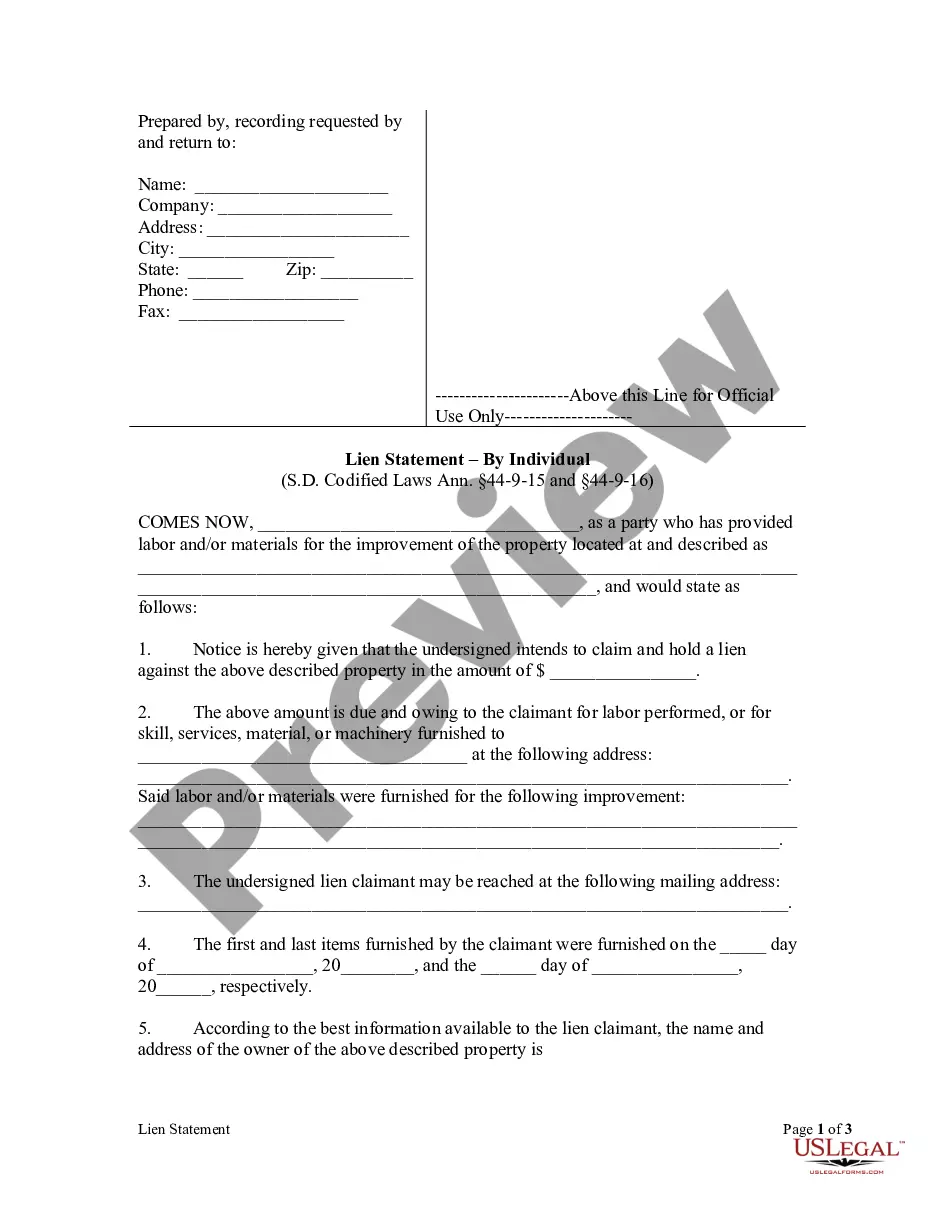

Florida Bond is a type of surety bond offered by the state of Florida. It is a three-party agreement between the principal (the person or entity that needs the bond), the obliged (the entity that requires the bond), and the surety (the company providing the bond). The bond guarantees that the principal will fulfill their contractual obligations or pay any damages that may arise from not fulfilling those obligations. The two most common types of Florida Bond are Contract Bonds and License & Permit Bonds. Contract Bonds are required for government contracts in order to ensure that contractors will complete projects as required. License & Permit Bonds are required for certain licensed activities such as construction, real estate, and auto dealerships.

