Florida Trust Agreement - Family Special Needs

Description

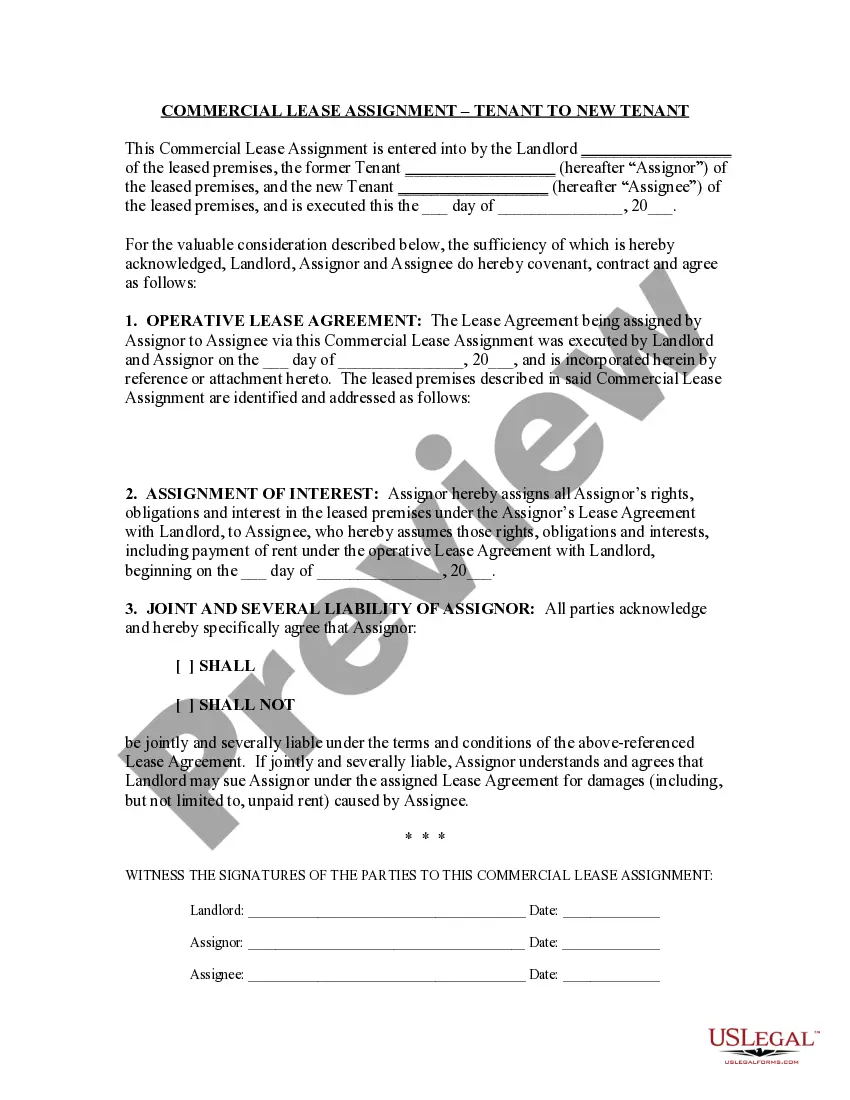

How to fill out Trust Agreement - Family Special Needs?

It is feasible to allocate time online trying to locate the legal form template that fits the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that have been evaluated by professionals.

You can obtain or print the Florida Trust Agreement - Family Special Needs from our service.

If available, utilize the Preview option to view the form template simultaneously.

- If you already have a US Legal Forms account, you may sign in and click on the Get option.

- Afterward, you can complete, modify, print, or sign the Florida Trust Agreement - Family Special Needs.

- Every legal form template you obtain is yours indefinitely.

- To get another copy of any acquired form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct form template for the region/area of your choice.

- Review the form description to confirm you have picked the correct form.

Form popularity

FAQ

In Florida, the statute governing special needs trusts is outlined in the Florida Statutes, particularly under Chapter 736, known as the Florida Trust Code. This legislation sets the framework for establishing and managing these trusts, ensuring they align with state and federal laws. Adhering to the rules of a Florida Trust Agreement - Family Special Needs can protect beneficiaries and preserve their eligibility for essential benefits. It's advisable to review these statutes with a professional to ensure compliance and effective use.

The best trust for a disabled person often depends on individual circumstances, but a special needs trust is typically the most suitable option. This trust enables the individual to benefit from additional funds for necessities beyond government assistance. With a Florida Trust Agreement - Family Special Needs, families can provide their loved ones with a higher quality of life while ensuring compliance with regulations. Consulting with a legal expert can help determine the best course of action tailored to specific needs.

A special needs trust in Florida is a legal arrangement that allows a disabled individual to receive financial support without losing government benefits. This type of trust can hold funds for various expenses, enhancing the quality of life of the beneficiary. It ensures that the assets do not count against eligibility for programs such as Medicaid. Using a Florida Trust Agreement - Family Special Needs can help families protect their loved ones while maintaining access to important services.

If you established a revocable special needs trust for your son years ago, it is wise to review the trust provisions regularly. Assess whether the trust still meets his needs and consider changes in his circumstances. You may want to consult with a legal expert to ensure the trust remains compliant with Florida Trust Agreement - Family Special Needs guidelines. Platforms like US Legal Forms can also provide resources to assist with updates or modifications to your existing trust.

To establish a special needs trust in Florida, you should start by understanding the specific needs of your family member with disabilities. A Florida Trust Agreement - Family Special Needs can be created through a qualified attorney who specializes in this area. They will help you draft the trust document to ensure it complies with state laws and effectively safeguards your loved one's benefits. Using a platform like US Legal Forms can simplify this process by providing templates and guidance.

While it is possible to set up a Florida Trust Agreement - Family Special Needs without an attorney, it is strongly advised to seek legal guidance. An attorney experienced in Florida trust laws can ensure that your trust meets all legal requirements and serves its intended purpose. They can also help you navigate complex scenarios involving special needs, providing you peace of mind. Ultimately, the investment in professional advice can lead to better management of your trust.

In Florida, the duration of a trust can vary based on its terms but generally lasts until the assets are fully distributed following the objectives outlined in the trust document. Special needs trusts typically continue until the beneficiary no longer requires assistance or passes away. The Florida Trust Agreement - Family Special Needs provides a flexible framework for managing trust duration and ensures that funds are available for the beneficiary's entire life. Understanding these timelines is crucial for effective planning.

The grantor of a third-party special needs trust is the individual who creates the trust and contributes assets to it. This is often a family member, such as a parent or grandparent, who wishes to provide financial support for a loved one with special needs. The Florida Trust Agreement - Family Special Needs specifies the roles and responsibilities of the grantor, ensuring that the trust effectively addresses the beneficiary's needs. Involvement from the grantor is vital for the trust's success.

One of the biggest mistakes parents make when establishing a trust fund is failing to properly understand the specific needs of their child with disabilities. Without a clear plan, assets may not be allocated effectively, possibly endangering government benefits. Consulting legal experts and using the Florida Trust Agreement - Family Special Needs can help parents create a comprehensive strategy that addresses all aspects of their child's care. Proper planning is essential to avoid pitfalls and ensure long-term support.

The key difference between 1st party and 3rd party special needs trusts lies in who funds the trust. A 1st party trust is funded with the beneficiary's own assets, while a 3rd party trust is created with funds from another individual, typically a family member. This distinction is crucial because, unlike 1st party trusts, 3rd party trusts do not require Medicaid payback upon the beneficiary's death. The Florida Trust Agreement - Family Special Needs helps families navigate these differences for better financial planning.