Florida Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

If you wish to finish, download, or print valid document templates, utilize US Legal Forms, the primary collection of legal forms available online.

Leverage the site's straightforward and convenient search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Florida Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Florida Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate. Each legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to get the Florida Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate.

- You can also access forms you previously saved in the My documents tab of your account.

- If you use US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct state/region.

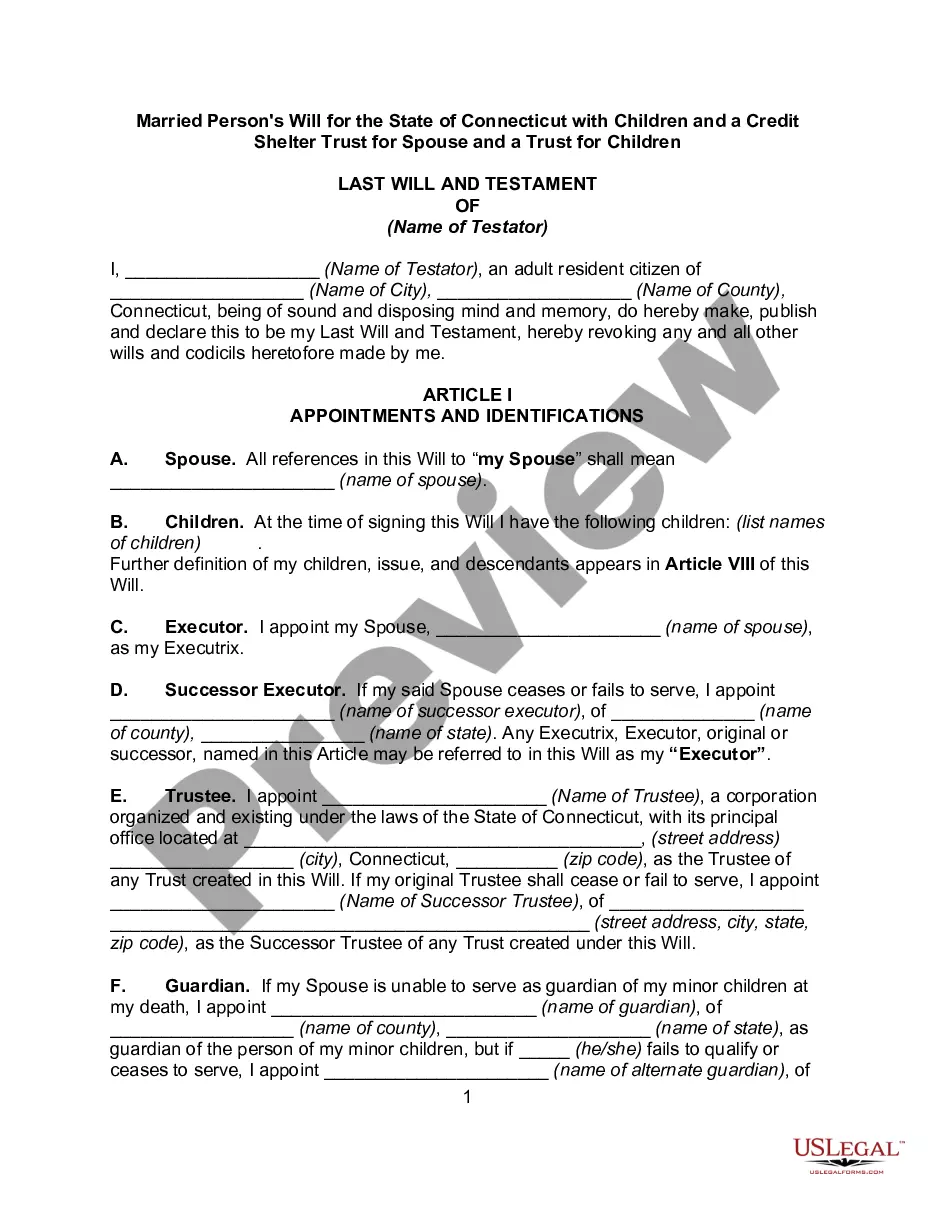

- Step 2. Use the Review option to examine the form’s content. Be sure to read through the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form repository.

- Step 4. Once you have identified the form you need, click the Get now button. Choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

In fact, ing to Florida Statutes, section 733.607- Possession of estate, the personal representative must take control of such property. It is acceptable for the property that was gifted to a specific beneficiary to be transferred to that beneficiary.

General Guidelines of the Process. The requirement for giving Notice to Creditors in Florida comes from Florida Statute 733.2121, which states that the personal representative of the estate must immediately publish a Notice to Creditors.

Under FL. Stat, section 733.109- Revocation of probate, an interested party can initiate a proceeding to revoke probate by filing a petition with the court having jurisdiction over the administration.

Attorney-in-Fact and Power of Attorney An attorney-in-fact is a person who has been legally appointed to act on behalf of another person in a legal or business matter. The person appointing the attorney-in-fact is called the "principal," and the attorney-in-fact is sometimes referred to as the "agent."

Ing to FL. Stat, section 733.201- Proof of wills, self-proved wills executed in ance with this code may be admitted to probate without further proof. For a will to be self-proving, it must be executed in a specific manner.

Stat, section 733.702- Limitations on presentation of claims, the timeframe is either 3 months from the date of the first publication of the notice, or for creditors to which the personal representative was required to serve notice, 30 days after the date of service.

The requirement for giving Notice to Creditors in Florida comes from Florida Statute 733.2121, which states that the personal representative of the estate must immediately publish a Notice to Creditors. This notice must contain the following details of information: The decedent's full legal name.

The Florida Senate 733.302 Who may be appointed personal representative. ?Subject to the limitations in this part, any person who is sui juris and is a resident of Florida at the time of the death of the person whose estate is to be administered is qualified to act as personal representative in Florida.