Florida Bond

Description

How to fill out Florida Bond?

How much time and resources do you usually allocate to creating formal documentation.

There’s a better chance to obtain such forms than employing legal professionals or spending hours searching the internet for an appropriate template. US Legal Forms is the leading online repository offering professionally crafted and verified state-specific legal documents for any purpose, like the Florida Bond.

Another advantage of our service is that you can retrieve previously acquired documents that you securely store in your profile in the My documents tab. Access them anytime and redo your paperwork as often as necessary.

Save time and energy preparing formal documents with US Legal Forms, one of the most trusted online solutions. Register with us today!

- Browse the form content to ensure it aligns with your state regulations. To do so, review the form description or use the Preview option.

- If your legal template doesn't meet your requirements, locate another one using the search bar at the top of the page.

- If you are already enrolled with our service, Log In and retrieve the Florida Bond. If not, continue to the next steps.

- Click Buy now once you identify the correct document. Choose the subscription plan that fits you best to access the full potential of our library.

- Create an account and remit payment for your subscription. You can pay with your credit card or via PayPal - our service is completely dependable for that.

- Download your Florida Bond onto your device and fill it out either on a printed hard copy or electronically.

Form popularity

FAQ

Filling out a bond form for a Florida Bond is straightforward. Start by gathering all necessary information, such as your personal details and relevant identification. Next, ensure you understand the terms associated with the bond, as clarity will help you complete the form accurately. If you need assistance, consider using US Legal Forms, which offers user-friendly templates and guidance to simplify the process.

To bond someone out of jail in Florida, start by determining the bail amount set by the court. Next, contact a licensed bail bond agent who can assist you in completing the necessary paperwork and securing a Florida Bond on behalf of the individual. It's important to provide the agent with accurate information about the arrested person, including their full name and booking details. Lastly, ensure you understand the terms of the bond and any associated fees before finalizing the arrangement.

The time required to obtain a Florida Bond can vary based on the type and complexity of the bond. Generally, you can expect the process to take anywhere from a few hours to several days. By working with experienced agencies or US Legal Forms, you might find that the process becomes more efficient, allowing you to secure a Florida Bond effectively.

Filing a bond claim in Florida involves a few straightforward steps. Begin by gathering all necessary documents, such as your bond number and any related paperwork. Next, submit your claim to the bond issuer, ensuring all information is accurate and complete. Utilizing US Legal Forms can streamline this process, providing you with templates and guidance tailored for Florida Bond claims.

With conventional loans, you often only need to put 3% down. With an FHA loan, you'll need to put at least 3.5% down. Through Florida's first-time homebuyer assistance programs, you may be able to get a second loan to cover this down payment.

To purchase a $200,000 house, you need a down payment of at least $40,000 (20% of the home price) to avoid PMI on a conventional mortgage. If you're a first-time home buyer, you could save a smaller down payment of $10,000?20,000 (5?10%). But remember, that will drive up your monthly payment with PMI fees.

Florida Housing offers a Homebuyer Program that offers 30-year fixed rate first mortgage loans to first time homebuyers through participating lenders and lending institutions throughout the State of Florida.

The Division currently issues three types of bonds: general obligation bonds, revenue bonds and appropriation-based bonds. General obligation bonds are backed by the full faith and credit of the State in conjunction with the pledge of a specific revenue source such as gross receipts taxes.

How much is the down payment for a $300K house? You'll need a down payment of $9,000, or 3 percent, if you're buying a $300K house with a conventional loan. If you're using an FHA loan, you'll need a downpayment of $10,500, which is 3.5 percent of the purchase price.

What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981. (This is an estimated example.)