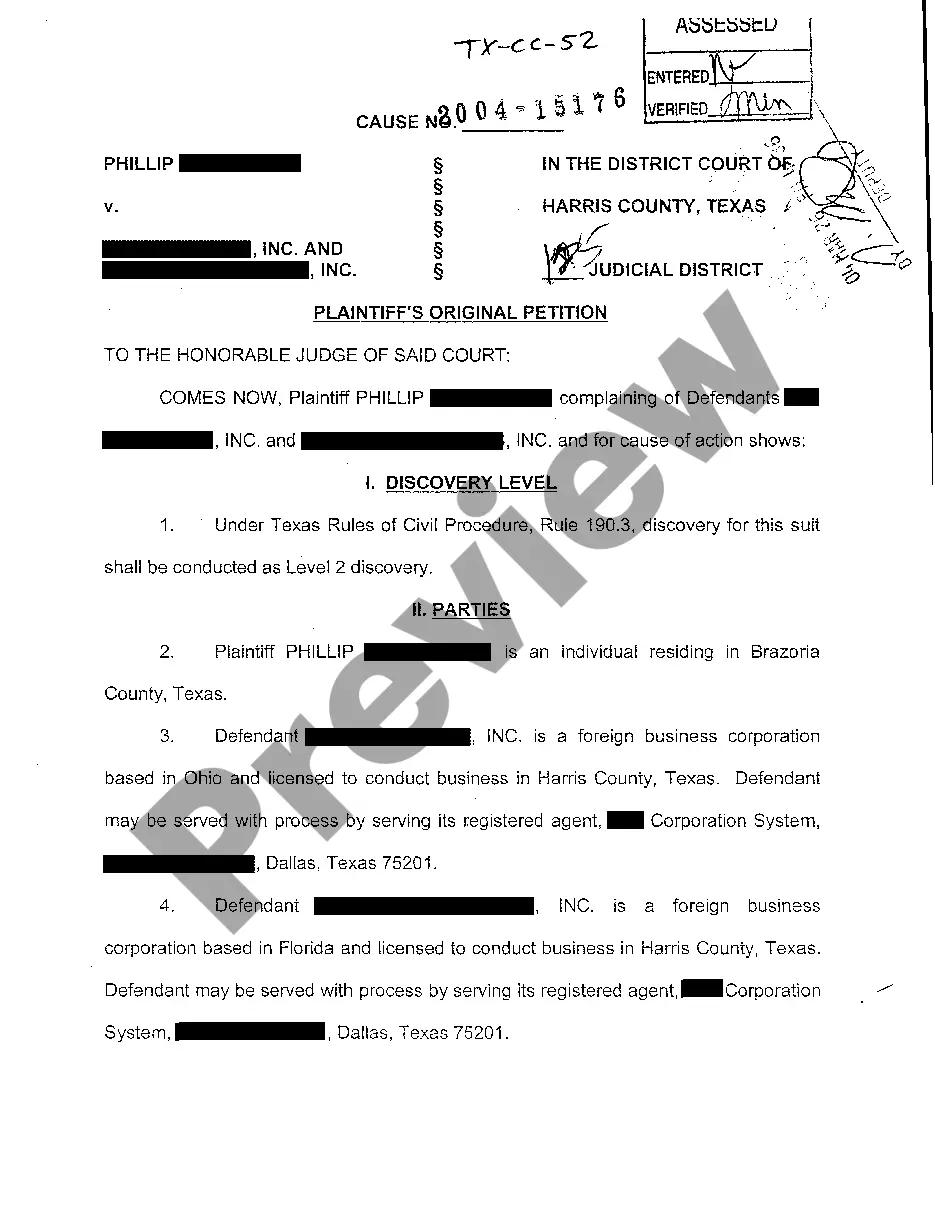

A Florida Balloon Secured Note is a financial instrument commonly used in real estate transactions, particularly in the state of Florida. It is a type of promissory note that combines characteristics of a balloon payment and a secured note. The term "balloon" refers to a large, final payment due at the end of the loan term. This final payment is typically much larger than the regular monthly payments made throughout the loan term. The balloon payment allows borrowers to have lower monthly payments during the term but requires them to make a lump-sum payment at the end to fully repay the loan. The note is secured, meaning that the borrower pledges some form of collateral to secure the loan. The collateral can be a property, such as real estate or a vehicle, which serves as security for the lender in case the borrower defaults on the loan. If the borrower defaults, the lender has the right to seize and sell the collateral to recover the outstanding balance. Different types of Florida Balloon Secured Notes may include: 1. Commercial Real Estate Balloon Secured Note: This type of note is commonly used in commercial real estate transactions, where the borrower secures the loan with a commercial property, such as an office building or retail space. 2. Residential Real Estate Balloon Secured Note: This note is used in residential real estate transactions, where the borrower secures the loan with a residential property, such as a house or condominium. 3. Vehicle Balloon Secured Note: This type of note is often used for purchasing vehicles, such as cars, motorcycles, or boats. The borrower secures the loan by pledging the vehicle as collateral. 4. Equipment Balloon Secured Note: This note is utilized in cases where businesses need to secure financing to purchase equipment or machinery necessary for their operations. The equipment serves as collateral for the loan. It is important for borrowers to carefully consider the terms and conditions of a Florida Balloon Secured Note before entering into an agreement. They should review the interest rates, repayment schedule, balloon payment amount, and collateral requirements to ensure that they can meet the financial obligations. Likewise, lenders should assess the borrower's creditworthiness, collateral value, and the feasibility of the balloon payment to determine the risk associated with the loan. Consulting with a financial advisor or attorney experienced in real estate or lending transactions is often recommended for both parties involved.

