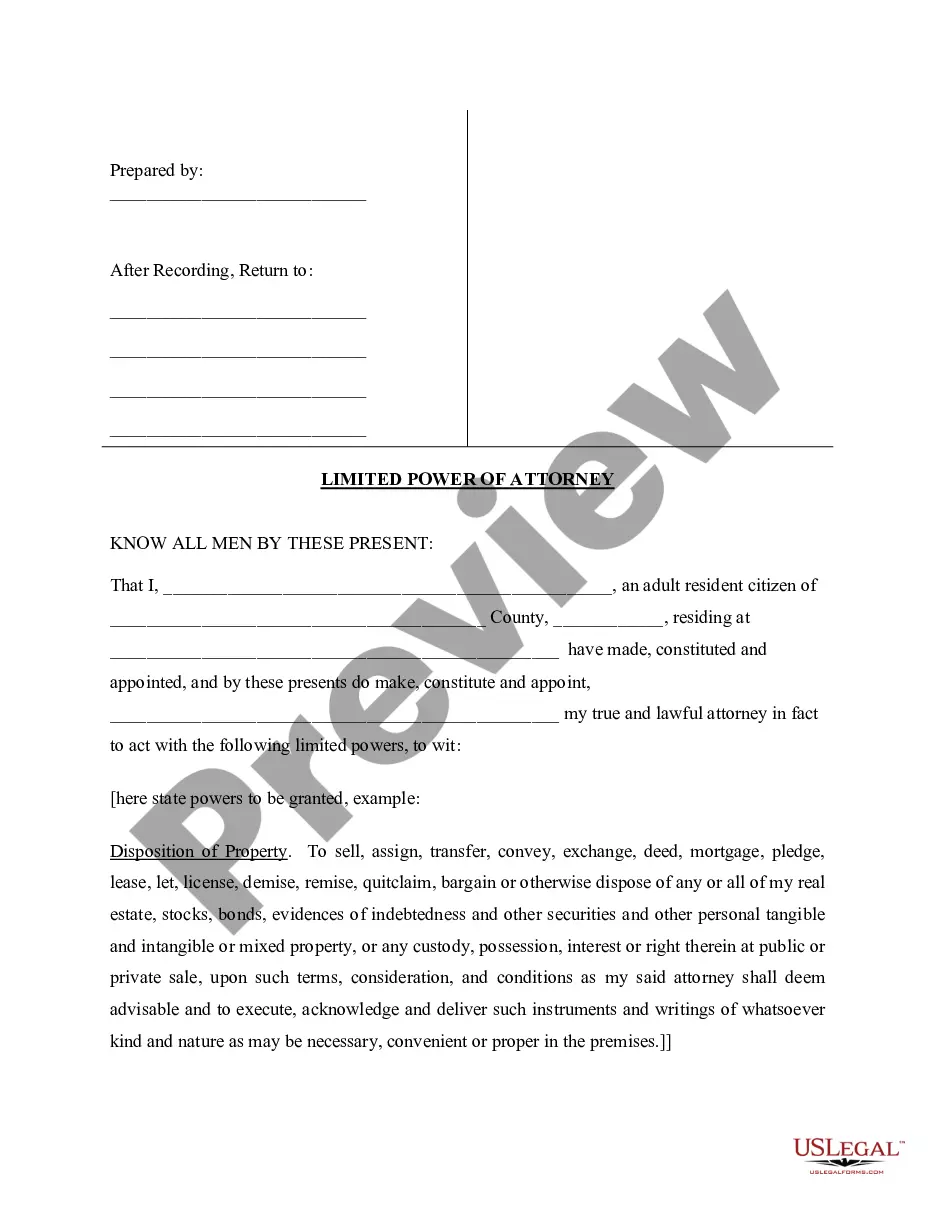

Florida Limited Power of Attorney - Limited Powers

Description Limited Power Of Attorney Form Florida

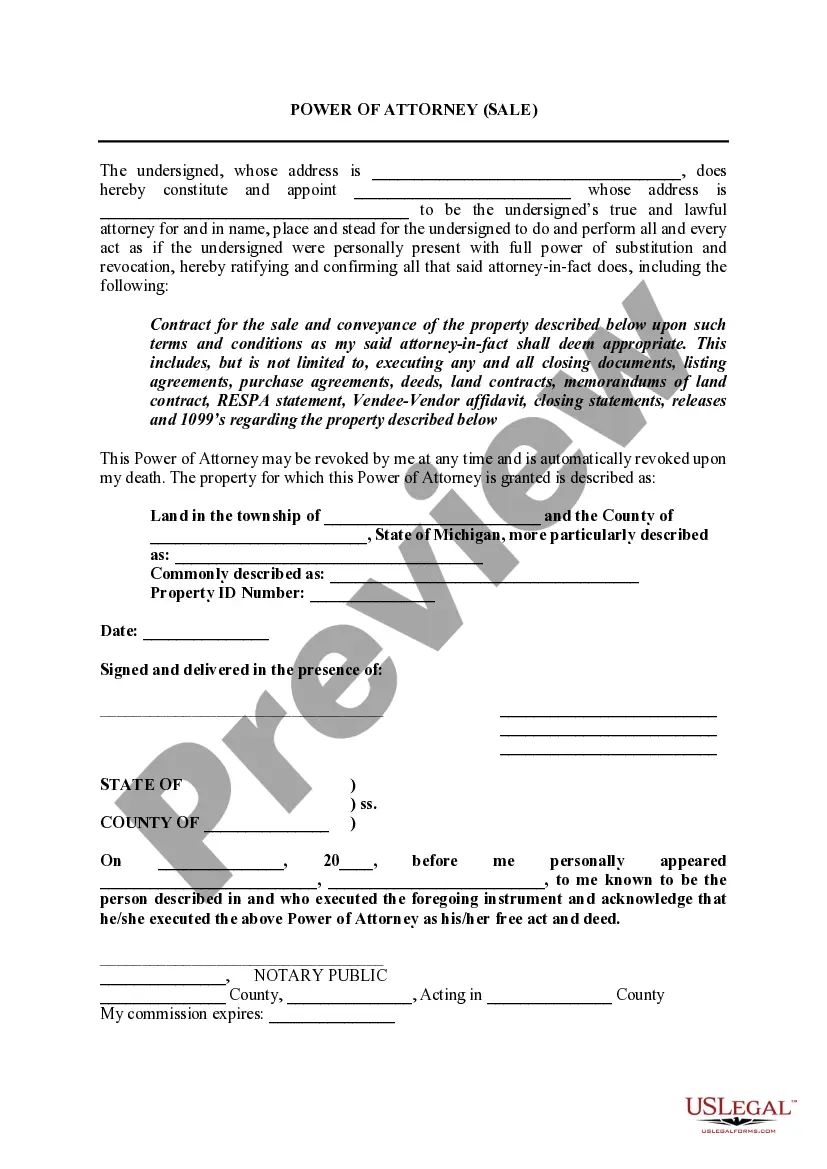

How to fill out Power Of Attorney Template Word?

Get access to the most holistic catalogue of legal forms. US Legal Forms is a solution where you can find any state-specific form in couple of clicks, such as Florida Limited Power of Attorney - Limited Powers templates. No requirement to spend time of the time trying to find a court-admissible form. Our licensed pros make sure that you get up to date documents all the time.

To take advantage of the documents library, pick a subscription, and create your account. If you already created it, just log in and click on Download button. The Florida Limited Power of Attorney - Limited Powers template will immediately get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To create a new account, look at brief recommendations below:

- If you're proceeding to utilize a state-specific sample, be sure to indicate the correct state.

- If it’s possible, go over the description to learn all of the nuances of the document.

- Make use of the Preview option if it’s accessible to take a look at the document's information.

- If everything’s correct, click Buy Now.

- After selecting a pricing plan, create your account.

- Pay by card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You need to complete the Florida Limited Power of Attorney - Limited Powers form and check out it. To be sure that all things are precise, contact your local legal counsel for help. Register and easily look through over 85,000 beneficial templates.

