Florida Report of Outstanding Workers Compensation Liabilities

Description

How to fill out Florida Report Of Outstanding Workers Compensation Liabilities?

Get one of the most holistic catalogue of authorized forms. US Legal Forms is actually a platform where you can find any state-specific file in clicks, even Florida Report of Outstanding Workers Compensation Liabilities samples. No need to spend several hours of the time seeking a court-admissible sample. Our qualified specialists ensure you get up to date samples all the time.

To take advantage of the documents library, select a subscription, and register your account. If you registered it, just log in and then click Download. The Florida Report of Outstanding Workers Compensation Liabilities sample will immediately get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, follow the short recommendations below:

- If you're having to use a state-specific documents, be sure to indicate the appropriate state.

- If it’s possible, look at the description to learn all of the nuances of the document.

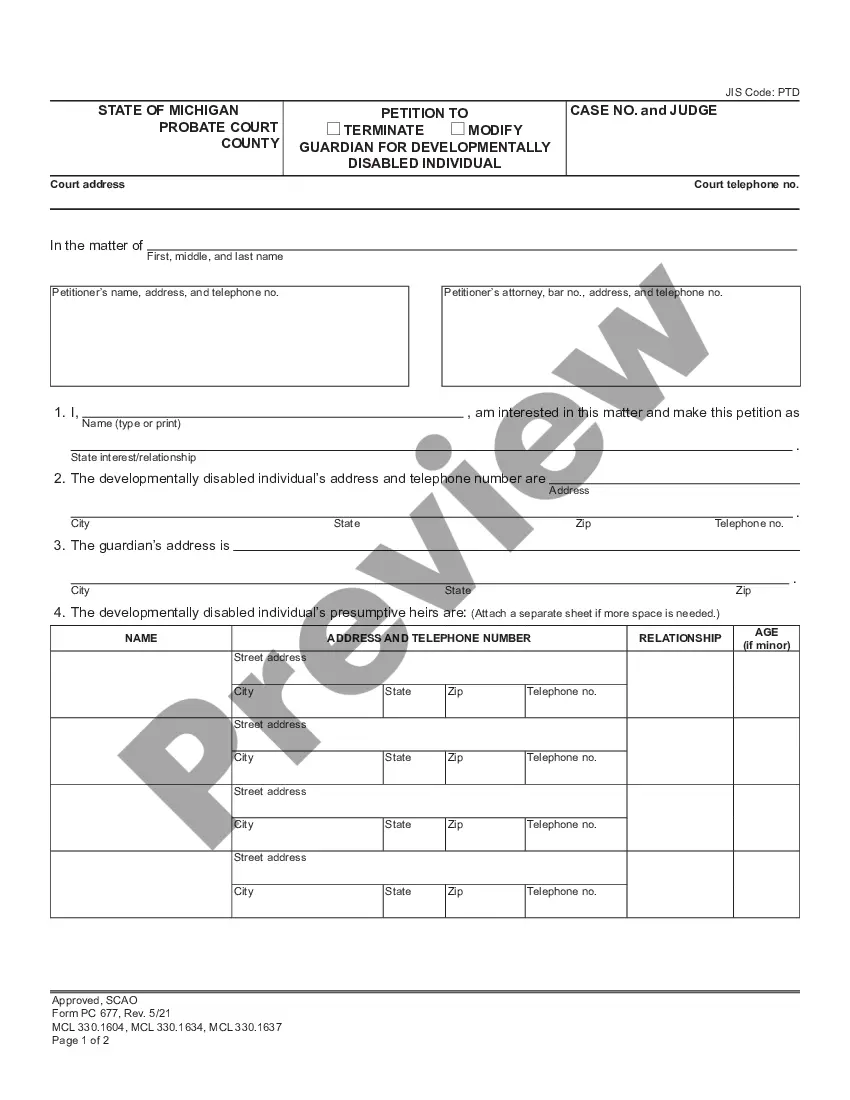

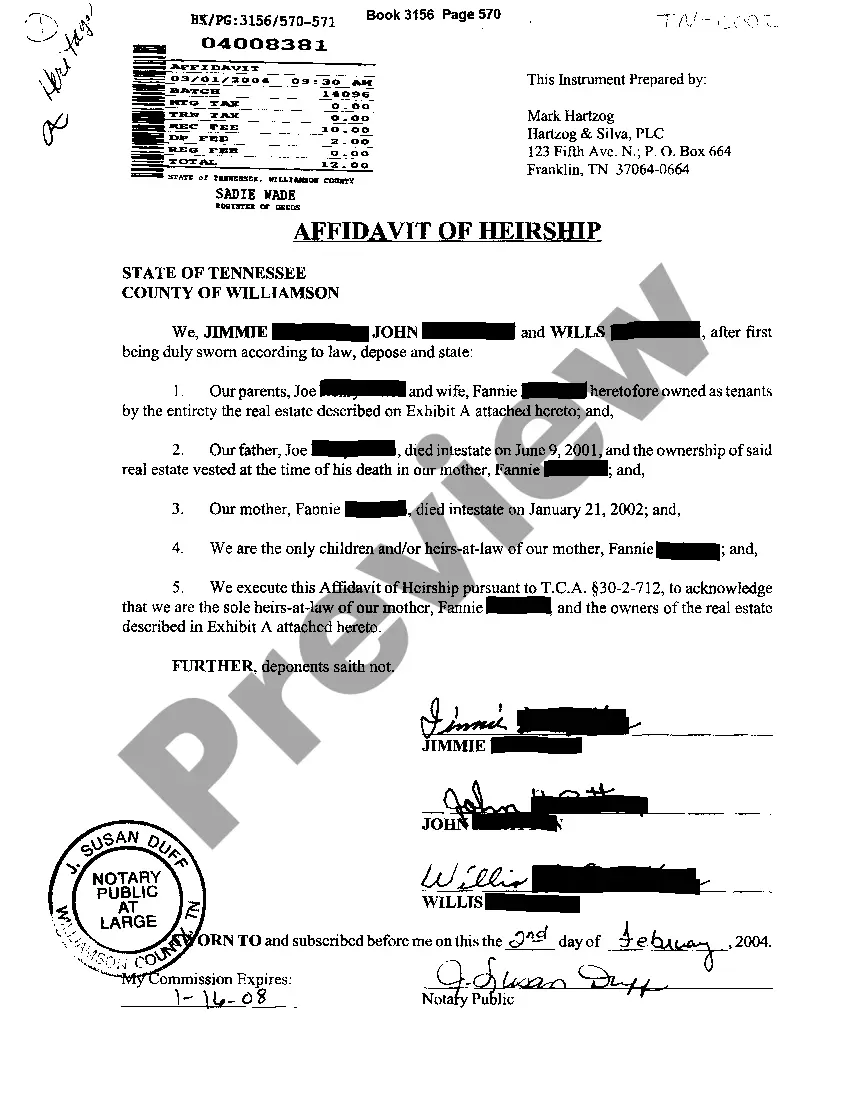

- Make use of the Preview function if it’s accessible to look for the document's content.

- If everything’s proper, click Buy Now.

- Right after picking a pricing plan, register your account.

- Pay out by card or PayPal.

- Save the document to your computer by clicking on Download button.

That's all! You should fill out the Florida Report of Outstanding Workers Compensation Liabilities form and double-check it. To ensure that all things are exact, speak to your local legal counsel for support. Sign up and simply browse more than 85,000 valuable samples.

Form popularity

FAQ

Calling the Department of Financial Services (DFS) hotline at 1-800-378-0445. Using the Report Insurance Fraud Link. (Be sure to select Workers Compensation in the drop-down menu of options.) By going to a local field office.

