Florida Self-Insurer Payroll Report

Description

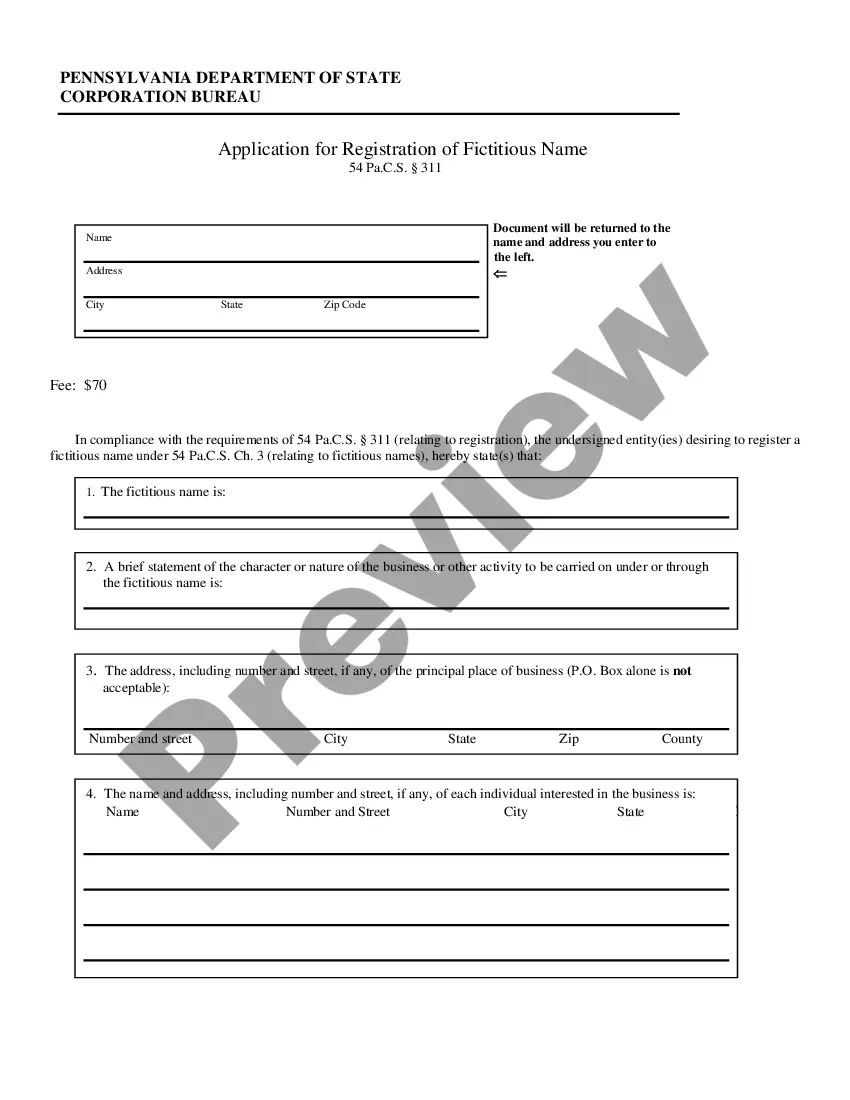

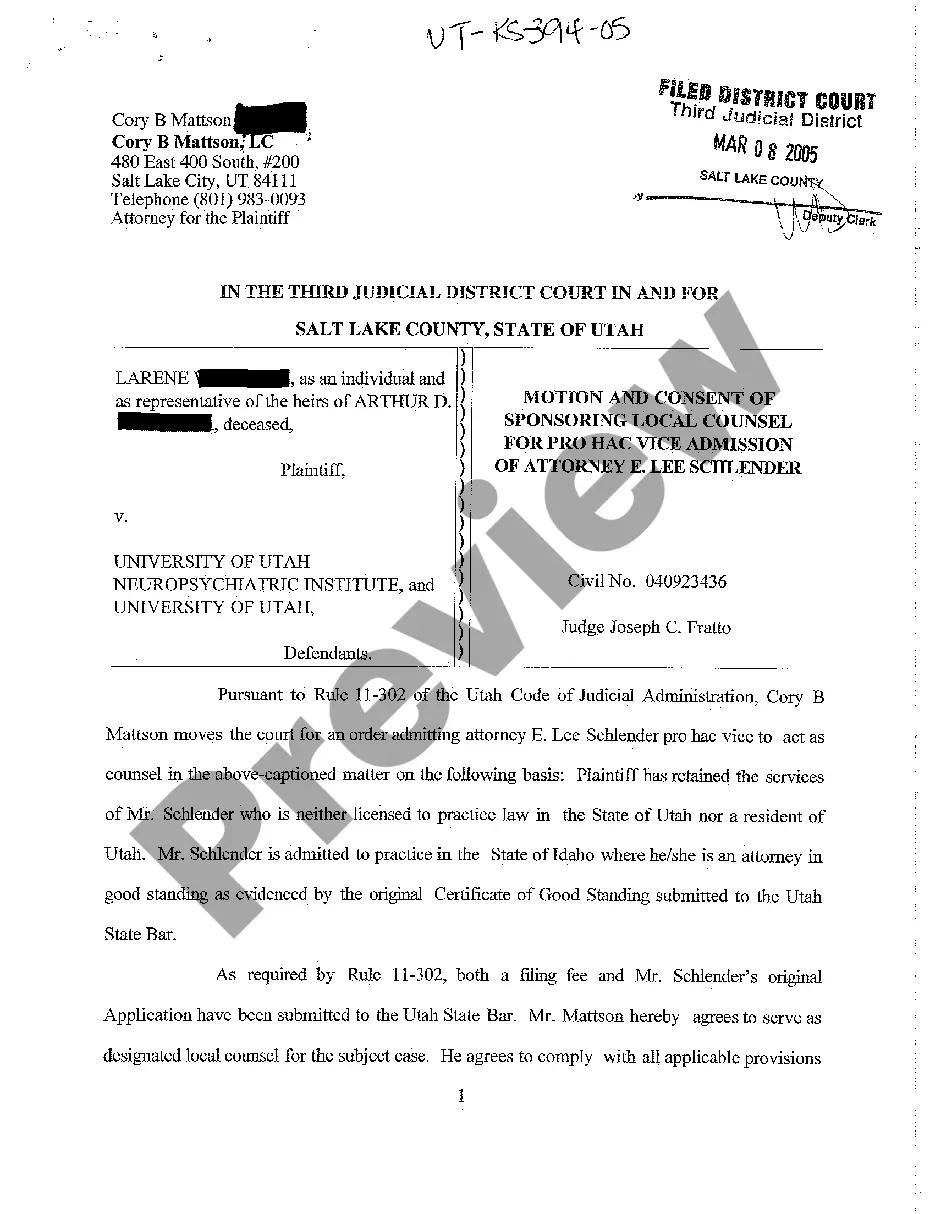

How to fill out Florida Self-Insurer Payroll Report?

Get access to the most expansive catalogue of legal forms. US Legal Forms is actually a solution where you can find any state-specific document in a few clicks, including Florida Self-Insurer Payroll Report templates. No reason to spend hrs of the time searching for a court-admissible example. Our qualified pros make sure that you receive up to date samples all the time.

To take advantage of the forms library, pick a subscription, and sign up your account. If you already did it, just log in and click Download. The Florida Self-Insurer Payroll Report sample will immediately get saved in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new account, follow the simple instructions below:

- If you're having to use a state-specific documents, make sure you indicate the proper state.

- If it’s possible, look at the description to understand all of the nuances of the document.

- Take advantage of the Preview option if it’s available to take a look at the document's content.

- If everything’s appropriate, click on Buy Now button.

- After choosing a pricing plan, register an account.

- Pay out by card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You need to submit the Florida Self-Insurer Payroll Report template and double-check it. To ensure that all things are exact, call your local legal counsel for assist. Sign up and easily find over 85,000 helpful samples.

Form popularity

FAQ

Step 1: Find your employer identification number. Step 2: Collect employee tax information. Step 3: Choose a payroll schedule. Step 4: Calculate gross pay. Step 5: Determine deductions, allowances and other withholdings. Step 6: Calculate net pay and pay your employees.