Printable Power Of Attorney Form Florida Form popularity

Any Attorney Here Other Form Names

What Is A Power Of Attorney Letter FAQ

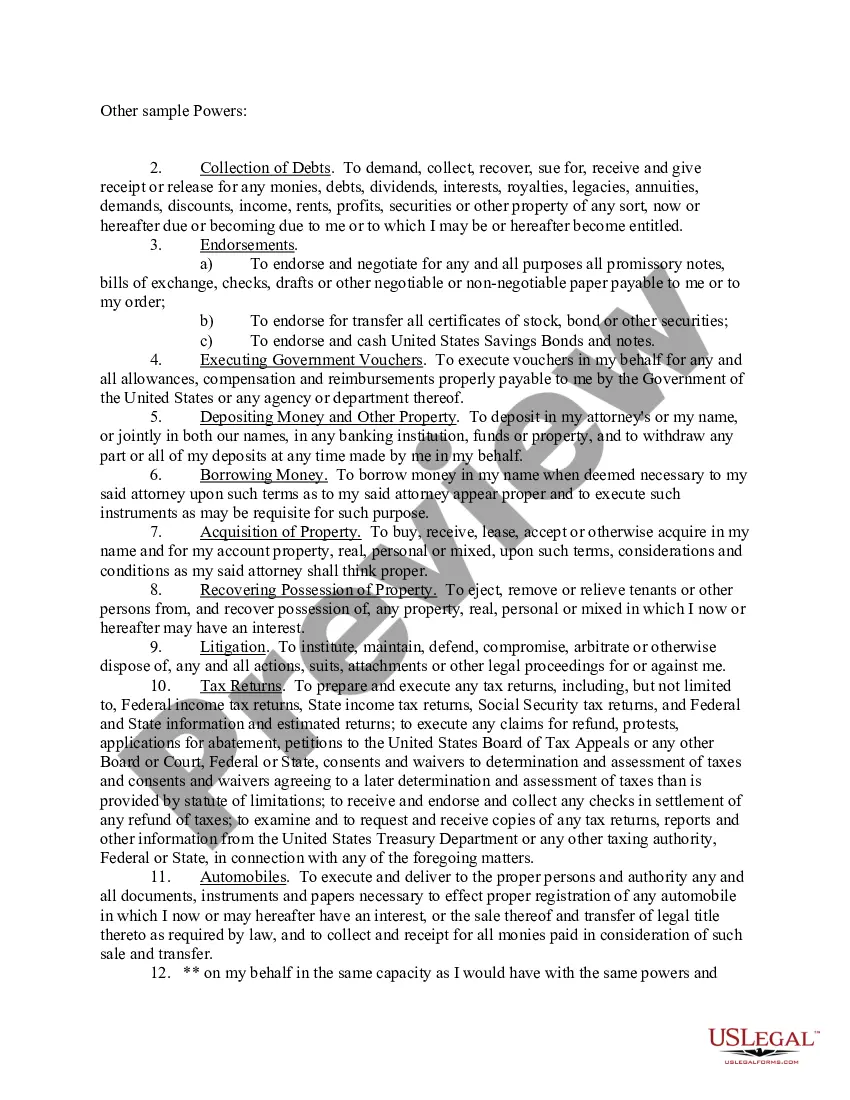

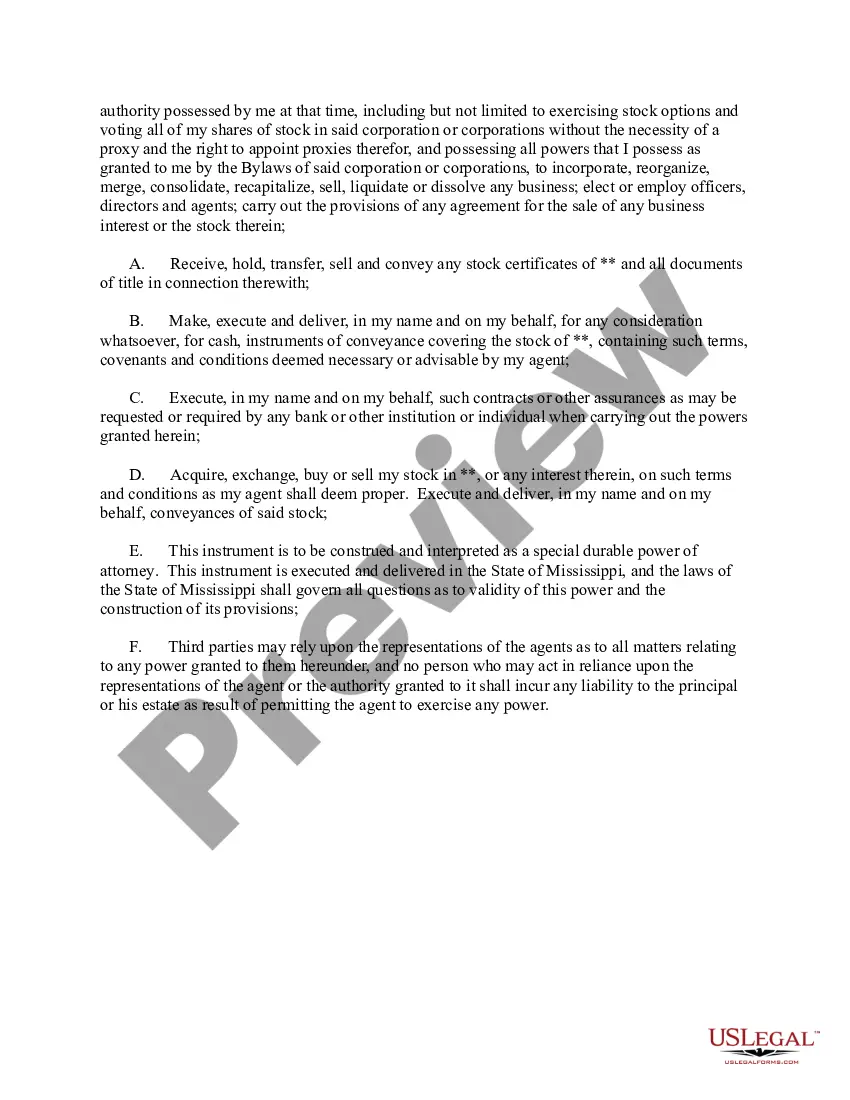

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

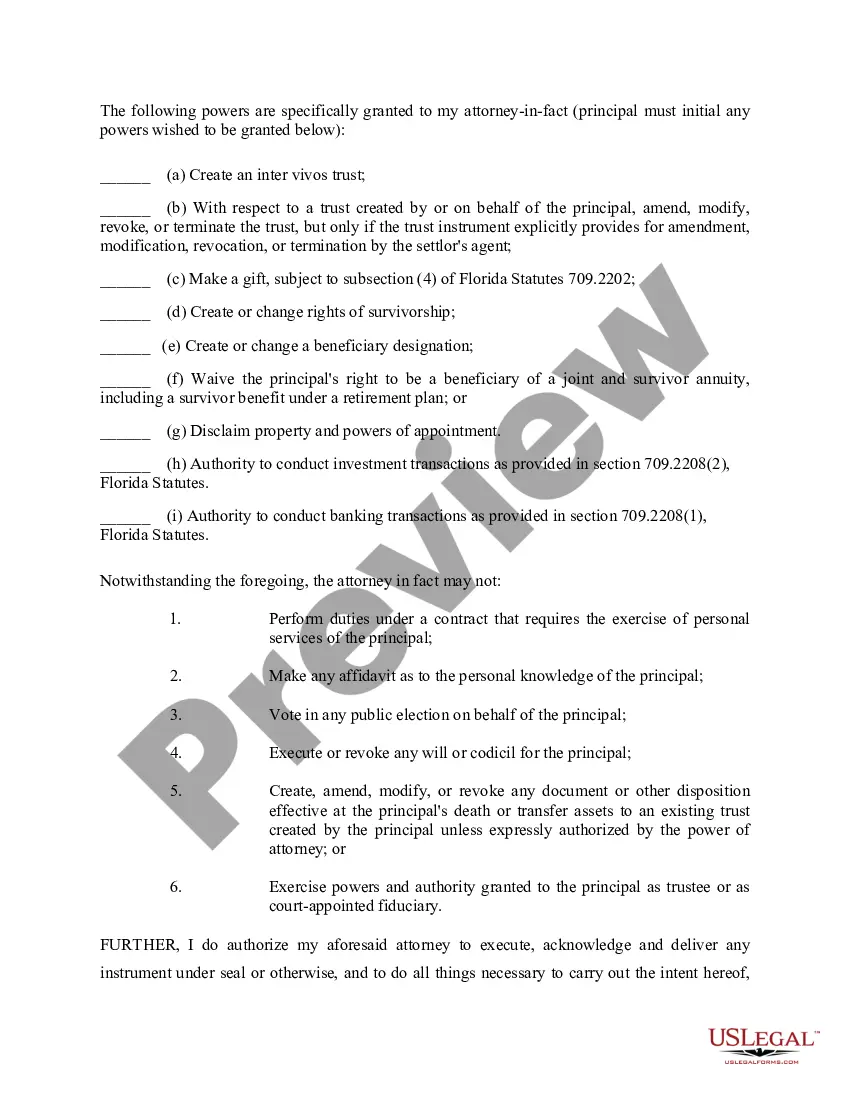

