Florida Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement

Description

How to fill out Balloon Secured Note Addendum And Rider To Mortgage, Deed Of Trust Or Security Agreement?

If you desire to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Employ the site's straightforward and user-friendly search to locate the documents you need. Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Florida Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Florida Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement. Every legal document template you purchase is yours permanently. You will have access to each form you saved in your account. Visit the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Florida Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Florida Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your correct city/state.

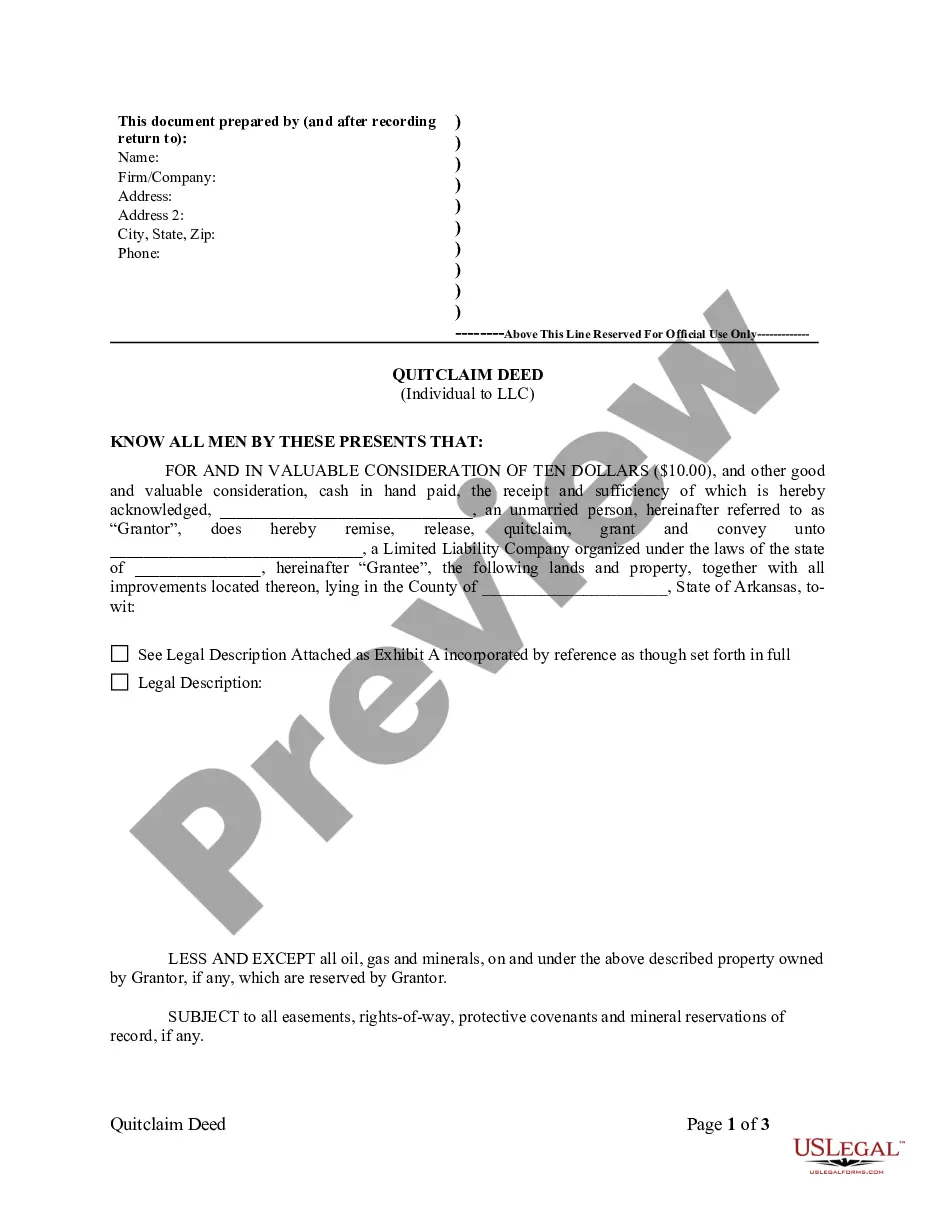

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

This means the mortgage agreement and deed of trust both pledge the property as ?security? or ?collateral? in case the borrower defaults on the loan. These documents are always signed together with a promissory note, which contains the actual promise to repay the loan.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

A mortgage involves two parties: a borrower (or mortgagor) and a lender (or mortgagee). When a borrower signs a mortgage, they pledge the property as security to the lender to ensure repayment. In contrast, a trust deed involves three parties: a borrower (or trustor), a lender (or beneficiary), and the trustee.

In a mortgage loan, the borrower always creates two documents: a note and a mortgage.

The Mortgage pledges your home as security for the loan. In some states, the buyer signs a Deed of Trust rather than a mortgage, but both documents serve the same purpose. The Mortgage Note is your promise to repay your loan.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

A mortgage is a pledge of property to the lender as security of payment of the debt. The mortgagor is the borrower giving the pledge to the lender.

Security instruments for regularly amortizing mortgages include the Fannie Mae/Freddie Mac Uniform Mortgages, Mortgage Deeds, Deeds of Trust, or Security Deeds for each of the jurisdictions from which we purchase conventional mortgages.