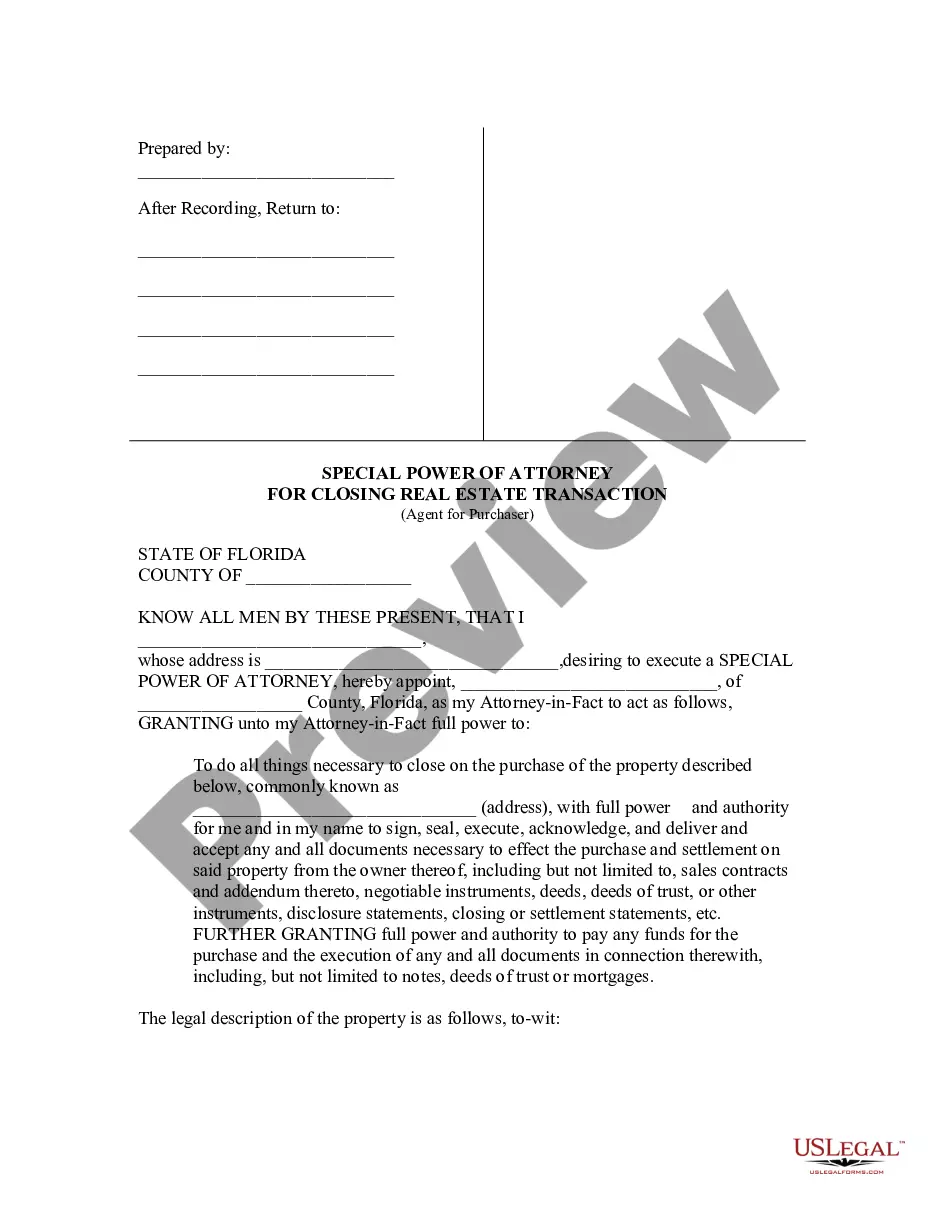

Florida Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out Florida Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Access one of the most extensive library of legal forms. US Legal Forms is actually a system where you can find any state-specific file in couple of clicks, such as Florida Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser templates. No requirement to waste time of the time looking for a court-admissible example. Our certified specialists ensure you get up to date samples every time.

To benefit from the documents library, select a subscription, and create an account. If you registered it, just log in and click Download. The Florida Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser file will automatically get saved in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, follow the brief instructions listed below:

- If you're proceeding to use a state-specific documents, be sure you indicate the right state.

- If it’s possible, go over the description to learn all of the nuances of the form.

- Make use of the Preview function if it’s available to take a look at the document's information.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, create your account.

- Pay out by card or PayPal.

- Save the document to your device by clicking Download.

That's all! You need to submit the Florida Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser template and double-check it. To make sure that things are accurate, contact your local legal counsel for help. Join and easily browse above 85,000 helpful samples.