Execution Requirements In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

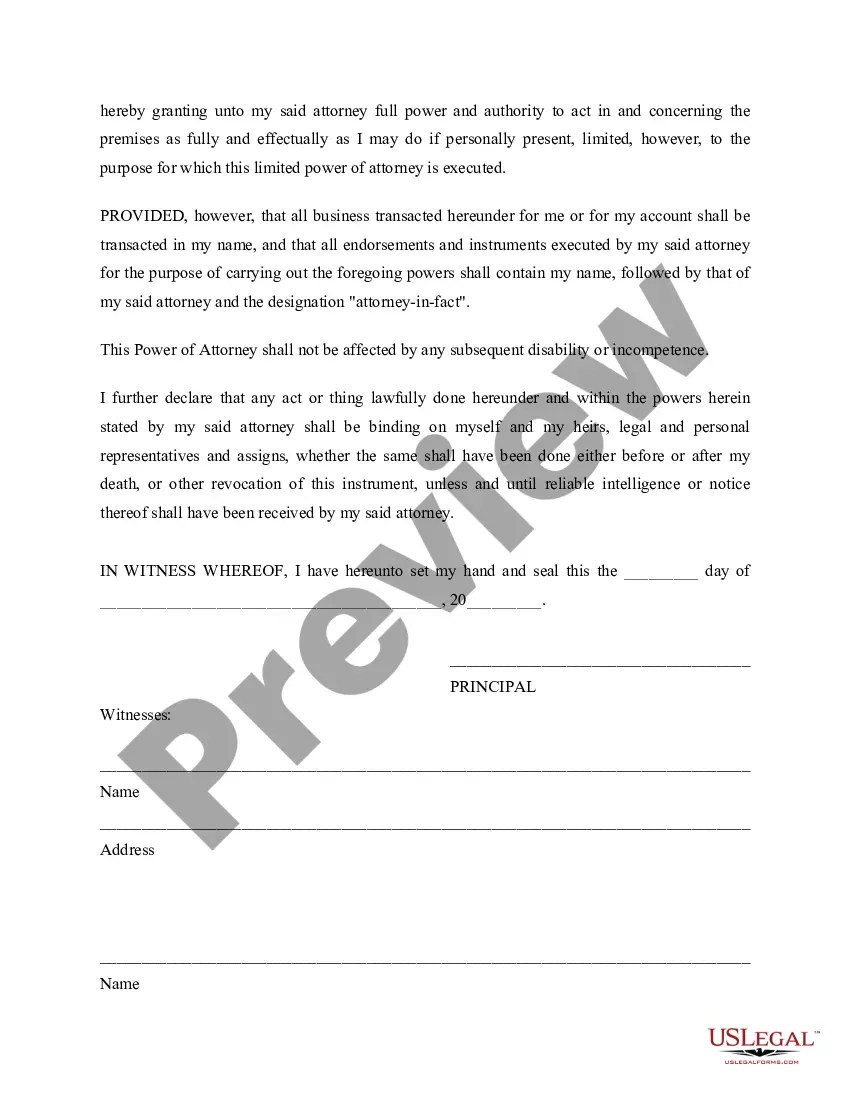

Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission.

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian. The power of attorney ends at death.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.

The biggest limitation on a power of attorney is that it can only be signed when the principal is of sound mind.If the principal is unable to make decisions, the principal's family will need to go to court to become a court appointed guardian before they can make financial or medical decisions.