Employer Identification Number (EIN) State/Local Tax ID Number. State Unemployment ID Number. Employee Addresses and SSNs. I-9. W-4. State Withholding Allowance Certificate. Department of Labor (DOL) Records.

Payroll taxes include Medicare tax, with a tax rate of 1.45% on the first $200,000, and Social Security tax, with a rate of 6.2% on the first $132,900. You're also responsible for paying state and federal unemployment taxes.

You as the employer will pay 6% of each employee's first $7,000 of taxable income. If you pay state unemployment taxes, you are eligible for a tax credit of up to 5.4%.

Contact the Human Resource Department Depending on the company or staffing, some employers require that employees submit a formal request to get copies of pay stubs. Employers may charge a fee for copies of paystubs, provide the service for free, or require an employee to set up an appointment to pick up copies.

Collect Your New Employees' Documents. Track Hours Worked & Calculate Gross Pay. Calculate Payroll Deductions. Determine Net Pay and Pay Employees. Document and Store Payroll Records.

While ZipRecruiter is seeing salaries as high as $114,894 and as low as $17,319, the majority of salaries within the Average jobs category currently range between $41,818 (25th percentile) to $62,516 (75th percentile) with top earners (90th percentile) making $76,033 annually in Florida.

What are the state payroll tax obligations? Employers in Florida are required to contribute to unemployment insurance, entitled Reemployment Assistance. There are no state income taxes imposed in Florida.

Florida Sales Tax: Florida sales tax rate is 6%. Florida State Tax: Florida does not have a state income tax. Florida Corporate Income Tax: Corporations that do business and earn income in Florida must file a corporate income tax return (unless they are exempt).