Florida Employment Application for Accountant

Description

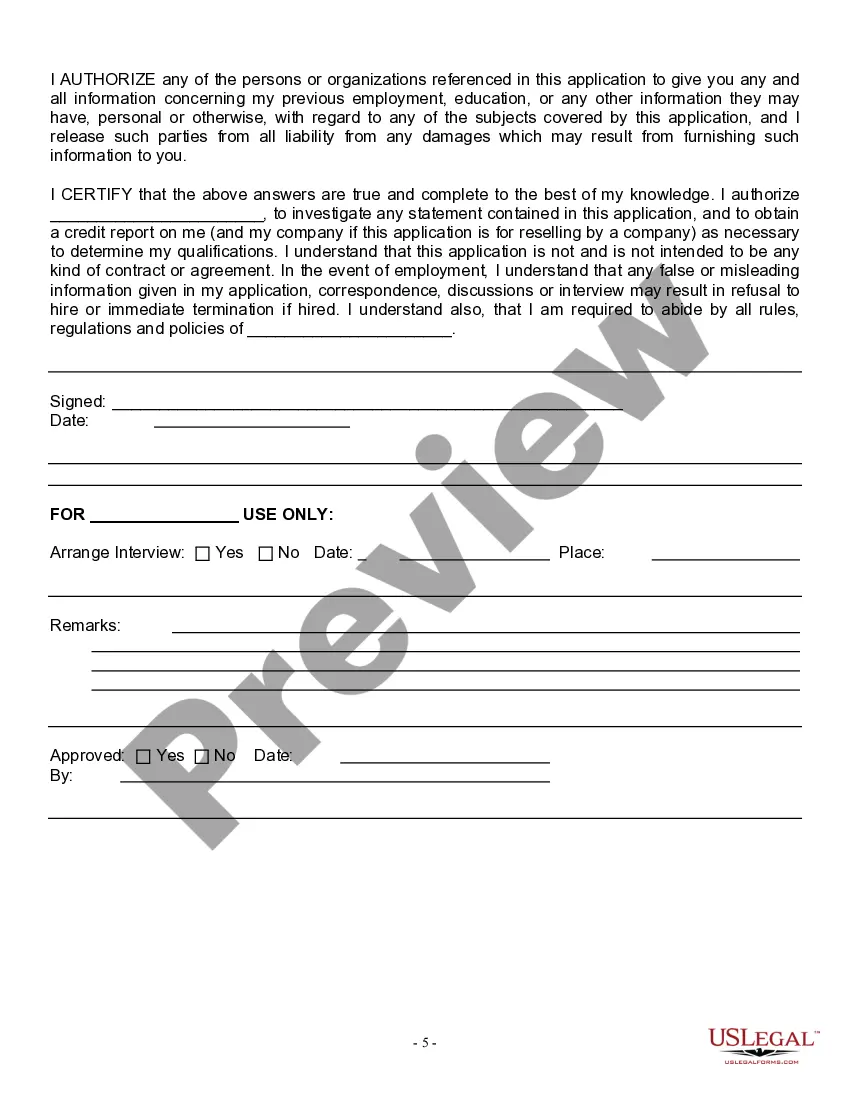

How to fill out Employment Application For Accountant?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal templates that you can download or print.

By utilizing the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You can obtain the most current versions of forms such as the Florida Employment Application for Accountant within moments.

Review the form description to ensure you have chosen the right one.

If the form does not meet your needs, use the Search section at the top of the screen to find one that does.

- If you possess a monthly membership, Log In and download the Florida Employment Application for Accountant from the US Legal Forms catalog.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- To utilize US Legal Forms for the first time, here are simple instructions to assist you in getting started.

- Ensure that you have selected the correct form for your city/county.

- Click on the Preview button to review the form’s contents.

Form popularity

FAQ

Steps to Hiring your First Employee in FloridaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Required Employment Forms in FloridaSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

Employment InformationNames, addresses, and phone numbers of previous employers.Supervisor's Name.Dates of Employment.Salary.Reason for Leaving.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Job hunting documents that will help your applicationCV. It may seem silly, but many applicants often send an email to apply for a vacancy and forget to attach their CV!Cover letter.Sample Portfolio.Copies of your qualifications.A copy of your ID and Driver's Licence.Your academic results.Testimonials.Photograph.More items...?29-Dec-2015

One document of ID - passport or driving licence. One document showing proof of address utility bill, bank statement, credit card statement, driving licence (only if driving licence shows the applicant's current address and has not also been used as ID document)

Federal Employee Withholding Tax The next step to hiring your first employee in Florida is to have them complete a W-4 form, known as a Withholding Exemption Certificate. This form is used to calculate how much of your employee's wages will need to be withheld for Federal Income Tax.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

How to structure an effective job application formName of applicant.Contact information, including phone and email.Education history.Work experience.Professional references (optional)Availability (e.g., weekends, night shift)Applicant signature and date.

Work documentsSchool and employment records. Almost every job application will ask for your contact information, job history, and education or training.Birth certificate.Driver's license.Social Security card.Work permits.Under 18.Criminal record, or rap sheet.