Florida Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

Selecting the ideal legal documents template can be a challenge. Naturally, there are numerous designs accessible online, but how will you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a wide array of templates, such as the Florida Corporation - Transfer of Stock, that you can utilize for both business and personal needs.

All the forms are reviewed by experts and comply with state and federal requirements.

If the form does not fulfill your requirements, use the Search field to find the right document. Once you are certain the form is appropriate, click the Purchase button to acquire the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal documents template to your device. Complete, edit, print, and sign the obtained Florida Corporation - Transfer of Stock. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Take advantage of the service to download properly prepared paperwork that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Florida Corporation - Transfer of Stock.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, make sure you have selected the correct document for your city/region.

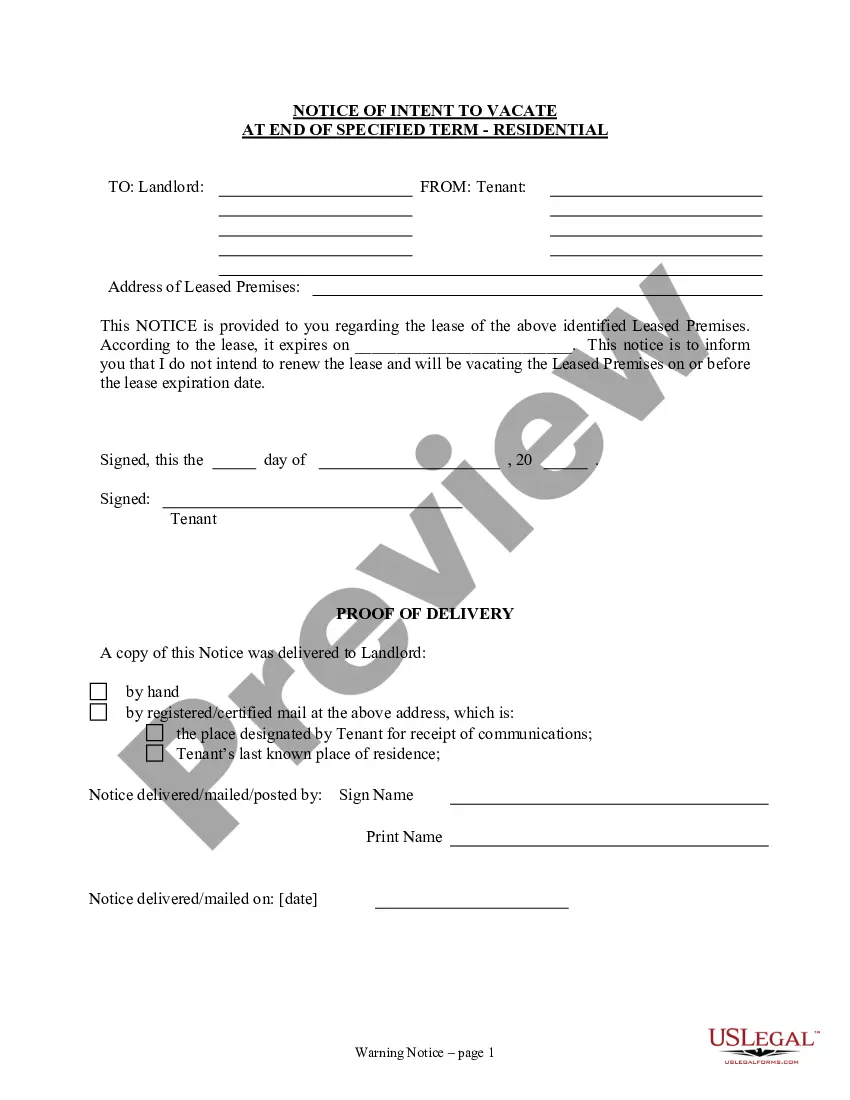

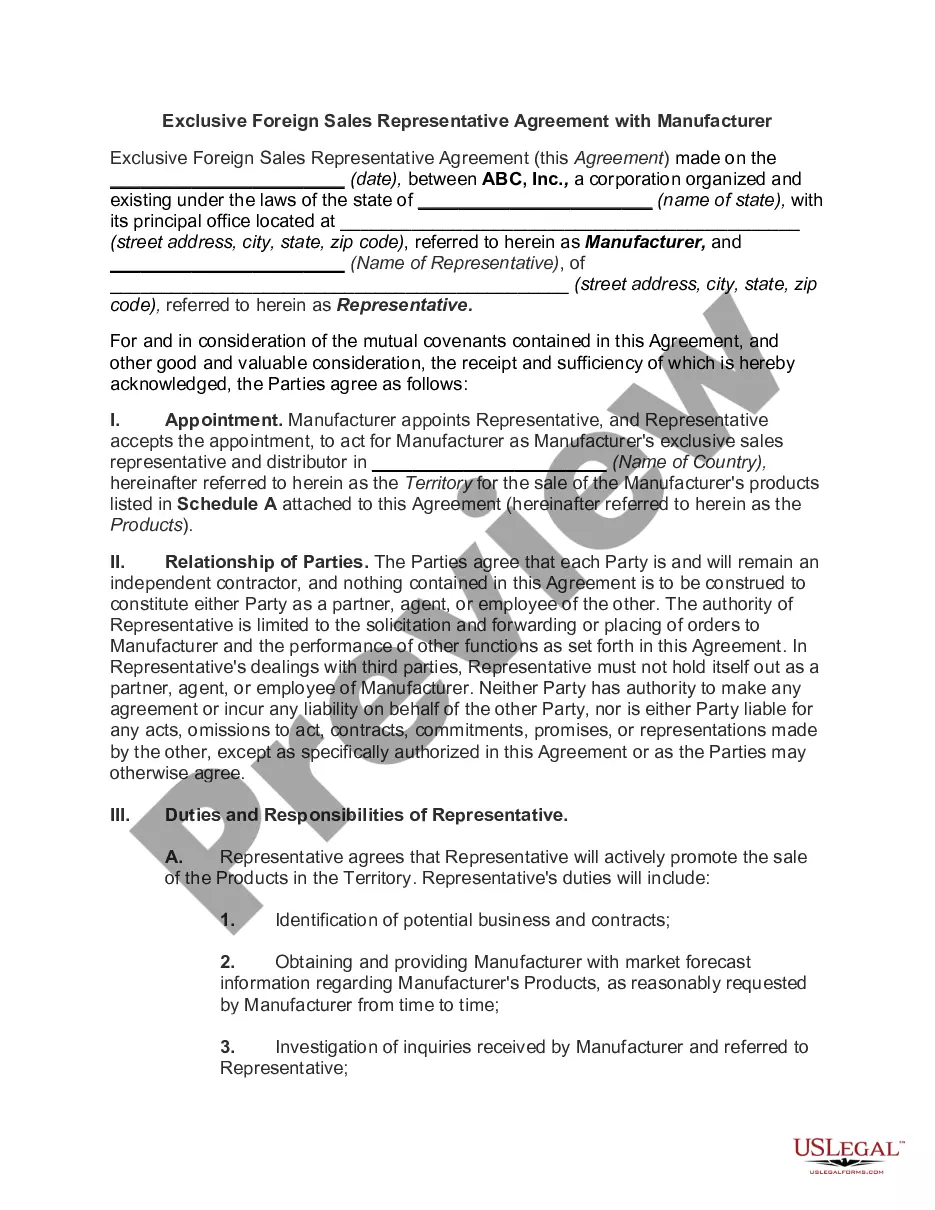

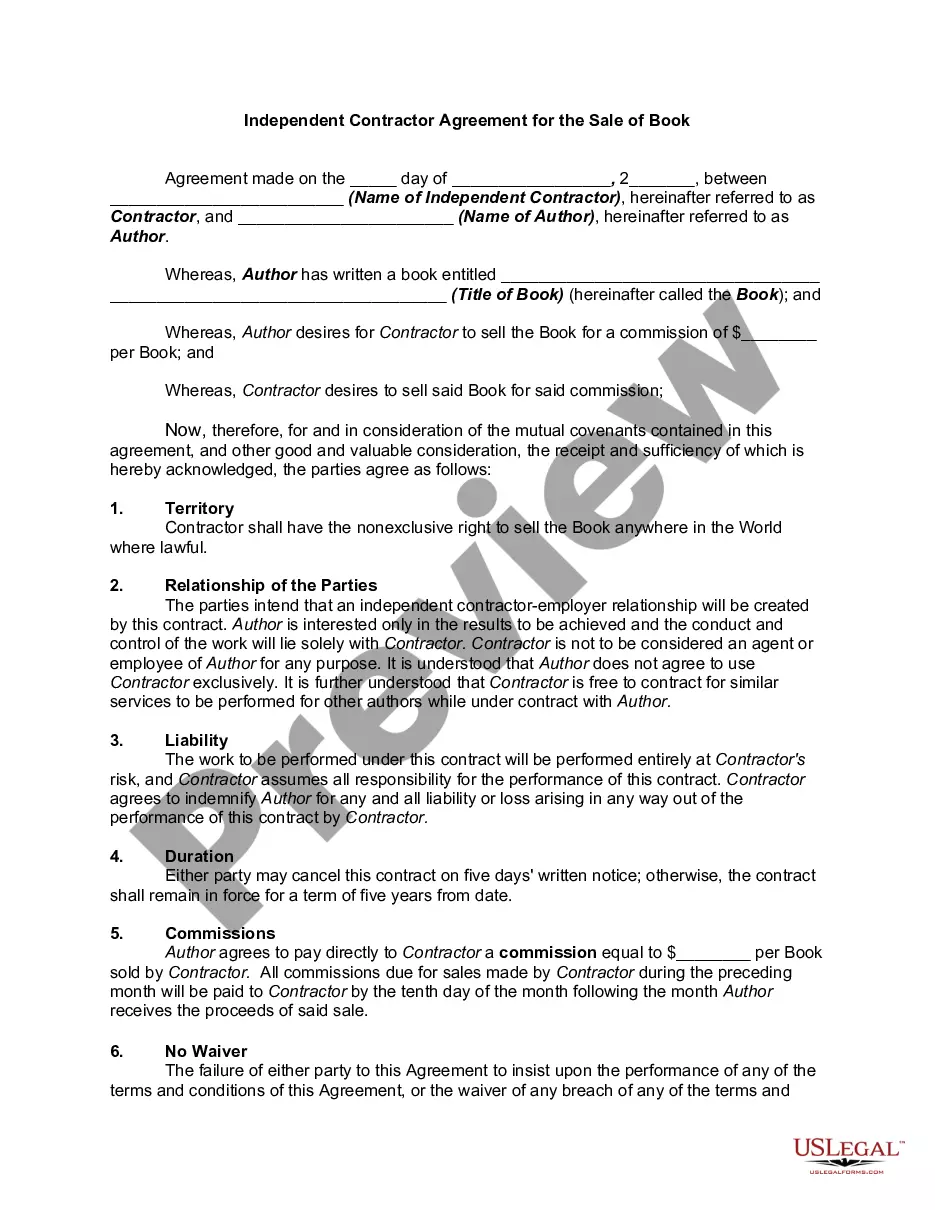

