Florida Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land

Description

How to fill out Contract For The Sale And Purchase Of Real Estate - No Broker - Commercial Lot Or Land?

It is feasible to invest numerous hours online looking for the legal document template that fulfills the state and federal requirements you require.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can effortlessly download or print the Florida Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land from their service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Florida Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land.

- Every legal document template you receive is yours permanently.

- To obtain an additional copy for any acquired form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city you choose.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

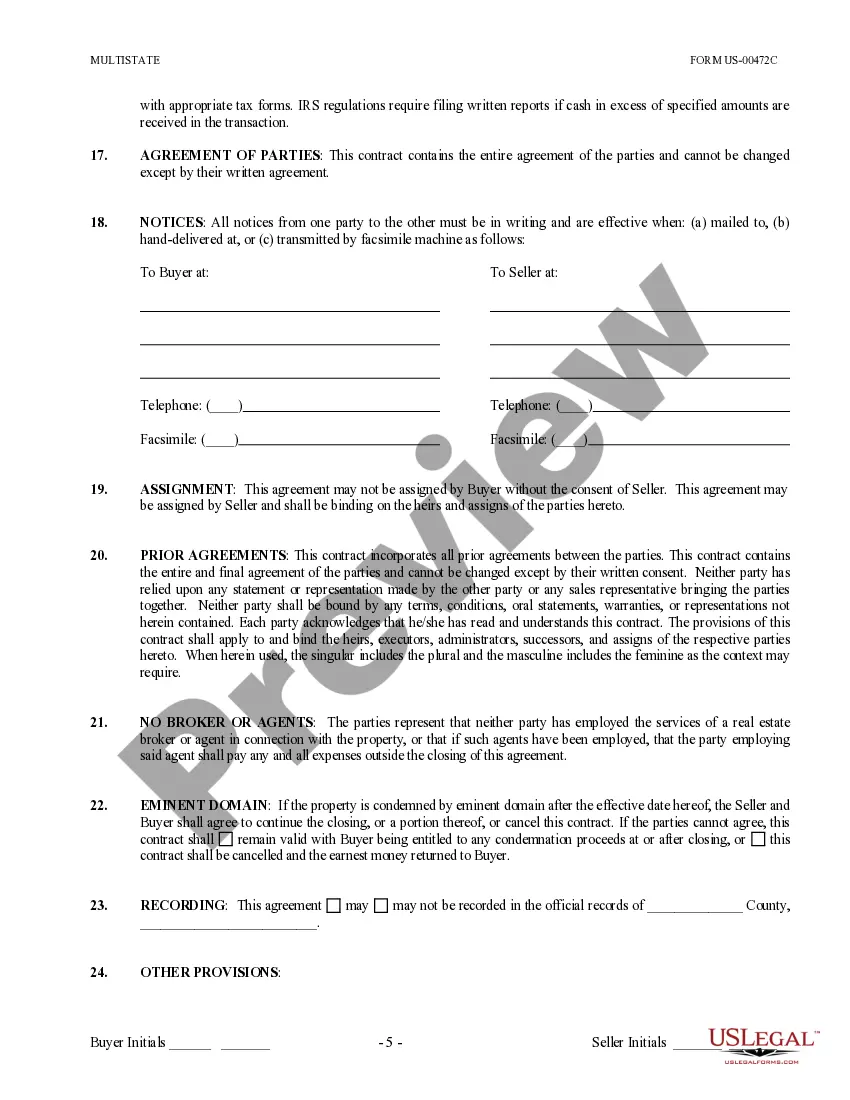

Brokerage RelationshipA relationship created by a written brokerage agreement. between a client and a broker where the client. authorizes the broker to provide real estate brokerage. services in a residential real estate transaction.

Florida Realtors has three residential contracts. Two are Florida Realtors/Florida Bar contracts(FR/Bar), the standard Residential Contract for Sale and Purchase and the AS IS version, and one is the Florida Realtors Contract for Residential Sale and Purchase (CRSP).

- Real estate license law prohibits a broker to create a fiduciary relationship with both, buyer and seller at the same time.

