Title: Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone Description: The Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is an important process for Florida residents who have become victims of credit card theft or misplacement. This report can be made by contacting the credit card issuer's customer service through a telephone call. When a credit cardholder notices unauthorized transactions, suspicious activity, or realizes their credit card is missing, it is crucial to take immediate action in order to minimize potential financial loss or fraudulent charges. Initiating the credit cardholder's report of a lost or stolen credit card after giving notice by telephone is an effective way to safeguard personal financial information. After contacting the credit card issuer, the customer service representative will guide the cardholder through the process of reporting the lost or stolen card. It is important to provide all the necessary details including cardholder's personal information, card number, the date and time the card was noticed missing, and any relevant transactions made prior to the report. The credit card issuer will record these details in order to block further transactions on the card and prevent any unauthorized usage. The Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone aims to ensure prompt action is taken to protect the cardholder's financial well-being and prevent potential identity theft. This report alerts the credit card issuer about the unfortunate incident, allowing them to take the necessary steps to secure the account and prevent unauthorized access. Different types of Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone: 1. Standard Report: This type of report is made when the cardholder has lost their credit card or suspects that it has been stolen. It is essential to notify the credit card issuer promptly to avoid fraudulent charges and unauthorized transactions. 2. Unauthorized Transaction Report: This report is made by a cardholder when they notice suspicious or unauthorized transactions on their credit card statement. It is important to report such incidences immediately to safeguard personal finances and prevent further unauthorized usage. 3. Emergency Report: In urgent situations where time is crucial, such as noticing suspicious activity on the credit card while traveling, an emergency report is made to expedite the process of blocking the card and preventing any additional unauthorized charges. By promptly reporting a lost or stolen credit card after notice by telephone, Florida residents can ensure their financial security and minimize the potential negative impact of credit card theft or loss.

Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

How to fill out Florida Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

Are you presently in a position where you need papers for sometimes enterprise or person reasons virtually every day? There are tons of authorized papers layouts available on the Internet, but finding ones you can trust is not straightforward. US Legal Forms provides 1000s of develop layouts, like the Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, which are created to fulfill federal and state requirements.

Should you be currently familiar with US Legal Forms web site and also have a free account, basically log in. Next, it is possible to acquire the Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone web template.

If you do not have an account and wish to begin using US Legal Forms, follow these steps:

- Find the develop you will need and make sure it is for that correct area/area.