Florida Balloon Secured Note

Description

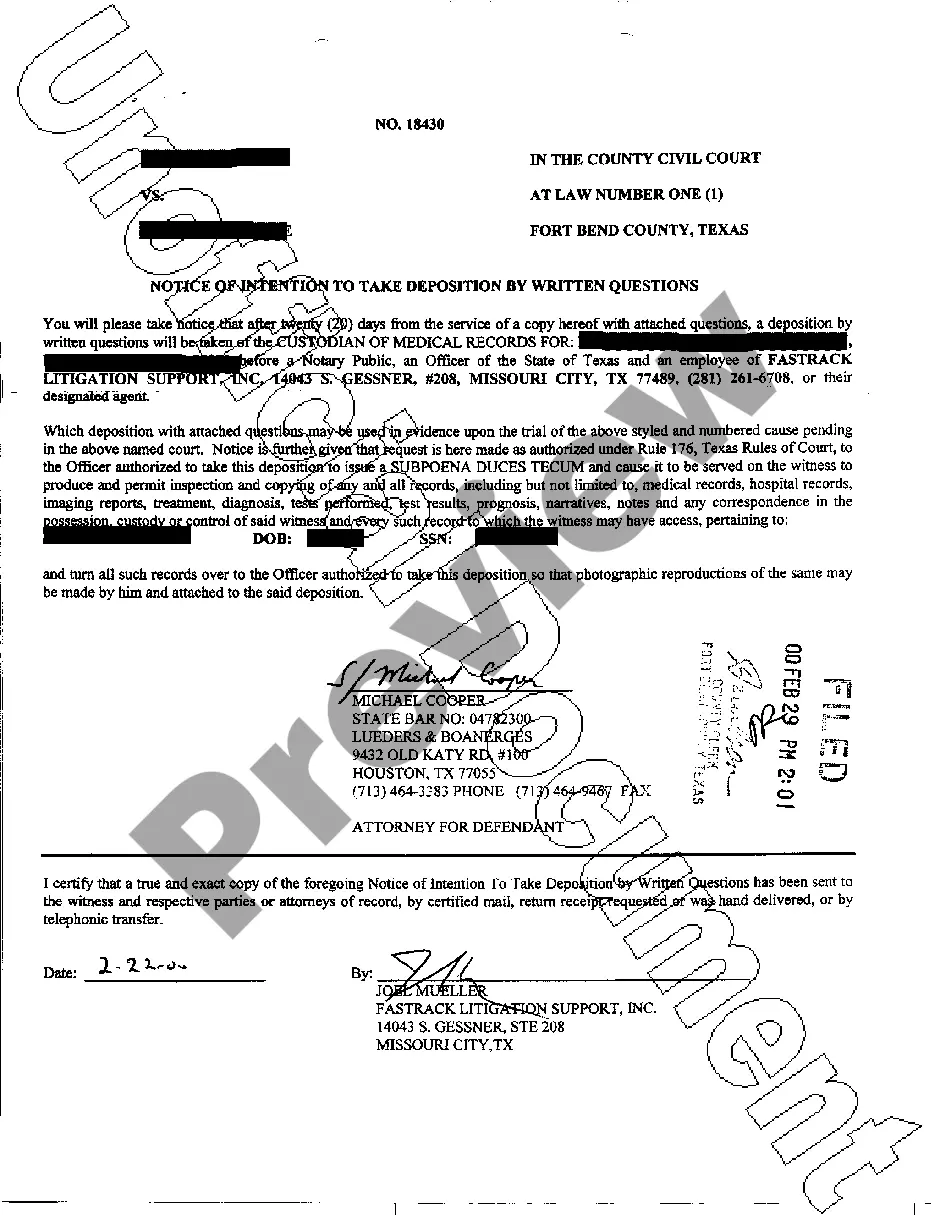

How to fill out Florida Balloon Secured Note?

In case you desire to complete, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Leverage the site's intuitive and straightforward search to find the documents you require.

A variety of templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device.

- Leverage US Legal Forms to access the Florida Balloon Secured Note with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to retrieve the Florida Balloon Secured Note.

- You can also find forms you previously downloaded in the My documents section of your account.

- If it's your first time using US Legal Forms, follow the steps provided below.

- Step 1. Make sure you have selected the form for the correct region/country.

- Step 2. Use the Preview option to review the content of the form. Remember to read the instructions carefully.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you find the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

A balloon loan is a type of loan that includes lower monthly payments in exchange for a larger one-time payment at the end of your loan term. If you plan to finance your car purchase, you may be offered the option of a balloon loan.

The Court concluded the text and structure of BAPCPA supported its conclusion that a balloon payment was prohibited under 1325 as did the majority rule on the issue.

Balloon payments allow borrowers to reduce that fixed payment amount in exchange for making a larger payment at the end of the loan's term. In general, these loans are good for borrowers who have excellent credit and a substantial income.

A balloon payment provision in a loan is not illegal per se. Federal and state legislatures have enacted various laws designed to protect consumers from being victimized by such a loan. The Federal TRUTH IN LENDING ACT (15U.

The biggest advantage of a balloon mortgage is it generally comes with lower interest rates, so you make smaller monthly mortgage payments. You also may qualify for a larger loan amount with a balloon mortgage than you would if you got an adjustable-rate or fixed-rate mortgage.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

Interesting Questions

More info

Sustained Investing How to Invest Your Bank Account.