Form popularity

FAQ

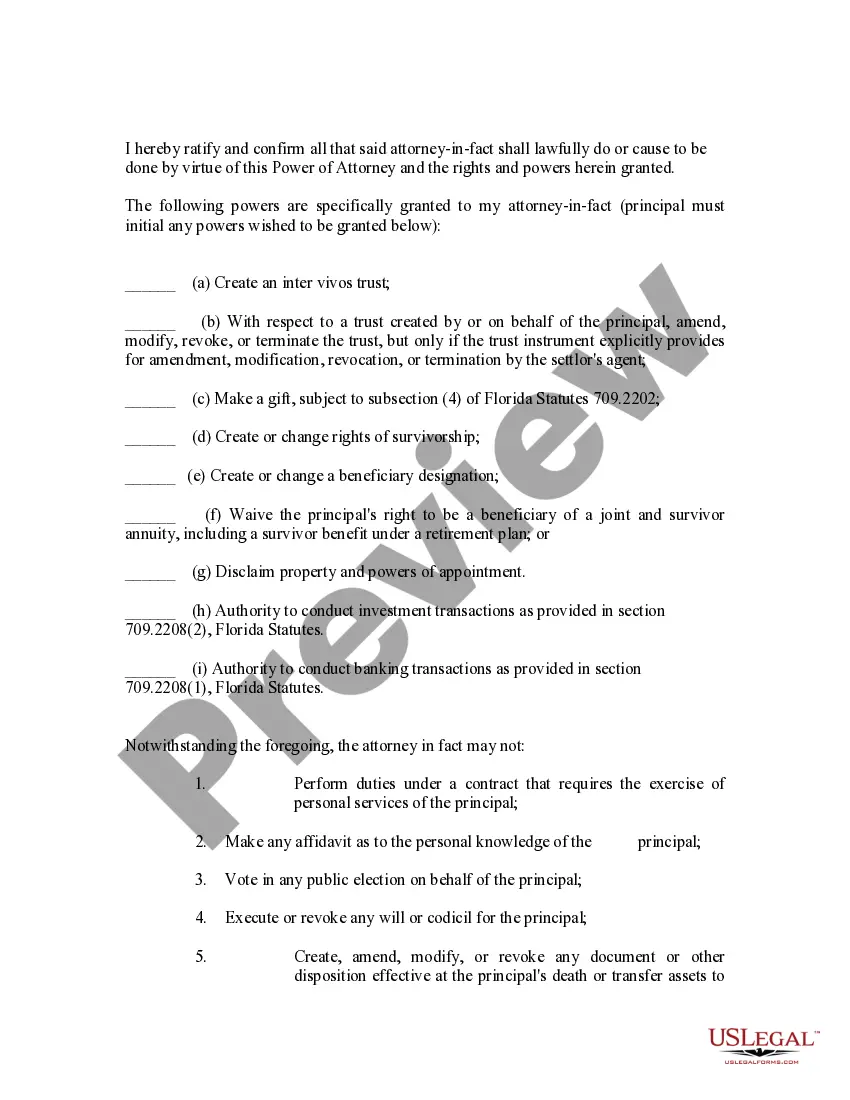

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

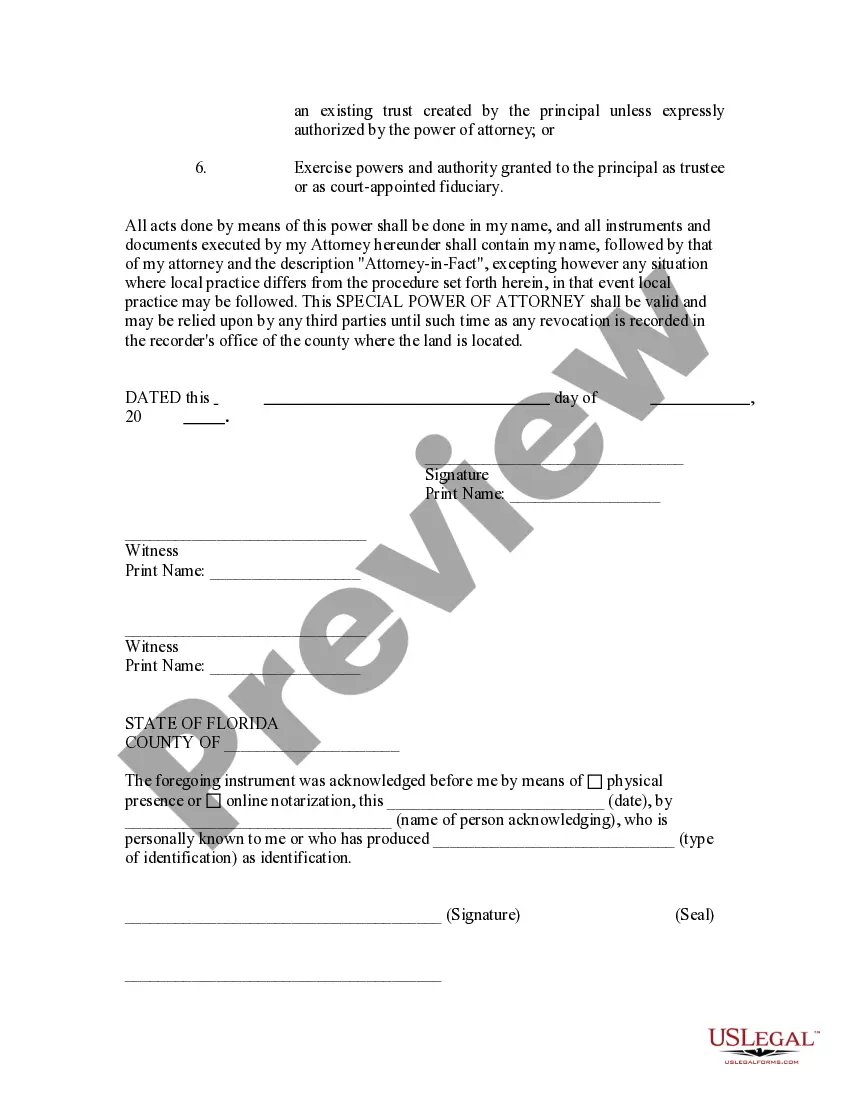

Step 1: Bring Your Power of Attorney Agreement and ID. Step 2: Determine the Preferred Signature