Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm.

From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

DISSOLUTION BY ACT OF THE PARTIES

A partnership is dissolved by any of the following events:

* agreement by and between all partners;

* expiration of the time stated in the agreement;

* expulsion of a partner by the other partners; or

* withdrawal of a partner.

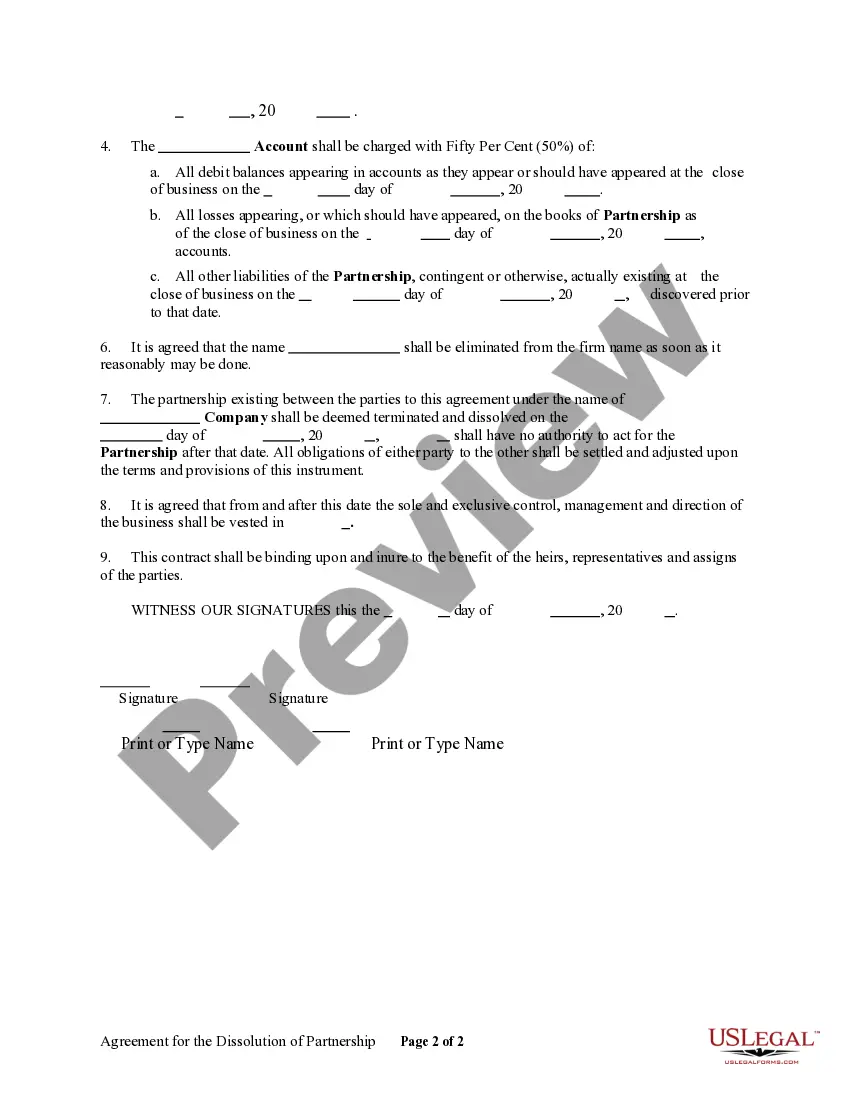

The Florida Agreement for the Dissolution of a Partnership is a legal document that outlines the terms and conditions for ending a partnership in the state of Florida. This agreement is crucial for partnerships that have decided to go their separate ways and want to ensure a smooth and mutually agreed-upon dissolution process. Keywords relevant to the Florida Agreement for the Dissolution of a Partnership include: 1. Partnership: Refers to the legal arrangement where two or more individuals or entities agree to carry out a business venture, pooling their resources, skills, and profits. 2. Dissolution: The process of formally terminating a partnership. Dissolution can be voluntary, wherein the partners mutually agree to end the partnership, or involuntary, due to legal or financial reasons. 3. Agreement: A legally binding document that outlines the terms, conditions, and responsibilities of the parties involved. In this context, it specifically addresses the dissolution of the partnership. 4. Terms and Conditions: The specific provisions and obligations agreed upon by the partners for the dissolution of the partnership. This includes matters such as the division of assets, liabilities, and the overall winding up of the partnership's affairs. 5. Smooth: Refers to the desired outcome of the dissolution process wherein the partners aim to resolve all matters without undue conflict or dispute. The agreement aims to promote a smooth dissolution process, ensuring fairness and clarity for both parties involved. Different types of Florida Agreements for the Dissolution of a Partnership may include: 1. Voluntary Dissolution Agreement: Pertains to situations where partners mutually agree to dissolve the partnership. This agreement outlines the terms surrounding the dissolution, including the division of assets, liabilities, and any ongoing commitments. 2. Involuntary Dissolution Agreement: In cases where a partnership is dissolved under legal or financial duress, an involuntary dissolution agreement may be required. This agreement outlines the terms agreed upon by the parties involved or may be determined by a court decision. 3. Dissolution without Litigation: Refers to partnerships that dissolve without resorting to legal proceedings. In this type of agreement, partners outline the terms and conditions of the dissolution and agree to resolve any disputes amicably or through alternative dispute resolution methods like mediation or arbitration. 4. Dissolution with Litigation: In situations where disputes arise during the dissolution process and legal action becomes necessary, a dissolution agreement with litigation clauses may be drafted. This agreement outlines the terms under which partners undertake litigation, including jurisdiction, procedures, and any associated costs. It is crucial to consult with a qualified attorney who specializes in partnership law and dissolution when drafting a Florida Agreement for the Dissolution of a Partnership. This will help ensure that the agreement aligns with legal requirements and protects the rights and interests of all parties involved.