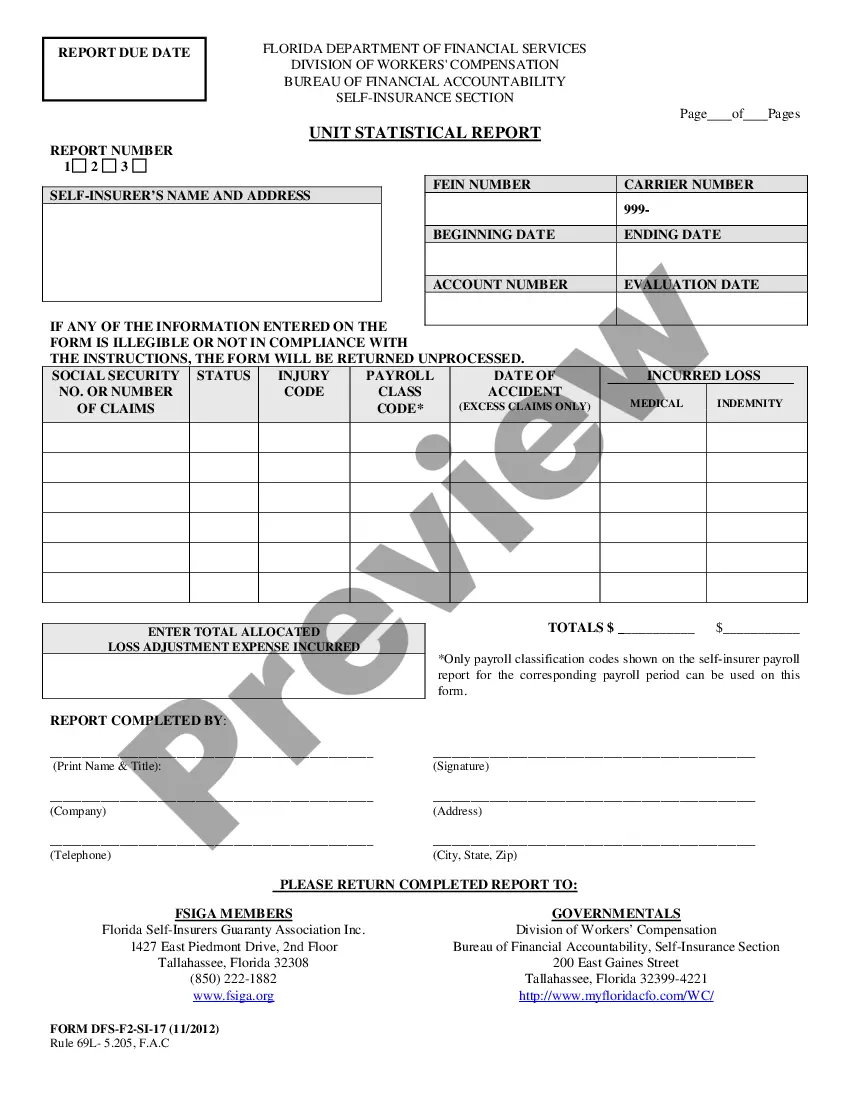

Florida Self-Insurance Unit Statistical Report (New Applicant)

Description

How to fill out Florida Self-Insurance Unit Statistical Report (New Applicant)?

Access the most extensive collection of sanctioned forms.

US Legal Forms is effectively a platform to locate any state-specific document in a few clicks, including examples of the Florida Self-Insurance Unit Statistical Report (New Applicant).

No need to waste hours searching for a court-admissible template.

After selecting a pricing plan, establish your account. Pay using a card or PayPal. Download the example to your computer by selecting the Download button. That’s it! You are now ready to complete the Florida Self-Insurance Unit Statistical Report (New Applicant) template and check it over. To ensure accuracy, contact your local legal advisor for assistance. Register and effortlessly browse over 85,000 useful samples.

- To utilize the forms library, select a subscription and create your account.