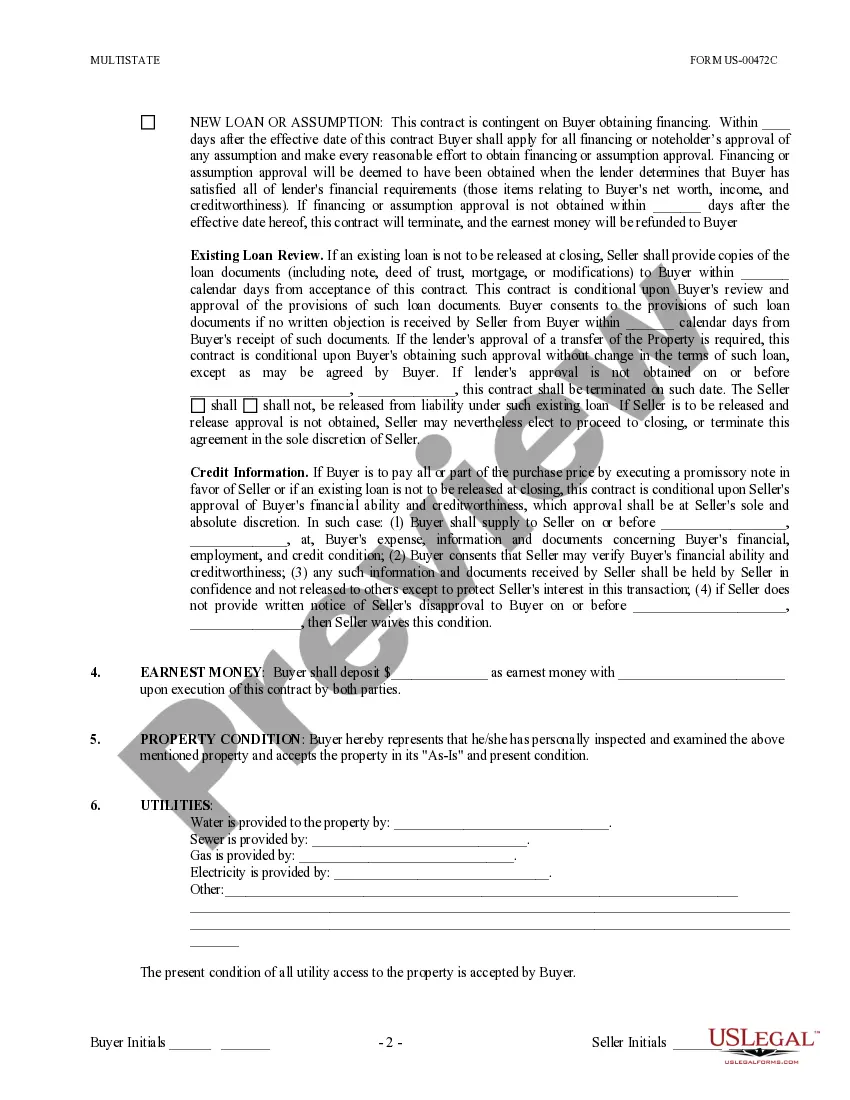

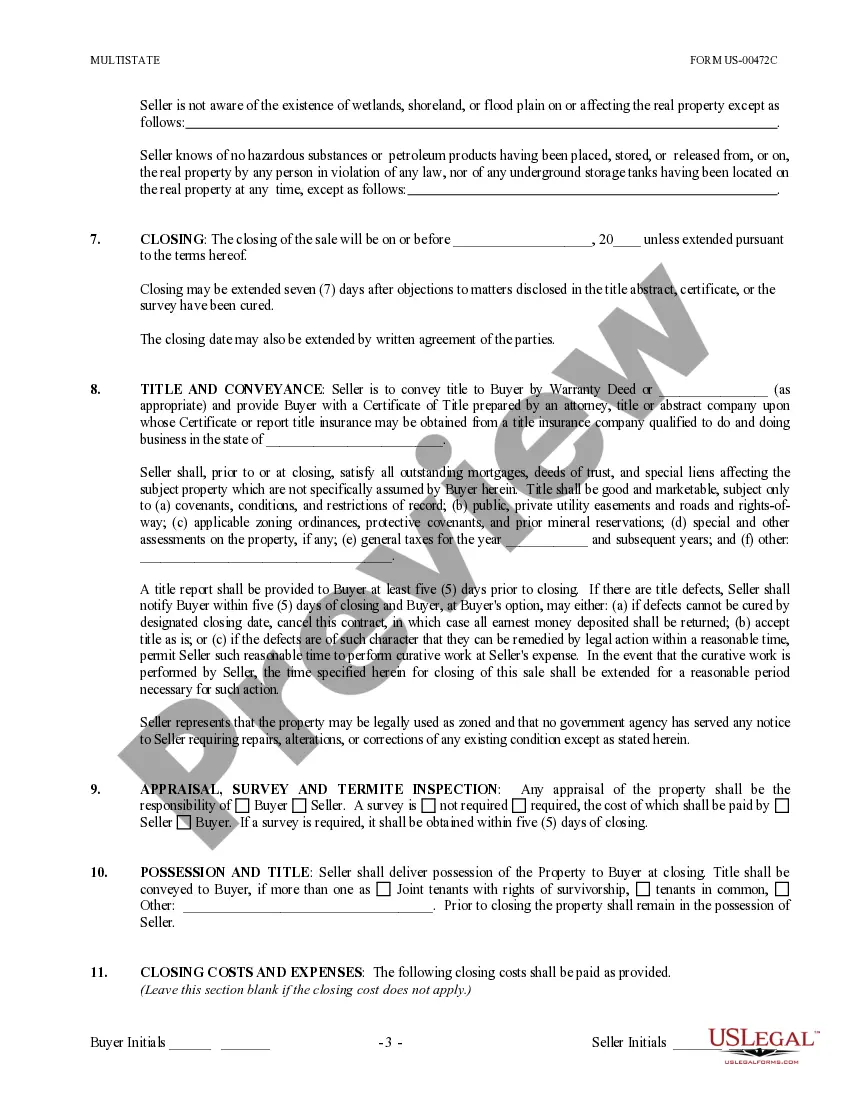

A purchase agreement, or sales contract, is the most common type of real estate contract. As the name suggests, this is a real estate contract that lays out an agreement between the buyer and seller of a specific property.