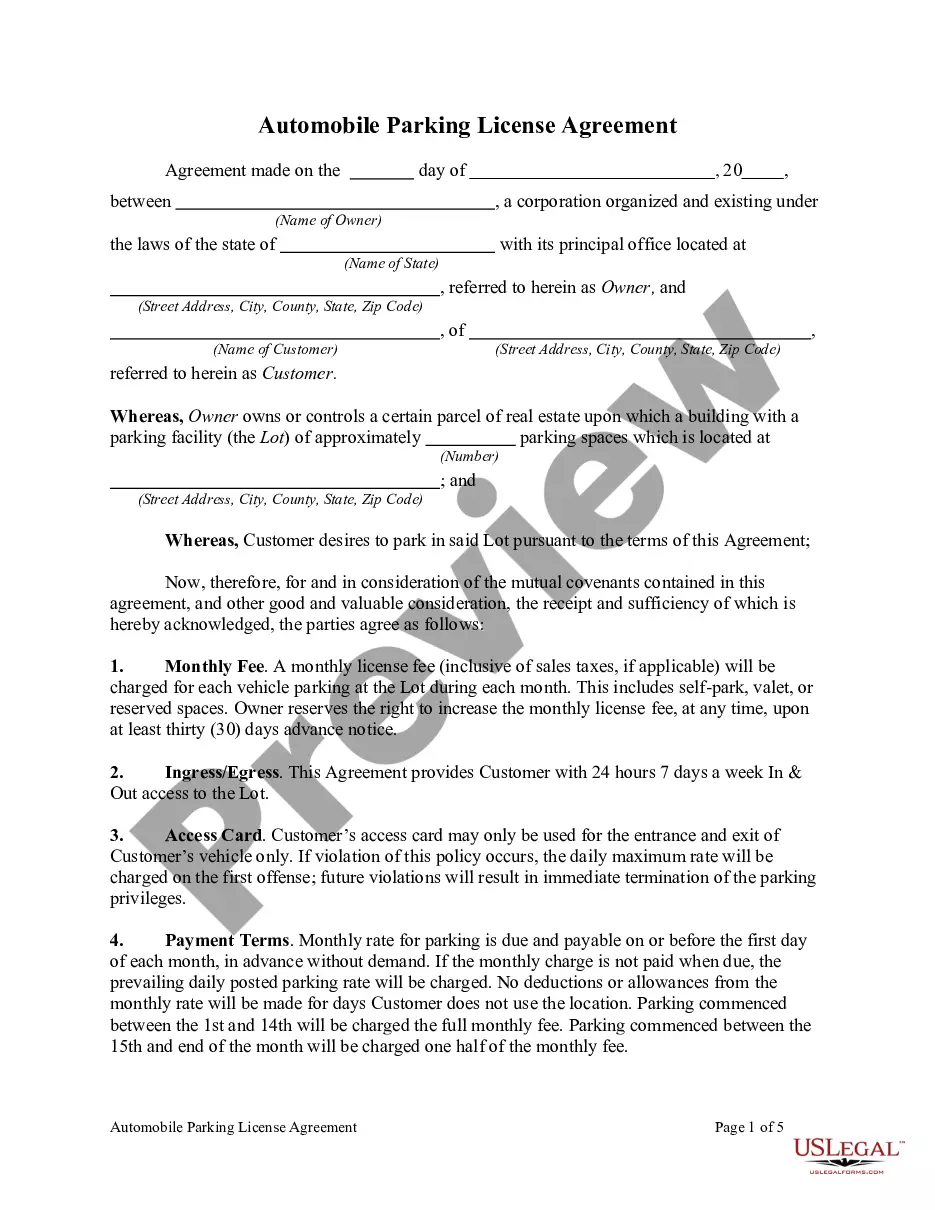

- You can view the form using the Preview option and read the form description to confirm it is suitable for your needs.

Form popularity

FAQ

To submit an article of Amendment, you must fill out the official form that outlines the changes to your Florida Corporation - Transfer of Stock. Once you have completed the form, you can file it either electronically or by mailing it to the appropriate state office, along with the applicable fees. Make sure to verify that your submission includes all necessary information to avoid delays.

To file articles of Amendment in Florida, you need to complete the designated form provided by the Florida Department of State. First, ensure that your Florida Corporation - Transfer of Stock is correctly prepared, detailing the specific amendments you wish to make. After filling out the form, submit it along with the required fees, either online or by mail. Ensure you keep a copy for your records.

Generally, a Florida Corporation - Transfer of Stock is one of the easiest methods for transferring ownership due to its established procedures and clear regulations. Compared to sole proprietorships or partnerships, transfers in a corporation are less cumbersome and require minimal interruption to ongoing operations. Utilizing templates from US Legal Forms can streamline this process even further.