- If you have already registered, simply Log In and then click Download.

- The Florida Self-Insurance Unit Statistical Report (New Applicant) example will be instantly saved in the My documents tab (a section for every document you save on US Legal Forms).

- To set up a new profile, adhere to the brief instructions below.

- If you need to use a state-specific example, make sure to specify the accurate state.

- If possible, review the description to grasp all the details of the form.

- Utilize the Preview option if it is available to examine the document's details.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

Proof of self-insurance is documentation that verifies a business's financial capability to cover its own risks. In the context of the Florida Self-Insurance Unit Statistical Report for new applicants, this proof often includes financial statements or specific guarantees that outline how a business intends to manage potential liabilities. By providing this proof, businesses can meet legal requirements and demonstrate their commitment to financial responsibility. Utilizing platforms like US Legal Forms can help ensure all necessary documentation is correctly prepared.

Self-insurance occurs when a business retains a portion of its risk rather than transferring it to an insurance company. For instance, a company may decide to set aside funds to cover potential liabilities instead of purchasing a traditional insurance policy. This approach often aligns with the compliance requirements outlined in the Florida Self-Insurance Unit Statistical Report for new applicants. Businesses that choose self-insurance can gain more control over their risk management strategies.

The certificate of insurance serves as proof that you have an active insurance policy. Specifically, for new applicants dealing with the Florida Self-Insurance Unit Statistical Report, it demonstrates compliance with state insurance requirements. This document outlines the types of coverage you hold, the limits of that coverage, and the policy's effective dates. It helps you and other parties verify that adequate insurance is maintained.

Becoming self-insured involves evaluating your business's financial stability and risk exposure. You need to submit an application to the relevant state authority, including a detailed plan on how you will manage risks. Upon approval, you will receive a Florida Self-Insurance Unit Statistical Report (New Applicant), which outlines your obligations and helps you stay compliant. Utilizing USLegalForms can facilitate this journey with the right forms and resources at your fingertips.

To become self-insured in Florida, you must first submit a completed application to the Florida Self-Insurance Unit. This application should include necessary documentation, such as financial statements and a clear outline of your risk management strategies. Once approved, you will receive a Florida Self-Insurance Unit Statistical Report (New Applicant) that confirms your status and outlines any further requirements. Using platforms like USLegalForms can help streamline this process by providing the necessary templates and guidance.

Yes, you can self-insure workers' compensation in Florida if you meet specific requirements set by the state. This option allows businesses to manage their insurance costs while providing necessary coverage for employees. However, careful planning and financial assessment are essential to ensure successful self-insurance. For guidance, consult the Florida Self-Insurance Unit Statistical Report (New Applicant) for a comprehensive overview.

Certification of self-insurance is the process by which an employer proves their capability to cover workers' compensation claims without traditional insurance. This certification requires thorough documentation and compliance with state regulations. It provides assurance to the state and employees that adequate resources will be available for claims. For new applicants, the Florida Self-Insurance Unit Statistical Report highlights the necessary steps in obtaining certification.

In Florida, independent contractors are generally not required to carry workers' compensation insurance. However, if they hire employees, they must provide coverage for those workers. This distinction is essential when considering potential liability and financial implications. You can reference the Florida Self-Insurance Unit Statistical Report (New Applicant) for more related details.

In Florida, to be self-insured, employers must provide proof of financial stability and meet minimum statutory requirements. They need to submit a detailed application and comply with various regulations. This process ensures that sufficient funds are available to cover potential claims. Checking the Florida Self-Insurance Unit Statistical Report (New Applicant) can guide you through these requirements.

Yes, Florida does allow self-insurance for workers' compensation under certain conditions. Employers must apply and meet specific criteria to self-insure, which helps manage costs effectively. This option can be beneficial for larger businesses that can handle the financial risk. The Florida Self-Insurance Unit Statistical Report (New Applicant) provides essential guidelines for this process.