A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

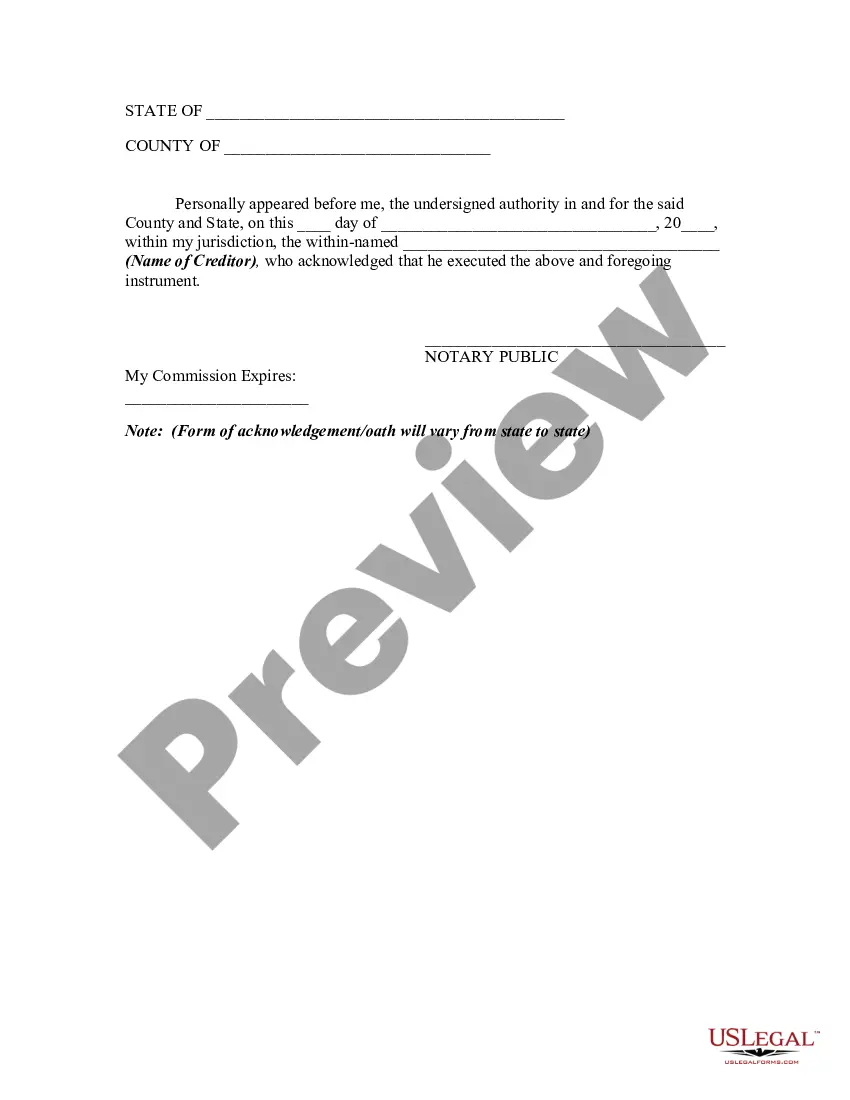

A Florida Release of Claims Against an Estate By Creditor is a legal document that is used to settle any outstanding debts or claims against an estate in the state of Florida. This release serves as a formal agreement between a creditor and the executor or personal representative of the estate, clearing the debtor's liabilities and ensuring a smooth transfer of assets to the beneficiaries. There are several types of Florida Release of Claims Against an Estate By Creditor, depending on the specific circumstances and the nature of the debt owed. Some common types include: 1. General Release: This is a comprehensive release that relinquishes all claims, debts, and liabilities that the creditor may have against the estate. It provides a complete discharge of the debt owed, ensuring that the creditor cannot pursue any further legal action in the future. 2. Limited Release: In certain cases, the creditor may agree to release only a specific portion of the debt owed or may agree to settle for a discounted amount. This type of release is typically negotiated between the creditor and the representative of the estate, and it specifies the terms and conditions of the partial settlement. 3. Conditional Release: In some instances, a creditor may require certain conditions to be met before releasing their claim against the estate. For example, they may demand that the estate sells a particular asset or property to repay the debt owed. A conditional release sets out these conditions and the timeframe within which they should be fulfilled. 4. Release and Waiver of Rights: This type of release not only clears the creditor's claim against the estate but also waives any further rights or interests they may have in any other assets or properties of the estate. By signing this release, the creditor relinquishes any potential future claims against the estate or its beneficiaries. It is important to note that a Florida Release of Claims Against an Estate By Creditor must be signed voluntarily by both parties involved and usually requires a witness or notary public for validation. It is recommended to consult with an attorney specializing in estate law to ensure that all legal requirements are met and that the release accurately reflects the creditor's intentions and the terms of the settlement agreement.A Florida Release of Claims Against an Estate By Creditor is a legal document that is used to settle any outstanding debts or claims against an estate in the state of Florida. This release serves as a formal agreement between a creditor and the executor or personal representative of the estate, clearing the debtor's liabilities and ensuring a smooth transfer of assets to the beneficiaries. There are several types of Florida Release of Claims Against an Estate By Creditor, depending on the specific circumstances and the nature of the debt owed. Some common types include: 1. General Release: This is a comprehensive release that relinquishes all claims, debts, and liabilities that the creditor may have against the estate. It provides a complete discharge of the debt owed, ensuring that the creditor cannot pursue any further legal action in the future. 2. Limited Release: In certain cases, the creditor may agree to release only a specific portion of the debt owed or may agree to settle for a discounted amount. This type of release is typically negotiated between the creditor and the representative of the estate, and it specifies the terms and conditions of the partial settlement. 3. Conditional Release: In some instances, a creditor may require certain conditions to be met before releasing their claim against the estate. For example, they may demand that the estate sells a particular asset or property to repay the debt owed. A conditional release sets out these conditions and the timeframe within which they should be fulfilled. 4. Release and Waiver of Rights: This type of release not only clears the creditor's claim against the estate but also waives any further rights or interests they may have in any other assets or properties of the estate. By signing this release, the creditor relinquishes any potential future claims against the estate or its beneficiaries. It is important to note that a Florida Release of Claims Against an Estate By Creditor must be signed voluntarily by both parties involved and usually requires a witness or notary public for validation. It is recommended to consult with an attorney specializing in estate law to ensure that all legal requirements are met and that the release accurately reflects the creditor's intentions and the terms of the settlement agreement.