A Florida Asset Purchase Agreement — Business Sale is a legal contract that outlines the terms and conditions for purchasing the assets of a business in the state of Florida. This agreement typically involves the transfer of tangible and intangible assets such as equipment, inventory, customer lists, trademarks, licenses, and goodwill. The purpose of this agreement is to provide a clear understanding between the buyer and the seller regarding the specific assets being sold, the purchase price, payment terms, and other important details related to the transaction. It aims to protect the rights and interests of both parties involved in the business sale. There are different types of Florida Asset Purchase Agreements — Business Sale that can be customized to suit the specific needs and circumstances of the buyer and seller. Some common types include: 1. Basic Asset Purchase Agreement: This is a standard agreement that covers the sale of all or a specified set of assets. It includes provisions related to the purchase price, payment terms, representations and warranties, closing conditions, and any additional terms agreed upon by both parties. 2. Limited Asset Purchase Agreement: This type of agreement focuses on the sale of a specific category of assets, such as equipment or real estate. It may exclude certain assets that are not being transferred or sold. 3. Bulk Asset Purchase Agreement: This agreement is used when an entire business or a substantial part of it is being sold. It covers the transfer of all assets necessary for the continued operation of the business, including customer contracts, lease agreements, and intellectual property rights. 4. Intellectual Property Asset Purchase Agreement: In cases where the primary assets being purchased are intellectual property rights, such as patents, copyrights, or trademarks, this specialized agreement is used. It includes provisions related to the assignment and protection of intellectual property rights. When drafting a Florida Asset Purchase Agreement — Business Sale, it is essential to include clauses that address key aspects of the transaction. These may include: — Identification of assets being sold: Clearly listing out the assets being transferred, their condition, and any relevant details or specifications. — Purchase price and payment terms: Specifying the total purchase price, any installment payments, or financing arrangements, and the timeline for payment. — Representations and warranties: Defining the assurances made by both parties regarding the accuracy of financial statements, absence of liens or encumbrances, and compliance with laws and regulations. — Closing conditions: Outlining the conditions that need to be satisfied before the sale is considered complete, such as obtaining necessary approvals or consents. — Indemnification: Determining the responsibilities for any liabilities or claims arising before or after the closing date and outlining the procedures for indemnification. — Confidentiality and non-compete agreements: Specifying any confidentiality clauses or restrictions on the seller's ability to compete with the buyer's business. It is important to consult with legal professionals experienced in Florida business law to ensure the Asset Purchase Agreement complies with state regulations and protects the interests of both parties involved in the sale.