Format. Step 3: Sign as the Principal. Step 4: Sign Your Own Name. Step 5: Express Your Authority as Attorney-in-Fact. Step 6: File the Documentation Somewhere Safe.

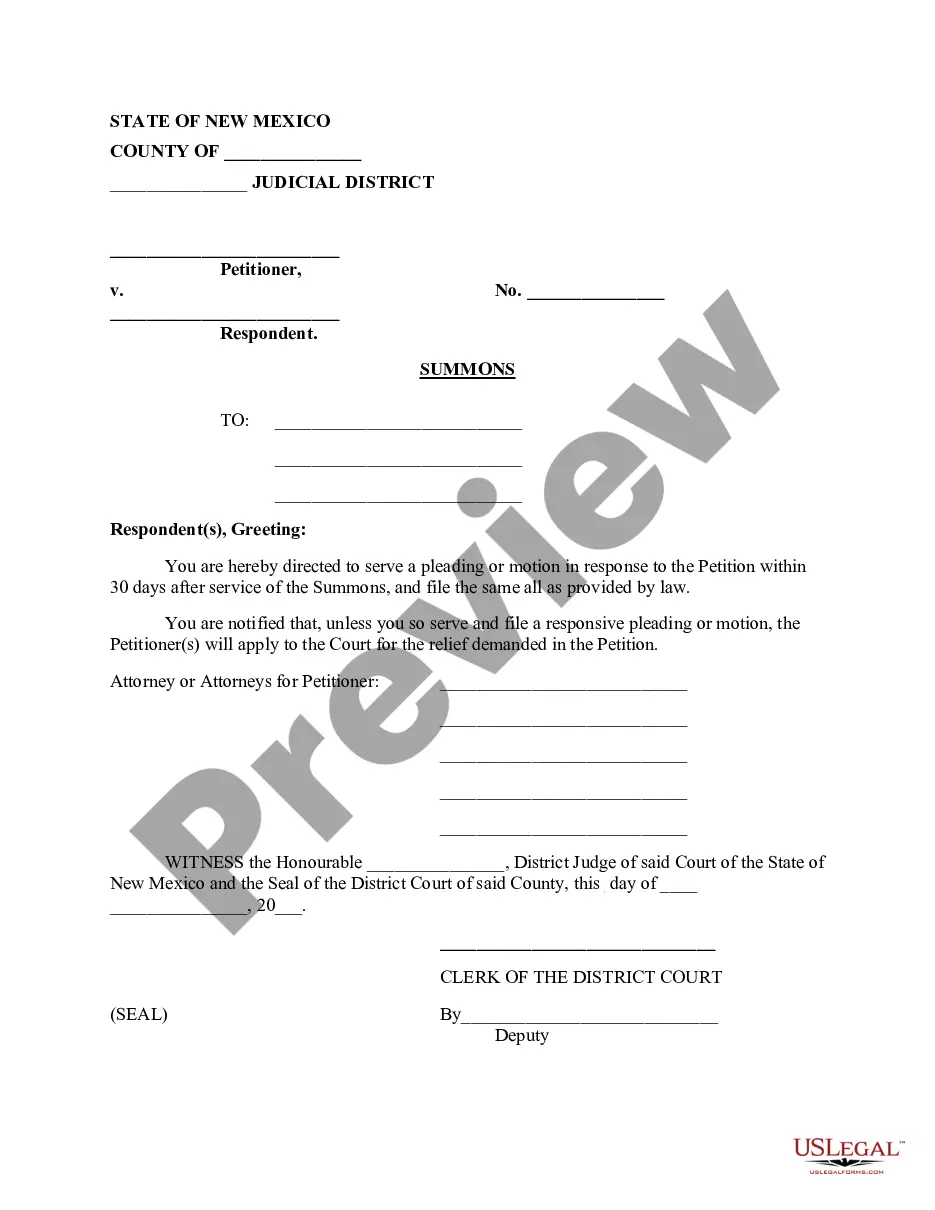

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.