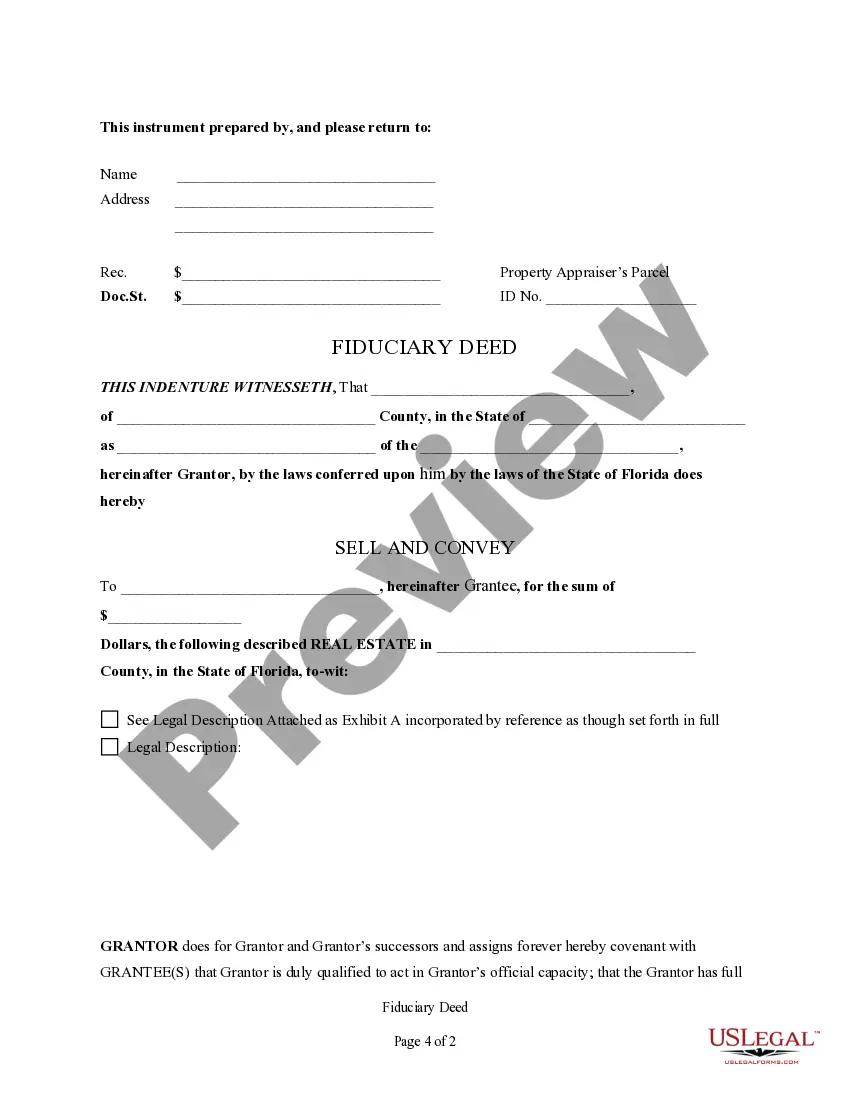

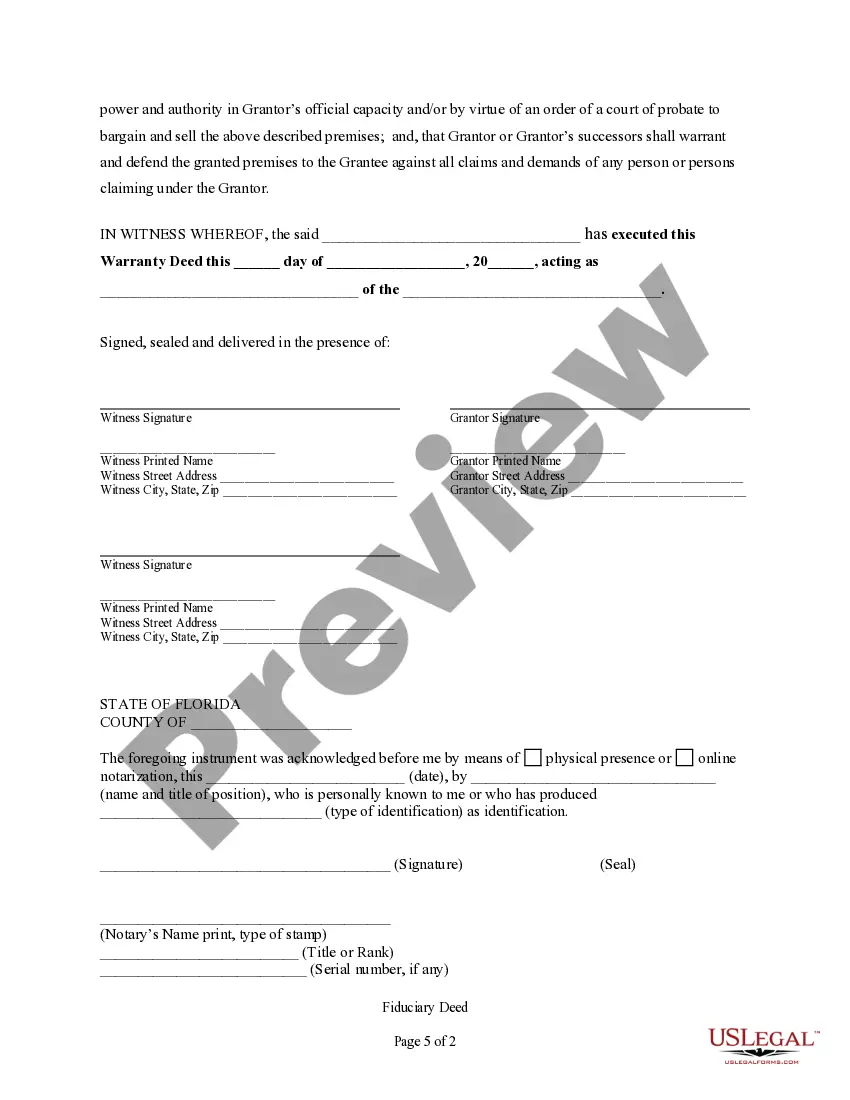

Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description Executor's Deed

How to fill out Administrator's Deed?

Among hundreds of free and paid examples that you can find on the net, you can't be sure about their accuracy. For example, who created them or if they’re competent enough to take care of what you need these to. Always keep relaxed and utilize US Legal Forms! Get Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries templates made by skilled attorneys and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access your earlier downloaded templates in the My Forms menu.

If you’re utilizing our platform the very first time, follow the instructions below to get your Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries quick:

- Ensure that the document you find applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or find another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you have signed up and purchased your subscription, you can use your Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as often as you need or for as long as it stays valid in your state. Edit it with your preferred editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Fiduciary Forms Form popularity

Fiduciary Deed Sample Other Form Names

What Is A Fiduciary Deed FAQ

When you are creating a will and a trust as part of your estate planning, you need to name an executor as well as a trustee, which can both be the same person, if you wish.

The executor of a will has a fiduciary duty to act in the best interest of the estate. This means that the law prevents you from acting in your own interest to the detriment of the estate. As an extension of this duty, executors also have several responsibilities to the beneficiaries of the will.

Yes. It's quite common for an executor to be a beneficiary. Consider when one spouse passes away, the living spouse of the decedent is frequently named executor. It's also common for children to be named both beneficiaries and executors of wills/trustees of family trusts.

The role of Executor is to administer the deceased's Estate, but the Trustees are there to manage any ongoing Trusts which arise from the Will.

Fiduciary - An individual or trust company that acts for the benefit of another.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

An executor manages a deceased person's estate to distribute his or her assets according to the will. A trustee, on the other hand, is responsible for administering a trust. A trust is a legal arrangement in which one or more trustees hold the legal title of the property for the benefit of the beneficiaries.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

Executor v. If you have a trust and funded it with most of your assets during your lifetime, your successor Trustee will have comparatively more power than your Executor.