NO BROKERAGE RELATIONSHIP NOTICE. FLORIDA LAW REQUIRES THAT REAL ESTATE LICENSEES WHO HAVE NO BROKERAGE RELATIONSHIP WITH A POTENTIAL SELLER OR BUYER DISCLOSE THEIR DUTIES TO SELLERS AND BUYERS.

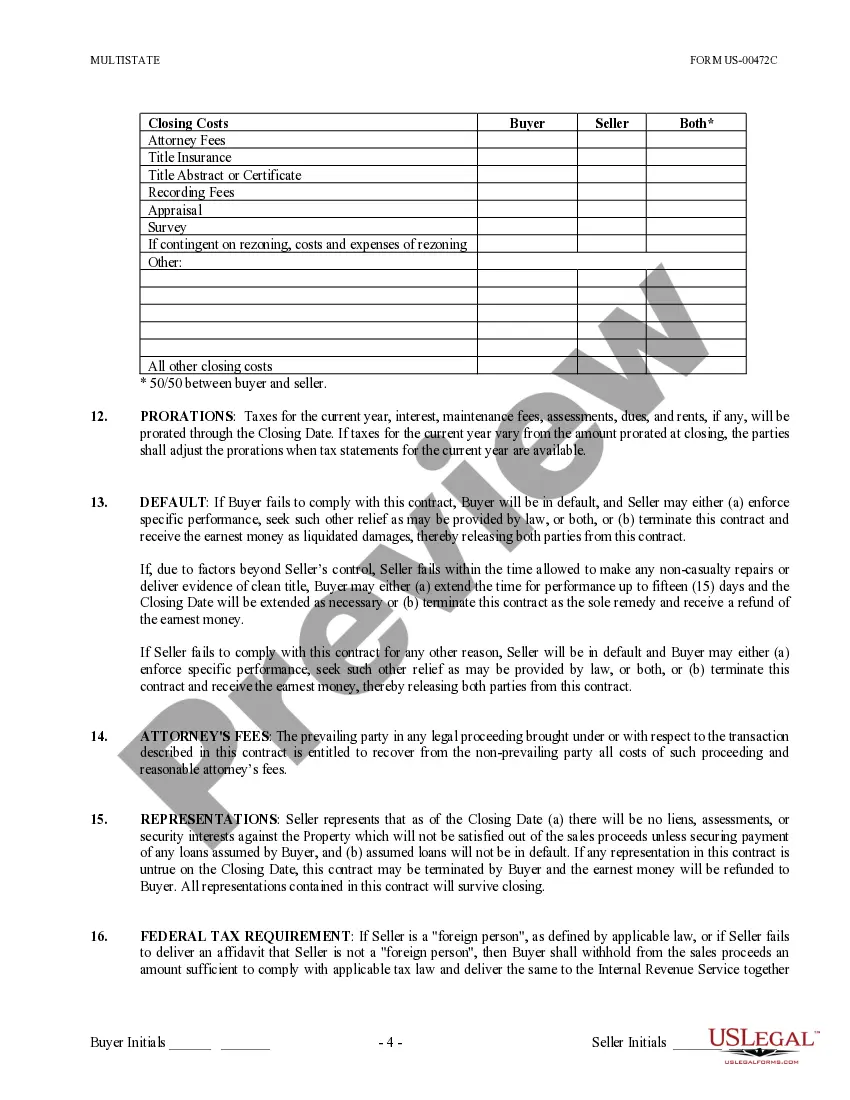

All real estate contracts must include the following essential elements:The contract must be in writing.Names of parties to the contract.Address and legal description of the property being sold/purchased.Purchase price.Acceptance and counteroffer period.Closing date.Disclosures.Default/dispute resolution.More items...

In Florida, real estate sold 'as is' means it's sold in the current condition. If the buyer inspects the property and notices a huge problem or the seller informs them of a potential problem, then the seller need not worry. The seller will not need to make repairs, regardless of their severity.

A Florida Real Estate Contract must be in writing and contain the following, in order to be legally binding; The parties to the contract - Buyers and Sellers identification. Identification of the Real Property by means of a legal description and street address.

The three duties owed by licensees to all customers and clients spell out DAD. They are: Deal honestly and fairly, Account for all funds, and Disclose material facts. Which duty is missing from this string of duties owed by licensees in a "no-broker" relationship with a real estate customer?

In Florida, which type of brokerage relationship is presumed? The answer is TRANSACTION BROKER. Under Florida law, it is presumed that all licensees are operating as transaction brokers unless a single agent or no brokerage relationship is established.