Florida law does not mandate the issuance of stock certificates, but many corporations choose to issue them as a form of formal documentation of ownership. A Florida Corporation - Transfer of Stock can still occur without certificates through digital records or book entries. Regardless of the method, ensuring proper documentation is key to a successful transfer.

Ownership in a Florida Corporation is generally not difficult to transfer if you follow the proper procedures. The process requires specific documentation but is designed to protect both the seller and the buyer. Once you adhere to the legal requirements, transferring ownership can be smooth and straightforward.

Yes, transferring ownership in a Florida Corporation - Transfer of Stock is usually simpler than in a sole proprietorship. In a corporation, ownership can change hands through stock transfers without needing to dissolve the business entity. This flexibility provides significant advantages for those looking to change ownership quickly and efficiently.

To transfer shares in a Florida Corporation, you typically need to prepare a stock transfer agreement that outlines the terms of the transfer. This process might also require updating the corporation's stock ledger and providing the new shareholder with a share certificate. Utilizing resources like US Legal Forms can help guide you through this process and ensure you complete it accurately.

To fill out a corporate stock certificate for your Florida Corporation, you need to include the corporation's name, the name of the shareholder, and the number of shares owned. Additionally, provide the date of issuance and any restrictions, if applicable. Make sure the certificate is signed by the appropriate corporate officers to validate the ownership of the shares.

When filling a share transfer form for your Florida Corporation, start by clearly indicating the names of both the transferring and receiving parties. You should also specify the class of shares being transferred and include any necessary identification numbers. Double-check all entries for precision before signing to ensure a smooth transfer.

Filling out a stock transfer form for a Florida Corporation involves several steps. First, carefully enter the relevant details, including the stock certificate number and the number of shares being transferred. Make sure both parties review the form for accuracy, then proceed to sign and date it to complete the transfer process.