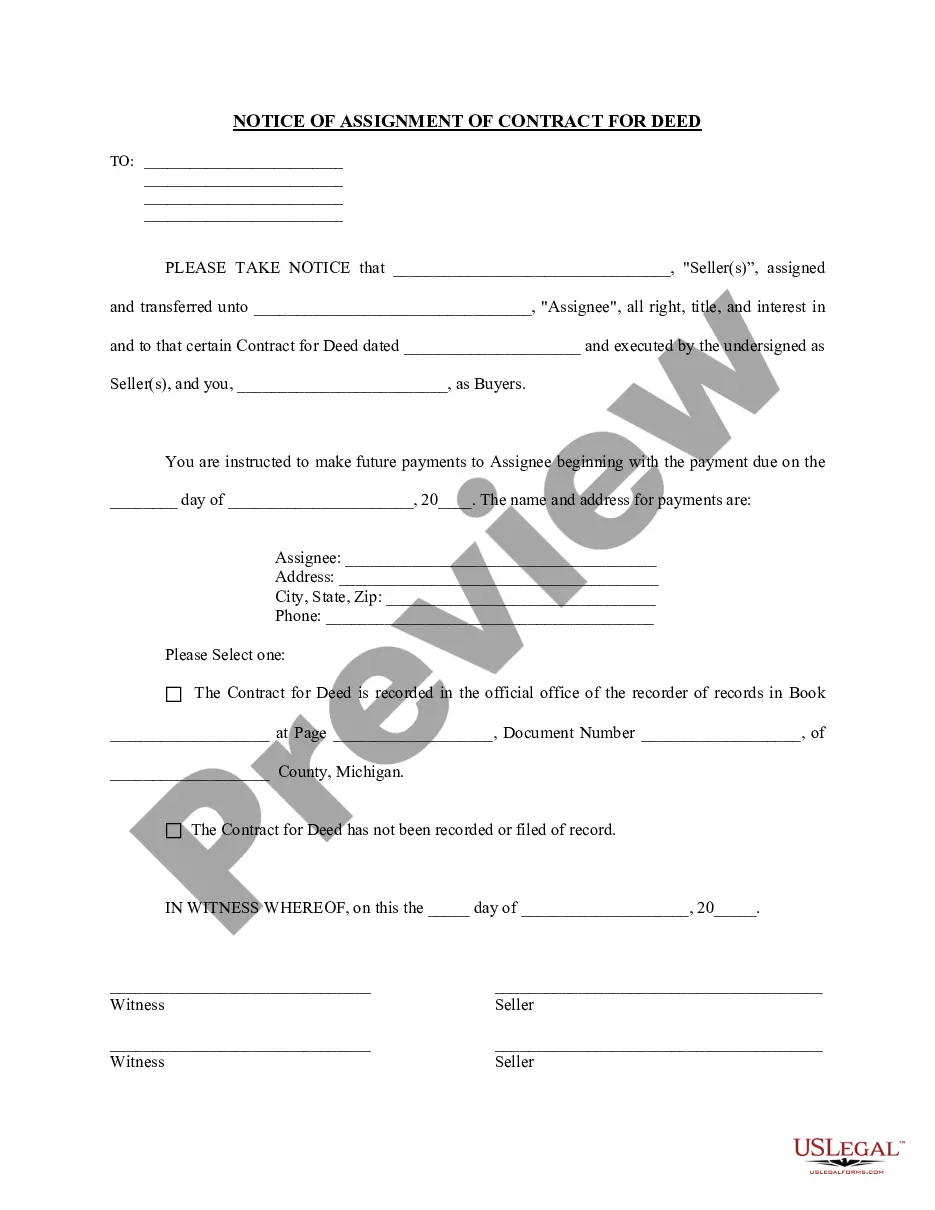

- Use the Review switch to analyze the shape.

- Read the explanation to actually have selected the proper develop.

- In case the develop is not what you`re looking for, make use of the Search area to obtain the develop that meets your requirements and requirements.

- Once you get the correct develop, click on Buy now.

- Select the pricing prepare you desire, fill in the required details to produce your account, and pay money for an order utilizing your PayPal or bank card.

- Pick a handy file format and acquire your backup.

Find all the papers layouts you have purchased in the My Forms menu. You can obtain a more backup of Florida Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone any time, if necessary. Just select the required develop to acquire or print the papers web template.

Use US Legal Forms, probably the most comprehensive collection of authorized forms, to save lots of efforts and steer clear of mistakes. The assistance provides skillfully created authorized papers layouts that can be used for an array of reasons. Create a free account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

Got some time to spare? Call the number on the back of the card and tell the credit card company that you found it. They'll contact the card's owner for you. It's possible that the card was already reported as lost anyway, and the card company will issue a new card with a new number.

Notify your bank or credit union. As soon as you're reasonably certain you won't find your card, contact your bank or credit union and request a replacement. Typically, you can do this by phone or by visiting a branch location. Your lost card will be canceled, and it may take up to seven days to receive a new one.

In most instances, a credit card reported as lost is completely deactivated and a new one is issued. Some issuers allow cardholders to lock the card, either online or by requesting it through customer service. This option ensures that the card isn't usable if someone finds it, but can be reactivated it if you find it.

If you can see what bank the card is through, then drop it off at one of those branches, and the will get it to the owner. Or you can drop it off at the police station. You could cut it up and throw it away as another option.

Contact your credit card issuer When you speak to a representative, tell them that your account was compromised and list the fraudulent transactions. The bank will cancel the card (this doesn't mean your account is closed) and mail you a new card with a new account number, expiration date and security code.

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.

Report Loss Or Theft Immediately If your credit, ATM, or debit card is lost or stolen, don't wait to report it. Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible.

If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Depending on timing, they may instruct you to destroy and dispose of the card and begin using the replacement card that they've arranged to be sent to your address.