Regarding your question: do you claim workers comp on taxes, the answer is no. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Payroll journal and summary. Your check book (if it's your only means of keeping records. Federal Tax Report- 941's that cover the period. State Unemployment Tax reports or individual earnings records. All overtime payroll records (charged at reduced rates)

The cancellation of any current workers compensation coverage. If an employer is not compliant with their audit the insurance company will take that as a sign of being uncooperative and will cancel or set for non-renewal their current policy. The application of a monetary penalty.

At the end of your annual policy period, a final premium audit is conducted to determine if you paid the appropriate amount for your workers' compensation insurance. Your final premium audit is based on actual payroll, operations and job classifications for the expired coverage period.

Your workers' comp policy requires audits to verify your estimated payroll. These audits help make sure you're paying the right amount for the right coverage. Depending on your state, workers' compensation audits can also be a legal requirement.

Report these payments as wages on Line 7 of Form 1040 or Form 1040A, or on Line 1 of Form 1040EZ. If your disability pension is paid under a statute that provides benefits only to employees with service-connected disabilities, part of it may be workers' compensation. That part is exempt from tax.

Be factual with the information you provide. Be concise with the information you provide. Keep descriptions simple and to the point. Be sure to monitor your audit results.

Calling our Customer Service Centre on 13 10 50. sending an email to contact@sira.nsw.gov.au. writing to Compliance, Investigations & Prosecutions, Locked Bag 2906, Lisarow NSW 2252.