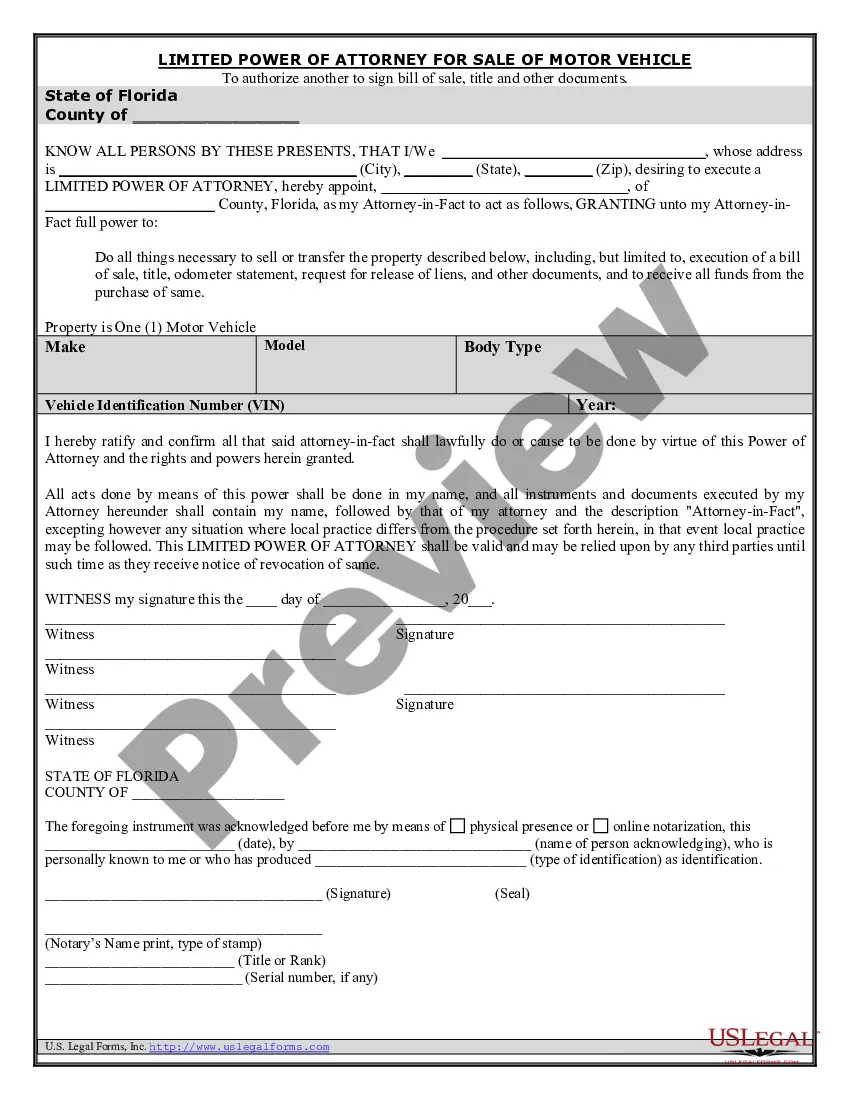

Florida Power of Attorney for Sale of Motor Vehicle

Description

How to fill out Florida Power Of Attorney For Sale Of Motor Vehicle?

Get one of the most extensive library of authorized forms. US Legal Forms is actually a platform to find any state-specific form in couple of clicks, even Florida Power of Attorney for Sale of Motor Vehicle templates. No reason to waste time of the time seeking a court-admissible form. Our licensed professionals ensure you receive updated samples all the time.

To take advantage of the forms library, pick a subscription, and create an account. If you registered it, just log in and click on Download button. The Florida Power of Attorney for Sale of Motor Vehicle file will immediately get stored in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new account, follow the short guidelines listed below:

- If you're proceeding to utilize a state-specific sample, be sure to indicate the right state.

- If it’s possible, go over the description to learn all of the nuances of the document.

- Utilize the Preview option if it’s accessible to look for the document's content.

- If everything’s appropriate, click Buy Now.

- Right after choosing a pricing plan, register an account.

- Pay by credit card or PayPal.

- Save the sample to your computer by clicking on Download button.

That's all! You need to complete the Florida Power of Attorney for Sale of Motor Vehicle template and double-check it. To be sure that all things are accurate, call your local legal counsel for support. Sign up and simply browse around 85,000 helpful samples.

Form popularity

FAQ

The recipient has two ways to transfer the FL car title when gifted. One way to do it is to go to their local FL DMV with you, the gift-giver, wait in line and fill out the paperwork there including a Certificate of Title. There will be title fees and registration fees, because now the car will be under new ownership.

How much does a power of attorney cost in Florida? Though a power of attorney can be drafted online and later notarized for less than $100, it is best to consult a lawyer when completing such an important legal document. That being said, the average legal fees range from $250 to $500.

Yes, California law requires that the Durable Power of Attorney must be notarized or signed by at least two witnesses. In California, a principal cannot act as one of the witnesses.

When you're ready to have the title transferred, make sure the agent signs the title or deed in their capacity as your agent. They should sign either: a) Jane Smith principal's name, by Sally Stevens agent's name under Power of Attorney, or b) Sally Stevens, attorney-in-fact for Jane Smith.

After the principal's name, write by and then sign your own name. Under or after the signature line, indicate your status as POA by including any of the following identifiers: as POA, as Agent, as Attorney in Fact or as Power of Attorney.

A power of attorney must be signed by the principal and by two witnesses to the principal's signature, and a notary must acknowledge the principal's signature for the power of attorney to be properly executed and valid under Florida law.

In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

The purpose of the power of attorney is to enable the dealership to apply for a title in your name.The power of attorney allows them to take care of the title transfer without you having to be present.

Selling a car means that, as the original owner, you don't have to pay any tax.This may make selling a car a better option than giving it to a friend or family member, which could cause the gift tax to come into play. According to the IRS, any gift worth more than $13,000 is liable for gift taxes, as of 2010.