Florida Asset Purchase Agreement - Business Sale

Description

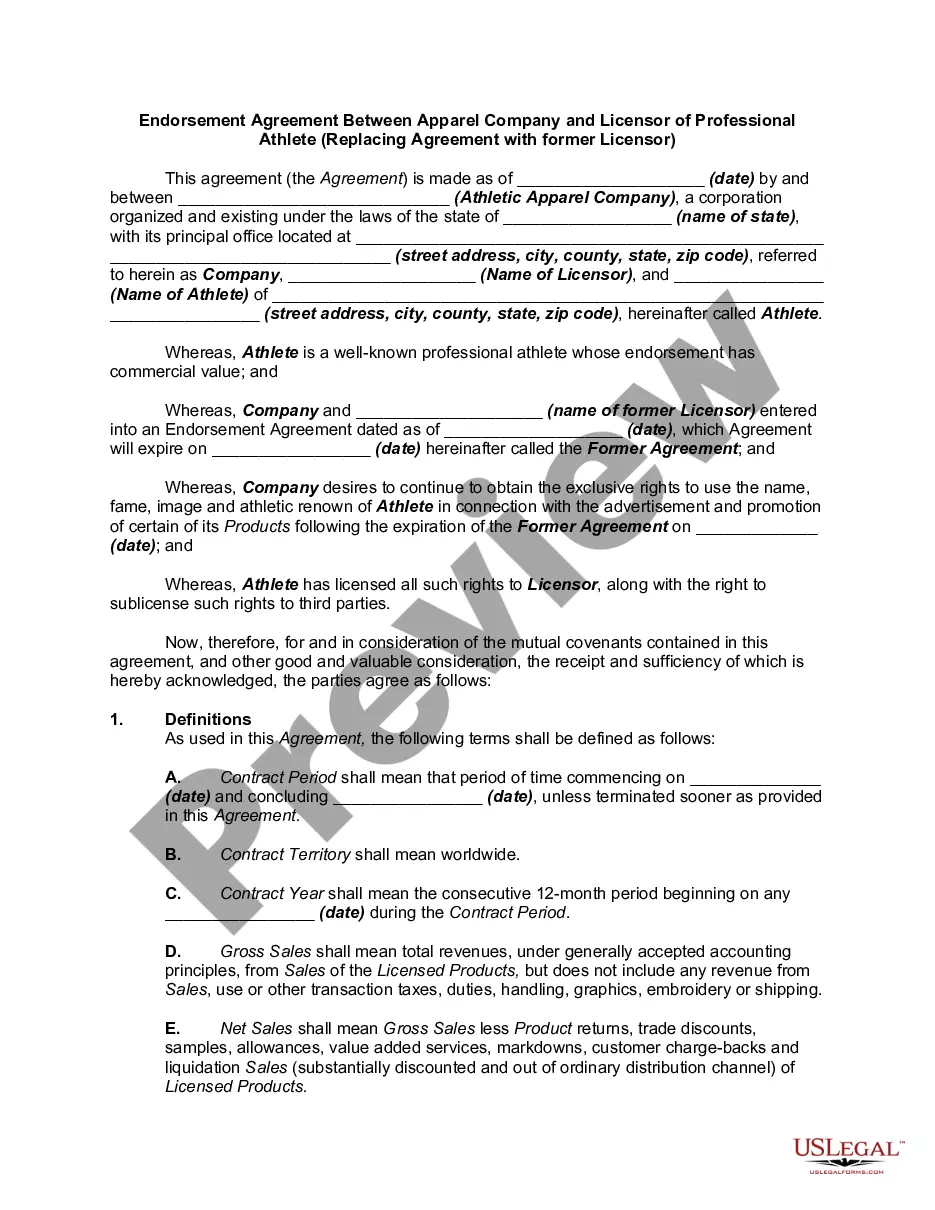

How to fill out Florida Asset Purchase Agreement - Business Sale?

US Legal Forms - one of the largest libraries of legitimate types in the States - delivers a variety of legitimate file layouts you may down load or printing. Utilizing the internet site, you may get thousands of types for enterprise and specific uses, categorized by classes, says, or keywords.You can get the newest versions of types such as the Florida Asset Purchase Agreement - Business Sale in seconds.

If you have a subscription, log in and down load Florida Asset Purchase Agreement - Business Sale from your US Legal Forms collection. The Obtain switch can look on each develop you perspective. You have accessibility to all previously downloaded types from the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, listed below are straightforward directions to obtain started out:

- Ensure you have picked the right develop for your personal metropolis/state. Select the Review switch to examine the form`s content material. Look at the develop outline to actually have selected the appropriate develop.

- If the develop doesn`t fit your requirements, utilize the Search field near the top of the display screen to get the the one that does.

- Should you be pleased with the shape, verify your option by simply clicking the Purchase now switch. Then, pick the rates prepare you prefer and provide your accreditations to register for an bank account.

- Procedure the financial transaction. Make use of your charge card or PayPal bank account to complete the financial transaction.

- Pick the file format and down load the shape on the gadget.

- Make modifications. Fill up, edit and printing and indication the downloaded Florida Asset Purchase Agreement - Business Sale.

Every template you included in your bank account does not have an expiry time and is also your own eternally. So, in order to down load or printing yet another backup, just go to the My Forms segment and click on the develop you want.

Get access to the Florida Asset Purchase Agreement - Business Sale with US Legal Forms, by far the most considerable collection of legitimate file layouts. Use thousands of expert and status-specific layouts that meet up with your business or specific requires and requirements.